UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ Preliminary Proxy Statement

|

¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| x Definitive Proxy Statement |

||||

| ¨ Definitive Additional Materials |

||||

| ¨ Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 |

COLUMBIA SPORTSWEAR COMPANY

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(I)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Portland, Oregon

April 17, 2003

Dear Shareholders:

You are cordially invited to attend the annual meeting of shareholders of Columbia Sportswear Company at 3:00 p.m., Pacific Time, on Thursday, May 15, 2003, at Columbia’s headquarters located at 14375 NW Science Park Drive, Portland, Oregon.

Details of the business to be conducted at the annual meeting are provided in the attached Notice of Annual Meeting and Proxy Statement. At the annual meeting, we will also report on the Company’s operations and respond to any questions you may have.

Your vote is very important. Whether or not you attend the annual meeting in person, it is important that your shares are represented and voted at the meeting. Please promptly sign, date, and return the enclosed proxy card in the postage-prepaid envelope. If you attend the meeting, you will have the right to revoke your proxy and vote your shares in person. Retention of the proxy is not necessary for admission to or identification at the meeting.

Very truly yours,

Timothy P. Boyle

President and Chief Executive Officer

COLUMBIA SPORTSWEAR COMPANY

14375 NW Science Park Drive

Portland, OR 97229

(503) 985-4000

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 15, 2003

To the Shareholders of Columbia Sportswear Company:

The annual meeting of the shareholders of Columbia Sportswear Company, an Oregon corporation, will be held at 3:00 p.m., Pacific Time, on Thursday, May 15, 2003, at 14375 NW Science Park Drive, Portland, Oregon for the following purposes:

| 1. | To elect eight directors, each to serve until the next annual meeting of shareholders or until a successor has been elected and qualified; |

| 2. | To ratify the selection of Deloitte & Touche LLP as the Company’s independent auditors for the 2003 fiscal year; and |

| 3. | To transact any other business that may properly come before the meeting or any adjournment of the meeting. |

Only shareholders of record at the close of business on April 2, 2003 are entitled to receive notice of and to vote at the annual meeting or any adjournment of the meeting.

A list of shareholders will be available for inspection by the shareholders commencing April 21, 2003 at the corporate headquarters of the Company.

Even if you plan to attend the meeting in person, please sign, date and return the enclosed proxy in the enclosed postage-prepaid envelope. You may attend the meeting in person even if you send in your proxy; retention of the proxy is not necessary for admission to or identification at the meeting.

By Order of the Board of Directors

Carl K. Davis

Vice President, General Counsel and Secretary

Portland, Oregon

April 17, 2003

COLUMBIA SPORTSWEAR COMPANY

PROXY STATEMENT

Annual Meeting of Shareholders

This proxy statement is provided by the Board of Directors of Columbia Sportswear Company, an Oregon corporation (the “Company”), in connection with the solicitation of proxies by the Board of Directors for use at the annual meeting of shareholders to be held at 3:00 p.m., Pacific Time, on Thursday, May 15, 2003, at Columbia’s headquarters, located at 14375 NW Science Park Drive, Portland, Oregon for the purposes set forth in the accompanying Notice of Annual Meeting.

Upon written request to the Secretary of the Company, any person whose proxy is solicited by this proxy statement will be provided, without charge, a copy of the Company’s Annual Report on Form 10-K. The Annual Report can also be obtained from the Company’s website at www.columbia.com and the website of the Securities and Exchange Commission at www.sec.gov.

All proxies in the enclosed form that are properly executed and received by the Company before or at the annual meeting and not revoked will be voted at the annual meeting or any adjournments in accordance with the instructions on the proxy. Any shareholder who gives a proxy in the form accompanying this proxy statement may revoke it at any time before it is voted. Proxies may be revoked by (i) submitting to the Secretary of the Company, at or before the taking of the vote at the annual meeting, a written notice of revocation bearing a later date than the date of the proxy; (ii) submitting to the Secretary of the Company, at or before the taking of the vote at the annual meeting, a later-dated proxy relating to the same shares; or (iii) by attending the annual meeting and voting in person. A shareholder who attends the meeting, however, is not required to revoke the proxy and vote in person. Any written notice revoking a proxy should be sent to Columbia Sportswear Company, 14375 NW Science Park Drive, Portland, Oregon 97229, Attention: Carl K. Davis, or hand delivered to Mr. Davis at or before the vote at the annual meeting.

This proxy statement and the enclosed proxy card are being mailed on or about April 17, 2003 to the Company’s shareholders of record on April 2, 2003. The Company will bear the cost of preparing and mailing this proxy statement, the proxies solicited hereby and any other material furnished to shareholders by the Company in connection with the annual meeting. Proxies will be solicited by use of the mail and the Internet, and directors, officers and employees of the Company may also solicit proxies by telephone, fax or personal contact. No additional compensation will be paid for these services. The Company will request fiduciaries, custodians, brokerage houses and other like parties to forward copies of proxy materials to beneficial owners of the Company’s stock and will reimburse these parties for their reasonable and customary charges for expenses of such distribution.

The record date for determination of shareholders entitled to receive notice of and to vote at the annual meeting is April 2, 2003. At the close of business on April 2, 2003, 39,790,137 shares of Common Stock of the Company were outstanding and entitled to vote at the annual meeting. The Common Stock is the only outstanding authorized voting security of the Company. Each share of Common Stock issued and outstanding is entitled to one vote with respect to each matter to be voted on at the annual meeting, and there are no cumulative voting rights.

1

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership as of February 28, 2003 of the Company’s Common Stock by (i) each person known by the Company to own beneficially more than 5% of the Common Stock, (ii) each director of the Company, (iii) each executive officer of the Company named in the Summary Compensation Table, and (iv) all executive officers and directors as a group. The address for each of the named executive officers and directors is 14375 NW Science Park Drive, Portland, Oregon 97229. Except as otherwise noted, the persons listed below have sole investment and voting power with respect to the Common Stock owned by them.

| Beneficial Owner |

Shares Beneficially Owned(1) |

Percentage of Shares |

||||

| Gertrude Boyle |

5,396,879 |

(2) |

13.57 |

% | ||

| Timothy P. Boyle |

15,723,997 |

(3) |

39.53 |

% | ||

| Sarah A. Bany |

4,219,170 |

(4) |

10.60 |

% | ||

| Don R. Santorufo |

352,251 |

(5) |

* |

| ||

| Grant D. Prentice |

64,272 |

(6) |

* |

| ||

| Robert G. Masin |

68,232 |

(7) |

* |

| ||

| Murrey R. Albers |

25,418 |

(8) |

* |

| ||

| Stephen E. Babson |

4,799 |

(9) |

* |

| ||

| Edward S. George |

48,217 |

(10) |

* |

| ||

| Walter T. Klenz |

10,780 |

(11) |

* |

| ||

| John W. Stanton |

321,693 |

(12) |

* |

| ||

| All directors and executive officers as a group (16 persons) |

26,441,660 |

(13) |

65.80 |

% |

| * | Less than 1%. |

| (1) | Shares which the person or group has the right to acquire within 60 days after February 28, 2003 are deemed to be outstanding in calculating the percentage ownership of the person or group but are not deemed to be outstanding as to any other person or group. |

| (2) | Includes 59,493 shares held in two grantor retained annuity trusts for which Mrs. Boyle is the trustee and income beneficiary. |

| (3) | Includes (a) 263,680 shares held in trust, for which Mr. Boyle’s wife is trustee, for the benefit of Mr. Boyle’s children, (b) 417 shares held in trust for Mr. Boyle’s wife, for which she is trustee, and (c) 15,459,900 shares held in a grantor retained annuity trust for which Mr. Boyle is trustee and income beneficiary. |

| (4) | Includes (a) 177,000 shares held in trust, for which Ms. Bany’s husband is trustee, for the benefit of Ms. Bany’s children, (b) 1,104,138 shares held in grantor retained annuity trusts for which Ms. Bany is trustee and income beneficiary, (c) 44,445 shares held by Ms. Bany’s husband and (d) 16,030 shares subject to options exercisable within 60 days after February 28, 2003. |

| (5) | Includes 234,833 shares that will vest within 180 days of Mr. Santorufo’s retirement on January 3, 2003, unless the Company compensates Mr. Santorufo as described below in “Certain Relationships and Related Transactions.” |

| (6) | Includes 63,822 shares subject to options exercisable within 60 days after February 28, 2003. |

| (7) | Includes 57,355 shares subject to options exercisable within 60 days after February 28, 2003. |

| (8) | Includes 23,918 shares subject to options exercisable within 60 days after February 28, 2003. |

| (9) | Includes (a) 750 shares held by Babson Capital Partners, LP, for which Mr. Babson is general partner (b) 1,500 shares held by Jean McCall Babson Trust for which Mr. Babson is trustee and whose beneficiaries include members of Mr. Babson’s family and (c) 1,049 shares subject to options exercisable within 60 days after February 28, 2003. |

2

| (10) | Includes 14,200 shares held by trust and 34,017 shares subject to options exercisable within 60 days after February 28, 2003. |

| (11) | Consists of 10,780 shares subject to options exercisable within 60 days after February 28, 2003. |

| (12) | Includes 27,918 shares subject to options exercisable within 60 days after February 28, 2003. |

| (13) | Includes 405,451 shares subject to options exercisable within 60 days after February 28, 2003. |

3

PROPOSAL 1: ELECTION OF DIRECTORS

The Board of Directors of the Company consists of eight members. The directors of the Company are elected at each annual meeting to serve until the next annual meeting and until their successors are elected and qualified. Proxies received from shareholders, unless directed otherwise, will be voted FOR election of the following nominees: Mrs. Gertrude Boyle and Ms. Sarah A. Bany and Messrs. Timothy P. Boyle, Murrey R. Albers, Stephen E. Babson, Edward S. George, Walter T. Klenz and John W. Stanton.

Each nominee is now a director of the Company. If a quorum of shareholders is present at the annual meeting, the eight nominees for election as directors who receive the greatest number of votes cast at the meeting will be elected directors. Abstentions and broker nonvotes are counted for purposes of determining whether a quorum exists at the annual meeting, but will have no effect on the results of the vote. If any of the nominees for director at the annual meeting becomes unavailable for election for any reason, the proxy holders will have discretionary authority to vote pursuant to the proxy for a substitute or substitutes. The following table briefly describes the name, age and position with the Company of each of the Company’s nominees for directors.

| Name, Principal Occupation, and Other Directorships |

Age |

Director Since | ||

| Gertrude Boyle has served as Chairman of the Board of Directors since 1970. Mrs. Boyle also served as the Company’s President from 1970 to 1988. Mrs. Boyle is Timothy P. Boyle’s and Sarah A. Bany’s mother. |

79 |

1970 | ||

| Timothy P. Boyle has served on the Board of Directors since 1978. Mr. Boyle joined the Company in 1971 as general manager and has served as President and Chief Executive Officer since 1988. Mr. Boyle is Gertrude Boyle’s son and Sarah A. Bany’s brother. |

53 |

1978 | ||

| Sarah A. Bany has served on the Board of Directors since 1988. Ms. Bany is the owner and Executive Vice President of Brand Development of Moonstruck Chocolate Company. From 1979 to August 1998, Ms. Bany held various positions at Columbia Sportswear, most recently as Director of Retail Stores. Ms. Bany is Gertrude Boyle’s daughter and Timothy P. Boyle’s sister. |

44 |

1988 | ||

| Murrey R. Albers became a director of the Company in July 1993. Mr. Albers is President and Chief Executive Officer of United States Bakery, a bakery with operations in Oregon, Washington, Idaho, Montana and California. Mr. Albers, who has been in his current position since June 1985, joined United States Bakery as general manager of Franz Bakery in 1975. Mr. Albers chairs the Compensation Committee. |

61 |

1993 | ||

| Stephen E. Babson became a director of the Company in July 2002. Mr. Babson has been a Principal of Endeavour Capital, a Northwest private equity firm, since April 2002. Mr. Babson joined Stoel Rives LLP in 1978, was a partner from 1984 to February 2002, and served as its chairman from July 1999 to February 2002. |

52 |

2002 | ||

| Edward S. George became a director of the Company in 1989. For 30 years, until his retirement, Mr. George worked in the banking industry. From 1980 to 1990, he was President and CEO of Torrey Pines Bank and from 1991 to 1998 he served as a financial consultant. Mr. George also served as a director of First National Bank of San Diego until its sale in September 2002. Mr. George chairs the Audit Committee. |

66 |

1989 | ||

| Walter T. Klenz became of director of the Company in 2000. He has served as Managing Director of Beringer Blass Wine Estates since 2001. Mr. Klenz became President and Chief Executive Officer of Beringer Wine Estates in 1990, and Chairman of its Board of Directors in August 1997, and he served in those positions until the 2000 acquisition of Beringer Wine Estates by Foster’s Brewing Group Limited. Mr. Klenz joined Beringer Wine Estates in 1976 as director of marketing for the Beringer brand. He also serves on the Board of Directors of America West Airlines. |

57 |

2000 | ||

| John W. Stanton became a director of the Company in July 1997. Since 1992, Mr. Stanton has served as Chairman and Chief Executive Officer of Western Wireless Corporation, a publicly traded company, and its predecessors. Mr. Stanton also serves as Chairman of T-Mobile USA, a member of the T-Mobile International Group, the mobile telecommunications subsidiary of Deutsche Telekom AG. T-Mobile USA was formerly known as VoiceStream Wireless Corporation, which became a subsidiary of Deutsche Telekom AG in May 2001. Mr. Stanton served as Chief Executive Officer and Chairman of VoiceStream from 1994 to 2002. Mr. Stanton is a member of the board of directors of Advanced Digital Information Corporation and T-Mobile USA and a Trustee of Whitman College, a private college in the state of Washington. Mr. Stanton chairs the Nominating Committee. |

47 |

1997 |

4

Board Meetings and Committees

The Board of Directors met five times in 2002. All directors attended at least 75% of all Board meetings and meetings of the committees of which they were a member during 2002, except that Mr. Babson did not attend three of the meetings of the Board of Directors that were held before he became a director. The standing committees of the Board of Directors are the Audit Committee, the Compensation Committee and the Nominating Committee.

The Audit Committee, which met four times in 2002, consists of Messrs. George, Albers, Stanton and Klenz. A description of the functions performed by the Audit Committee and Audit Committee activity is set forth below in “Report of the Audit Committee.”

The Compensation Committee, which met four times in 2002, determines compensation for the Company’s executive officers and administers the Company’s 1997 Stock Incentive Plan and the 1999 Employee Stock Purchase Plan. The Compensation Committee consists of Messrs. Albers, George, Stanton and Klenz. For additional information about the Compensation Committee, see “Compensation Committee Report on Executive Compensation,” set forth below.

The Nominating Committee, which met once in 2002, reviews the composition of the Board and makes recommendations regarding nominations for director. Shareholders wishing to recommend a prospective nominee for the Board of Directors may do so by following the procedures set forth in the Company’s bylaws, which are summarized below under “Shareholder Nominations for Director.” The Nominating Committee consists of Messrs. Stanton, Albers and George and Ms. Bany.

Compensation of Directors

Directors who are not officers of the Company receive annual compensation of $20,000 plus $1,000 per meeting attended in addition to reasonable out-of-pocket expenses incurred in attending meetings. Each year directors who are not officers of the Company receive an option to acquire 5,250 shares of Common Stock and a $2,000 Columbia Sportswear apparel merchandise allowance. Directors are given the opportunity to receive an option grant in lieu of annual cash compensation. In 2002, five of the six non-employee directors elected to receive an option grant to acquire 1,072 shares of Common Stock in lieu of annual cash compensation. All option grants to directors have an exercise price equal to the fair market value of the Company’s Common Stock at the time of the grant, vest ratably over thirty-six months beginning the first month following the date of grant and expire ten years from the date the option was granted. Directors who are employees of the Company receive no separate compensation for their service as directors.

Recommendation by the Board of Directors

The Board of Directors recommends that shareholders vote FOR the election of the nominees named in this proxy statement.

5

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth all compensation paid by the Company for each of the last three years to the Chief Executive Officer and each of the four other most highly compensated executive officers.

| Annual Compensation |

Long-Term Compensation Securities Underlying Options |

All Other Compensation(1) |

||||||||||||

| Name and Principal Position |

Year |

Salary |

Bonus |

|||||||||||

| Timothy P. Boyle |

2002 |

$ |

690,000 |

$ |

927,751 |

— |

$ |

18,114 |

(2) | |||||

| President, Chief Executive Officer |

2001 |

$ |

690,000 |

$ |

1,404,458 |

— |

$ |

14,283 |

(3) | |||||

| 2000 |

$ |

660,250 |

$ |

1,518,000 |

— |

$ |

17,038 |

(4) | ||||||

| Don R. Santorufo* |

2002 |

$ |

500,000 |

$ |

611,167 |

— |

$ |

13,126 |

| |||||

| Former Executive Vice President and |

2001 |

$ |

500,673 |

$ |

925,203 |

— |

$ |

9,294 |

| |||||

| 2000 |

$ |

495,289 |

$ |

1,000,000 |

— |

$ |

12,050 |

| ||||||

| Gertrude Boyle |

2002 |

$ |

675,000 |

$ |

330,030 |

— |

$ |

13,126 |

| |||||

| Chairman of the Board |

2001 |

$ |

675,000 |

$ |

499,610 |

— |

$ |

9,294 |

| |||||

| 2000 |

$ |

643,039 |

$ |

540,000 |

— |

$ |

12,050 |

| ||||||

| Robert G. Masin |

2002 |

$ |

324,177 |

$ |

177,886 |

26,000 |

$ |

19,322 |

(2) | |||||

| Senior Vice President of Sales and Merchandising |

2001 |

$ |

303,188 |

$ |

224,408 |

26,250 |

$ |

13,947 |

(3) | |||||

| 2000 |

$ |

308,463 |

$ |

242,550 |

37,500 |

$ |

16,451 |

(4) | ||||||

| Grant D. Prentice |

2002 |

$ |

289,312 |

$ |

141,965 |

26,000 |

$ |

16,533 |

(2) | |||||

| Vice President, General Merchandising Manager Outerwear |

2001 |

$ |

290,635 |

$ |

213,398 |

26,250 |

$ |

13,743 |

(3) | |||||

| 2000 |

$ |

274,626 |

$ |

135,358 |

37,500 |

$ |

15,545 |

(4) | ||||||

| * | Mr. Santorufo retired from the Company on January 3, 2003. |

| (1) | Includes the Company’s profit sharing contribution of $6,800 for 2000, $4,044 for 2001 and $7,126 for 2002, and a matching contribution under the Company’s 401(k) savings plan of $5,250 for 2000 and 2001 and $6,000 for 2002, except for Mr. Prentice for whom the Company’s matching contribution was $5,500. |

| (2) | Includes $4,989, $6,196 and $3,908 for Messrs. Boyle, Masin and Prentice, respectively, paid in connection with an executive officer disability insurance premium. |

| (3) | Includes $4,989, $4,653, and $4,449 for Messrs. Boyle, Masin and Prentice, respectively, paid in connection with an executive officer disability insurance premium. |

| (4) | Includes $4,989, $4,401, and $3,096 for Messrs. Boyle, Masin and Prentice, respectively, paid in connection with an executive officer disability insurance premium. |

6

Stock Option Grants in Fiscal Year 2002

The following table provides information regarding stock options granted in 2002 to the Company’s executive officers named in the Summary Compensation Table.

| Number of Shares Underlying Options Granted(1) |

Percentage of Options Granted to Employees During Fiscal Year |

Exercise Price Per Share |

Expiration Date |

Potential Realizable Value at Assumed Rates of Annual Stock Price Appreciation For Option Term(2) | |||||||||||

| Name |

5% |

10% | |||||||||||||

| Gertrude Boyle |

— |

— |

|

— |

— |

|

— |

|

— | ||||||

| Timothy P. Boyle |

— |

— |

|

— |

— |

|

— |

|

— | ||||||

| Don R. Santorufo |

— |

— |

|

— |

— |

|

— |

|

— | ||||||

| Robert G. Masin |

26,000 |

3.2% |

$ |

38.29 |

4/19/12 |

$ |

626,090 |

$ |

1,586,634 | ||||||

| Grant D. Prentice |

26,000 |

3.2% |

$ |

38.29 |

4/19/12 |

$ |

626,090 |

$ |

1,586,634 | ||||||

| (1) | 25% of the options granted to Mr. Masin and Mr. Prentice during 2002 become exercisable on the first anniversary of the first full month after the date of grant, and the remaining 75% become exercisable ratably over the following 36 months. |

| (2) | In accordance with the rules of the Securities and Exchange Commission, these amounts are the hypothetical gains or option spreads that would exist for the respective options based on assumed compounded rates of annual stock price appreciation of 5% and 10% from the date the options were granted over the option term. |

Aggregated Option Exercises and Year-End Option Values

The following table indicates for all executive officers named in the Summary Compensation Table, on an aggregated basis, (i) stock options exercised during 2002, including the value realized on the date of exercise, (ii) the number of shares subject to exercisable and unexercisable stock options as of December 31, 2002 and (iii) the value of “in-the-money” options.

| Number of Shares Acquired on Exercise |

Value Realized |

Number of Shares Underlying Unexercised Options at Fiscal Year-End |

Value of Unexercised | ||||||||||||

| Name |

Exercisable |

Unexercisable |

Exercisable |

Unexercisable | |||||||||||

| Gertrude Boyle |

— |

|

— |

— |

— |

|

— |

|

— | ||||||

| Timothy P. Boyle |

— |

|

— |

— |

— |

|

— |

|

— | ||||||

| Don R. Santorufo |

— |

|

— |

— |

— |

|

— |

|

— | ||||||

| Robert G. Masin |

— |

|

— |

49,105 |

64,609 |

$ |

1,389,531 |

$ |

715,434 | ||||||

| Grant D. Prentice |

48,395 |

$ |

1,162,246 |

52,172 |

69,756 |

$ |

1,735,434 |

$ |

1,087,523 | ||||||

| (1) | Options are “in-the-money” at the fiscal year-end if the fair market value of the underlying securities on such date exceeds the exercise price of the option. The amounts set forth represent the fair market value of the securities underlying the options on December 31, 2002 based on the closing sale price of $44.42 per share of Common Stock on that date (as reported on the NASDAQ National Market) and the exercise price of the options, multiplied by the applicable number of shares. |

7

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

The Company entered into a five-year lease agreement with Gertrude Boyle on January 1, 1998, for a building for use as a portion of its previous headquarters building. In connection with this lease, the Company paid $72,071 to Mrs. Boyle in 2002 and agreed to an early termination of the lease after moving to its new corporate headquarters.

The Company entered into a five-year lease of a building from the Frank Deggendorfer Trust for $6,250 monthly beginning March 5, 1998. Frank Deggendorfer is Gertrude Boyle’s son-in-law and Timothy P. Boyle’s brother-in-law and Sarah A. Bany’s brother-in-law. Until late 2000, the leased building housed the Company’s Bend, Oregon outlet store. The lease for that store was terminated early and the store has been relocated. The Company paid the Frank Deggendorfer Trust $75,000 in 2002, including $50,000 for lease payments and $25,000 for an early termination fee.

In December 1996 the Company entered into a Deferred Compensation Conversion Agreement with Don Santorufo, Executive Vice President and Chief Operating Officer of the Company, providing for the conversion of deferred compensation units granted under a prior agreement into an aggregate of 2,700,653 restricted shares of the Company’s Common Stock. The agreement provided that approximately 60 percent of those shares vested immediately, and the remainder were to vest ratably between 1997 and December 2004. Under the agreement, the Company provided Mr. Santorufo with bonuses and amounts to cover certain taxes through 1998. In addition, the Company loaned Mr. Santorufo approximately $5.7 million (the “Loan”) for payment of related income taxes. The Loan was repaid in full in 1998. As of Mr. Santorufo’s retirement on January 3, 2003, 234,833 shares were subject to annual vesting through December 31, 2004. As provided in the agreement, these unvested shares will vest automatically upon termination of employment unless the Company pays Mr. Santorufo approximately $498,000 as compensation for such unvested shares within 180 days of his termination date. In addition, the Company agreed to pay a cash bonus for up to 50% of any additional tax liability that may be imposed on Mr. Santorufo with respect to the compensation received under the agreement. The amount of this cash bonus would be increased to offset taxes owed by Mr. Santorufo as a result of such bonus.

B2 Flight LLC, a limited liability company owned by Timothy P. Boyle and his wife, leases its Hawker aircraft to the Company for business use at a price comparable to commercial fares. In 2002, the Company paid B2 Flight LLC $66,346 for use of the aircraft.

The Company believes the foregoing transactions were on terms as fair to the Company as those which would have been available in arm’s-length negotiations.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Compensation Committee of the Board of Directors (the “Committee”) consists of Messrs. Murrey R. Albers, Edward S. George, Walter T. Klenz and John W. Stanton, all non-employee directors. No committee member participates in committee deliberations or recommendations relating to his own compensation.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION 1

The Committee makes recommendations to the Board regarding compensation for the executive officers of the Company, and administers the executive compensation plans, the Company’s Employee Stock Purchase Plan and the Company’s stock option program, from which stock options are granted periodically to executive officers and other employees of the Company.

| 1 | This Compensation Committee Report in addition to the section entitled “Report to the Audit Committee” and the section entitled “Performance Graph” are not “soliciting material,” are not deemed “filed” with the Securities and Exchange Commission and are not to be incorporated by reference in any filing of the Company under the Securities Act of 1933 or the Securities Act of 1934, regardless of date or any general incorporation language in such filing. |

8

Compensation Principles and Philosophy

The Committee believes that leadership and motivation of the Company’s executives are critical to the long-term success of the Company. In support of this philosophy, the Company has adopted an executive compensation policy in which the primary objectives are to provide a total compensation package:

| (1) | which will allow it to attract and retain key executive officers who are primarily responsible for the long-term success of the Company; |

| (2) | that takes into consideration the compensation practices of comparable companies with whom the Company competes for executive talent; and |

| (3) | which will motivate executives to maximize shareholder returns by achieving both short and long-term Company goals. |

The Committee maintains the philosophy that compensation of the Company’s executives should be directly linked to the financial performance of the Company as well as to each executive’s individual contribution. In determining competitive compensation levels, the Committee has engaged independent compensation consultants to analyze base salaries and incentive compensation for executive officers at comparable companies. Base compensation for executive officers is generally targeted between the 50th and 75th percentiles of pay at these comparable companies, depending on levels of experience and responsibility. Most executive salaries remained unchanged in 2002 and 2003 and fell slightly below the 75th percentile. However, market data for these comparable companies was generally lower in 2003 than in years past.

The Committee continues to place increasing emphasis on aligning compensation with Company performance, by increasing the proportion of executive pay that is “at risk,” offering increased rewards for strong Company and individual performance and reduced returns if performance expectations are not met.

The total compensation package includes a competitive base salary, incentive bonuses and periodic stock option grants, as well as a 401(k) plan with a Company match, and a Company profit sharing plan.

Compensation Elements

There are different elements in the Company’s executive compensation program, all determined by individual performance and Company profitability, except for stock option grants which are intended to correlate compensation to stock price performance.

Base Salary Compensation

Base salaries for the Chief Executive Officer and other select executive officers have been established by reviewing a number of factors, including responsibilities, experience, demonstrated performance and potential for future contributions. The Committee also takes into account competitive factors, including the level of salaries associated with similar positions at businesses that compete with the Company.

Annual Incentive Compensation

In 1999, the Board of Directors and shareholders approved the Executive Incentive Compensation Plan. Under the Executive Incentive Compensation Plan, the Committee establishes performance goals, which may include Company revenues or earnings or other Company benchmarks, within ninety days of the beginning of the calendar year. Cash target bonuses for eligible executive officers will be determined by the extent to which the Company attains the established goals and by an assessment of each executive officer’s performance during the year. Specific performance goals to which an eligible executive’s bonus is tied will be at the discretion of the Committee. In each case, the target bonus will be a percentage of the executive’s base salary. Bonuses may exceed the target if performance goals are exceeded. An executive may also receive no bonus for the year if less

9

than a predetermined percentage of the applicable performance goal is met or if the executive’s performance does not meet the Committee’s expectations. Although the Executive Incentive Compensation Plan requires that Company performance goals and target bonuses be established in the first quarter of the year in order to comply with Section 162(m) of the Internal Revenue Code, the Committee is free to exercise discretion by reducing bonuses from a preset amount. For example, if Company performance would result in a maximum bonus, but individual performance does not meet the Committee’s standards, the Committee could exercise discretion by reducing the bonus amount. Under the Executive Incentive Compensation Plan the Committee established a performance goal for the Company for 2002 based on pre-tax income. The Company exceeded its performance goals for fiscal 2002 and each Executive Officer received a cash bonus.

Stock Options

Options provide executives with the opportunity to buy and maintain an equity interest in the Company and to share in the appreciation of the value of the stock. They also provide a long-term incentive for the executive to remain with the Company and promote shareholder returns. The Company has made periodic stock option grants under the 1997 Stock Incentive Plan to most executive officers. The Company to date has not granted stock options to Timothy P. Boyle, Gertrude Boyle or Don R. Santorufo, each of whom has a substantial ownership interest in the Company, which provides a long-term performance incentive. Mr. Santorufo previously received long-term incentive compensation in the form of restricted stock that vested ratably over a period of several years; restricted stock that was unvested at Mr. Santorufo’s retirement on January 3, 2003, will automatically fully vest 180 days after Mr. Santorufo’s termination date unless the Company pays him approximately $498,000 as compensation for such shares before that payment date, pursuant to the agreement between the Company and Mr. Santorufo described above under “Certain Relationships and Related Transactions.” Shares that remain unexercisable upon payment to Mr. Santorufo by the Company may be cancelled.

The Committee makes annual stock option grants to certain executives and other select employees. The number of shares in each grant will depend on factors such as the level of base pay and individual performance. Stock options are awarded with an exercise price equal to the fair market value of the Company’s Common Stock at the time of the grant. Options granted in 2002 expire ten years after the option was granted and vest over a period of four years. The options only have value to the recipients if the price of the Company’s stock appreciates after the options are granted.

Other Benefits

The Company has a 401(k) plan and a profit-sharing plan, which cover substantially all employees with more than ninety days of service. The Company has historically made discretionary matching and non-matching contributions, with the non-matching contributions made in the form of profit sharing. All contributions to the plans are determined by the Board of Directors. In addition, executive officers, other than Timothy and Gertrude Boyle, are eligible to participate in the Company’s 1999 Employee Stock Purchase Plan.

Other benefits that are offered to key executives are largely those that are offered to the general employee population, with some variation. In general, they are designed to provide a safety net of protection against the financial catastrophes that can result from illness, disability or death.

Chief Executive Officer Compensation

The Committee has determined the compensation for the Chief Executive Officer based on a number of factors. Mr. Boyle’s base salary was determined after a review of his experience, performance and an evaluation of comparable positions at other companies. Under the Executive Incentive Compensation Plan total compensation for Mr. Boyle is tied to the overall financial performance of the Company. For 2002, Mr. Boyle was eligible to receive between 30 percent and 220 percent of his base salary, depending on the Company achieving between 85 and 130 percent of predetermined financial goals. The Company exceeded 100 percent of

10

the financial goals, and Mr. Boyle received a bonus of $927,751, or 134 percent of his annual salary. Mr. Boyle’s 2003 salary of $690,000 is unchanged from 2002, and was established by the Committee after commissioning a review of executive salaries across related industries as well as in the same geographic region. In 2003, Mr. Boyle is again eligible for a performance-based bonus of between 30 percent and 220 percent of his base salary, depending on his performance and on the Company achieving between 85 percent and 130 percent of pre-set financial goals. If the Company’s performance is below 85 percent of the financial goals, Mr. Boyle will receive no bonus under the Executive Incentive Compensation Plan. Because of Mr. Boyle’s substantial ownership interest in the Company, the Committee believes he has an effective long-term incentive tied directly to shareholder return.

Deductibility of Compensation

Section 162(m) of the Internal Revenue Code of 1986, as amended, limits to $1,000,000 per person the amount that the Company can deduct for compensation paid to the Company’s Chief Executive Officer and four highest compensated officers (other than the Chief Executive Officer) in any year. Depending on individual and Company performance, total compensation for certain of such executives may be greater than $1,000,000. The limit on deductibility, however, does not apply to performance-based compensation that meets certain requirements. The Company’s current policy is generally to grant stock options that meet those requirements so that option compensation recognized by an optionee will be fully deductible by the Company. Similarly the Executive Incentive Compensation Plan is intended to provide for fully deductible performance-based compensation.

Members of the Compensation Committee:

Murrey R. Albers—Chairman

Edward S. George

Walter T. Klenz

John W. Stanton

11

REPORT OF THE AUDIT COMMITTEE

On May 25, 2000, the Board of Directors approved a charter for the Audit Committee, which reflects the standards set forth in the Securities and Exchange Commission regulations and NASDAQ Stock Market listing standards. A copy of the Audit Committee charter was attached as Appendix A to the Company’s proxy statement for the 2001 annual meeting of shareholders, which is available at the Company’s website at www.columbia.com and at the SEC’s website at www.sec.gov. Messrs. George, Albers, Stanton and Klenz serve on the Audit Committee. Each member of the Audit Committee is a non-employee director and is “independent,” in accordance with the NASDAQ Stock Market listing standards.

The Audit Committee’s role is to provide governance, guidance, and oversight regarding financial information provided by the Company to the public or governmental bodies, the Company’s systems of internal controls, and the auditing, accounting, and financial reporting processes in general. The Audit Committee regularly meets with management and the Company’s outside auditors, Deloitte & Touche LLP, to discuss, among other things, the preparation of financial statements, including key accounting and reporting issues. In accordance with the Audit Committee charter, the Audit Committee also oversees the relationship between the Company and its outside auditors, including recommending their appointment, reviewing the scope of their services and related fees, and assessing their independence.

The Audit Committee reviewed the audited financial statements for the year ended December 31, 2002 with management and Deloitte & Touche LLP. The Audit Committee also discussed with Deloitte & Touche LLP matters required to be discussed with audit committees under generally accepted auditing standards, including, among other things, matters related to the conduct of the audit of the Company’s consolidated financial statements and the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (Communication with Audit Committees) (“SAS 61”). SAS 61 requires the Company’s independent auditors to provide the Audit Committee with additional information regarding the scope and results of their audit of the Company’s consolidated financial statements, including with respect to:

| • | their responsibility under generally accepted auditing standards, |

| • | significant accounting policies, |

| • | management judgments and estimates, |

| • | any significant audit adjustments, |

| • | any disagreements with management, and |

| • | any difficulties encountered in performing the audit. |

The Audit Committee also discussed with Deloitte & Touche LLP their independence, and Deloitte & Touche LLP provided the Audit Committee with written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees) to the effect that, in their professional judgment, Deloitte & Touche LLP is independent of the Company within the meaning of the federal securities laws. When considering Deloitte & Touche LLP’s independence, the Audit Committee discussed whether Deloitte & Touche LLP’s provision of services to the Company beyond those rendered in connection with their audit and review of the Company’s consolidated financial statements was compatible with maintaining their independence. The Audit Committee also reviewed, among other things, the amount of fees paid to Deloitte & Touche LLP for audit and non-audit services.

Based on the Audit Committee’s review and these meetings, discussions and reports, and subject to the limitations of the Audit Committee’s role and responsibilities referred to above and in the Audit Committee Charter, the Audit Committee recommended to the Board that the Company’s audited consolidated financial statements for the year ended December 31, 2002 be included in the Company’s Annual Report on Form 10-K.

Members of the Audit Committee:

Edward S. George—Chairman

Murrey R. Albers

Walter T. Klenz

John W. Stanton

12

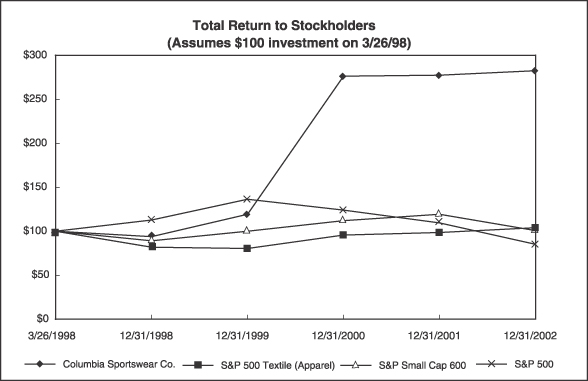

PERFORMANCE GRAPH

Set forth below is a line graph comparing the cumulative total shareholder return of the Company’s Common Stock, assuming reinvestment of dividends, with the cumulative total return of the Standard & Poor’s Small Cap 600 Index, the S&P 500 Textile (Apparel) Index and the S&P 500 Index for the period commencing March 26, 1998 (the date of the Company’s initial public offering) and ending on December 31, 2002. The S&P Textile (Apparel) Small Cap Index, included in prior years, was discontinued by Standard & Poors in 2002. The graph assumes that $100 was invested March 26, 1998 in each of

| • | the Common Stock of the Company (at the initial public offering price of $18), |

| • | the stocks represented in the Standard and Poor’s Small Cap 600 Index, |

| • | the stocks represented in the S&P’s 500 Textile (Apparel) Index, and |

| • | the stocks represented in the S&P 500 Index. |

The table also assumes the reinvestment of dividends, if any. The Company included indices for the S&P 500 and S&P 500 Textile (Apparel) in order to provide shareholders comparisons with companies outside the small capitalization category.

Historical stock price performance should not be relied upon as indicative of future stock price performance.

Columbia Sportswear Company

Stock Price Performance

March 26 [Inception] – December 31, 2002

| 03/26/1998 |

12/31/1998 |

12/31/1999 |

12/31/2000 |

12/31/2001 |

12/31/2002 | |||||||||||||

| Columbia Sportswear Co. |

$ |

100.00 |

$ |

93.75 |

$ |

119.42 |

$ |

276.39 |

$ |

277.50 |

$ |

282.73 | ||||||

| S&P 500 Textile (Apparel) |

$ |

100.00 |

$ |

81.94 |

$ |

80.35 |

$ |

95.81 |

$ |

98.74 |

$ |

103.97 | ||||||

| S&P 500 Index |

$ |

100.00 |

$ |

112.96 |

$ |

136.56 |

$ |

124.22 |

$ |

109.50 |

$ |

85.27 | ||||||

| S&P Small Cap 600 Index |

$ |

100.00 |

$ |

89.17 |

$ |

100.15 |

$ |

111.94 |

$ |

119.20 |

$ |

100.94 | ||||||

13

PROPOSAL 2: RATIFICATION OF SELECTION OF INDEPENDENT AUDITOR

The Board of Directors has selected Deloitte & Touche LLP as the Company’s independent auditor for the 2003 fiscal year, subject to ratification of the selection by the shareholders of the Company at the annual meeting. Proxies will be voted in accordance with the instructions specified in the proxy form. If no instructions are given, proxies will be voted for approval of Deloitte & Touche LLP as independent auditor. Representatives of Deloitte & Touche LLP are expected to be present at the annual meeting and will be available to respond to appropriate questions. They do not plan to make any statement but will have the opportunity to make a statement if they wish.

The Board of Directors recommends a vote FOR this proposal.

FEES PAID TO INDEPENDENT AUDITORS

The following table presents the fees billed to the Company for the audit and other services provided by Deloitte & Touche LLP for fiscal year 2002.

Audit Fees: for audit of Form 10-K and review of Forms 10-Q were $312,101.

Financial Information Systems Design and Implementation Fees: None.

All Other Fees: for all other services were $1,274,069, of which fees for audit related services, which include employee benefit plan audits and consultation concerning financial accounting and reporting standards, were $79,143, fees for tax related services were $1,004,996 and fees for all other services, primarily including consulting services for expatriate tax consulting, customs and value added tax related matters in various European countries were $189,930.

The Audit Committee has determined that the provision of services described above is consistent with the independence of Deloitte & Touche LLP.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers, directors and persons who own more than 10% of the Common Stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission (SEC). Executive officers, directors, and beneficial owners of more than 10% of the Common Stock are required by SEC regulation to furnish the Company with copies of all Section 16(a) reports they file. Based solely on a review of such reports received by the Company and on written representations from certain reporting persons that they have complied with the relevant filing requirements, the Company believes that all Section 16(a) transactions were reported on a timely basis.

DISCRETIONARY AUTHORITY

Although the Notice of Annual Meeting of Shareholders provides for transaction of any other business that properly comes before the meeting, the Board of Directors has no knowledge of any matters to be presented at the meeting other than the matters described in this proxy statement. The enclosed proxy, however, gives discretionary authority to the proxy holders to vote in accordance with their judgment if any other matters are presented.

14

SHAREHOLDER PROPOSALS

Shareholder Proposals to be Included in the Company’s Proxy Statement

A shareholder proposal to be considered for inclusion in proxy materials for the Company’s 2004 annual meeting of shareholders must be received by the Company not later than December 19, 2003.

Shareholder Proposals Not in the Company’s Proxy Statement

Shareholders wishing to present proposals for action at this annual meeting or at another shareholders’ meeting must do so in accordance with the Company’s bylaws, a copy of which is available upon written request to Carl K. Davis, Vice President, General Counsel and Secretary. A shareholder must give timely notice of the proposed business to the Secretary. For purposes of the Company’s 2004 annual meeting of shareholders, such notice, to be timely, must be received by the Company by January 19, 2004.

Shareholder Nominations for Director

Shareholders wishing to directly nominate candidates for election to the Board of Directors at an annual meeting must do so in accordance with the Company’s bylaws by giving timely notice in writing to the Secretary as defined above. The notice shall set forth (a) the name and address of the shareholder who intends to make the nomination, (b) the name, age, business address and residence address of each nominee, (c) the principal occupation or employment of each nominee, (d) the class and number of shares of the Company which are beneficially owned by each nominee and by the nominating shareholder, (e) any other information concerning the nominee that must be disclosed of nominees in proxy solicitations pursuant to Regulation 14A of the Securities Exchange Act of 1934, and (f) the executed consent of each nominee to serve as a director of the Company if elected. If the number of directors to be elected is increased and there is no public announcement by the Company naming all nominees or specifying the size of the increased Board of Directors at least 100 days prior to the first anniversary of the preceding years annual meeting, a shareholder’s notice shall also be considered timely (but only with respect to nominees for new positions created by such increase) if delivered to the Secretary at the Company’s principal executive offices no later than the close of business on the tenth day following the day on which the public announcement is first made by the Company. Shareholders wishing to make any director nominations at any special meeting of shareholders held for the purpose of electing directors must do so, in accordance with the Bylaws, by delivering timely notice to the Secretary setting forth the information described above for annual meeting nominations. To be timely, the notice must be delivered to the Secretary at the principal executive offices of the Company not earlier than the close of business on the 90th day prior to the special meeting and not later than the close of business on the tenth day following the day on which public announcement is first made of the date of the special meeting and of the nominees proposed by the Board to be elected at the meeting. The officer presiding at the meeting may, if in the officer’s opinion the facts warrant, determine that a nomination was not made in accordance with the procedures prescribed by the bylaws. If such officer does so, such officer shall so declare to the meeting and the defective nomination shall be disregarded.

By Order of the Board of Directors

Timothy P. Boyle

President and Chief Executive Officer

Portland, Oregon

April 17, 2003

15

PROXY

COLUMBIA SPORTSWEAR COMPANY

Proxy Solicited on Behalf of the Board of Directors of

the Company for the Annual Meeting May 15, 2003

The undersigned hereby appoints Gertrude Boyle, Timothy P. Boyle, Patrick D. Anderson and Carl K. Davis, and each of them, proxies with full power of substitution, to vote on behalf of the undersigned at the Annual Meeting of Shareholders of Columbia Sportswear Company on May 15, 2003, and at any adjournment thereof, all shares of the undersigned in Columbia Sportswear Company. The proxies are instructed to vote as follows:

The shares represented by this proxy will be voted in accordance with instructions, if given. If no instructions are given, they will be voted for the directors and for Deloitte & Touche as independent auditor. The proxies may vote in their discretion as to other matters that may come before the meeting.

PLEASE SIGN ON OTHER SIDE AND RETURN PROMPTLY

é FOLD AND DETACH HERE é

You can now access your Columbia Sportswear Company account online.

Access your Columbia Sportswear Company shareholder account online via Investor ServiceDirect® (ISD).

Mellon Investor Services LLC, agent for Columbia Sportswear Company, now makes it easy and convenient to get current information on your shareholder account. After a simple and secure process of establishing a Personal Identification Number (PIN), you are ready to log in and access your account to:

| • View account status • View certificate history • View book-entry information |

• View payment history for dividends • Make address changes • Obtain a duplicate 1099 tax form • Establish/change your PIN |

Visit us on the web at http://www.melloninvestor.com

and follow the instructions shown on this page.

| Step 1: FIRST TIME USERS—Establish a PIN

You must first establish a Personal Identification Number (PIN) online by following the directions provided in the upper right portion of the web screen as follows. You will also need your Social Security Number (SSN) or Investor ID available to establish a PIN.

The confidentiality of your personal information is protected using secure socket layer (SSL) technology.

• SSN or Investor ID • PIN • Then click on the Establish PIN button

Please be sure to remember your PIN, or maintain it in a secure place for future reference. |

Step 2: Log in for Account Access

You are now ready to log in. To access your account please enter your:

• SSN or Investor ID • PIN • Then click on the Submit button

If you have more than one account, you will now be asked to select the appropriate account. |

Step 3: Account Status Screen

You are now ready to access your account information. Click on the appropriate button to view or initiate transactions.

• Certificate History • Book-Entry Information • Issue Certificate • Payment History • Address Change • Duplicate 1099 |

For Technical Assistance Call 1-877-978-7778 between

9am-7pm Monday-Friday Eastern Time

| Please mark your votes as in this example |

x |

|

| (The Board of Directors recommends a vote FOR Item 1 and Item 2.) |

||||||||||||||

| FOR |

WITHHELD |

FOR |

AGAINST |

ABSTAIN | ||||||||||

| 1. ELECTION OF DIRECTORS:

Nominees: 01 Gertrude Boyle, 02 Timothy P. Boyle, 03 Sarah A. Bany, 04 Murrey R. Albers, 05 Edward S. George, 06 Walter T. Klenz 07 John W. Stanton 08 Stephen E. Babson |

¨ |

¨ |

2. |

Approval of Deloitte & Touche LLP as independent auditor. |

¨ |

¨ |

¨ | |||||||

| To facilitate meeting arrangements, please check here if you plan to attend the meeting in person. |

¨ |

|||||||||||||

| For, except vote withheld from the following nominee(s):

|

||||||||||||||

SIGNATURE(S) Date: ,2003

NOTE: Please sign exactly as name(s) appears hereon. Joint owners should each sign. Please mark, date, sign and return proxy card promptly. Receipt is acknowledged of the notice and proxy statement relating to this meeting.

é FOLD AND DETACH HERE é