UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

☑ Filed by the Registrant ☐ Filed by a Party other than the Registrant

| | | | | |

| Check the appropriate box: | |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under Rule 14a-12 |

COLUMBIA SPORTSWEAR COMPANY

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

| | | | | |

| Payment of Filing Fee (Check the appropriate box): | |

| ☑ | No fee required. |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) Title of each class of securities to which transaction applies: |

| (2) Aggregate number of securities to which transaction applies: |

| (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) Proposed maximum aggregate value of transaction: |

| (5) Total fee paid: |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) Amount Previously Paid: |

| (2) Form, Schedule or Registration Statement No.: |

| (3) Filing Party: |

| (4) Date Filed: |

MESSAGE FROM OUR CHAIRMAN, PRESIDENT AND CEO

DEAR FELLOW SHAREHOLDERS:

We are living through extraordinary times. During these times, I am reminded of the legacy of our late Tough Mother, Gert Boyle, and that resilience is in the DNA of this Company. Fifty years ago, Gert Boyle took the helm of Columbia Sportswear Company. She had no experience, no resources, forty employees and a dire national economy. It was an extraordinary situation. But she fought back and she came back. Those hard times shaped the character, resilience and determination that has built the great Company we have today. The shock to the global economy due to the COVID-19 pandemic will likely be felt for many years but I believe our Company is resilient. While not addressed specifically in this proxy statement, the Company has already initiated meaningful cost containment measures that will affect the compensation of our named executive officers and directors in 2020. My 2020 annual salary was reduced to $10,000 (an amount to allow for continuing coverage of standard health care benefits), the Board of Directors asked that their annual compensation be reduced by 50 percent through January 2021 and the leadership at the Company temporarily reduced their annual salaries by between 5 and 15 percent to reflect leadership’s commitment to focus available funds on business needs and employees.

The recent unprecedented challenges have left little time to celebrate our remarkable achievements in 2019, including surpassing $3 billion in sales for the first time in our Company’s history, and the efforts of our Board relating to corporate governance and human capital management.

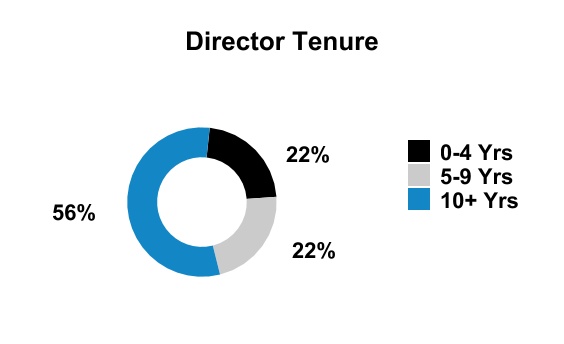

We are proud of our Company history and are fortunate to have had certain of our directors play critical roles in our success story, such as Ronald Nelson, who began assisting the Company in the early 1970s, when our business was fledgling. We value the deep understanding of our business that these experienced directors have and, at the same time, recognize the need to continue to welcome new ideas and diverse perspectives. Our Nominating and Corporate Governance Committee monitors the composition of our Board to ensure it is operating effectively. In order to maintain accountability for the actions of our directors, our Nominating and Corporate Governance Committee also oversees an annual evaluation of the Board and its committees, which helps to inform our Board nomination process.

There have been several changes in our Board’s composition in the past few years. Since 2015, we added three new members to our Board, had three longstanding members step down from our Board and, in late 2019, regretfully lost our matriarch, and former Chairman of the Board, Gertrude Boyle. We feel fortunate that two of the new Board members added since 2015 have been women, continuing Gertrude Boyle’s legacy of strong female influence on the Company.

Gertrude Boyle served as Chairman of the Board from 1970 until 2019. Following her passing, the Board acted to appoint me Chairman. The Board values strong, independent insight, so, given the combination of the Chairman and Chief Executive Officer roles, also acted to formalize the Lead Independent Director role and appointed Andy Bryant to serve as Lead Independent Director.

Our Company’s mission is to connect active people with their passions. We are deeply committed to the people and families who live, work and play in the communities where we operate, and to the scarce resources we share.

We believe global climate change is a real environmental, economic and social challenge affecting all of us, and warrants thoughtful and purposeful responses by all stakeholders. As a global distributor of products, we recognize the impact our business and operations have on the environment. As a responsible company, we also recognize that we have a role to play in mitigating these impacts by improving the energy efficiency of our manufacturing processes and working to reduce the negative impact of the products we sell. We are a single player in a large, complex supply chain and believe climate change related challenges are best tackled together. As such, we are collaborating with our employees, industry groups, other brands, NGOs and the communities in which we operate to effect positive change.

Our Corporate Responsibility team has worked to put policies, programs and resources in place to run our business responsibly, to be conscientious stewards of the environment and to have a positive impact on our communities. We also recognize that the tone starts at the top, and each of the Audit, Compensation and Nominating and Corporate Governance Committees plays a role in the oversight of environmental, social and governance matters.

The Compensation Committee of the Board regularly considers human capital initiatives not just for leadership, but for all employees. Under its oversight, in 2019, the Company’s management made significant investments in the human resources area to enable talent develop and provide consulting services that link people, processes, and business goals to the Company’s overall mission, vision, and strategy. In 2019, the Company also implemented a cloud-based human capital management system for use by our employees across the globe and gave access to a digital learning platform and content to all our corporate employees.

Our history informs our present. As a company founded by immigrants fleeing Nazi Germany, we truly understand that diversity and inclusion is one of the great strengths of our global business, including being open and welcoming toward individuals with diverse backgrounds. Just as our outdoor environments thrive with diversity, diverse perspectives in the workplace lead to creativity and innovation. We know that equity leads to empowerment and inclusion leads to teamwork. We are dedicated to creating a company that is diverse, equitable and inclusive.

The Board of Directors thanks you for your continued investment in Columbia Sportswear Company. We appreciate the opportunity to serve Columbia on your behalf.

Sincerely,

| | | | | |

| |

| |

| Timothy P. Boyle | |

| Chairman, President and Chief Executive Officer | |

| | |

| NOTICE OF 2020 ANNUAL MEETING OF SHAREHOLDERS |

Dear Shareholders:

The Board of Directors of Columbia Sportswear Company, an Oregon corporation, cordially invites you to attend our 2020 Annual Meeting of Shareholders (the “Annual Meeting”), which will be held at 3:00 p.m. Pacific Time on Wednesday, June 3, 2020. In order to ensure the health and safety of our employees, directors and shareholders during these uncertain times, the Board of Directors has authorized participation via remote communication for our Annual Meeting. There will be no physical location for shareholders to attend. The Annual Meeting will only occur virtually through an audio webcast, accessible at www.virtualshareholdermeeting.com/COLM2020. You may notify the Company of your desire to participate in the meeting by remote communication by logging into the online site in advance of the meeting. Log-in will begin at 2:45 p.m. Pacific Time. To participate in the Annual Meeting, you will need your unique control number included on your proxy card (printed in the box and marked by the arrow) or on the instructions that accompanied your proxy materials.

The purpose of the meeting is:

1.To elect eight directors for the next year;

2.To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2020;

3.To approve, by non-binding vote, executive compensation;

4.To approve the Columbia Sportswear Company 2020 Stock Incentive Plan; and

5.To act upon any other matters that may properly come before the meeting.

Only shareholders of record at the close of business on April 1, 2020, are entitled to vote at the Annual Meeting. A list of shareholders will be available for inspection beginning April 20, 2020, at our corporate headquarters, 14375 NW Science Park Drive, Portland, OR 97229, (503) 985-4000. If you would like to view this shareholder list, please contact us at the address or telephone number provided.

Your vote is very important. Whether or not you attend the virtual Annual Meeting, it is important that your shares are represented and voted at the meeting. Please promptly submit your vote by internet, by telephone, or by signing, dating, and returning the enclosed proxy card or voting instruction form in the postage-paid envelope provided so that your shares will be represented and voted at the Annual Meeting.

By Order of the Board of Directors

Peter J. Bragdon

Executive Vice President, Chief Administrative Officer, General Counsel and Secretary

Portland, Oregon

April 20, 2020

Important Notice Regarding the Availability of Proxy Materials for the 2020 Annual Meeting of Shareholders

This Notice of Meeting, our Proxy Statement and our 2019 Annual Report to Shareholders are available free of charge at www.proxyvote.com. These materials were first sent or made available to shareholders on April 20, 2020.

| | |

| Special Note Regarding Forward Looking Statements |

This document contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements often use words such as “will,” “anticipate,” “estimate,” “expect,” “should,” “may,” and other words and terms of similar meaning or reference future dates. The Company’s expectations, beliefs and projections are expressed in good faith and are believed to have a reasonable basis; however, each forward-looking statement involves a number of risks and uncertainties, including those set forth in this document, those described in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q under the heading “Risk Factors,” and those that have been or may be described in other reports filed by the Company, including reports on Form 8-K. The Company cautions that forward-looking statements are inherently less reliable than historical information. The Company does not undertake any duty to update any of the forward-looking statements after the date of this document to conform them to actual results or to reflect changes in events, circumstances or its expectations. New factors emerge from time to time and it is not possible for the Company to predict or assess the effects of all such factors or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement.

Throughout this Proxy Statement we may refer to Columbia Sportswear Company as “Columbia,” the “Company,” “we,” “us,” or “our.”

The content on any website referred to in this Proxy Statement is not incorporated by reference in this Proxy Statement unless expressly noted.

| | | | | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PROPOSAL 4: APPROVAL OF THE 2020 STOCK INCENTIVE PLAN | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | i

This proxy summary highlights information contained elsewhere in this Proxy Statement for Columbia. For more complete information about these topics, please review our 2019 Annual Report to Shareholders and this entire Proxy Statement.

2020 Annual Meeting of Shareholders

| | | | | | | | | | | | | | |

| Date and Time | | Place | | Meeting Agenda |

June 3, 2020 at 3 p.m. PT | | Virtually, through an audio webcast at www.virtualshareholdermeeting.com/COLM2020 | | The meeting will cover the proposals listed under voting items and board recommendations below, and any other business that may properly come before the meeting. |

| | | | |

| Record Date | | Mailing Date | | Voting Eligibility |

| April 1, 2020 | | This Proxy Statement was first mailed to shareholders on or about April 20, 2020. | | Owners of our common stock as of the Record Date are entitled to vote on all matters. |

Voting Items and Board Recommendations

| | | | | | | | | | | | | | | | | | | | |

| Item | | Proposal | | Board Vote Recommendation | | Further Details |

| 1. | | Elect 8 directors | | FOR ALL | | p. 15 |

| 2. | | Ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2020 | | FOR | | p. 19 |

| 3. | | Approve, by non-binding vote, executive compensation | | FOR | | p. 43 |

| 4. | | Approve the Columbia Sportswear Company 2020 Stock Incentive Plan | | FOR | | p. 44 |

How to Vote

We strongly encourage you to vote. You may vote via the Internet, by telephone, or, if you have received a printed version of these proxy materials, by mail. If you are a beneficial stockholder, your broker will NOT be able to vote your shares with respect to the election of directors and most of the other matters presented during the meeting unless you have given your broker specific instructions to do so. For more information, see “General Information About the Meeting” on page 53 of this Proxy Statement.

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 1

2019 Business Highlights

2019 was a record year for Columbia Sportswear Company, with sales surpassing the $3 billion mark for the first time in our Company’s history. Net sales increased 9% to $3,042.5 million, from $2,802.3 million in 2018. Operating income increased 13% to $395.0 million, or 13% of net sales, from operating income of $351.0 million, or 12.5% percent of net sales, in 2018. Net income increased 23% to $330.5 million, from $268.3 million, in 2018. We were also able to deliver on our identified strategic priorities:

v Driving global brand awareness and sales growth through increased, focused demand creation investments.

v Enhancing consumer experience and digital capabilities in all of our channels and geographies.

v Expanding and improving global Direct-to-Consumer (“DTC”) operations with supporting processes and systems.

v Investing in our people and optimizing our organization across our portfolio of brands.

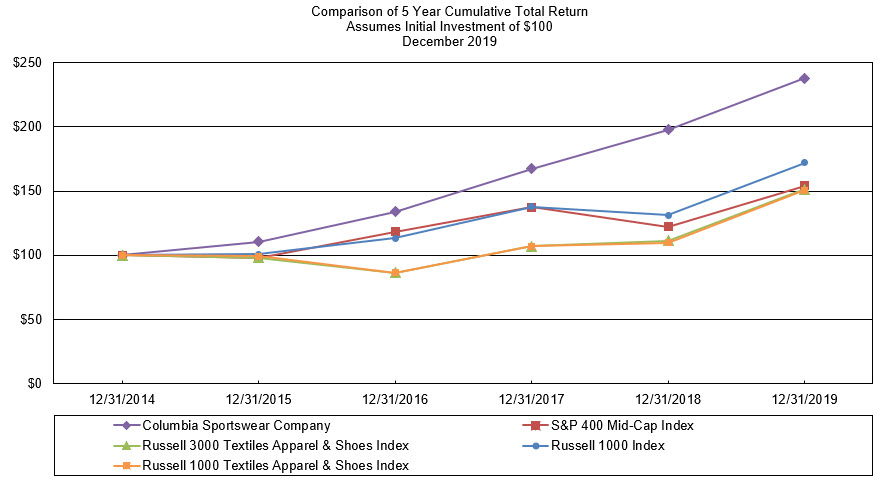

Continuing Strong Returns for our Shareholders(1)

Columbia continued its strong record of Total Shareholder Return (“TSR”) growth in 2019, with a TSR of 138% for the last 5 years. The line graph below compares the cumulative total shareholder return of our common stock with the cumulative total return of the Russell 1000 Index, Russell 1000 Textiles Apparel & Shoes Index, Standard & Poor’s 400 Mid-Cap Index and the Russell 3000 Textiles Apparel & Shoes Index for the period beginning December 31, 2014 and ending December 31, 2019. The graph assumes that $100 was invested on December 31, 2014, and that any dividends were reinvested.

(1) Historical stock price performance should not be relied on as indicative of future stock price performance.

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 2

Governance Matters

v Highly Qualified Board. Our directors bring a variety of different experiences to help provide effective oversight in the boardroom. Our most recent Board of Directors (the “Board”) addition, Kevin Mansell, served as President of Kohl’s Corporation from 1999, Chief Executive Officer from 2008 and Chairman of the Board of Directors from 2009 until his retirement in May 2018. Mr. Mansell brings a combination of retail, public company, strategic and financial expertise to the Board.

v Independent Board Leadership. Gertrude Boyle served as Chairman of the Board from 1970 until 2019. Following her passing, the Board elected Timothy P. Boyle as Chairman, in light of his knowledge of the Company and our industry, which has been built up over a lifetime with the Company. Given the combination of the Chairman and Chief Executive Officer roles, the Board also acted to formalize a Lead Independent Director role and appointed Andy D. Bryant as Lead Independent Director. As Lead Independent Director, Mr. Bryant oversees executive sessions of the Board’s independent directors. Currently eight out of the Board’s nine directors are independent. The Board believes the presence of a Lead Independent Director, together with a strong leader in the combined role of Chairman and Chief Executive Officer, serves the best interests of the Company and its shareholders at this time.

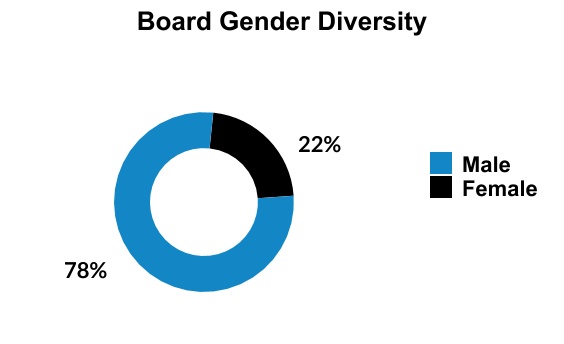

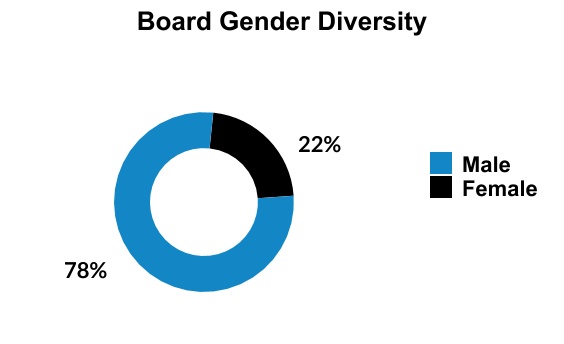

v Focus on Board Diversity. Our Board believes that differences in experiences, knowledge, skills and viewpoints enhance the Board’s overall performance. Although the Board does not maintain a specific policy with respect to Board diversity, the Nominating and Corporate Governance Committee considers a broad range of background and experience in its assessment of the Board’s composition. In that regard, since 2015, the Board has appointed two female directors. In addition, the legacy of our former Chairman of our Board, Gertrude Boyle, and her strong female leadership, are a constant presence in our boardroom.

v Mix of Company History and Fresh Ideas. We are proud of our long company history and feel fortunate to have had experienced leaders on our Board to help guide us in our growth. We value the deep understanding of our business that certain of our directors have due to their tenure, but also acknowledge the need for fresh ideas. Our Nominating and Corporate Governance Committee monitors the composition of our Board to ensure it is operating effectively. There have been several changes in our Board’s composition in the past few years. Since 2015, we added three new members to our Board, had three longstanding members step down from our Board and, in late 2019, regretfully, lost our matriarch, and former Chairman of the Board, Gertrude Boyle.

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 3

Executive Compensation Highlights

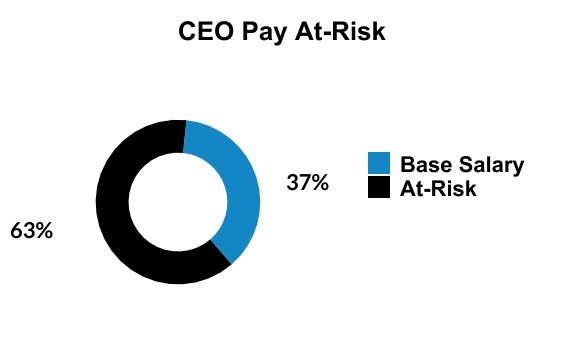

Columbia’s executive compensation program aims to reward performance. Our executive officers realize a significant portion of their compensation only when we achieve annual and long-term business goals and when our stock price increases. The following are highlights related to our 2019 compensation program for our named executive officers, Messrs. Boyle, Swanson, Bragdon, Cusick, and Fogliato:

v Strong Company Performance Exceeded the Short-Term Incentive Target. The Company’s performance in 2019, when compared to the corporate performance target previously set by the Compensation Committee under the Executive Incentive Compensation Plan, resulted in the achievement of 104.4% of target.

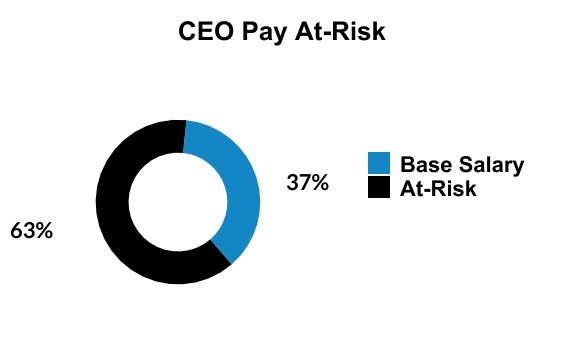

v Majority of Compensation at Risk. For each named executive officer, 55% or more of the officer’s actual 2019 compensation was “at-risk,” or subject to performance requirements or stock market fluctuations. We consider time-based Restricted Stock Units (“RSUs”) “at-risk,” as they are subject to stock market fluctuations. For Mr. Boyle, approximately 63% of his actual 2019 compensation was “at-risk,” or subject to performance requirements.

v Long-Term Compensation. Our named executive officers, other than Mr. Boyle, receive annual long-term equity awards in the form of stock options, time-based RSUs and performance-based RSUs that constitute a substantial portion of each executive’s total compensation opportunity. A significant portion of these awards vests based on achievement of specified long-term performance goals. Because Mr. Boyle holds a significant amount of our common stock, he does not receive equity compensation grants and instead receives long-term incentive cash awards tied to the same multi-year operating goals to which the vesting of performance-based RSU awards for other executive officers is subject.

Based on above-target achievement of the three-year cumulative operating income and three-year average return on invested capital goals set by the Compensation Committee in early 2017 and upon certification of such achievement by the Compensation Committee on March 5, 2020, 149.2% of the performance-based RSUs awarded to Mr. Bragdon and Mr. Cusick for the 2017 through 2019 performance period vested, and Mr. Boyle similarly received 149.2% of the long-term incentive cash award granted to him for the 2017 through 2019 performance period. Messrs. Fogliato and Swanson were not eligible to receive grants of performance-based RSUs in 2017.

v Executive Compensation Best Practices.

| | | | | | | | | | | | | | |

| What We Do | | | What We Don’t Do | |

| ü | Base a majority of our compensation on performance and retention incentives | | œ | Tax gross-ups |

| ü | Use multiple metrics in short-term and long-term incentive plans | | œ | Reprice stock options |

| ü | Retain an independent advisor for the Compensation Committee | | œ | Excessive severance payments |

| ü | Cap incentive programs | | œ | Single-trigger cash severance |

| ü | Have stock ownership guidelines for our named executive officers | | œ | Guaranteed bonus amounts |

| ü | Have a clawback policy for our named executive officers | | œ | Excessive perquisites |

| ü | Conduct annual “say-on-pay” advisory votes | | œ | Employment contracts |

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 4

Sustainability

While the Company is focused on sustainability efforts across our enterprise, our current corporate responsibility strategy is to sustain active lifestyles through investing in initiatives that have a positive impact on the people we reach, the places we touch and the products we make through:

•empowering people;

•sustaining places; and

•maintaining responsible practices.

Each of our four brands focuses on impacts that are unique to their positioning within our corporate responsibility strategy.

Our Corporate Responsibility team works to ensure we have the policies, programs and resources in place to execute on our corporate responsibility strategy. Detailed information regarding our (and our brands’) corporate responsibility priorities and progress can be found in our annual Corporate Responsibility Report (available on our website at www.columbiasportswearcompany.com/Corporate-Responsibility-Group).

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 5

Risk Oversight

Columbia’s management team is responsible for identifying, assessing and managing the material risks facing Columbia. The Board generally oversees Columbia’s risk management practices and processes. The Board has delegated primary oversight of the management of (i) financial, accounting and cybersecurity risk to the Audit Committee, (ii) compensation risk to the Compensation Committee, and (iii) governance risk to the Nominating and Corporate Governance Committee. Oversight of certain aspects of compliance risk is shared by the Audit Committee and the Nominating and Corporate Governance Committee. To permit the Board and its committees to perform their respective risk oversight roles, certain individual members of management who supervise Columbia’s risk management communicate directly to the Board or the relevant committee of the Board responsible for overseeing the management of specific risks, as applicable. For this purpose, management has a high degree of access and communication with independent directors. Because a majority of the Board consists of independent directors (eight out of nine directors), and each committee of the Board consists solely of independent directors, Columbia’s risk oversight structure conforms to the Board’s leadership structure discussed below and demonstrates Columbia’s belief that having a strong, independent group of directors is important for good governance.

The Board also oversees a process of risk assessment within Columbia that is designed to identify the enterprise risks facing Columbia’s business, including interviews conducted with independent directors and members of senior management seeking participants’ judgment and assessment of the relative likelihood and magnitude of risks identified. The results of the periodic assessments are reviewed with the Nominating and Corporate Governance Committee and by the entire Board.

Finally, the Board oversees various organizational structures, policies and procedures at Columbia to promote ethical conduct and compliance with laws and regulations. For example, Columbia maintains a Code of Business Conduct and Ethics and has established a confidential compliance line and web-based reporting platform through which employees and other stakeholders can report concerns subject to the Company’s processes for protecting confidentiality. The chair of the Audit Committee receives notifications of all compliance line reports.

Oversight Documents

Corporate Governance Guidelines. The Board has adopted Corporate Governance Guidelines that address:

| | | | | | | | | | | | | | |

| v | Director qualifications | | v | Director compensation |

| v | Director independence | | v | Director orientation and continuing education |

| v | Director responsibilities | | v | Chief Executive Officer (“CEO”) evaluation and management succession |

| v | Board committees | | v | Annual board and committee performance evaluations |

| v | Director access to officers, employees and others | | v | Annual review of the Corporate Governance Guidelines |

A copy of our Corporate Governance Guidelines is available on our website at https://investor.columbia.com.

Code of Business Conduct and Ethics. As mentioned above, the Board has adopted a Code of Business Conduct and Ethics that sets out basic principles to guide all of Columbia’s officers, directors and employees worldwide, as well as certain third parties in their dealings with or on behalf of Columbia and our subsidiaries and affiliates. Our Code of Business Conduct and Ethics has been translated into various languages and is available to our employees and also on our website at https://investor.columbia.com. We plan to satisfy the disclosure requirement regarding any amendment to, or a waiver of, the Code of Business Conduct and Ethics by posting such information on our website at https://investor.columbia.com.

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 6

Board Structure

Meetings. The Board met five times and the independent directors held four executive sessions of the Board in 2019. Each director attended at least 75% of the aggregate of (a) the total number of meetings of the Board held during the period during which he or she was a director, and (b) the total number of meetings held by all committees on which the director served during the period that he or she served, except Mrs. Boyle, who, due to health concerns, attended 40% of the total number of meetings of the Board held prior to her passing. While we do not maintain a formal policy regarding director attendance at annual shareholder meetings, three of our directors attended our 2019 annual meeting of shareholders.

Independence. Under our Corporate Governance Guidelines, which adopt the standards for “independence” under applicable Nasdaq listing rules and Securities and Exchange Commission (“SEC”) rules, a majority of the members of our Board of Directors must be independent, as determined by the Board. The Board has determined that Mss. Simmons and Wasson and Messrs. Albers, Babson, Bryant, Klenz, Mansell, and Nelson are independent and, accordingly, a majority of the members of our Board are independent. In addition, the Board has determined that all members of our Audit Committee and Compensation Committee are independent under the standards for independence applicable to members of each committee. There are no undisclosed material transactions, relationships or arrangements that were considered by the Board in connection with the determination of whether any particular director is independent.

Leadership. Under our Board structure, leadership is provided primarily by our:

v Chairman of the Board, President and CEO; and

v Lead Independent Director

Timothy P. Boyle is our Chairman of the Board, President and CEO. As President and CEO, Mr. Boyle is primarily responsible for Columbia’s general operations and implementing its business strategy. Mr. Boyle is also Columbia’s largest shareholder. For these reasons, the Board believes that, at this time, Columbia and its shareholders are best served by having the President and CEO also serve as Chairman of the Board.

The Board also believes that having a strong, independent leader is important for good governance. Upon appointing our President and CEO as Chairman of the Board in early 2020, the Board also acted to formalize the Lead Independent Director role and appointed long-serving director Andy D. Bryant to serve in such capacity. The Lead Independent Director is elected by a majority of the Board for a renewable term of one year (and until such time as her or his successor is elected) or until such earlier time as he or she ceases to be a director, resigns as Lead Independent Director, is removed or replaced as Lead Independent Director or the roles of Chairman and Chief Executive Officer are no longer combined. The Board adopted a Lead Independent Director Charter outlining the scope of the Lead Independent Director role that is available for review on our website at https://investor.columbia.com. Pursuant to this Charter, the Lead Independent Director has certain powers and responsibilities, including:

| | | | | | | | | | | |

| v | Presiding at all meetings of the Board in the absence of, or upon the request of, the Chairman | v | Advising on meeting agendas for the Board |

| v | Leading regular executive sessions of the independent Directors | v | Advising on information sent to the Board |

| v | Serving as a liaison and supplemental channel of communication between the Chairman and the independent Directors | v | Being available for consultation and direct communication with shareholders of the Company |

On an annual basis, the Lead Independent Director, in consultation with the independent directors, will review the Lead Independent Director Charter and recommend any modifications or changes to the Board for approval.

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 7

Committees. The Board has designated three standing committees of the Board: the Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee. Each committee operates under a written charter that is available for review on our website at https://investor.columbia.com. The table below provides information regarding the current membership of each standing Board committee and number of meetings held in fiscal 2019.

| | | | | | | | | | | | | | | | | |

| | | | | |

| Director Name | Audit Committee | | Compensation Committee | | Nominating and Corporate Governance Committee |

| Timothy P. Boyle | | | | | |

| Murrey R. Albers | | | ü | | ü |

| Stephen E. Babson | | | Chair | | ü |

| Andy D. Bryant | ü | | | | Chair |

| Walter T. Klenz | | | ü | | ü |

| Kevin Mansell | ü | | | | ü |

| Ronald E. Nelson | ü | | | | ü |

| Sabrina L. Simmons | | | ü | | ü |

| Malia H. Wasson | Chair | | | | ü |

| Meetings in Fiscal 2019 | 5 | | | 5 | | | 4 | |

Audit Committee. The Board has determined that each member of the Audit Committee meets all applicable independence and financial literacy requirements. The Board has also determined that Ms. Wasson is an “audit committee financial expert” as defined in regulations adopted by the SEC. A description of the functions performed by the Audit Committee and Audit Committee activity is set forth in the “Report of the Audit Committee.”

Compensation Committee. The Compensation Committee determines compensation for the Company’s executive officers and administers the Company’s 1997 Stock Incentive Plan and any executive officer incentive compensation plans, including our Executive Incentive Compensation Plan. The Compensation Committee’s processes and procedures for determining compensation for the Company’s executive officers and directors are described below in “Compensation Discussion and Analysis.” The Compensation Committee also regularly considers human capital initiatives not just for leadership, but for all employees.

Compensation Consultant. The Compensation Committee retained Exequity LLP (“Exequity”) as its independent outside compensation consultant for 2019. The Compensation Committee chose Exequity primarily because of the competence, knowledge, background, and reputation of the representative who advises the Compensation Committee. Exequity reports directly to the Compensation Committee. Based on direction from the Compensation Committee, Exequity provides the Compensation Committee with:

•information about market trends in executive officer compensation;

•general information on compensation practices at other companies;

•specific data on the compensation paid to executive officers at peer companies; and

•analyses of performance measures used in incentive programs.

Exequity also:

•assists the Compensation Committee in its evaluation of executive pay, practices and programs; and

•advises the Compensation Committee on ad hoc issues related to broad-based compensation plans.

Exequity reports on executive officer compensation matters and presents findings directly to the Compensation Committee but does not provide recommendations on compensation decisions for individual executive officers.

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 8

Compensation Committee Interlocks and Insider Participation. No member of our Compensation Committee is a past or present officer or employee of ours or any of our subsidiaries, nor has any member of our Compensation Committee had any relationship requiring disclosure under Item 404 of Regulation S-K under the Securities Exchange Act of 1934, which requires disclosure of certain relationships and related party transactions. Likewise, none of our executive officers has served on the board of directors or compensation committee (or other committee serving an equivalent function) of any other entity, where one of the other entity’s executive officers served on our Board or Compensation Committee.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee develops and recommends corporate governance guidelines and standards for business conduct and ethics, identifies individuals qualified to become Board members and makes recommendations regarding nominations for director. The Nominating and Corporate Governance Committee will consider individuals recommended by shareholders for nomination as director in accordance with the procedures described under “Director Nomination Policy” below. The Nominating and Corporate Governance Committee also makes recommendations concerning the size, structure, composition, and membership of the Board and its committees.

Assessments and Evaluations

Board Size. The Board sets the number of directors from time to time by resolution. The Board has the flexibility to increase or decrease the size of the Board as circumstances warrant. The Board is currently composed of nine members, but Murrey R. Albers is not standing for reelection at the Annual Meeting, when his current term expires. If all of the Board’s nominees are elected, the Board will be composed of eight members immediately following the Annual Meeting. If any nominee is unable to serve as a director or if any director leaves the Board between Annual Meetings, the Board, by resolution, may reduce the number of directors or elect an individual to fill the resulting vacancy.

Annual Evaluations. Our Nominating and Corporate Governance Committee monitors the composition of our Board to ensure it is operating effectively. In order to maintain accountability for the actions of our directors, our Nominating and Corporate Governance Committee also oversees an annual self-evaluation of the Board and its committees. A copy of each committee’s self-evaluation is shared with the Nominating and Corporate Governance Committee’s chair. The evaluations help to inform our Board nomination process.

Diversity. Columbia’s Corporate Governance Guidelines establish that the Nominating and Corporate Governance Committee of the Board is responsible for reviewing annually the desired skills and characteristics of new Board members and the composition of the Board as a whole. In assessing the appropriate composition of the Board, the Committee considers factors set forth in the Corporate Governance Guidelines, including diversity. Although the Board does not maintain a specific policy with respect to Board diversity, the Board believes that the Board should be a diverse body, and the Nominating and Corporate Governance Committee considers a broad range of backgrounds and experiences in its assessment. The Nominating and Corporate Governance Committee considers these and other factors as it oversees the annual Board and committee assessments.

Director Nominations

Director Nomination Policy. Shareholders may recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board (see “2021 Shareholders Proposals or Nominations” for more information). In addition to shareholder recommendations, the Nominating and Corporate Governance Committee may identify potential director nominees through referrals by directors, officers, employees, and third parties, including search firms, and internal research and recruitment activities.

Director Selection and Qualifications. Following the identification of director candidates, the Nominating and Corporate Governance Committee meets to discuss and consider each candidate’s qualifications and determines by majority vote the candidates who the Nominating and Corporate Governance Committee believes will best serve Columbia, which candidates are then submitted to the Board for approval. In evaluating director candidates, the Nominating and Corporate Governance Committee considers a variety of factors, including the composition of the Board as a whole, the characteristics of each candidate and the performance and continued tenure of incumbent Board members. The Nominating and Corporate Governance Committee considers these factors to evaluate potential candidates regardless of the source of the recommendation. The Nominating and Corporate Governance Committee believes that director candidates should possess high ethical character, business experience with high accomplishment in his or her respective field, the ability to read and understand

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 9

financial statements, relevant expertise and experience, and the ability to exercise sound business judgment. Candidates must also be over 21 years of age. In addition, the Nominating and Corporate Governance Committee believes at least one member of the Board should meet the criteria for an “audit committee financial expert” as defined by the SEC rules, and that a majority of the members of the Board should meet the definition of “independent director” under the applicable Nasdaq listing requirements.

Our Board believes that maintaining a strong, independent group of directors that comprises a majority of our Board is important for good governance, and eight of our nine directors qualify as independent. The Board believes that all of our directors should possess the qualities described in our Corporate Governance Guidelines, including integrity and moral responsibility, the capacity to evaluate strategy and reach sound conclusions and the willingness and ability to devote the time required to fulfill the duties of a director. In addition, the Board places high value on the ability of individual directors to contribute to a constructive Board environment.

The Board believes that our current directors, collectively, provide the diversity of experience and skills necessary for a well-functioning board. All of our directors have substantial senior executive-level business experience. For a more complete description of individual backgrounds, professional experiences, qualifications, and skills, see the director profiles set forth under “Proposal 1: Election of Directors” below.

Certain Relationships and Related Person Transactions

Details. Joseph P. Boyle, son of Timothy P. Boyle and grandson of former Board member Gertrude Boyle, is employed by Columbia as Executive Vice President and Columbia Brand President. In 2019, Joseph P. Boyle received an annualized salary of $504,000 as Executive Vice President and Columbia Brand President and was eligible to receive bonus, equity and employment benefits available to other executive officers. The Nominating and Corporate Governance Committee reviewed and ratified Joseph P. Boyle’s compensation arrangements.

In early 2019, Molly Boyle, daughter of Timothy P. Boyle, granddaughter of former Board member Gertrude Boyle and sister of Joseph P. Boyle, was employed by Columbia as a Senior Retail Merchandise Manager. In such role, Molly Boyle received an annualized salary of $90,283 and was eligible to receive bonus, equity and employment benefits available to other employees of similar rank. In February 2019, Ms. Boyle was promoted to E-commerce Merchandising Manager and Direct-to-Consumer Liaison for the SOREL brand in North America. In connection with her new role, Ms. Boyle received an annualized salary of $106,554 and was eligible to receive bonus, equity and employment benefits available to other employees of similar rank. The Nominating and Corporate Governance Committee reviewed and ratified Molly Boyle’s compensation arrangements.

In January 2016, Columbia entered into an aircraft arrangement, whereby it subleases an aircraft from Alvador, LLC, a limited liability company wholly owned by Timothy P. Boyle and his wife. Under the terms of the arrangement, Columbia has engaged an unaffiliated entity to provide pilot services for operation of the aircraft. Under the terms of the sublease, Columbia pays Alvador, LLC a monthly rental amount equal to $3,500 per flight hour. In 2019, Columbia paid Alvador, LLC $273,000 for use of the aircraft. Columbia also incurred expenses totaling $12,000 for pilot services and $7,184 for miscellaneous related flight crew services. The Nominating and Corporate Governance Committee believes that these arrangements are on terms at least as fair to Columbia as those that would have been available in arm’s-length negotiated transactions.

Our former Chairman, Gertrude Boyle, was the victim of a targeted crime, including an attempted kidnapping, in November 2010. In response to the incident, Columbia established security protocols recommended by an independent security review for Mrs. Boyle and hired a former police officer to oversee those protocols (such employment was terminated upon Mrs. Boyle’s passing). The former police officer is an in-law of Timothy P. Boyle and received compensation of $40,250 in 2019; Mr. Boyle reimbursed Columbia in 2019 for this compensation and payroll taxes in the amount of $44,618.

Approval Process. Our Nominating and Corporate Governance Committee generally approves in advance any transactions with an officer, director, greater-than-5% shareholder, or any immediate family member of an officer, director, or greater-than-5% shareholder (“related person”) pursuant to our written related person transaction approval policy. A “related person transaction” is any actual or proposed transaction or series of transactions, since the beginning of the last fiscal year, amounting to more than $120,000 in which Columbia was or is to be a participant, and in which a related person has or will have a direct or indirect material interest. Our policy requires that the Nominating and Corporate Governance Committee review the material facts of any transaction that

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 10

could potentially qualify as a “related person transaction” and either approve or disapprove of our entry into the transaction. If advance Nominating and Corporate Governance Committee approval is not feasible, the related person transaction is considered, and if the Committee determines it to be appropriate, ratified at the Committee’s next regularly scheduled meeting. In determining whether to approve or ratify a transaction, the Nominating and Corporate Governance Committee takes into account, among other factors it deems to be appropriate, whether the transaction is on terms no less favorable than terms generally available to an unaffiliated person in the same or similar circumstances and the extent of the related person’s direct or indirect interest in the transaction. If a related person transaction is ongoing, the Nominating and Corporate Governance Committee may establish guidelines for management to follow in its ongoing dealings with the related person. Thereafter, the Nominating and Corporate Governance Committee reviews and assesses ongoing relationships with the related person annually to confirm they are in compliance with the Nominating and Corporate Governance Committee’s guidelines and are appropriate.

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 11

Director Compensation Philosophy

Our director compensation program is intended to enable us to:

v attract and retain qualified non-employee directors by providing compensation that is competitive with other companies; and

v align directors’ interests with shareholders’ interests by including equity as a significant portion of each non-employee director’s compensation package.

In setting director compensation, we consider compensation offered to directors by other companies, the amount of time that our directors spend providing services to us and the experience, skill and expertise that our directors have. Directors who are employees of Columbia receive no separate compensation for their service as directors.

Non-Employee Director Compensation

Overview of Compensation. In 2019, each director who was not a Columbia employee was eligible to receive:

v Service Fees;

▪a $70,000 annual board service fee

▪a $10,000 annual committee service fee for each committee on which the director serves as a member

▪a $20,000 annual committee chair fee for each committee for which the director serves as chair

Annual cash fees are paid quarterly following the date the director is appointed to the Board or elected by shareholders at our annual meeting of shareholders.

Directors may elect to receive equity compensation in lieu of all or half of the $70,000 annual board service fee and may elect how they wish to allocate this amount between stock options or RSU awards that vest in full on May 1 following the date of grant. In 2019, four of our non-employee directors elected to receive equity compensation in lieu of half of their $70,000 annual board service fee for the one-year term following our annual meeting.

v Merchandise Allowance; and

▪a $3,500 Company merchandise allowance

v An Annual Equity Award, consisting of:

▪a Stock Option grant valued at $70,000 (using the Black-Scholes valuation method) to purchase shares of our common stock at an exercise price equal to the closing market price of our common stock on the date of grant

▪a grant of Time-Based RSUs valued at $70,000 based on the closing market price of our common stock on the date of grant, discounted by the present value of the future stream of dividends over the vesting period using the Black-Scholes valuation method

The annual equity awards are granted immediately following the election of directors at each annual meeting of shareholders. One hundred percent of the stock options become exercisable and one hundred percent of the shares of RSUs vest (subject to postponement for weekends and Nasdaq holidays) on May 1 of the year following the year in which the annual equity award was granted.

Non-employee directors who own more than $50 million of Columbia common stock may elect to receive cash in lieu of the annual equity award. A cash payment is made in the amount of $140,000 and paid in full on the vesting date of the applicable annual equity awards.

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 12

On March 25, 2019, the Board appointed Kevin Mansell to the Board. Mr. Mansell received a pro-rata portion of the annual board and committee service fees, a pro-rata portion of the annual equity award, merchandise allowance, and reasonable out-of-pocket expenses incurred in attending meetings for his service as a director prior to the 2019 annual meeting of shareholders. Mr. Mansell was not eligible to elect to receive equity in lieu of his pro-rated annual board service fee, for service prior to the 2019 annual meeting of shareholders.

In March 2020, the Board, upon recommendation of the Compensation Committee, voted to reduce non-employee director compensation in the aggregate by 50% through their January 2021 pay period, except with respect to Mr. Albers.

Reimbursements and Expenses. Non-employee directors are reimbursed for reasonable out-of-pocket expenses (including costs of travel, food and lodging) incurred in attending Board, committee and shareholder meetings. Non-employee directors are also reimbursed for participation in director education programs.

2019 Non-Employee Director Compensation Table. The following table summarizes the compensation paid to each non-employee director in 2019.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name(1) | Fees Earned

or Paid in Cash

($) | | Stock Awards(2) ($) | | Option Awards(2) ($) | | All Other Compensation(3) ($) | | Total

($) |

Sarah A. Bany(4) | 250,000 | | (5) | — | | | — | | | 3,500 | | | 253,500 | |

| Murrey R. Albers | 55,000 | | | 105,047 | | (6) | 70,028 | | | 3,500 | | | 233,575 | |

| Stephen E. Babson | 65,000 | | | 87,586 | | (7) | 87,556 | | (7) | 3,500 | | | 243,642 | |

| Andy D. Bryant | 65,000 | | | 87,586 | | (7) | 87,556 | | (7) | 3,500 | | | 243,642 | |

Edward S. George(8) | 45,000 | | | 74,909 | | | 102,471 | | | 3,500 | | | 225,880 | |

| Walter T. Klenz | 90,000 | | | 70,032 | | | 70,028 | | | 3,500 | | | 233,560 | |

Kevin Mansell(9) | 67,500 | | | 77,954 | | | 77,914 | | | 3,500 | | | 226,868 | |

| Ronald E. Nelson | 55,000 | | | 87,586 | | (7) | 87,556 | | (7) | 3,500 | | | 233,642 | |

| Sabrina L. Simmons | 90,000 | | | 70,032 | | | 70,028 | | | 3,500 | | | 233,560 | |

| Malia H. Wasson | 100,000 | | | 70,032 | | | 70,028 | | | 3,500 | | | 243,560 | |

(1)Gertrude Boyle served as Chairman of the Board until her passing in November 2019 and was an executive officer in such capacity. She received no additional compensation in 2019 for her services provided to the Company as a director.

(2)Other than for Mr. George, the amounts set forth in the “Stock Awards” and “Option Awards” columns in the table above reflect the aggregate grant date fair value computed in accordance with the Financial Accounting Standards Board Accounting Standards Codification Topic No. 718, Compensation-Stock Compensation (FASB ASC Topic 718), excluding the effect of any estimated forfeiture rate. For Mr. George, the amounts represent the incremental increase in fair value related to the modification of certain of his outstanding equity awards due to acceleration of vesting prior to his retirement from the Board on May 30, 2019, computed in accordance with FASB ASC Topic 718, excluding the effect of any estimated forfeiture rate. These amounts may not correspond to the actual value eventually realized by the director, which depends in part on the market value of our common stock in future periods. Assumptions used in the calculation of these amounts are described in the Notes to Consolidated Financial Statements included in Columbia’s Annual Report on Form 10-K for the year ended December 31, 2019, filed with the SEC. The following table sets forth the aggregate number of unvested stock awards and the aggregate number of option awards held as of December 31, 2019, by each of our directors:

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 13

| | | | | | | | | | | |

| Name | Stock Awards

Outstanding | | Option Awards

Outstanding |

| Timothy P. Boyle | — | | | — | |

| Gertrude Boyle | — | | | — | |

| Sarah A. Bany | — | | | — | |

| Murrey R. Albers | 1,492 | | | 45,550 | |

| Stephen E. Babson | 1,304 | | | 52,865 | |

| Andy D. Bryant | 1,304 | | | 6,501 | |

Edward S. George(8) | — | | | — | |

| Walter T. Klenz | 1,115 | | | 16,926 | |

| Kevin Mansell | 754 | | | 2,759 | |

| Ronald E. Nelson | 1,304 | | | 37,479 | |

| Sabrina L. Simmons | 754 | | | 4,016 | |

| Malia H. Wasson | 1,115 | | | 5,873 | |

(3)The amounts set forth in the “All Other Compensation” column consist of the clothing allowance accepted by the respective director.

(4)Ms. Bany resigned from the Board on December 9, 2019.

(5)For Ms. Bany, includes a $40,000 payment received in lieu of the 2017 annual equity awards, paid in accordance with the 2017 annual vesting schedule for director equity awards. This payment is equal to one-third of the $120,000 annual equity awards, paid in three installments on each of the first, second and third May 1 that occurs following the grant date. Amount also includes a $140,000 cash payment in lieu of the 2018 annual equity awards, which was paid in 2019, in accordance with the vesting schedule for the directors’ 2018 annual equity awards.

(6)Mr. Albers elected to receive equity compensation in the form of RSUs in lieu of $35,000 of the annual board service fee due for the twelve-month period beginning May 30, 2019.

(7)Messrs. Babson, Bryant and Nelson elected to receive equity compensation in the form of RSUs and stock options in lieu of $35,000 of the annual board service fee due to them for the twelve-month period beginning May 30, 2019.

(8)Mr. George retired from the Board on May 30, 2019.

(9)Mr. Mansell was appointed to the Board on March 25, 2019.

Board Stock Ownership Guidelines. On January 26, 2018, the Board adopted stock ownership guidelines for all non-employee directors. Under the guidelines, non-employee directors are encouraged to hold at a minimum the lesser of Columbia stock valued at five times their annual board service fee, or 5,200 shares. Non-employee directors elected prior to January 26, 2018 are expected to attain these ownership levels by January 26, 2023 and new non-employee directors within five years of their election to the Board.

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 14

| | |

| PROPOSAL 1: ELECTION OF DIRECTORS |

A Board of eight directors will be elected at the Annual Meeting. The directors are elected at each annual meeting to serve until the next annual meeting or until their successors are elected and qualified. Proxies received from shareholders, unless directed otherwise, will be voted FOR ALL of the following nominees: Mss. Malia H. Wasson and Sabrina L. Simmons, and Messrs. Timothy P. Boyle, Stephen E. Babson, Andy D. Bryant, Walter T. Klenz, Kevin Mansell, and Ronald E. Nelson. Each nominee is a current director of Columbia. If any of the nominees for director becomes unavailable for election for any reason, the proxy holders will have discretionary authority to vote pursuant to a proxy for a substitute or substitutes. Set forth below are the name, age and occupation of each of the nominees. Specific skills contributing to the nominee’s overall qualifications as a member of the Board are also highlighted. Proxies may not be voted for a greater number of persons than the number of nominees named below.

| | | | | | | | |

| Name | | Principal Occupation, Other Directorships and Qualification Highlights |

| | | | | |

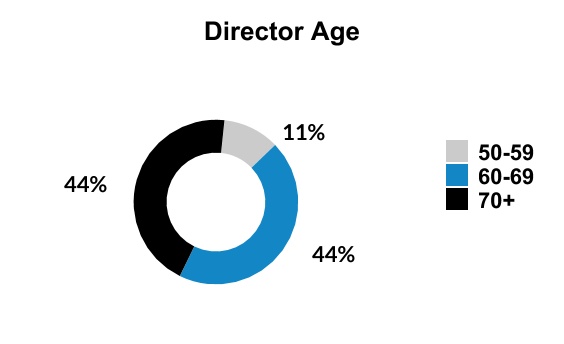

| Timothy P. Boyle | Mr. Boyle (age 70) has served on the Board since 1978 and was appointed Chairman of the Board in January 2020. Mr. Boyle joined Columbia in 1971 as General Manager, served as Chief Executive Officer since 1988, and reassumed the role of President in 2017, which he had previously held from 1988 to 2015. Mr. Boyle is also a member of the board of directors of Northwest Natural Gas Company (NYSE: NWN) and Craft Brew Alliance, Inc. (Nasdaq: BREW). Mr. Boyle is Joseph P. Boyle’s father. Mr. Boyle has spent his entire business career growing Columbia into a global leader in outdoor, active and everyday lifestyle apparel, footwear, accessories, and equipment products. Mr. Boyle’s customer relationships, market knowledge and breadth of experience performing nearly every function within Columbia has resulted in a deep understanding of the business issues facing Columbia. |

| | | | | |

| Stephen E. Babson | Mr. Babson (age 69) has served on the Board since July 2002. Mr. Babson chairs the Compensation Committee. Mr. Babson is a Managing Director of Endeavour Capital, a Northwest private equity firm, which he joined in 2002. Prior to 2002, Mr. Babson was an attorney at Stoel Rives LLP. Mr. Babson joined Stoel Rives in 1978, was a partner from 1984 to February 2002, and served as the firm’s chairman from July 1999 to February 2002. Mr. Babson serves on a number of boards of privately-held companies, including Pendleton Woolen Mills, Inc.; USNR, LLC; PMI (Pacific Market International, LLC) OFD Foods, LLC; Pacific Star Communications, Inc.; and ENTEK Technology Holdings LLC. Mr. Babson brings a combination of financial and legal expertise to the Board. His experience in a private equity firm provides Columbia with valuable insights related to capital markets, strategic planning and financial integrity. |

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 15

| | | | | |

| Andy D. Bryant | Mr. Bryant (age 69) has served on the Board since 2005. Mr. Bryant chairs the Nominating and Corporate Governance Committee and was named Lead Independent Director in January 2020. Mr. Bryant served as Chairman of the Board of Intel Corporation (Nasdaq: INTC) from May 2012 to January 2020. Mr. Bryant was named a director and Vice Chairman of Intel in July 2011 and served as Executive Vice President of Technology, Manufacturing and Enterprise Services and Chief Administrative Officer of Intel Corporation until January 2012. Mr. Bryant joined Intel in 1981 as Controller for the Commercial Memory Systems Operation, became the Chief Financial Officer in February 1994 and was promoted to Senior Vice President in January 1999. Mr. Bryant expanded his role to Chief Financial and Enterprise Services Officer in December 1999 and was promoted to Chief Administrative Officer in October 2007. Prior to joining Intel, Mr. Bryant held positions in finance at Ford Motor Company and Chrysler Corporation. Mr. Bryant served on the board of directors of Synopsys, Inc. (Nasdaq: SNPS) from 1999 to 2005 and is a member of the board of directors of McKesson Corporation (NYSE: MCK) and Intel Corporation. Mr. Bryant’s years of experience at a large, global public company provide operational, strategic planning and financial expertise to the Board. |

| | | | | |

| Walter T. Klenz | Mr. Klenz (age 74) has served on the Board since 2000. He served as Managing Director of Beringer Blass Wine Estates from 2001 until his retirement in 2005. Mr. Klenz became President and Chief Executive Officer of Beringer Wine Estates in 1990 and Chairman of its board of directors in August 1997, and he served in those positions until the 2000 acquisition of Beringer Wine Estates by Foster’s Group Limited. Mr. Klenz joined Beringer Wine Estates in 1976 as Director of Marketing for the Beringer brand, where he also served as Chief Financial Officer from 1981 to 1990. He served as a director of America West Airlines from 1998 until 2005. Mr. Klenz also serves as a director of Vincraft Group, Free Flow Wines and J. Lohr Winery, all privately-held wine companies, and Sonoma State University Wine Business Institute, a non-profit organization. Mr. Klenz brings a combination of global branding, distribution, financial, and operational expertise to the Board. |

| | | | | |

| Kevin Mansell | Mr. Mansell (age 67) has served as a member of the Board since March 2019. Mr. Mansell spent over 35 years at Kohl’s Corporation (NYSE: KSS) most recently serving as its Chairman, Chief Executive Officer and President prior to retiring in May 2018. Mr. Mansell began his retail career in 1975 with the Venture Store Division of May Department Stores, where he held a number of positions in buying and merchandising. He joined Kohl’s Corporation in 1982 as Divisional Merchandise Manager. He served as Executive Vice President and General Merchandise Manager from 1987 to 1998 and as Senior Executive Vice President of Merchandising and Marketing from 1998 to 1999. Mr. Mansell served as Kohl’s President from 1999, Chief Executive Officer from 2008 and Chairman of the Board of Directors from 2009 until his retirement in May 2018. Mr. Mansell brings a combination of retail, public company, strategic and financial expertise to the Board. |

| | | | | |

| Ronald E. Nelson | Mr. Nelson (age 77) has served on the Board since 2011. He joined NIKE, Inc. (NYSE: NKE) in 1976 and went on to serve as Vice President from 1982 to 1997, overseeing a wide variety of operations, including NIKE’s early advertising, promotions and retail operations, global footwear sourcing and financing, and the global apparel division, and he served as President of NIKE’s Japanese subsidiary from 1995 to 1997, retiring from NIKE in 1997. Mr. Nelson served as an advisory board member to Columbia in the 1970s and today serves as an informal advisor to several small companies. Mr. Nelson’s broad and deep experience within the apparel and footwear industry provides the Board with insights and guidance regarding our global supply chain, marketing and growth strategies. |

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 16

| | | | | |

| Sabrina L. Simmons | Ms. Simmons (age 56) has served on the Board since 2018. She served as Executive Vice President and Chief Financial Officer of Gap, Inc. (NYSE: GPS) from January 2008 until February 2017. Previously, Ms. Simmons also served in the following positions at Gap: Executive Vice President, Corporate Finance from September 2007 to January 2008, Senior Vice President, Corporate Finance and Treasurer from March 2003 to September 2007, and Vice President and Treasurer from September 2001 to March 2003. Prior to that, Ms. Simmons served as Chief Financial Officer and an executive member of the board of directors of Sygen International PLC, a British genetics company, and was Assistant Treasurer at Levi Strauss & Co. Ms. Simmons currently serves as a member of the board of directors of Williams-Sonoma, Inc. (NYSE: WSM), a consumer retail company, where she is the chair of the audit and finance committee, and of e.l.f. Cosmetics, Inc. (NYSE: ELF), an international cosmetics company, where she chairs the audit committee. Ms. Simmons also currently serves on the Haas School of Business Advisory Board. Ms. Simmons brings a combination of public company, global retail and financial experience to the Board. |

| | | | | |

| Malia H. Wasson | Ms. Wasson (age 61) has served on the Board since 2015. Ms. Wasson chairs the Audit Committee, and the Board has designated Ms. Wasson as an “audit committee financial expert.” Ms. Wasson worked at U.S. Bank of Oregon for over 25 years, serving as President of U.S. Bank’s Oregon and Southwest Washington operations from 2005 to 2015. She served as U.S. Bank’s senior executive in the region and led the U.S. Bank Board in Portland. In addition to her role as President, she led the Oregon Commercial Banking group for U.S. Bank, which provides a wide variety of financial services to middle market companies. Prior to joining U.S. Bank, Ms. Wasson held various commercial lending positions with the former Oregon Bank and Security Pacific Bank of Oregon. Currently, Ms. Wasson is the Chief Executive Officer of Sand Creek Advisors LLC, which provides business consulting to CEOs of public and private companies. Ms. Wasson currently serves as a member of the board of directors of Northwest Natural Gas Company (NYSE: NWN), where she is Chair of the audit committee. She is also a director and past chair of the Oregon Business Council. Ms. Wasson formerly served on the boards of Oregon Health & Science University Foundation, Inc., OHSU Knight Cancer Institute, Portland Business Alliance, Greater Portland Inc., as Chair of the Oregon Business Plan and as a Senior Fellow of the American Leadership Forum. Ms. Wasson’s extensive experience in commercial banking, finance and accounting, as well as local and regional leadership, enables her to provide insight and advice to Columbia on strategic matters including mergers and acquisitions, consumer and commercial businesses, regulatory, marketing, public and government policy and relations, media relations, change management and human capital management and diversity. |

| | |

RECOMMENDATION BY THE BOARD OF DIRECTORS |

The Board recommends that shareholders vote FOR ALL the nominees named in this Proxy Statement.

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 17

Management is responsible for the preparation, presentation and integrity of the Company’s financial statements and for maintaining appropriate financial reporting controls and procedures designed to reasonably ensure such integrity. As described more fully in its charter, the Audit Committee’s role is to assist the Board in its governance, guidance and oversight regarding the financial information provided by the Company to the public or governmental bodies, the Company’s systems of internal controls and the Company’s auditing, accounting and financial reporting processes in general. A copy of the Audit Committee’s charter, which is reviewed and reassessed by the Audit Committee on an annual basis, is available at https://investor.columbia.com.

Deloitte & Touche LLP (“Deloitte”), the Company’s independent registered public accounting firm, is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (“PCAOB”) (United States) and expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. The Audit Committee oversees the relationship between the Company and its independent registered public accounting firm, including appointment of the independent registered public accounting firm, reviewing and pre-approving the scope of services and related fees to be paid to the independent registered public accounting firm and assessing the independent registered public accounting firm’s independence. The Audit Committee regularly meets with management and the Company’s independent registered public accounting firm to discuss, among other things, the preparation of the financial statements, including key accounting and reporting issues.

The Audit Committee has:

•reviewed and discussed with management and Deloitte the audited financial statements and audit of internal control over financial reporting;

•discussed with Deloitte the matters required to be discussed by the applicable requirements of the PCAOB and the Securities and Exchange Commission;

•received the written disclosures and the letter from Deloitte required by applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence and discussed with Deloitte the independent registered public accounting firm’s independence from the Company and its management; and

•reviewed and approved the fees paid to Deloitte for audit and non-audit services and discussed whether Deloitte’s provision of non-audit services was compatible with maintaining its independence.

In considering the nature of the non-audit services provided by Deloitte, the Audit Committee determined that these services are compatible with the provision of independent audit services.

Based on the Audit Committee’s review and the meetings, discussions and communications described above, and subject to the limitations of the Audit Committee’s role and responsibilities referred to above and in the Audit Committee charter, the Audit Committee recommended to the Board that the Company’s audited consolidated financial statements for the year ended December 31, 2019 be included in the Company’s Annual Report on Form 10-K.

| | | | | |

| Members of the Audit Committee: |

| Malia H. Wasson—Chairman |

| Andy D. Bryant |

| Kevin Mansell |

| Ronald E. Nelson |

| |

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 18

| | |

| PROPOSAL 2: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

The Audit Committee has selected Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the 2020 fiscal year, subject to ratification of the selection by our shareholders at the Annual Meeting.

Principal Accountant Fees and Services

For work performed in regard to fiscal years 2018 and 2019, we incurred the following fees for services provided by Deloitte, as categorized below:

| | | | | | | | | | | |

| 2018 | | 2019 |

Audit Fees(1) | $ | 2,392,411 | | | $ | 2,558,607 | |

Tax Fees(2) | 162,184 | | | $ | 112,179 | |

| Total | $ | 2,554,595 | | | $ | 2,670,786 | |

(1)Fees for audit services billed to Columbia by Deloitte in 2018 and 2019, which services consisted of: audit of Columbia’s annual financial statements and internal controls over financial reporting; reviews of Columbia’s quarterly financial statements; and statutory audits.

(2)Fees for tax services billed to Columbia by Deloitte in 2018 and 2019, which services consisted of: federal tax return compliance assistance; and foreign tax compliance, planning and advice.

Representatives of Deloitte are expected to be at the virtual Annual Meeting and will be available to respond to appropriate questions. They do not plan to make a statement but will have an opportunity to make a statement if they wish.

Pre-Approval Policy

All of the services performed by Deloitte in 2019 were pre-approved in accordance with the pre-approval policy and procedures adopted by the Audit Committee. This policy describes the permitted audit, audit-related, tax, and other services (collectively, the “Disclosure Categories”) that the independent auditors may perform. The policy requires the Audit Committee to review at each regularly scheduled Audit Committee meeting (a) a description of the services provided or expected to be provided by the independent registered public accounting firm in each of the Disclosure Categories and the related fees and costs, and (b) a list of newly requested services subject to pre-approval since the last regularly scheduled meeting. Generally, pre-approval is provided at regularly scheduled meetings; however, the authority to pre-approve services between meetings, as necessary, has been delegated to the Chairman of the Audit Committee. The Chairman provides an update to the Audit Committee at the next regularly scheduled meeting of any services for which she granted specific pre-approval.

| | |

| RECOMMENDATION BY THE BOARD OF DIRECTORS |

The Board recommends that shareholders vote FOR ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2020.

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 19

| | |

| COMPENSATION COMMITTEE REPORT |

The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K and, based on its review and the discussions, the Committee recommended to the Board that the Compensation Discussion and Analysis be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 and this Proxy Statement.

| | | | | |

| Members of the Compensation Committee: |

| Stephen E. Babson—Chairman |

| Murrey R. Albers |

| Walter T. Klenz |

| Sabrina L. Simmons |

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 20

Compensation Discussion and Analysis

This Compensation Discussion and Analysis, or CD&A, discusses our compensation program for the executives identified as our named executive officers in the Summary Compensation Table and below.

| | | | | | | | |

2019 NAMED EXECUTIVE OFFICERS | | |

Timothy P. Boyle | | Chairman, President and Chief Executive Officer (“CEO”) |

Jim A. Swanson | | Senior Vice President, Chief Financial Officer (“CFO”) |

Peter J. Bragdon | | Executive Vice President, Chief Administrative Officer (“CAO”), General Counsel and Secretary |

Thomas B. Cusick | | Executive Vice President, Chief Operating Officer (“COO”) |

Franco Fogliato | | Executive Vice President, Americas General Manager |

In this CD&A, the terms “we,” “us,” “our,” “Columbia,” and the “Company” refer to Columbia Sportswear Company and not to the Compensation Committee. The compensation programs for our named executive officers also generally apply to our other senior officers, who are based in the U.S., and references in this CD&A to executive officers generally include the named executive officers and our other senior officers who are based in the U.S.

Overview of Executive Compensation Program

In this CD&A, we describe our overall compensation philosophy, objectives and practices. Our compensation philosophy and objectives generally apply to all of our employees, and most of our key employees are eligible to participate in the three main components of our compensation program: base salary, annual, short-term incentive compensation and long-term, incentive compensation. The relative value of each of these components of our compensation program varies from year to year and for each individual employee, depending on our financial and stock price performance, the employee’s role and responsibilities and competitive market data.

Compensation Objectives. Leadership and motivation of our executive officers are critical to our long-term success, and the market for high-quality executive officers in our industry remains competitive. Our challenge is to offer a compensation program that is competitive and at the same time reinforces both our commitment to being a brand-led, consumer-first organization and our strategic priorities.

Compensation Program Design. Our compensation program for our executive officers is designed to reward our executive officers competitively when they achieve targeted annual performance goals, increase shareholder value and maintain long-term careers with us. In our view, a competitive pay package in our industry includes:

| | | | | |

| v | a salary that provides for a minimum level of compensation for an executive officer; |

| v | a meaningful performance-based bonus tied to achievement of corporate, individual and, in some cases, regional or brand objectives; |

| v | long-term equity and cash incentives that offer significant rewards if the market price of our common stock increases in the future and/or if strategic multi-year performance objectives are achieved; and |

| v | benefits that aim to be competitive with those that are offered by companies similar to ours. |

The total compensation package for our executive officers is substantially weighted toward incentive compensation tied to corporate and individual performance and, in some cases, regional or brand objectives. Therefore, when targeted performance levels are not achieved or our stock price decreases, executive officer compensation may be significantly reduced. When targeted performance levels are exceeded or our stock price increases, executive officer compensation may be significantly increased.

COLUMBIA SPORTSWEAR COMPANY | 2020 Annual Proxy Statement | 21