Exhibit 99.2

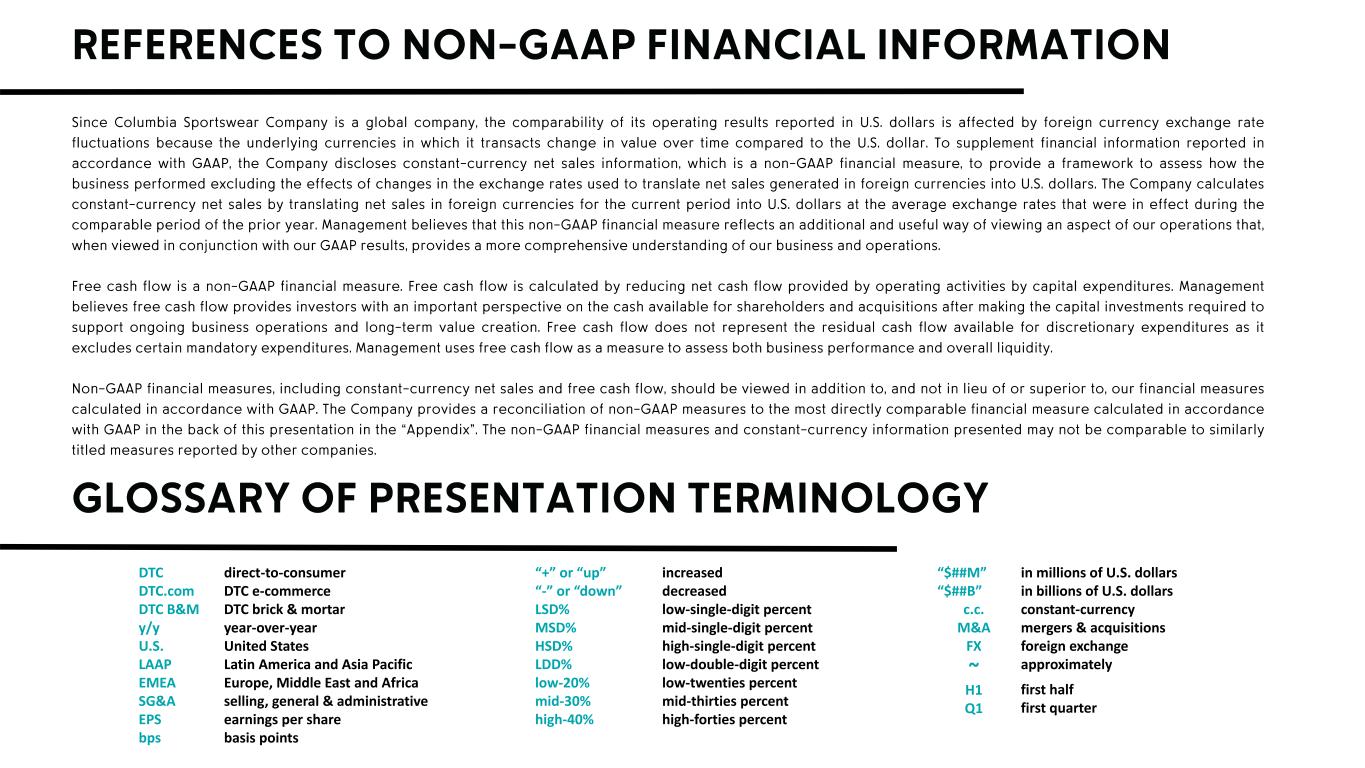

DTC DTC.com DTC B&M y/y U.S. LAAP EMEA SG&A EPS bps direct-to-consumer DTC e-commerce DTC brick & mortar year-over-year United States Latin America and Asia Pacific Europe, Middle East and Africa selling, general & administrative earnings per share basis points “+” or “up” “-” or “down” LSD% MSD% HSD% LDD% low-20% mid-30% high-40% increased decreased low-single-digit percent mid-single-digit percent high-single-digit percent low-double-digit percent low-twenties percent mid-thirties percent high-forties percent “$##M” “$##B” c.c. M&A FX ~ H1 Q1 in millions of U.S. dollars in billions of U.S. dollars constant-currency mergers & acquisitions foreign exchange approximately first half first quarter

• • • • •

• • •

• • • • •

• • • • • • • • • •

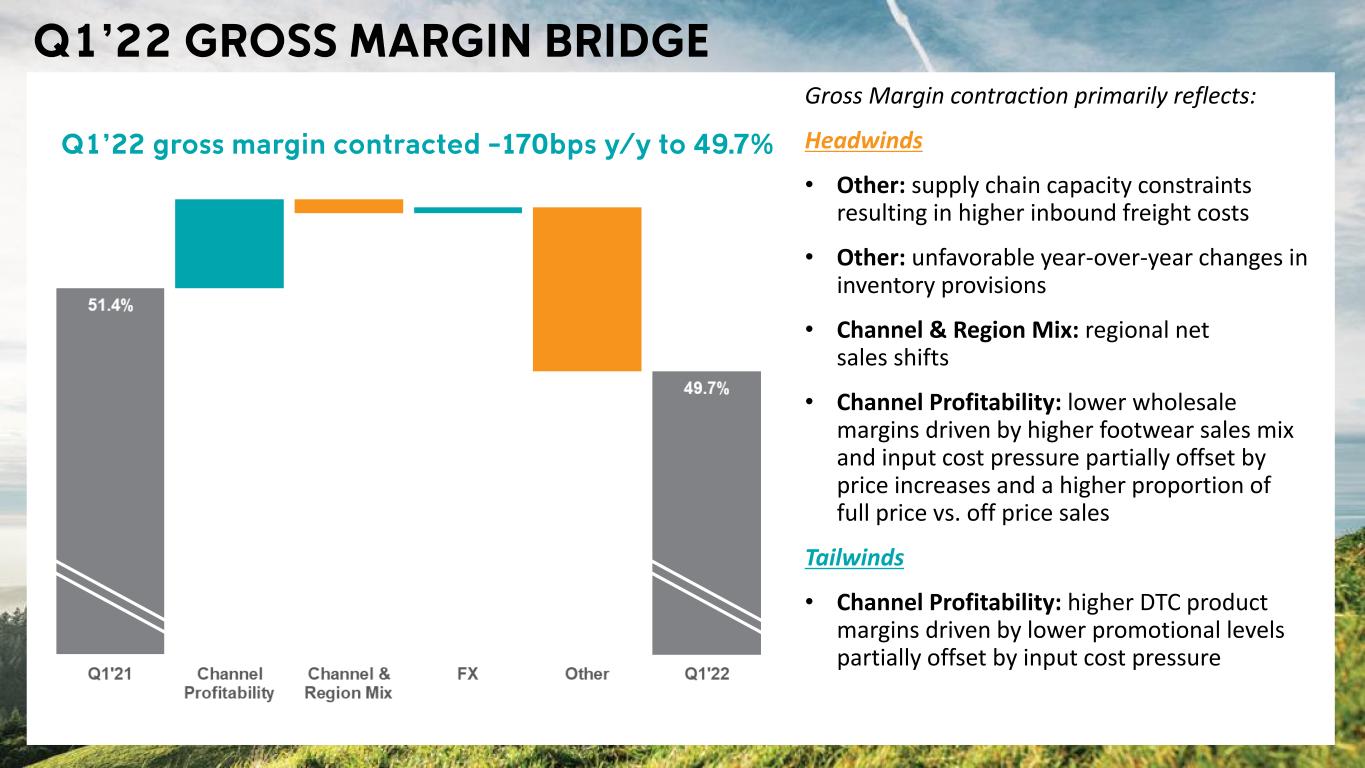

Gross Margin contraction primarily reflects: Headwinds • Other: supply chain capacity constraints resulting in higher inbound freight costs • Other: unfavorable year-over-year changes in inventory provisions • Channel & Region Mix: regional net sales shifts • Channel Profitability: lower wholesale margins driven by higher footwear sales mix and input cost pressure partially offset by price increases and a higher proportion of full price vs. off price sales Tailwinds • Channel Profitability: higher DTC product margins driven by lower promotional levels partially offset by input cost pressure

• • • •

• • • • • • • • • • • • • • • • • • • •

• • • • • • • • • • • • • • • • •