This presentation does not constitute an offer or invitation for the sale or purchase of securities and has been prepared solely for informational purposes. This presentation contains forward-looking statements within the meaning of the federal securities laws regarding Columbia Sportswear Company’s business opportunities and anticipated results of operations. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “might,” “will,” “would,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “likely,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Unless the context indicates otherwise, the terms "we," "us," "our," "the Company," and "Columbia" refer to Columbia Sportswear Company, together with its wholly owned subsidiaries and entities in which it maintains a controlling financial interest. The Company's expectations, beliefs and projections are expressed in good faith and are believed to have a reasonable basis; however, each forward-looking statement involves a number of risks and uncertainties, including those set forth in this document, those described in the Company's Annual Report on Form 10-K and Quarterly Reports on Form 10-Q under the heading "Risk Factors," and those that have been or may be described in other reports filed by the Company, including reports on Form 8-K. Potential risks and uncertainties include those relating to the impact of the COVID-19 pandemic on our operations; economic conditions, including inflationary pressures; supply chain disruptions, constraints and expenses; labor shortages; changes in consumer behavior and confidence; as well as geopolitical tensions. The Company cautions that forward-looking statements are inherently less reliable than historical information. New risks and uncertainties emerge from time to time and it is not possible for the Company to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this presentation. Nothing in this presentation should be regarded as a representation by any person that the forward- looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. We do not undertake any duty to update any of the forward- looking statements after the date of this document to conform the forward-looking statements to actual results or to changes in our expectations. FORWARD- LOOKING STATEMENTS

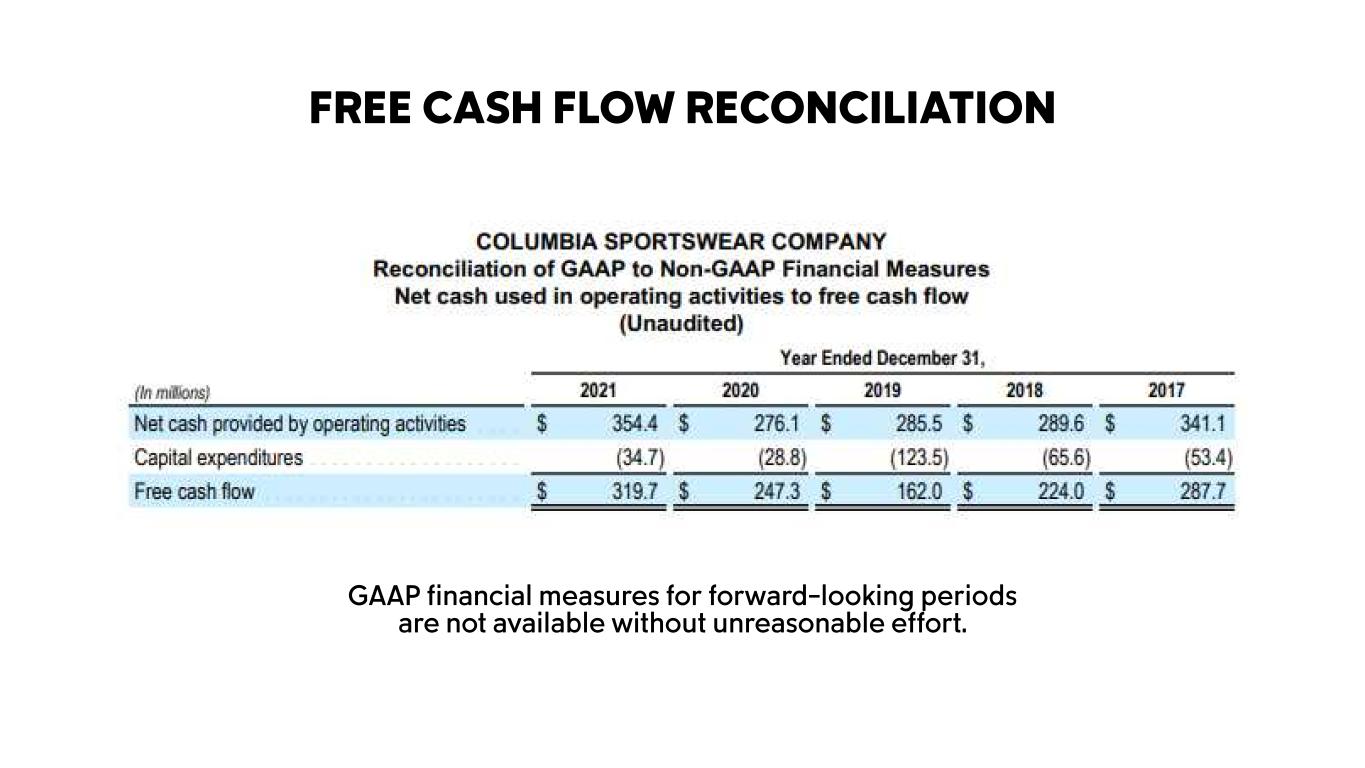

REFERENCES TO NON-GAAP FINANCIAL INFORMATION GLOSSARY OF PRESENTATION TERMINOLOGY DTC DTC.com DTC B&M y/y U.S. LAAP EMEA SG&A EPS bps direct-to-consumer DTC e-commerce DTC brick & mortar year-over-year United States Latin America and Asia Pacific Europe, Middle East and Africa selling, general & administrative earnings per share basis points “+” or “up” “-” or “down” LSD% MSD% HSD% LDD% low-20% mid-30% high-40% increased decreased low-single-digit percent mid-single-digit percent high-single-digit percent low-double-digit percent low-twenties percent mid-thirties percent high-forties percent “$##M” “$##B” c.c. M&A FX ~ H1 Q1 in millions of U.S. dollars in billions of U.S. dollars constant-currency mergers & acquisitions foreign exchange approximately first half first quarter Free cash flow is a non-GAAP financial measure. Free cash flow is calculated by reducing net cash flow provided by operating activities by capital expenditures. Management believes free cash flow provides investors with an important perspective on the cash available for shareholders and acquisitions after making the capital investments required to support ongoing business operations and long-term value creation. Free cash flow does not represent the residual cash flow available for discretionary expenditures as it excludes certain mandatory expenditures. Management uses free cash flow as a measure to assess both business performance and overall liquidity. Non-GAAP financial measures, including free cash flow, should be viewed in addition to, and not in lieu of or superior to, our financial measures calculated in accordance with GAAP. The Company provides a reconciliation of non-GAAP measures to the most directly comparable financial measure calculated in accordance with GAAP in the back of this presentation in the “Free Cash Flow Reconciliation” slide. The non-GAAP financial measures and constant-currency information presented may not be comparable to similarly titled measures reported by other companies.

THE HISTORY OF CSC VIDEO VIDEO PLAYING AT LIVE EVENT PRESENTATIONS WILL RESUME SHORTLY

C H A I R M A N , P R E S I D E N T & C H I E F E X E C U T I V E O F F I C E R TIM BOYLE

GLOBAL ADDRESSABLE MARKET OUTDOOR $40B Outdoor Source: Euromonitor, NPD, public company filings, Columbia Sportswear Company estimates

GLOBAL ADDRESSABLE MARKET OUTDOOR $40B ACTIVEWEAR $160B Activewear Source: Fortune Business, MarketWatch, public company filings, Columbia Sportswear Company estimates (excludes athletic brands)

GLOBAL ADDRESSABLE MARKET OUTDOOR $40B ACTIVEWEAR $1.5T TOTAL APPAREL & FOOTWEAR $160B Total Apparel & Footwear Source: Statista

STRATEGIC PRIORITIES ACCELERATE PROFITABLE GROWTH DRIVE BRAND ENGAGEMENT ENHANCE CONSUMER EXPERIENCES AMPLIFY MARKETPLACE EXCELLENCE EMPOWER TALENT THAT IS DRIVEN BY OUR CORE VALUES CREATE ICONIC PRODUCTS

DIFFERENTIATED, FUNCTIONAL AND INNOVATIVE CREATE ICONIC PRODUCTS INCREASED, FOCUSED DEMAND CREATION INVESTMENTS

DRIVE BRAND ENGAGEMENT INCREASED, FOCUSED DEMAND CREATION INVESTMENTSDIFFERENTIATED, FUNCTIONAL AND INNOVATIVE ENHANCE CONSUMER EXPERIENCES INVEST IN CAPABILITIES TO DELIGHT AND RETAIN CONSUMERS

ENHANCE CONSUMER EXPERIENCES INVEST IN CAPABILITIES TO DELIGHT AND RETAIN CONSUMERSINCREASED, FOCUSED DEMAND CREATION INVESTMENTS AMPLIFY MARKETPLACE EXCELLENCE

AMPLIFY MARKETPLACE EXCELLENCE DIGITALLY LED, OMNI-CHANNEL, GLOBAL ENHANCE CONSUMER EXPERIENCES INVEST IN CAPABILITIES TO DELIGHT AND RETAIN CONSUMERS EMPOWER TALENT THAT IS DRIVEN BY OUR CORE VALUES

EMPOWER TALENT THAT IS DRIVEN BY OUR CORE VALUES THROUGH A DIVERSE AND INCLUSIVE WORKFORCE AMPLIFY MARKETPLACE EXCELLENCE

CORE VALUES COMPETE TO WIN RELENTLESS IMPROVEMENT CULTURE OF HONESTY, RESPECT & TRUST DO THE RIGHT THING

DO THE RIGHT THING

9% 3 Y E A R C A G R 11%T O 2022 — 2025 NET SALES GROWTH

COLUMBIA BRAND MISSION VIDEO VIDEO PLAYING AT LIVE EVENT PRESENTATIONS WILL RESUME SHORTLY

E X E C U T I V E V I C E P R E S I D E N T, C O L U M B I A B R A N D P R E S I D E N T JOE BOYLE

UNLOCK THE OUTDOORS FOR EVERYONE M I S S I O N

TO BE THE #1 OUTDOOR BRAND IN THE WORLD V I S I O N

COLUMBIA BRAND CUMULATIVE NET SALES GAIN $700M 2 0 2 3 T O 2 0 2 5 >

ICONIC PRODUCT

INSPIRE THE NEXT GENERATION

UNLOCK THE MARKETPLACE OF THE FUTURE

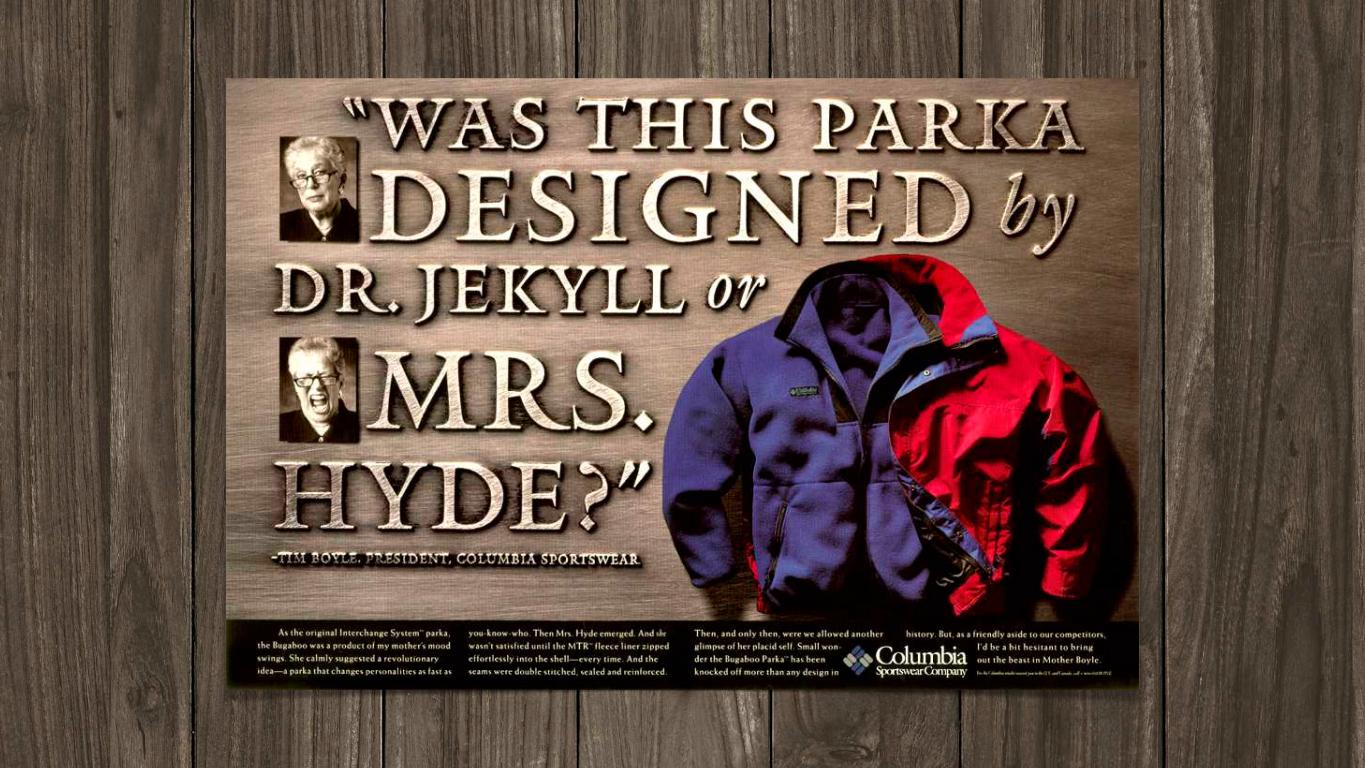

“IT’S PERFECT. NOW MAKE IT BETTER.”

S V P, C H I E F M A R K E T I N G O F F I C E R PRI SHUMATE

EVERYTHING MATTERS

FUTURE PROOFING THE BRAND

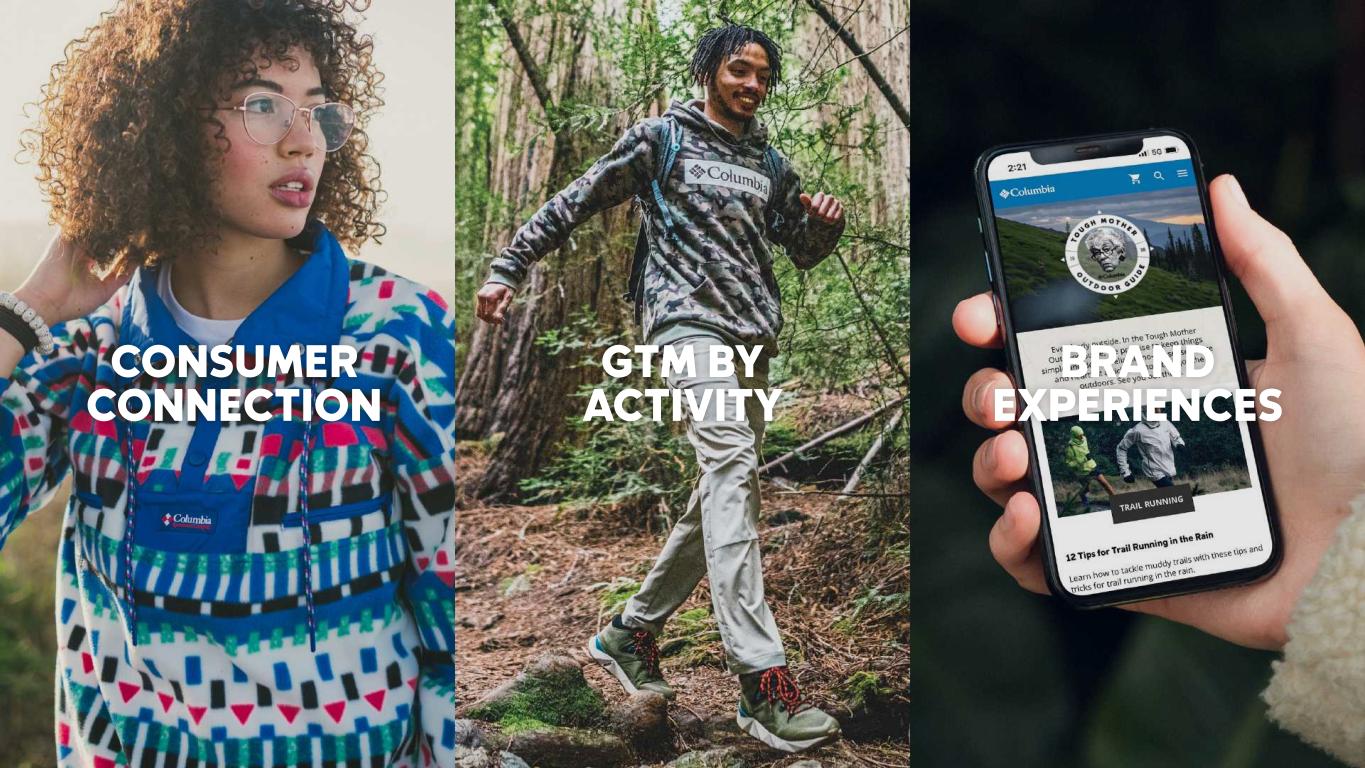

CONSUMER CONNECTION GTM BY ACTIVITY BRAND EXPERIENCES

DEEPEN CONNECTION

YOUNGER, MORE DIVERSE

CELEBRATE PRODUCT

CELEBRATE PEOPLE

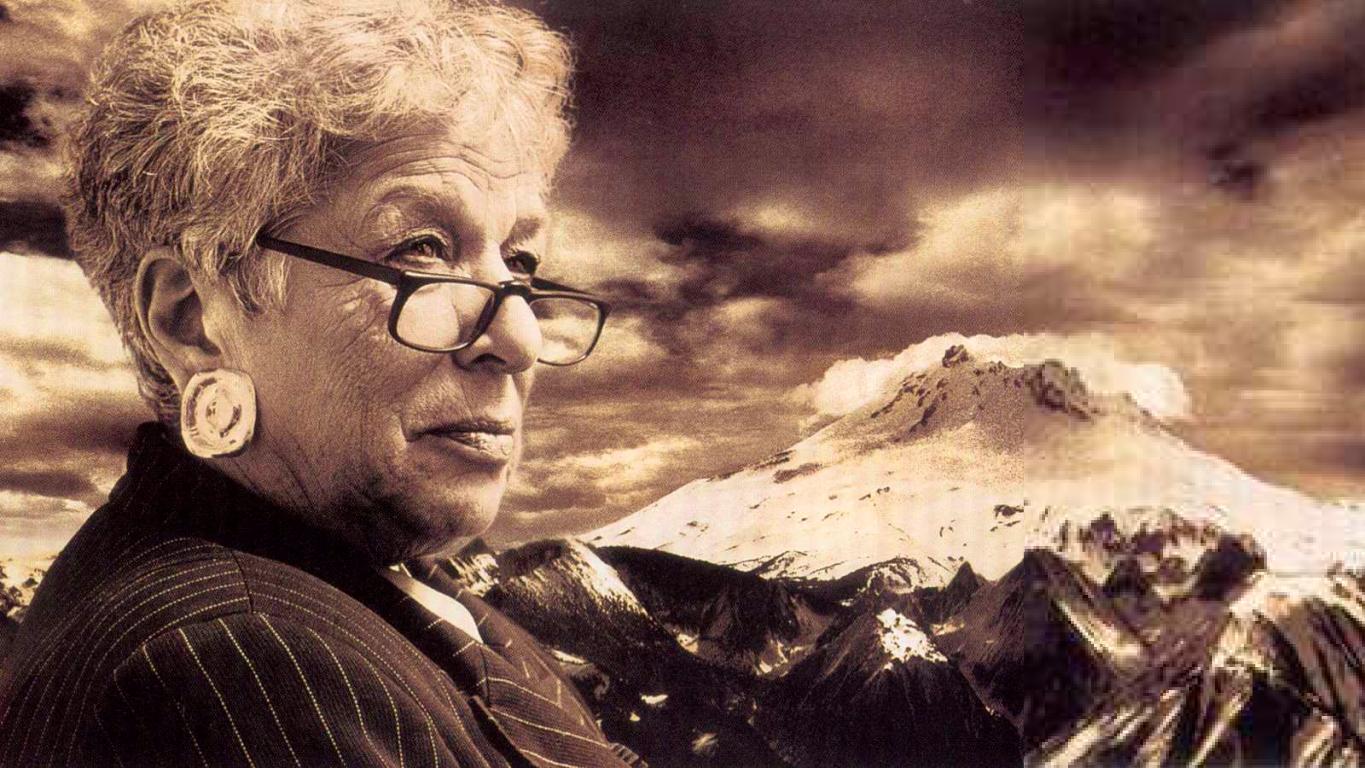

Image of Gert - the boss, driving the team

CELEBRATE PLACES

PRODUCT PEOPLE PLACES

GTM BY ACTIVITY

INNOVATIONS BRAND STORY TELLING TOUGH MOTHER OUTDOOR GUIDE

BALANCE

CONSUMER CONNECTION GTM BY ACTIVITY BRAND EXPERIENCES

BRAND EXPERIENCE

TRUSTED FRIEND

CONSUMER CONNECTION GTM BY ACTIVITY BRAND EXPERIENCES

S V P, C H I E F P R O D U C T O F F I C E R DEAN RURAK

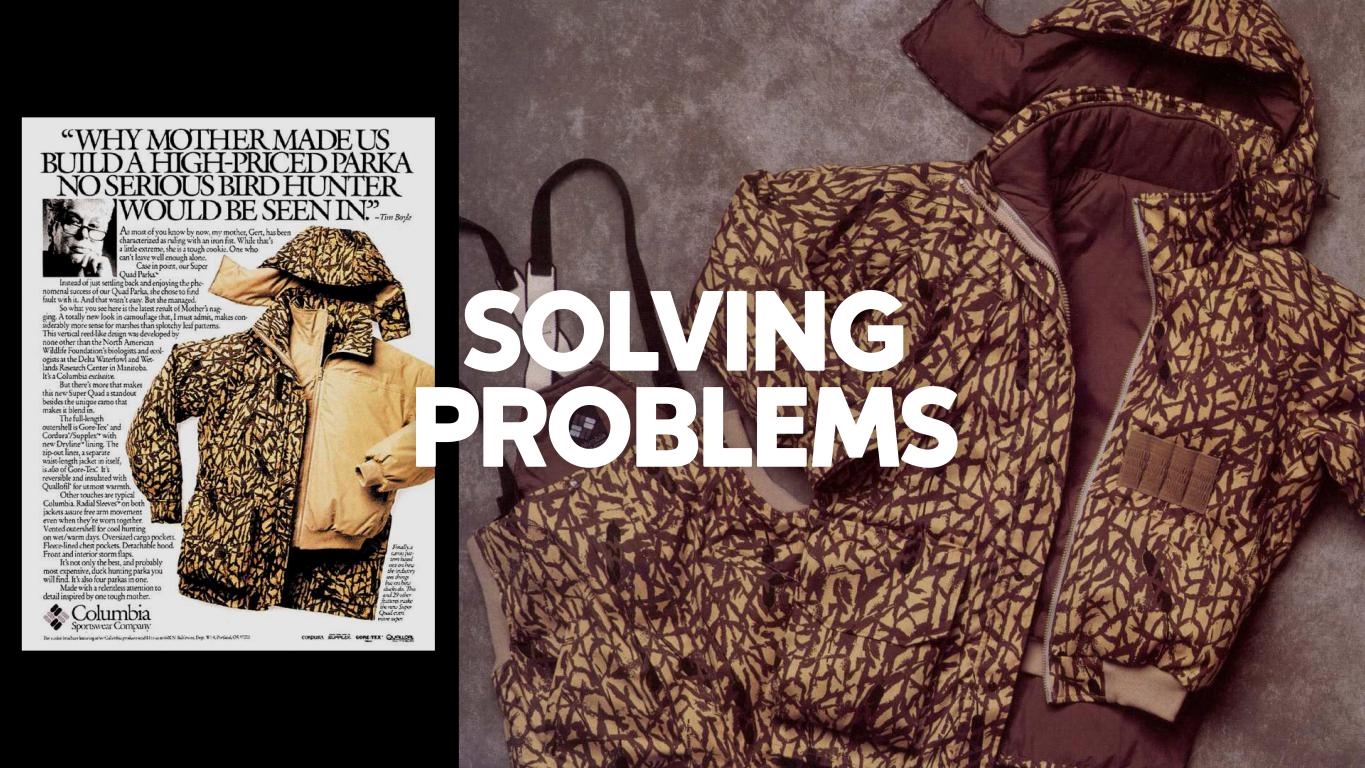

SOLVING PROBLEMS

SOLVING PROBLEMS TIM BOYLE

SOLVING PROBLEMS

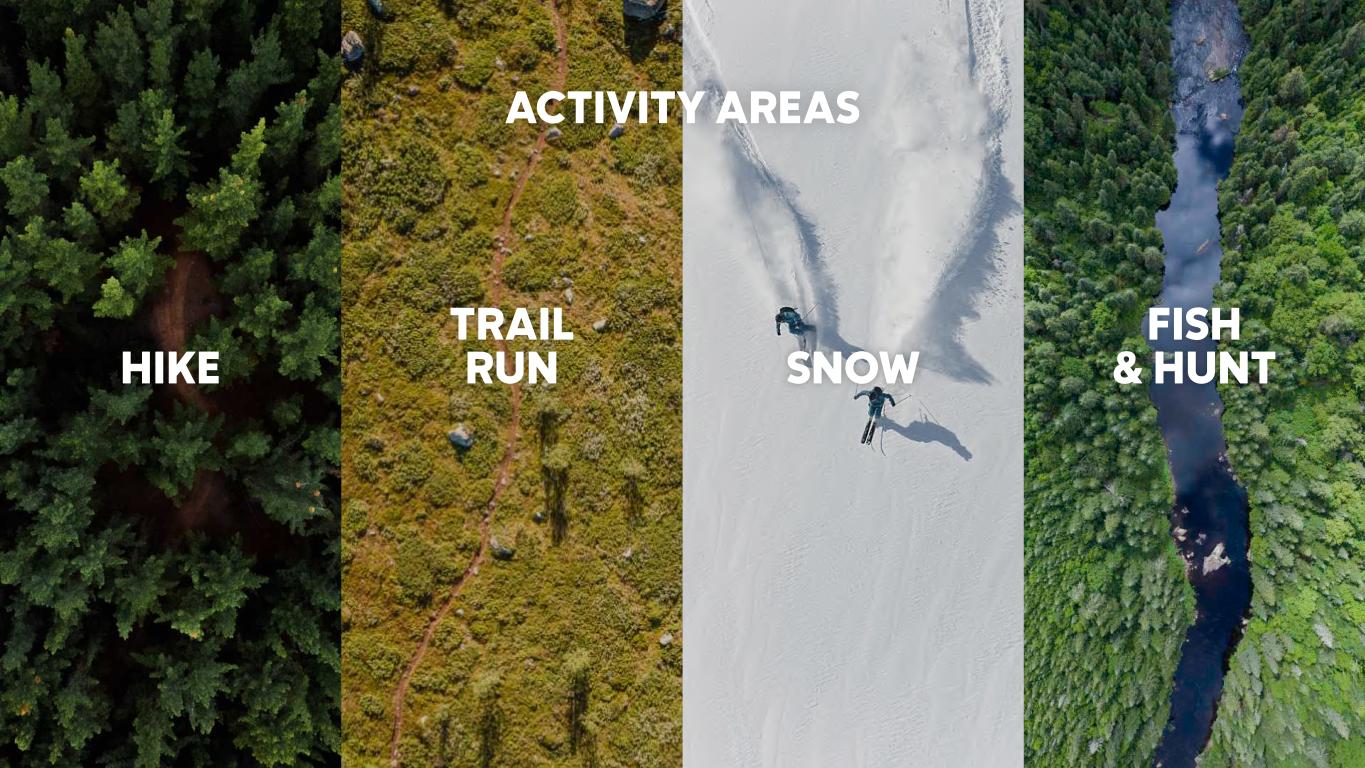

HIKE TRAIL RUN SNOW FISH & HUNT ACTIVITY AREAS

HIKE

TRAIL RUN

SNOW

FISH & HUNT

PFG FISHING PRODUCT AND INNOVATION VIDEO VIDEO PLAYING AT LIVE EVENT PRESENTATIONS WILL RESUME SHORTLY

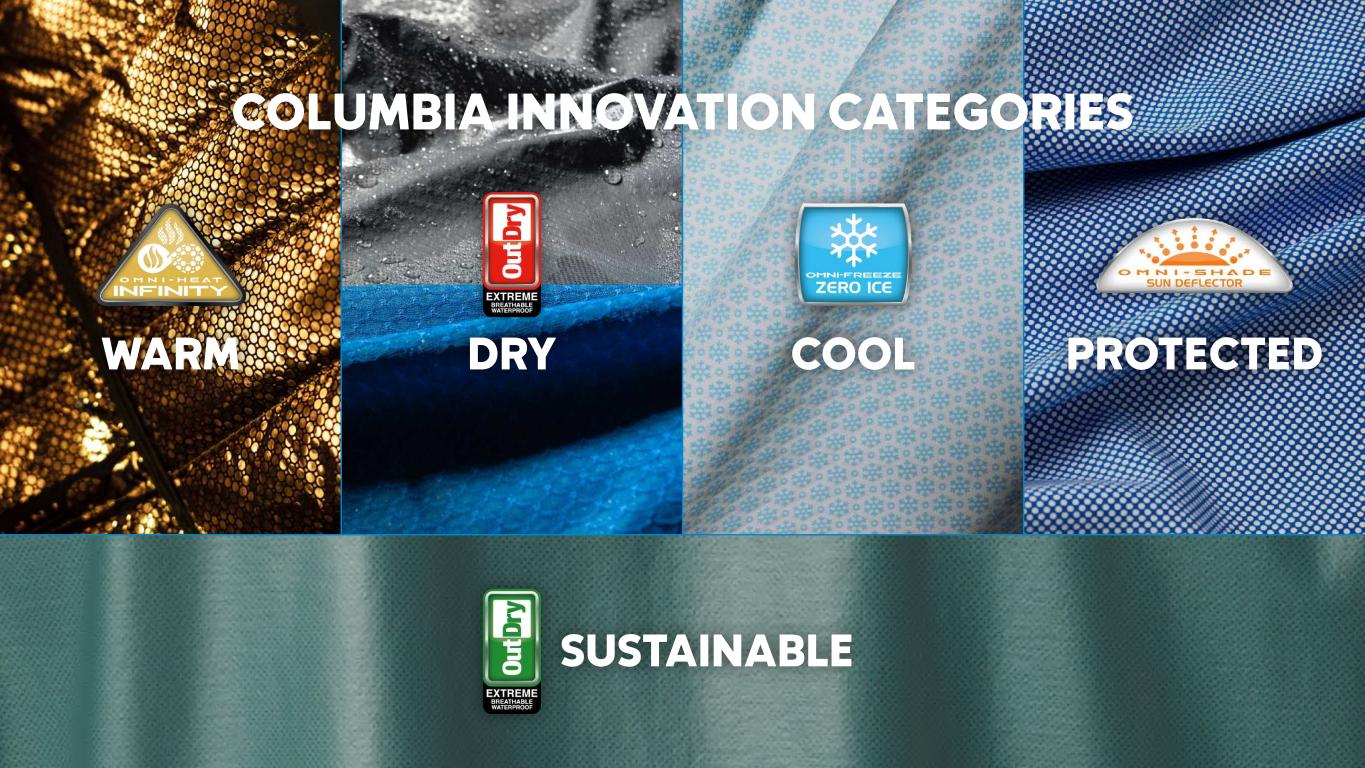

WARM DRY COOL PROTECTED

S E N I O R D I R E C T O R O F I N N O VA T I O N HASKELL BECKHAM

INNOVATION AT OUR CORE

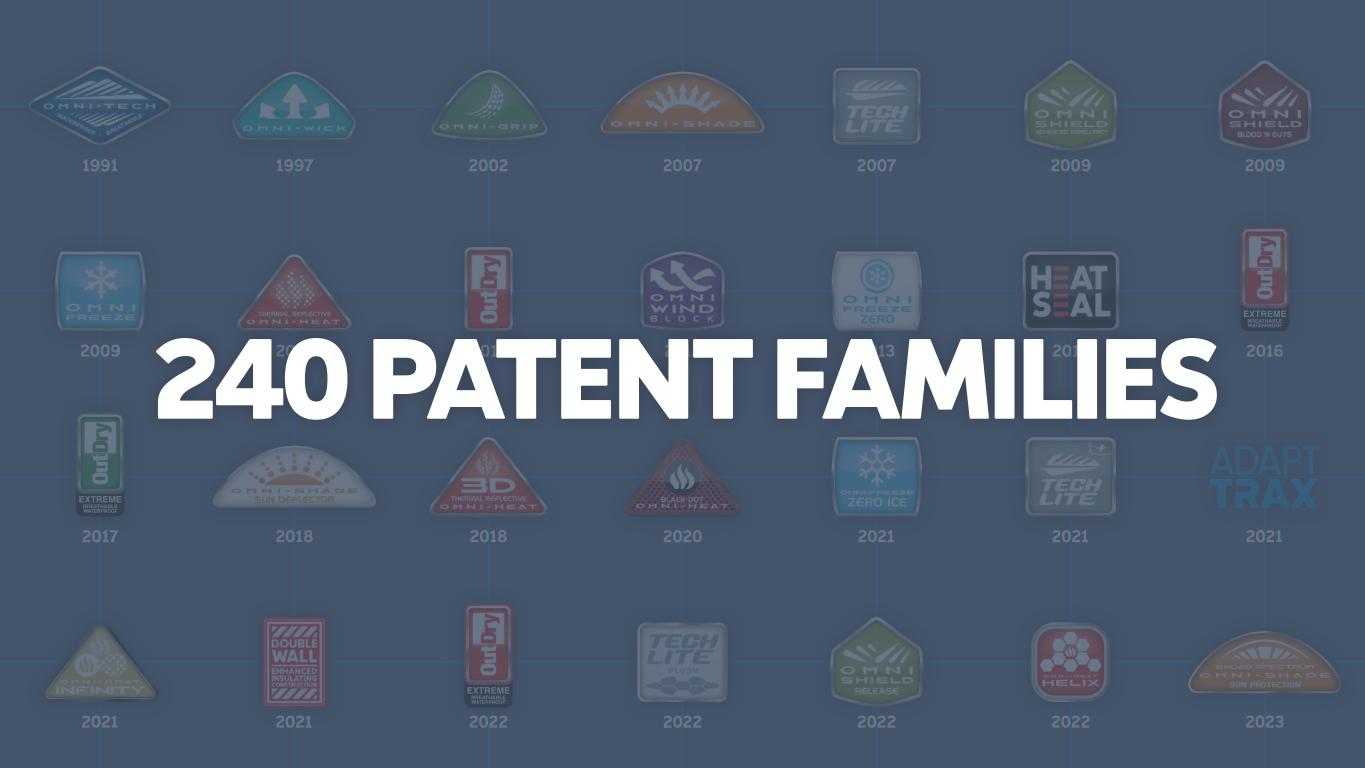

20212020201820182017 2021 2021 20222022202220212021 2022 2023 20132012201120102009 2015 2016 20072007200219971991 2009 2009

VISIBLE INNOVATION

20212020201820182017 2021 2021 20222022202220212021 2022 2023 20132012201120102009 2015 2016 20072007200219971991 2009 2009 90+ INDUSTRY AWARDS

20212020201820182017 2021 2021 20222022202220212021 2022 2023 20132012201120102009 2015 2016 20072007200219971991 2009 2009 240 PATENT FAMILIES

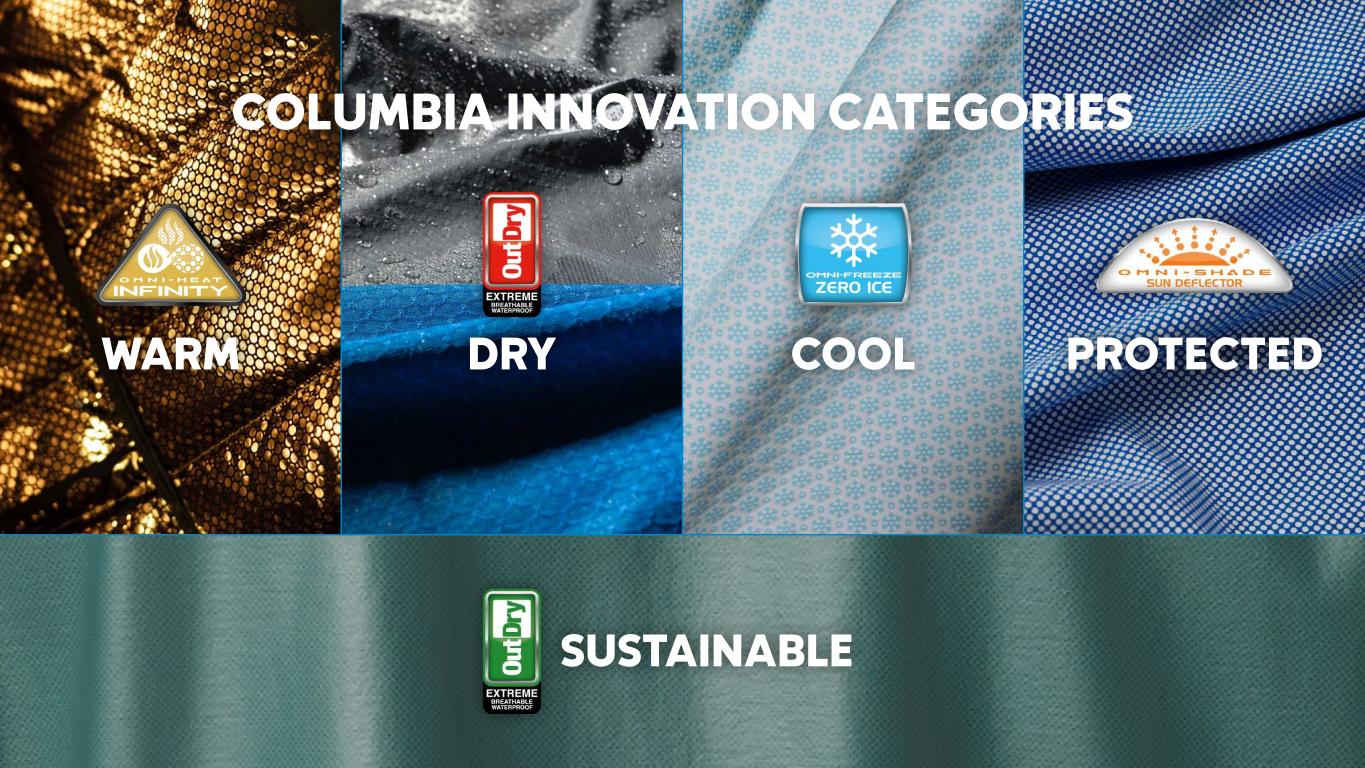

PROTECTEDCOOLDRYWARM COLUMBIA INNOVATION CATEGORIES

PROTECTEDCOOLDRYWARM SUSTAINABLE COLUMBIA INNOVATION CATEGORIES

CSC VALUES AND ESG EFFORTS VIDEO VIDEO PLAYING AT LIVE EVENT PRESENTATIONS WILL RESUME SHORTLY

PROTECTEDCOOLDRYWARM SUSTAINABLE COLUMBIA INNOVATION CATEGORIES

WARM

2010 2018 2020 2021 2022

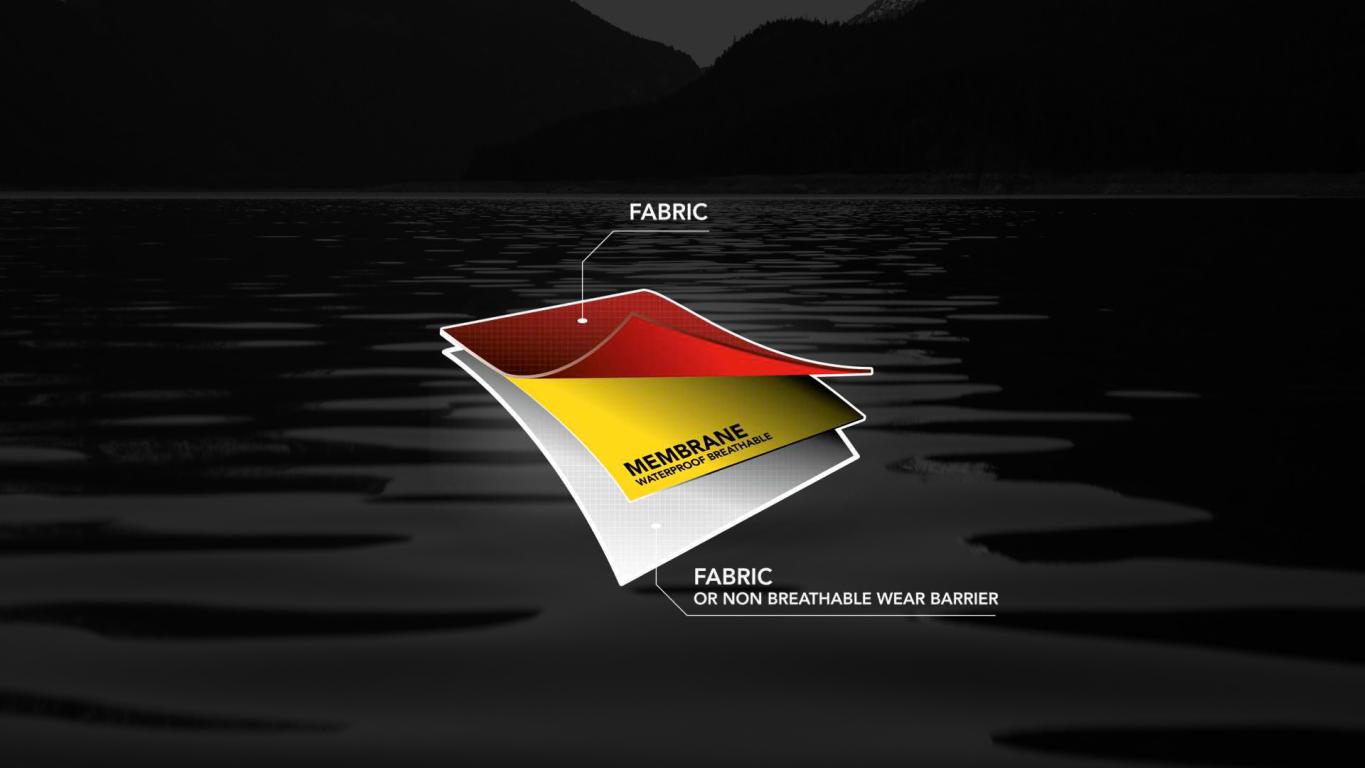

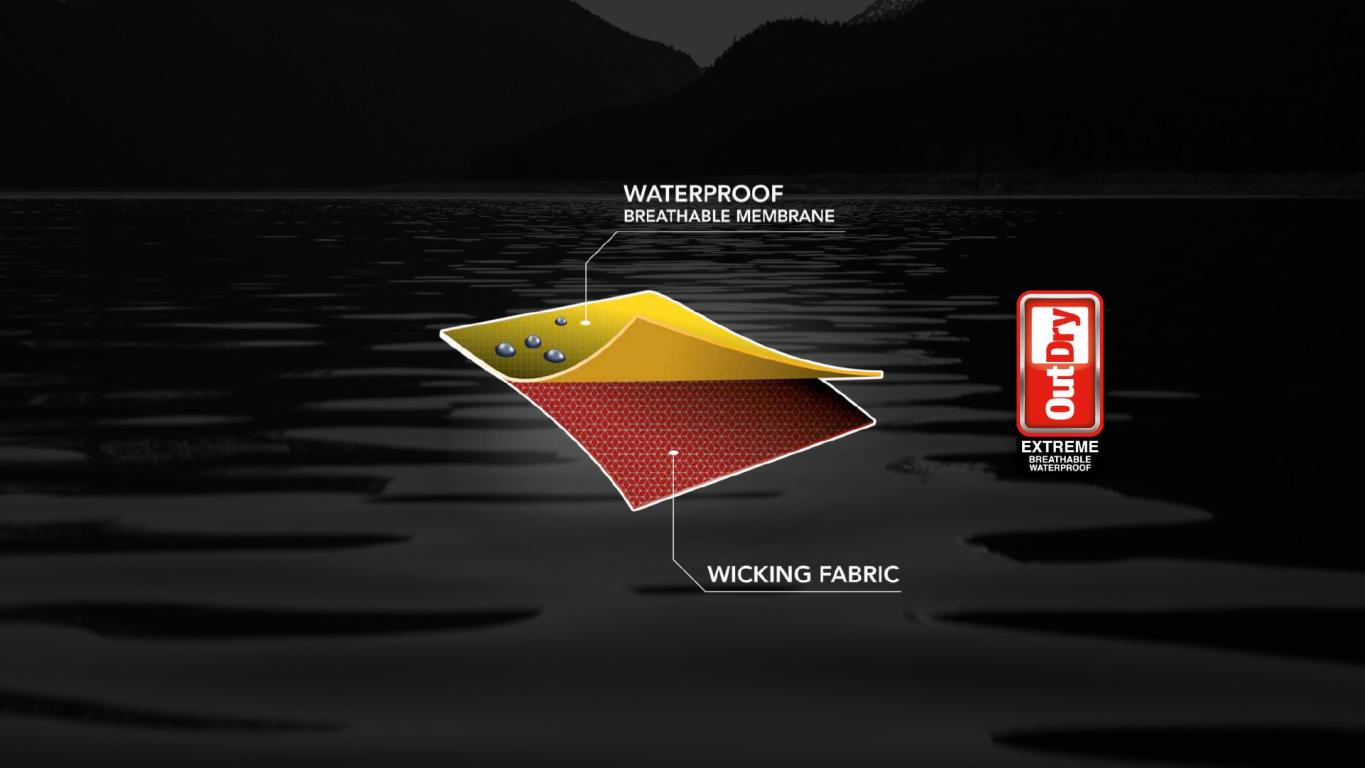

DRY

COOL

PROTECTED

20212020201820182017 2021 2021 20222022202220212021 2022 2023 20132012201120102009 2015 2016 20072007200219971991 2009 2009

BOAT TO BAR

EVERYDAY OUTDOOR

HIKE TRAIL RUN SNOW FISH & HUNT EVERYDAY OUTDOOR ACTIVITY AREAS

S V P, G L O B A L W H O L E S A L E TIM SHEERIN

MARKETPLACE

MARKETPLACE OF THE FUTURE

HUMBLE ACCESSIBLE DEMOCRATIC

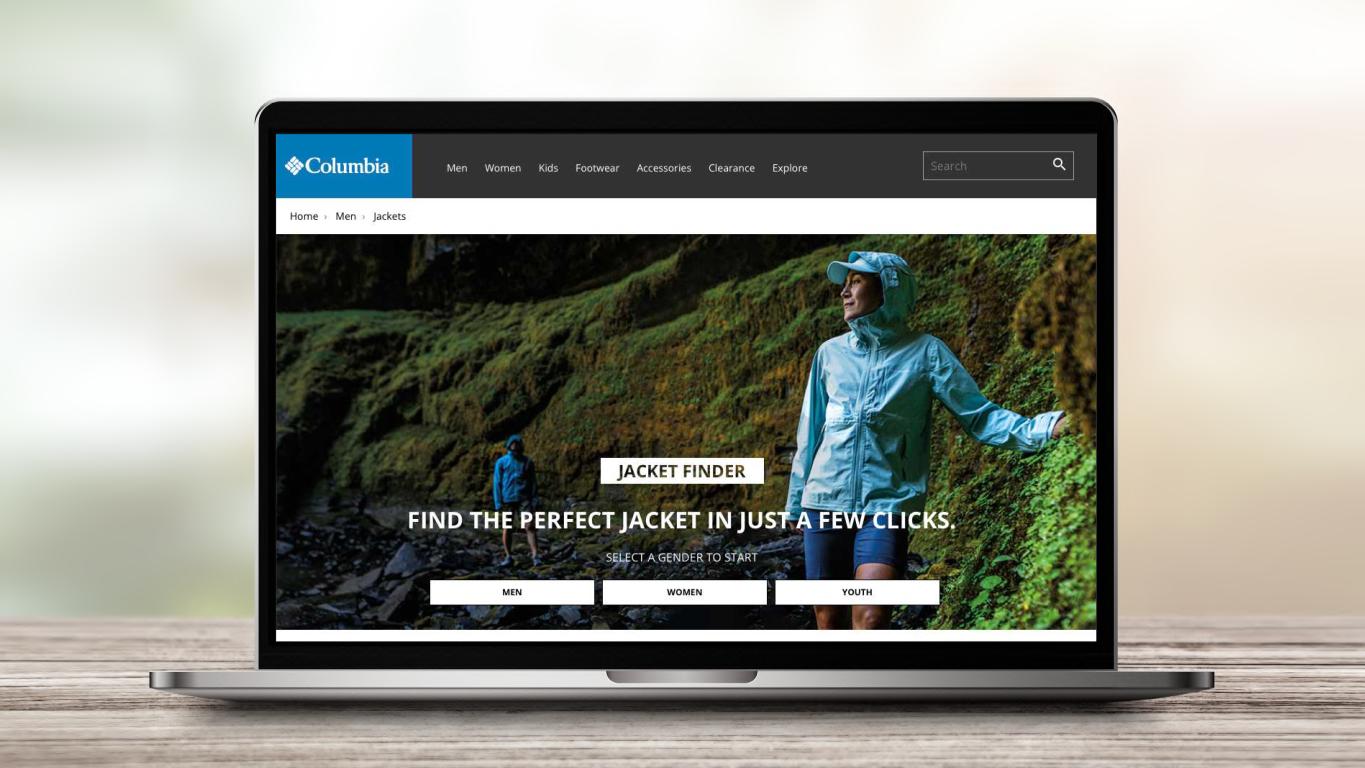

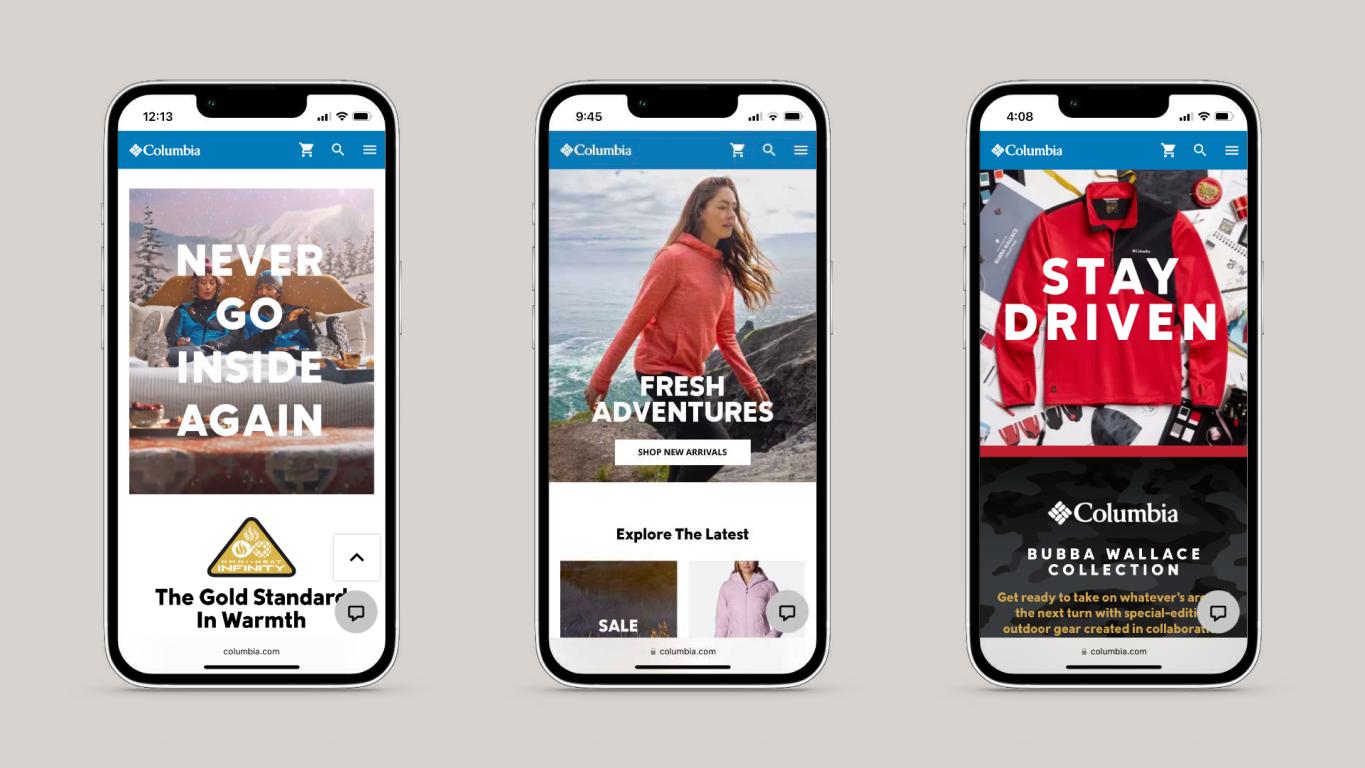

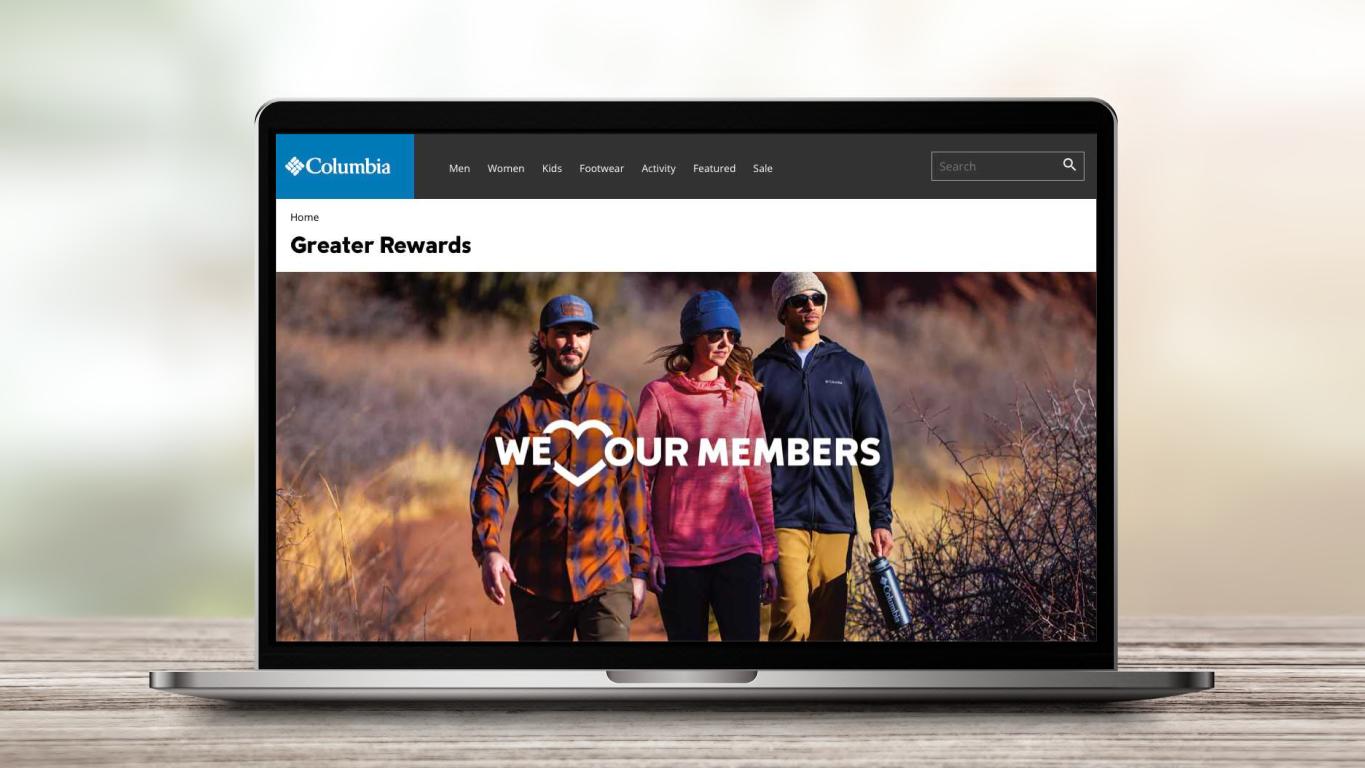

LEAD WITH COLUMBIA.COM ELEVATE THE COLUMBIA SHOPPING EXPERIENCE DEVELOP THE PARTNERSHIPS OF THE FUTURE

LEAD WITH COLUMBIA .COM

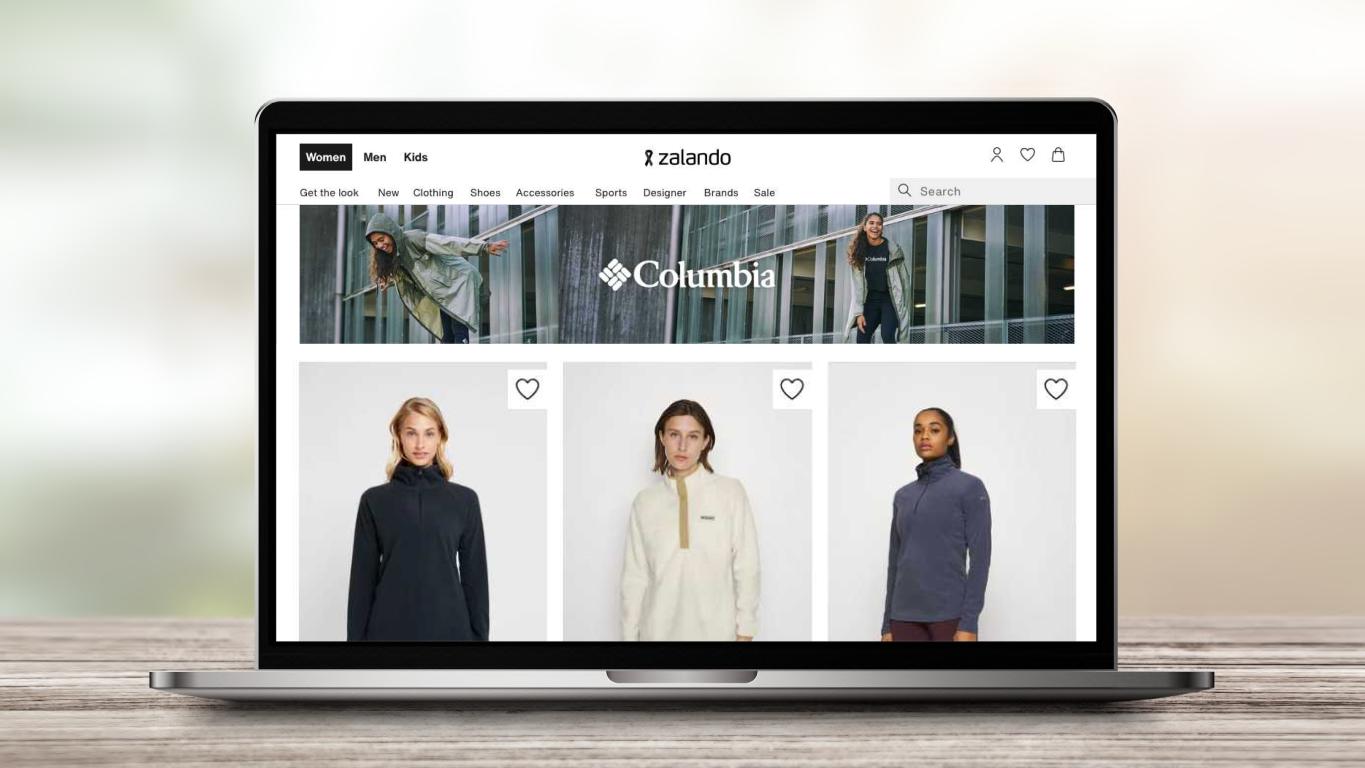

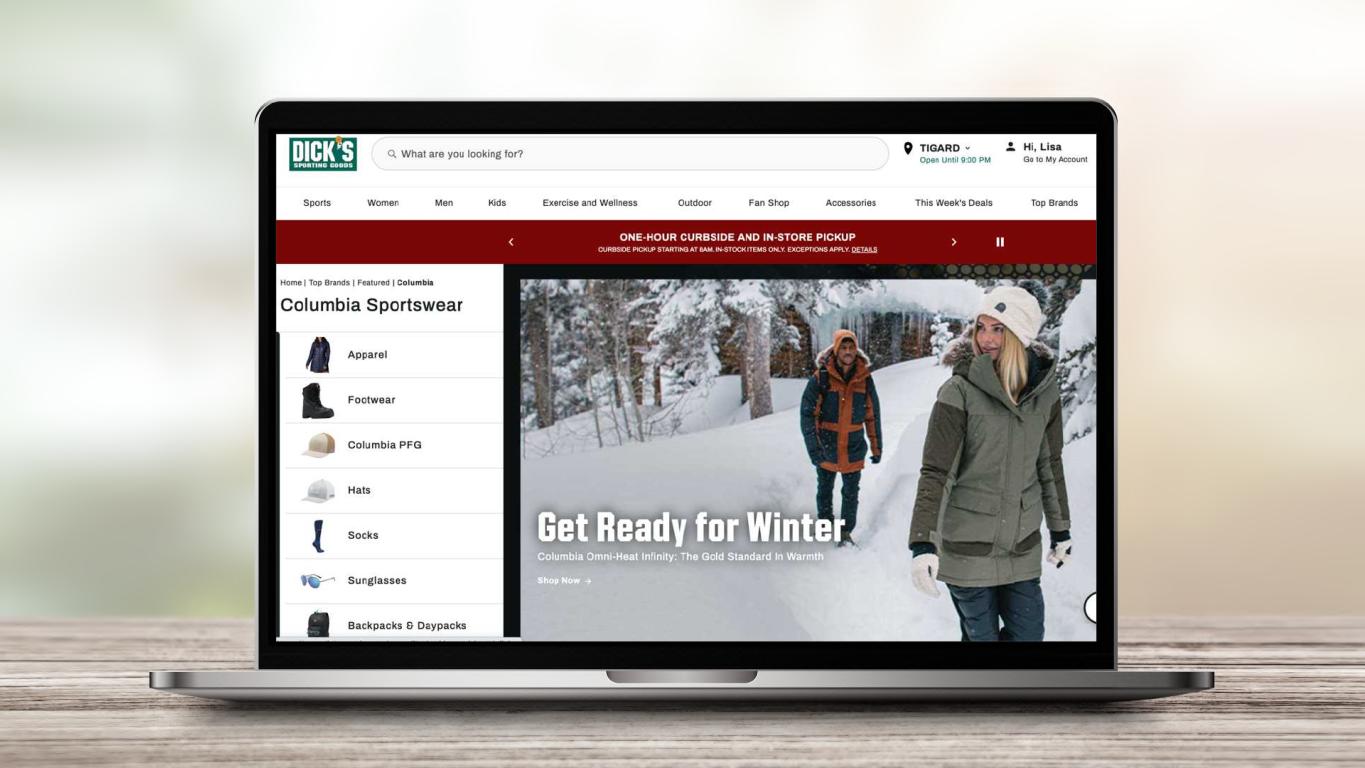

DEVELOP THE PARTNERSHIPS OF THE FUTURE

ELEVATE THE SHOPPING EXPERIENCE

LEAD WITH COLUMBIA.COM ELEVATE THE COLUMBIA SHOPPING EXPERIENCE DEVELOP THE PARTNERSHIPS OF THE FUTURE

28,000 POINTS OF DISTRIBUTION

CANADA

EUROPE

ASIA

CHINA

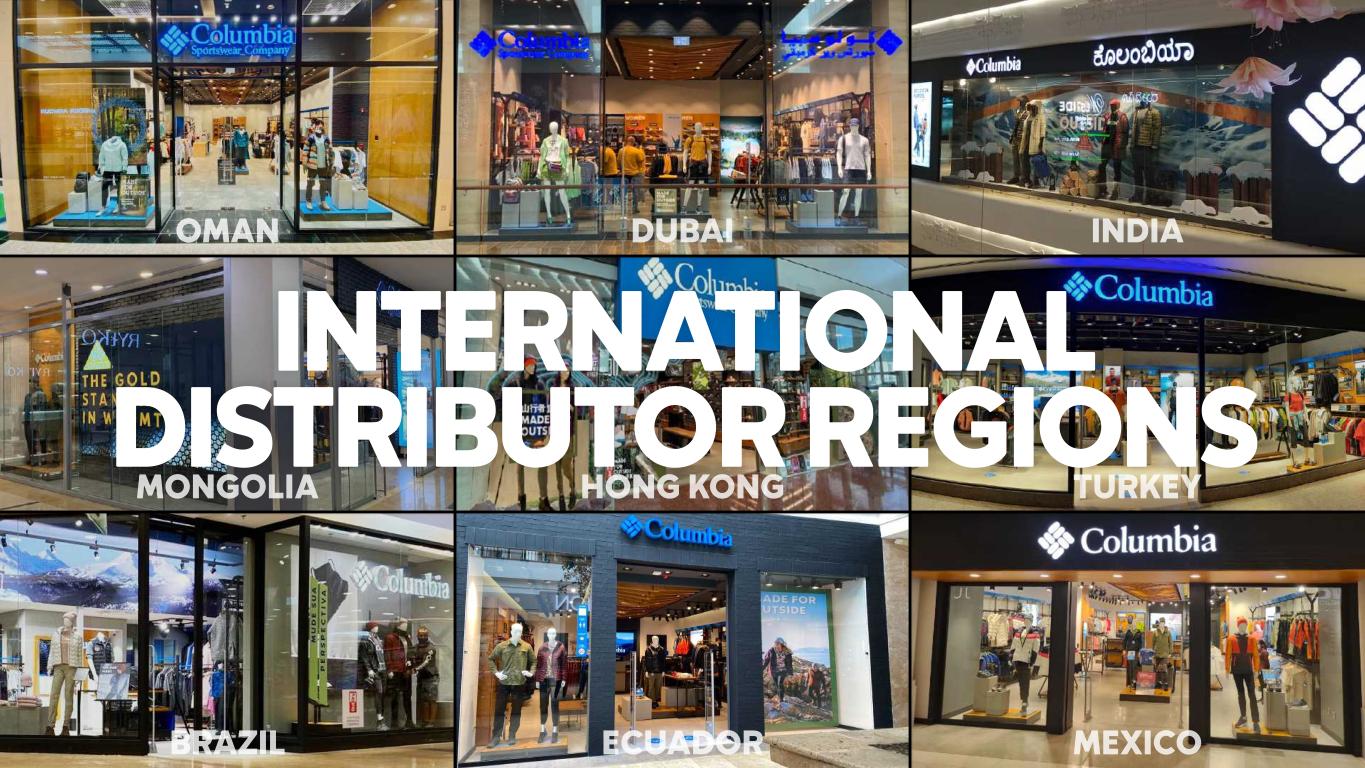

INTERNATIONAL DISTRIBUTOR REGIONS MEXICOBRAZIL ECUADOR TURKEYMONGOLIA HONG KONG INDIAOMAN DUBAI

UNITED STATES

BALANCE

OPPORTUNITY

OPPORTUNITY

OPPORTUNITY

OPPORTUNITY

MARKETPLACE OF THE FUTURE

E X E C U T I V E V I C E P R E S I D E N T, C O L U M B I A B R A N D P R E S I D E N T JOE BOYLE

INSPIRE THE NEXT GENERATION CREATE ICONIC PRODUCT UNLOCK THE MARKETPLACE OF THE FUTURE COLUMBIA BRAND STRATEGY

7% 3 Y E A R C A G R 9%T O 2022 — 2025 COLUMBIA BRAND GROWTH

COLUMBIA BRAND CUMULATIVE NET SALES GAIN $700M 2 0 2 3 T O 2 0 2 5 >

COLUMBIA BRAND GROWTH BY SEGMENT 2022E 2025E FOOTWEAR +LDD% APPAREL +HSD% >$700M PRODUCT Growth rates reflect 3-Year CAGR

COLUMBIA BRAND GROWTH BY SEGMENT 2022E 2025E DTC.COM +LDD% DTC B&M +HSD% WHOLESALE +HSD% >$700M CHANNELS Growth rates reflect 3-Year CAGR

COLUMBIA BRAND GROWTH BY SEGMENT 2022E CANADA +LDD% 2025E EMEA +LDD% LAAP +LDD% USA +HSD% >$700M REGIONS Growth rates reflect 3-Year CAGR

FOOTWEAR COLUMBIA.COM INTERNATIONAL ACCELERATING GROWTH

COLUMBIA BRAND PRODUCT AND MARKETING VIDEO VIDEO PLAYING AT LIVE EVENT PRESENTATIONS WILL RESUME SHORTLY

PRANA BRAND PRODUCT AND MARKETING VIDEO VIDEO PLAYING AT LIVE EVENT PRESENTATIONS WILL RESUME SHORTLY

P R E S I D E N T, p r A n a MONICA MIRRO

Emerging Brands

prAna__The Active Wellness Brand

OUR MISSION/ We inspire your pursuit of wellness to create a healthier body, mind and planet.

WHO WE SERVE/ Young-Spirited Adventurers who seek revitalization through the activities they love.

prAna__The Active Wellness Brand Our Unique Position Active Industry Outdoor Industry

Make Great Product 030201 Build The Brand Develop Balanced Omni-Channel Distribution Core Growth Strategy

Make Great Product

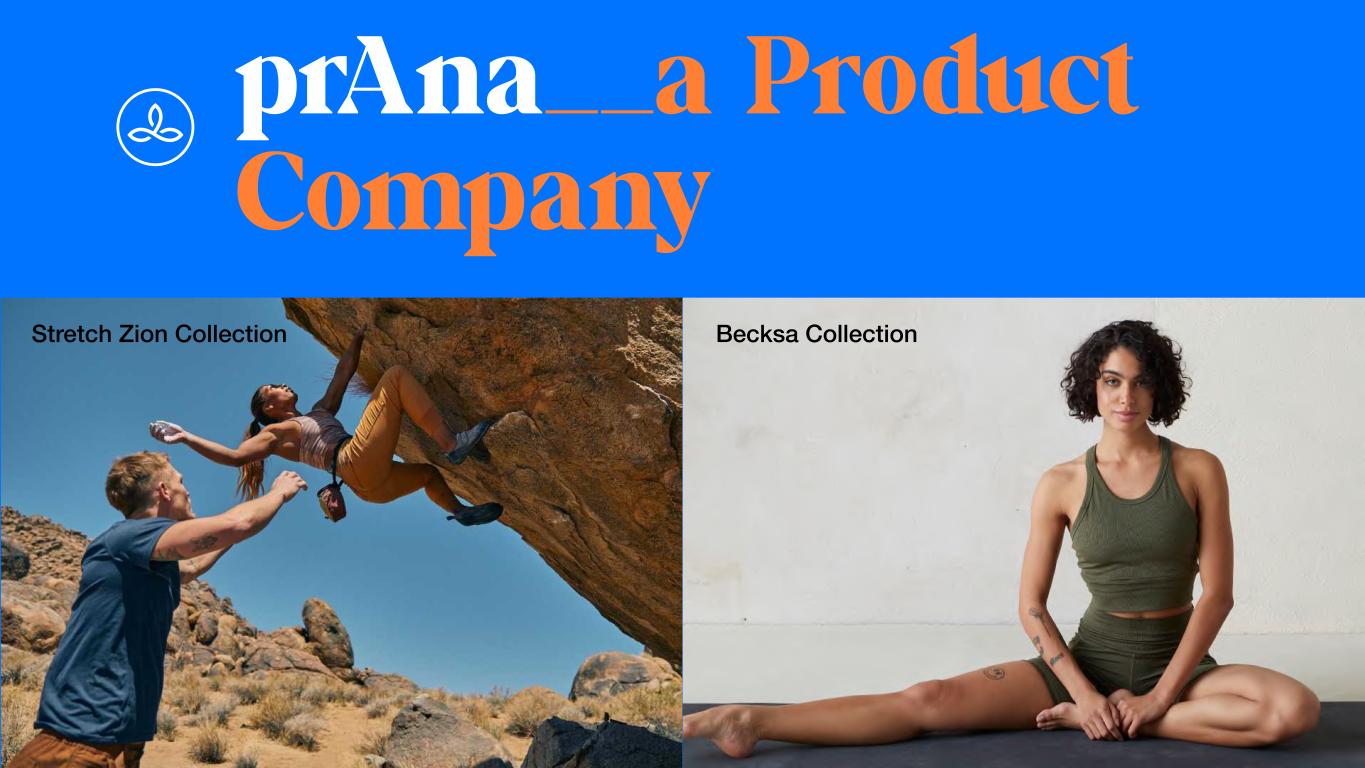

prAna__a Product Company Becksa CollectionStretch Zion Collection

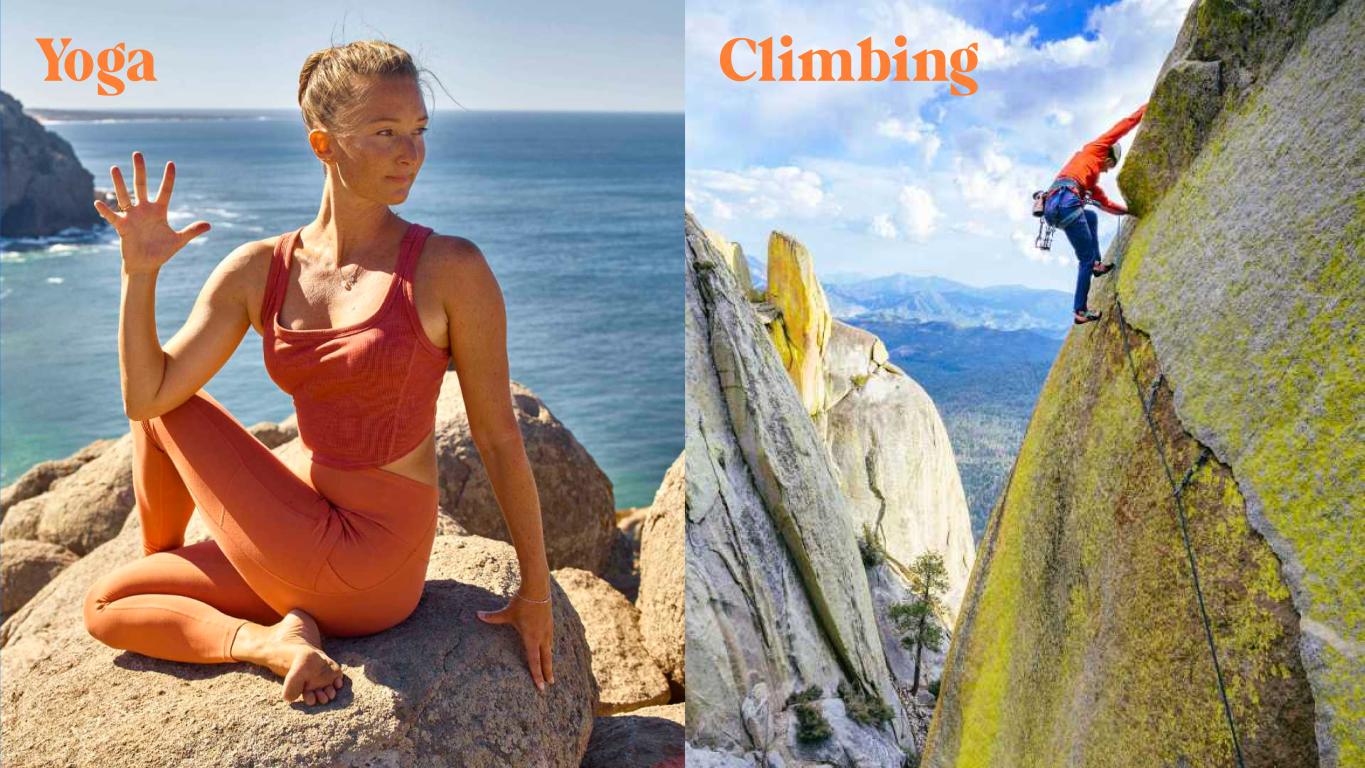

195 Yoga Climbing

Build the Brand

Develop Balanced Omni-Channel Distribution

Prepared for

prAna. Boulder, Colorado prAna Store

Sustainability Glassine BagRaffia Tie

Active Wellness

Brand Manifesto P R E S I D E N T, M O U N T A I N H A R D W E A R TROY SICOTTE

Secret sauce?

9% – 11% 2 0 2 2 – 2 0 2 5 N E T SA L E S G R OW T H 3 Y E A R CAG R

Our focus _01

M O U N TA I N E E R I N G

C L I M B I N G

S K I & S N OW B OA R D

T R A I L

CA M P

Our culture _02

#HumansOfHardwear

Sustainability

Warranty Team

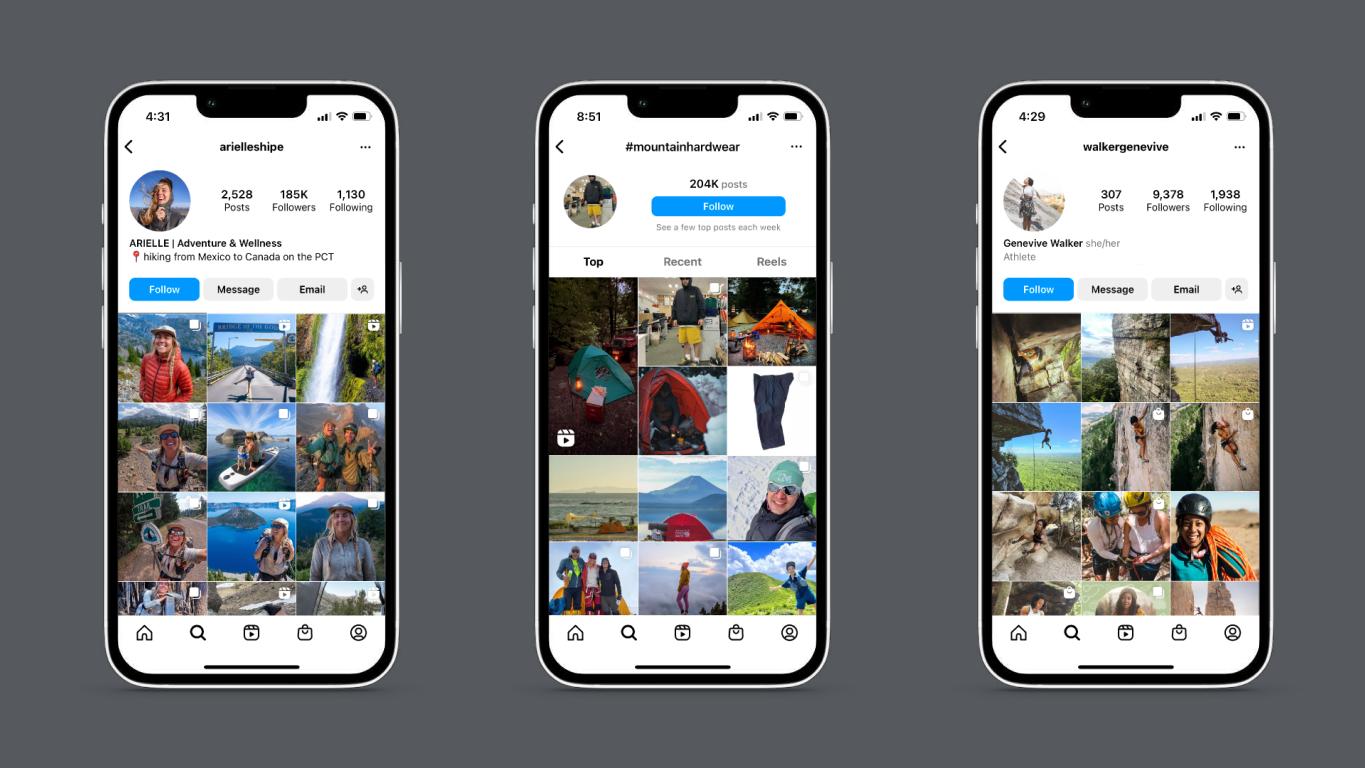

Our fans _03

Our product

Ghost Whisperer

Expedition Tents

Polartec Highloft Jacket

Dynama Bottoms

Crater Lake UPF Tops

Stretchdown

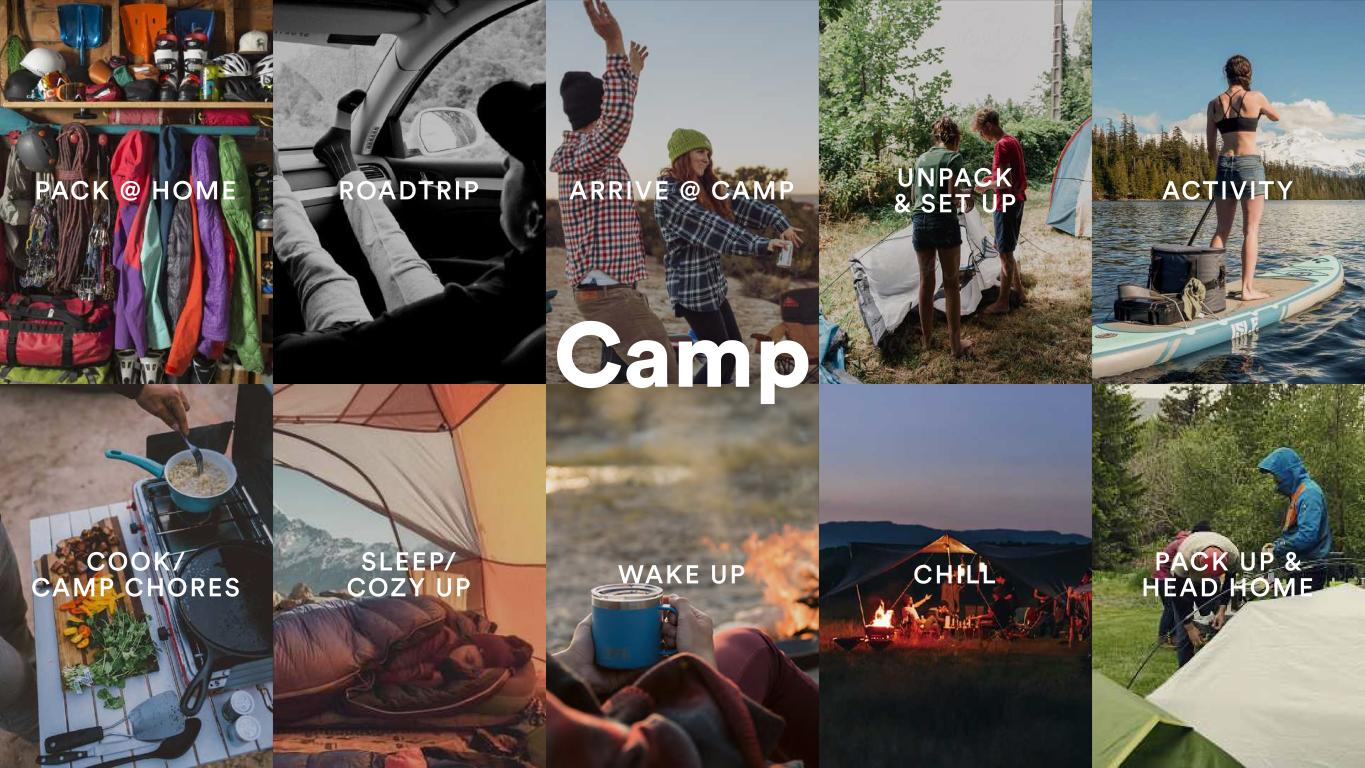

Camp

Camp PACK @ HOME ROADTRIP ARRIVE @ CAMP UNPACK & SET UP ACTIVITY PACK UP & HEAD HOMECHILLSLEEP/ COZY UP COOK/ CAMP CHORES WAKE UP

Looking ahead

Innovation _01

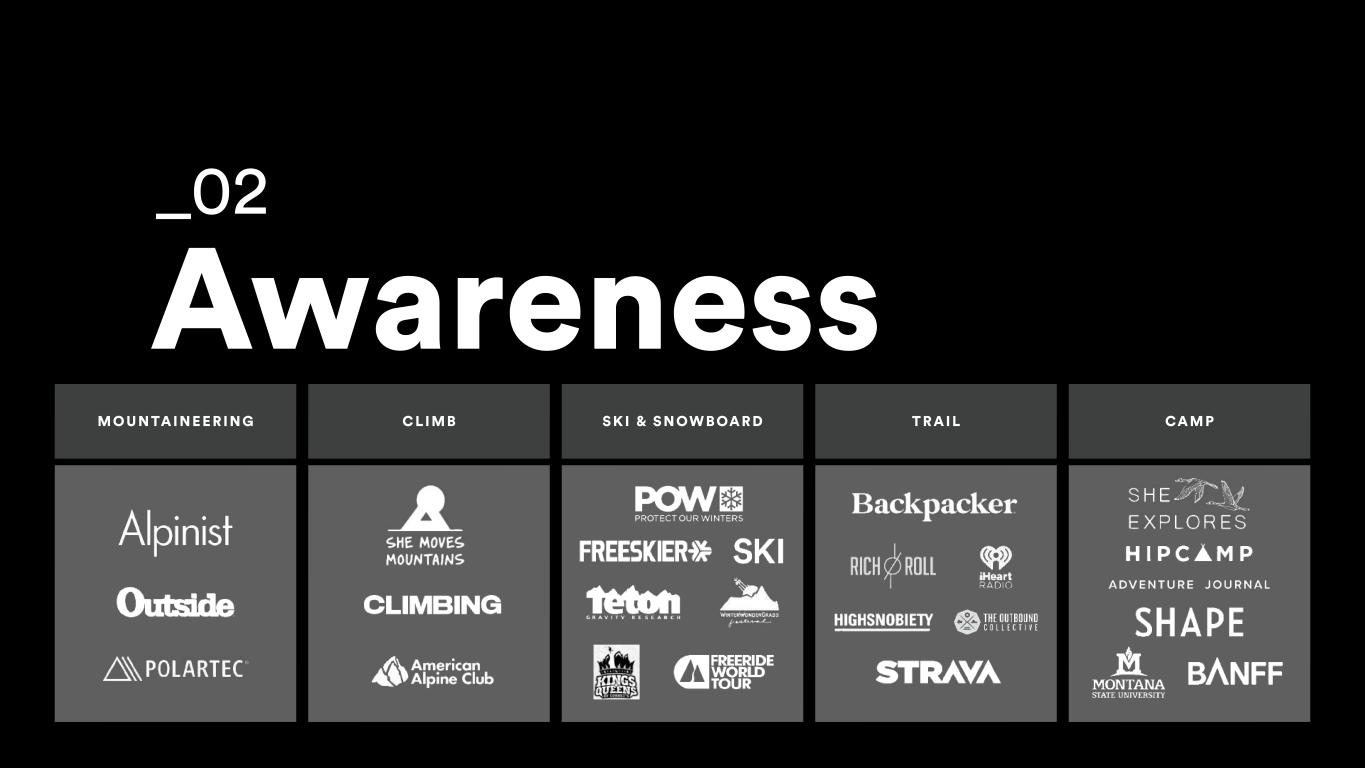

Awareness _02

Awareness _02

Awareness _02 M O U N TA I N E E R I N G C L I M B S K I & S N OW B OA R D T R A I L CA M P

Access _03

Access _03

Access _03

Access _03

Brand Manifesto

MOUNTAIN HARDWEAR BRAND PRODUCT AND MARKETING VIDEO VIDEO PLAYING AT LIVE EVENT PRESENTATIONS WILL RESUME SHORTLY

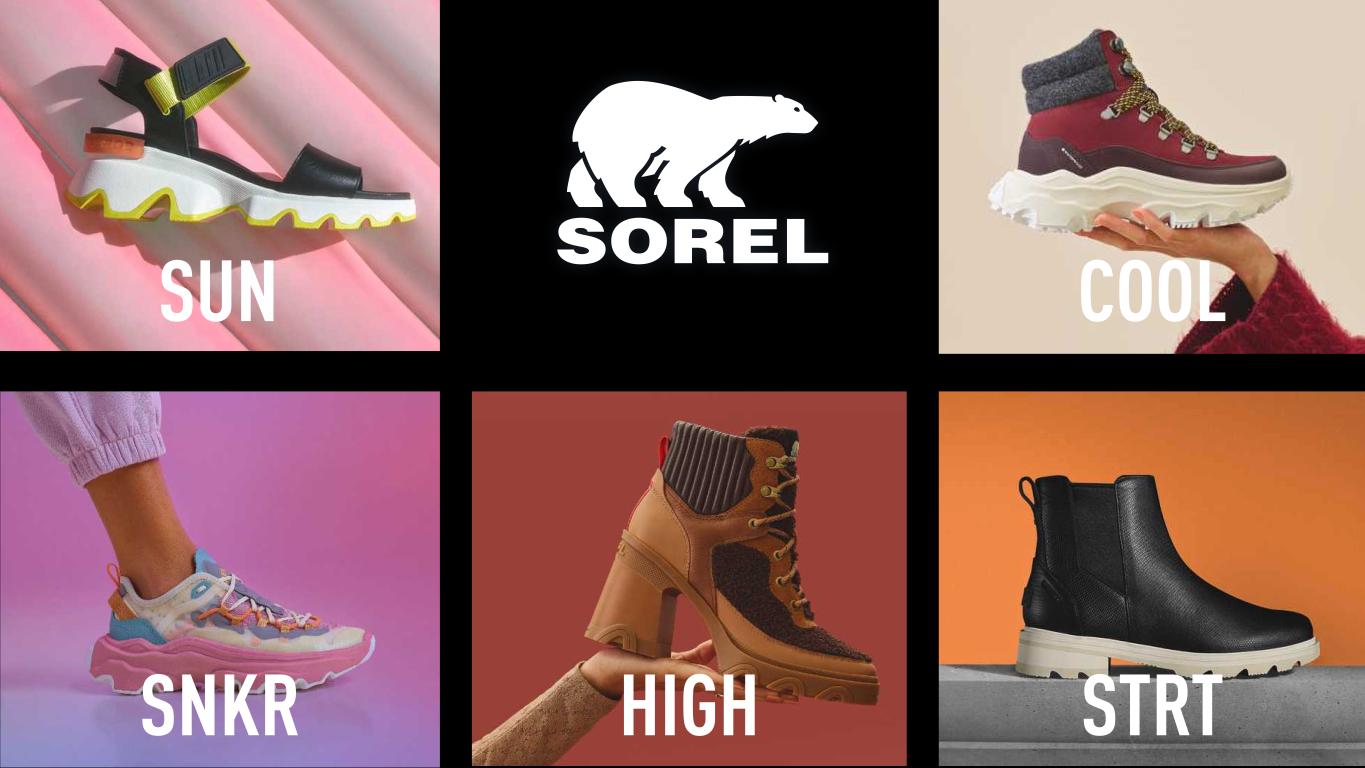

P R E S I D E N T, S O R E L MARK NENOW

THE NEXT GLOBAL FOOTWEAR FORCE

JOURNEY

BRAND

PRODUCT CREATION

FOCUS

ROTATION

SUN COOL STRTHIGHSNKR

PURPOSEFUL AUDACIOUS RELENTLESS CREATIVE

POWERFUL UNSTOPPABLE POWERFUL UNSTOPPABLE POWERFUL UNSTOPPABLE POWERFUL UNSTOPPABLE POWERFUL UNSTOPPABLE POWERFUL UNSTOPPABLE POWERFUL UNSTOPPABLE POWERFUL UNSTOPPABLE POWERFUL UNSTOPPABLE POWERFUL UNSTOPPABLE POWERFUL UNSTOPPABLE POWERFUL UNSTOPPABLE POWERFUL UNSTOPPABLE POWERFUL UNSTOPPABLE POWERFUL UNSTOPPABLE POWERFUL UNSTOPPABLE POWERFUL UNSTOPPABLE POWERFUL UNSTOPPABLE

UNSTOPPABLE

INDEPENDENT

INDEPENDENT

FUNCTION FIRST FASHION

DE-POSITION THE COMPETITION BECOME THE CATEGORY LEADER

LivelyFoam™ UNDER THE FOOT ™ EverTread™

OVER THE FOOT WaterProof WaterProtect ChillProof MoveFree BreatheFree ™

THE NEXT GLOBAL FOOTWEAR FORCE

SOREL BRAND PRODUCT AND MARKETING VIDEO VIDEO PLAYING AT LIVE EVENT PRESENTATIONS WILL RESUME SHORTLY

E V P, C H I E F F I N A N C I A L O F F I C E R JIM SWANSON

STRATEGIC PRIORITIES ACCELERATE PROFITABLE GROWTH DRIVE BRAND ENGAGEMENT ENHANCE CONSUMER EXPERIENCES AMPLIFY MARKETPLACE EXCELLENCE EMPOWER TALENT THAT IS DRIVEN BY OUR CORE VALUES CREATE ICONIC PRODUCTS

ACCELERATING PROFITABLE GROWTH

MARKET TAILWINDS A BROADER CASUALIZATION TREND IS SPUR- RING GROWTH IN LIFESTYLE APPAREL POPULARITY OF OUTDOOR ACTIVITIES HEALTH & WELLNESS AND THE IMPORTANCE OF BEING ACTIVE IS TAKING A LARGER PART IN PEOPLE’S LIVES

ACCELERATING PROFITABLE GROWTH FORTRESS BALANCE SHEET AND DISCIPLINED APPROACH TO CAPITAL ALLOCATION. PROVEN TRACK RECORD OF FINANCIAL PERFORMANCE POSITIONED TO GENERATE MEANINGFUL SHAREHOLDER VALUE.

DELIVERING SHAREHOLDER VALUE + % N E T S A L E S C A G R 9 D I L U T E D E P S C A G R 11+ % A N N U A L I Z E D T O T A L S H A R E H O L D E R R E T U R N 13+ % 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 21 $3.1B $427M NET SALES

1998 — 2021 ANNUAL SHAREHOLDER RETURN 13+ % C O L U M B I A S P O R T S W E A R C O M PA N Y 10+ % S & P 5 0 0 C O N S U M E R D I S C R E T I O N A R Y I N D E X 8+ % S & P 5 0 0 I N D E X

9% 3 Y E A R C A G R 11%T O 2022 — 2025 NET SALES GROWTH OPERATING MARGIN EXPANSION

B Y 2 0 2 5 OPERATING MARGIN EXPANSION 14%~ 2022 — 2025 NET SALES GROWTH 2022 — 2025 DILUTED EPS GROWTH

3 Y E A R C A G R 12% 15%T O 2022 — 2025 DILUTED EPS GROWTHOPERATING MARGIN EXPANSION

MARKET HEADWINDS SUPPLY CHAIN DISRUPTIONS BROAD-BASED INFLATIONARY PRESSURES ONGOING COVID-19 IMPACT GEOPOLITICAL ENVIRONMENT TIGHTENING FED POLICY

2023 SPRING 2023 ORDERS SUPPORT MODEST YEAR-OVER-YEAR FIRST HALF WHOLESALE NET SALES GROWTH

1. FOOTWEAR

1. FOOTWEAR

2. INTERNATIONAL EXPANSION CANADA EUROPE CHINA

3. DIGITAL COMMERCE

2022 — 2025 COLUMBIA BRAND GROWTH 7% 3 Y E A R C A G R 9%T O 20

20% 3 Y E A R C A G R 22%T O 2022 — 2025 SOREL GROWTH2022 — 2025 COLUMBIA BRAND GROWTH 2022 — 2025 MOUNTAIN HARDWEAR GROWTH

3 Y E A R C A G R 2022 — 2025 MOUNTAIN HARDWEAR GROWTH 9% 11%T O% 2022 — 2025 SOREL GROWTH 2022 — 2025 PRANA GROWTH

5% 3 Y E A R C A G R 7%T O 2022 — 2025 PRANA GROWTH2022 — 2025 MOUNTAIN HARDWEAR GROWTH

2022 — 2025 GROWTH BY BRAND C O L U M B I A S O R E L2022E82% 11% 3% 4% M O U N T A I N H A R D W E A R p r A n a 2025E79% 14% 3% 4%

3 Y E A R C A G R 2022 — 2025 GROWTH BY CATEGORY 7% A P PA R E L , A C C E S S O R I E S & E Q U I P M E N T T O9%15% F O O T W E A R Columbia Footwear up 10% to 12% SOREL up 20% to 22% T O17%

2022 — 2025 GROWTH BY CATEGORY A P PA R E L A C C E S S O R I E S E Q U I P M E N T F O O T W E A R 2022E 2025E76% 24% 71% 29%

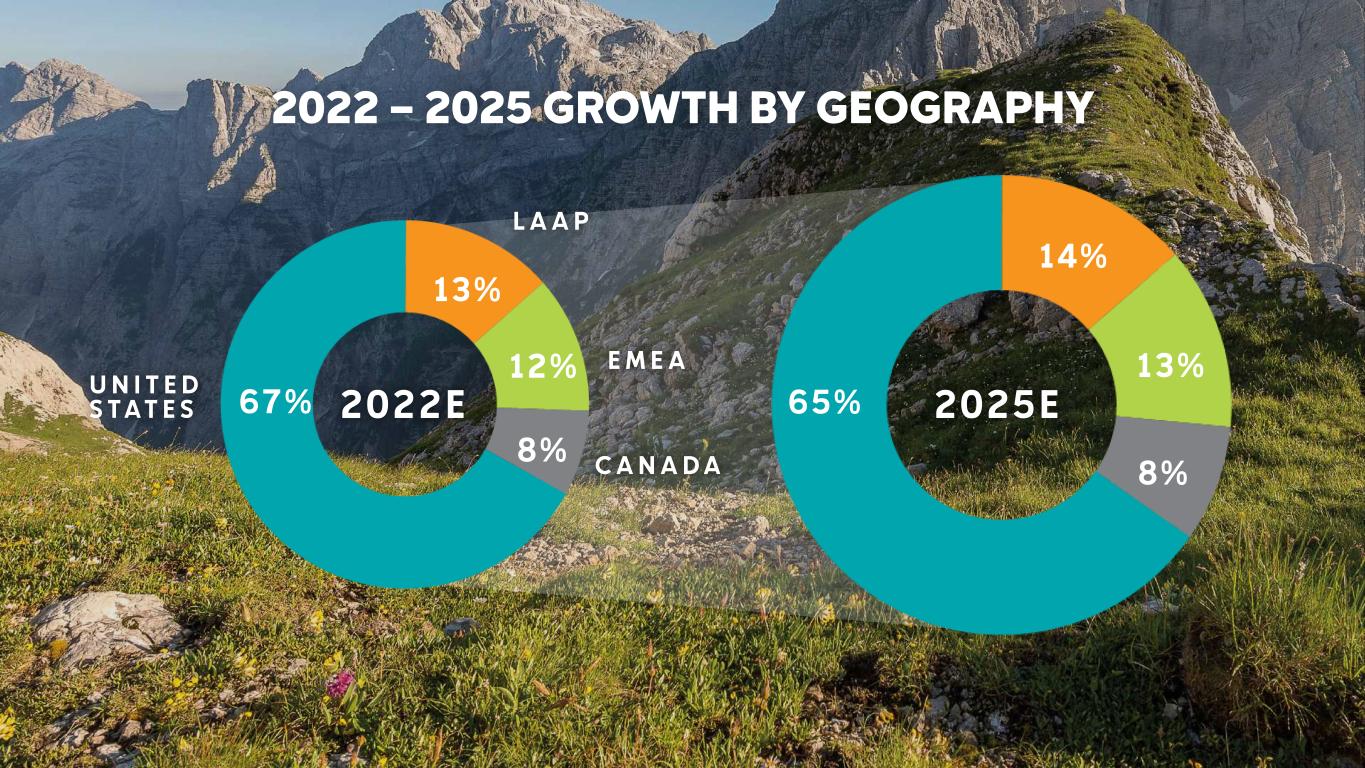

3 Y E A R C A G R 2022 — 2025 GROWTH BY GEOGRAPHY China up mid-teens% Europe Direct up mid-teens% U N I T E D S T A T E S L A A P E M E A C A N A D A 8+ % TO 10%+ 9+ % TO 11%+ 11+ % TO 13%+ 12+ % TO 14%+

2022 — 2025 GROWTH BY GEOGRAPHY U N I T E D S T A T E S L A A P 2022E67% 13% 12% 8% E M E A C A N A D A 2025E65% 14% 13% 8%

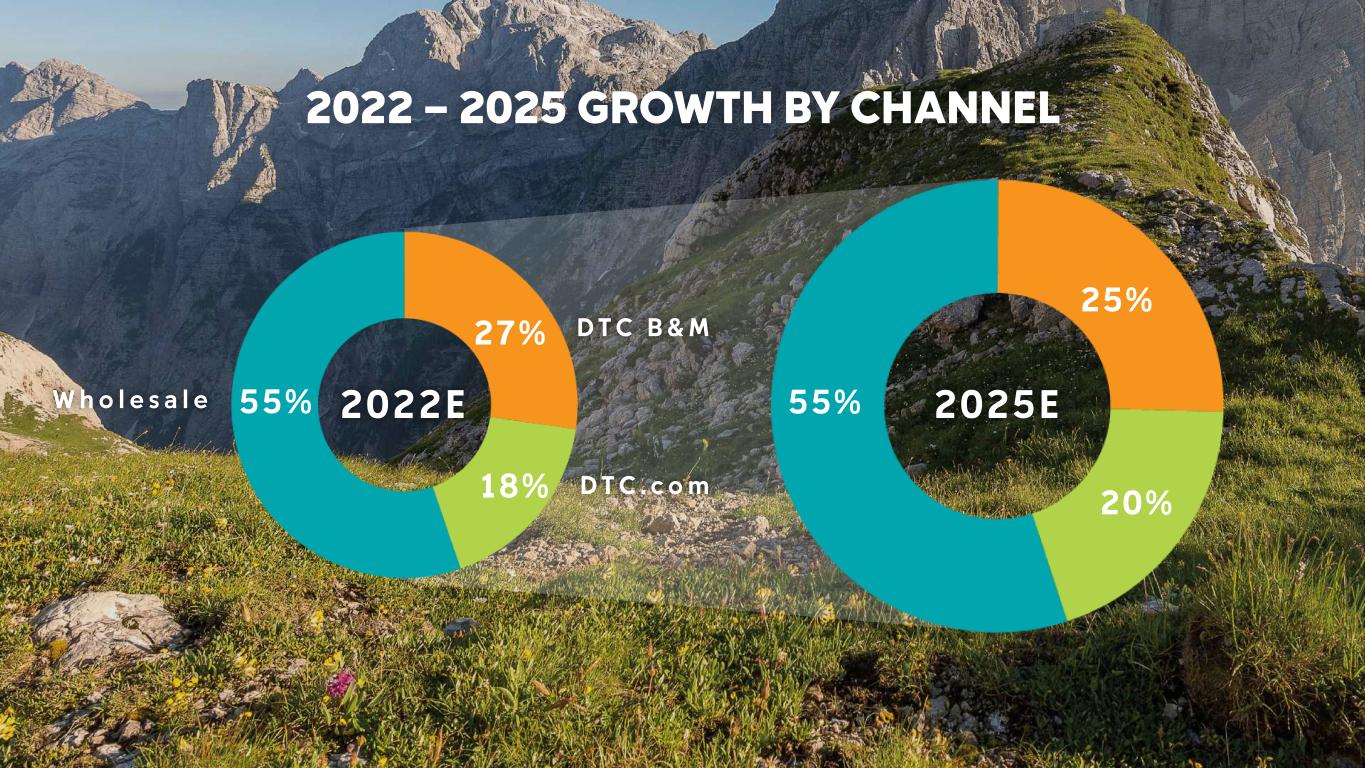

2022 — 2025 GROWTH BY CHANNEL 13% T O15% D T C E - C O M M E R C E 6% T O8% D T C B R I C K & M O R T A R 3 Y E A R C A G R T O11%9% W H O L E S A L E

2022 — 2025 GROWTH BY CHANNEL W h o l e s a l e D T C B & M 2022E55% 27% 18% D T C . c o m 2025E55% 25% 20%

OPERATING MARGIN EXPANSION B Y 2 0 2 5 14%~

GROSS MARGIN DRIVERS HEADWINDS ECONOMIC UNCERTAINTY — INFLATIONARY PRESSURES FOREIGN CURRENCY WEAKNESS INVENTORY & MARKETPLACE PROMOTION LEVELS TAILWINDS BRAND PRICING POWER DISCIPLINED EXECUTION

SG&A DRIVERS HEADWINDS/INVESTMENTS INFLATIONARY PRESSURES STRATEGIC INVESTMENTS, INCLUDING DEMAND CREATION TAILWINDS TOP LINE MOMENTUM, FUELS FIXED SG&A EXPENSE LEVERAGE OPERATIONAL EFFICIENCIES EXPENSE DISCIPLINE

STRATEGIC INVESTMENTS DEMAND CREATION DIGITAL SUPPLY CHAIN OTHER

STRATEGIC INVESTMENTS DEMAND CREATION INCREASE RATE OF SPEND TO >6.0% OF SALES EMPHASIZE GROWTH ACCELERATORS UTILIZE FULL FUNNEL – DIGITAL-FIRST MINDSET CREATE DEEPER CONNECTIONS WITH CONSUMERS

STRATEGIC INVESTMENTS DIGITAL ENHANCE ONLINE CONSUMER EXPERIENCES GENERATE CONSUMER INSIGHTS WITH DATA AND ANALYTICS AMPLIFY LOYALTY / MEMBERSHIP ENGAGE CONSUMERS WITH DIGITAL MARKETING

STRATEGIC INVESTMENTS SUPPLY CHAIN ENHANCE CONSUMER EXPERIENCES THROUGH SERVICE AND SPEED ADAPT OUR SUPPLY CHAIN TO AN EVOLVING BUSINESS MODEL SERVING AN OMNI-CHANNEL BUSINESS IMPROVE INVENTORY EFFICIENCY ACTIVATE CAPACITY GROWTH

STRATEGIC INVESTMENTS OTHER INVEST IN NEW GROWTH OPPORTUNITIES DTC STORE EXPANSION EMPOWER OUR TALENT THROUGH TOOLS & TECHNOLOGY

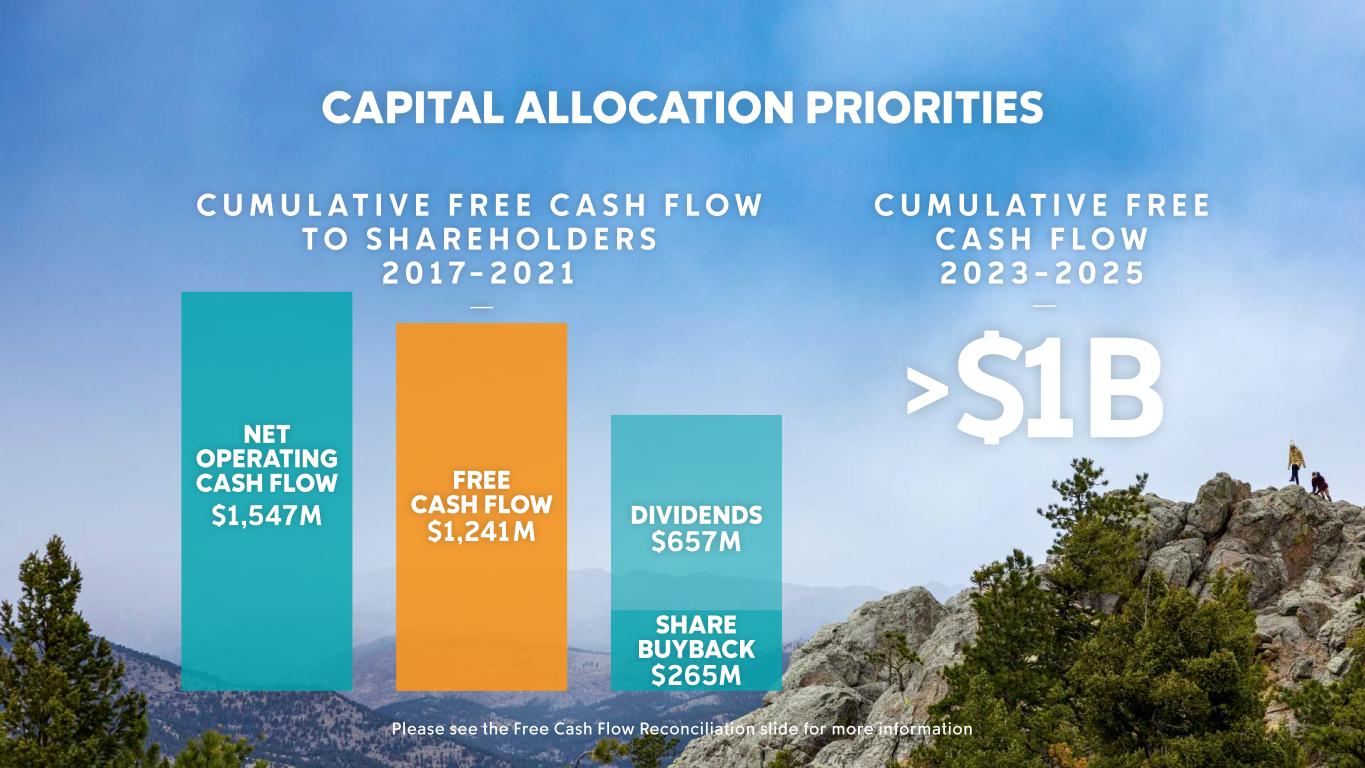

CAPITAL ALLOCATION PRIORITIES RETURN AT LEAST 40% OF FREE CASH FLOW TO SHAREHOLDERS INVEST IN ORGANIC GROWTH OPPORTUNITIES OPPORTUNISTIC M&A TO DRIVE LONG-TERM PROFITABLE GROWTH THROUGH DIVIDENDS AND SHARE REPURCHASES

CAPITAL ALLOCATION PRIORITIES C U M U L A T I V E F R E E C A S H F L O W 2 0 2 3 - 2 0 2 5 > C U M U L A T I V E F R E E C A S H F L O W T O S H A R E H O L D E R S 2 017- 2 0 21 FREE CASH FLOW $1,241M SHARE BUYBACK $265M DIVIDENDS $657M $1BNET OPERATING CASH FLOW $1,547M Please see the Free Cash Flow Reconciliation slide for more information

ANNUAL TOTAL SHAREHOLDER RETURN TARGET 3 Y E A R C A G R NET SALES GROWTH OPERATING MARGIN EXPANSION DIVIDEND/ REPURCHASE ORGANIC TSR TOTAL SHAREHOLDER RETURN POTENTIAL VALUATION MULTIPLE EXPANSION +9% TO 11% +3% TO 4% +1% TO 2% +13% TO 17% +13% TO 17%

2025 EARNINGS GROWTH ALGORITHM $4.5B T O % N E T S A L E S O P E R A T I N G M A R G I N D I L U T E D E P S $4.7B ~14 $7.35 T O $7.95 + =

FREE CASH FLOW RECONCILIATION GAAP financial measures for forward-looking periods are not available without unreasonable effort.