Sportswear Company:M CFO Commentary and Financial Review Th.rd Quarter 2022 October 27, 2022 Exhibit 99.2

DTC DTC.com DTC B&M y/y U.S. LAAP EMEA SG&A EPS bps direct-to-consumer DTC e-commerce DTC brick & mortar year-over-year United States Latin America and Asia Pacific Europe, Middle East and Africa selling, general & administrative earnings per share basis points “+” or “up” “-” or “down” LSD% MSD% HSD% LDD% low-20% mid-30% high-40% increased decreased low-single-digit percent mid-single-digit percent high-single-digit percent low-double-digit percent low-twenties percent mid-thirties percent high-forties percent “$##M” “$##B” c.c. M&A FX ~ H1 Q1 in millions of U.S. dollars in billions of U.S. dollars constant-currency mergers & acquisitions foreign exchange approximately first half first quarter

W E C O N N E C T A C T I V E P E O P L E W I T H T H E I R P A S S I O N S 4

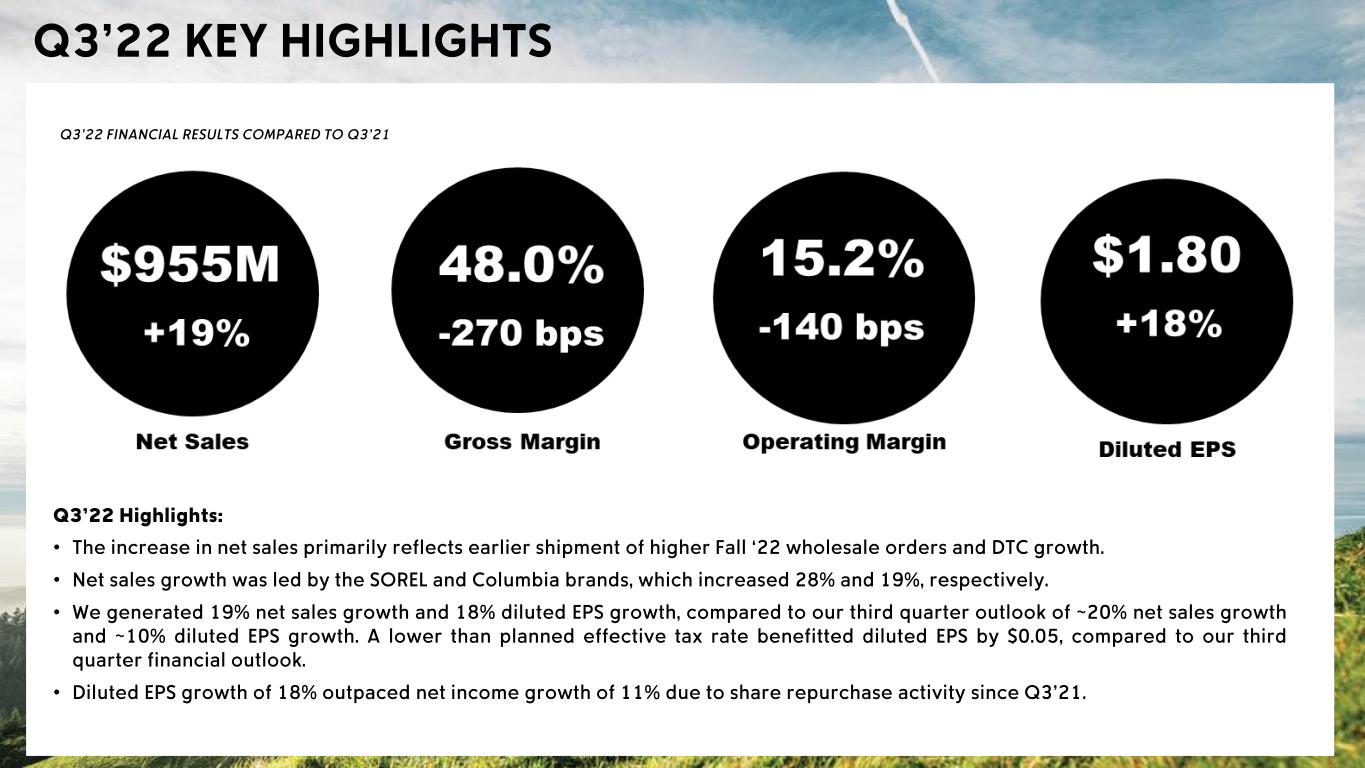

• • • •

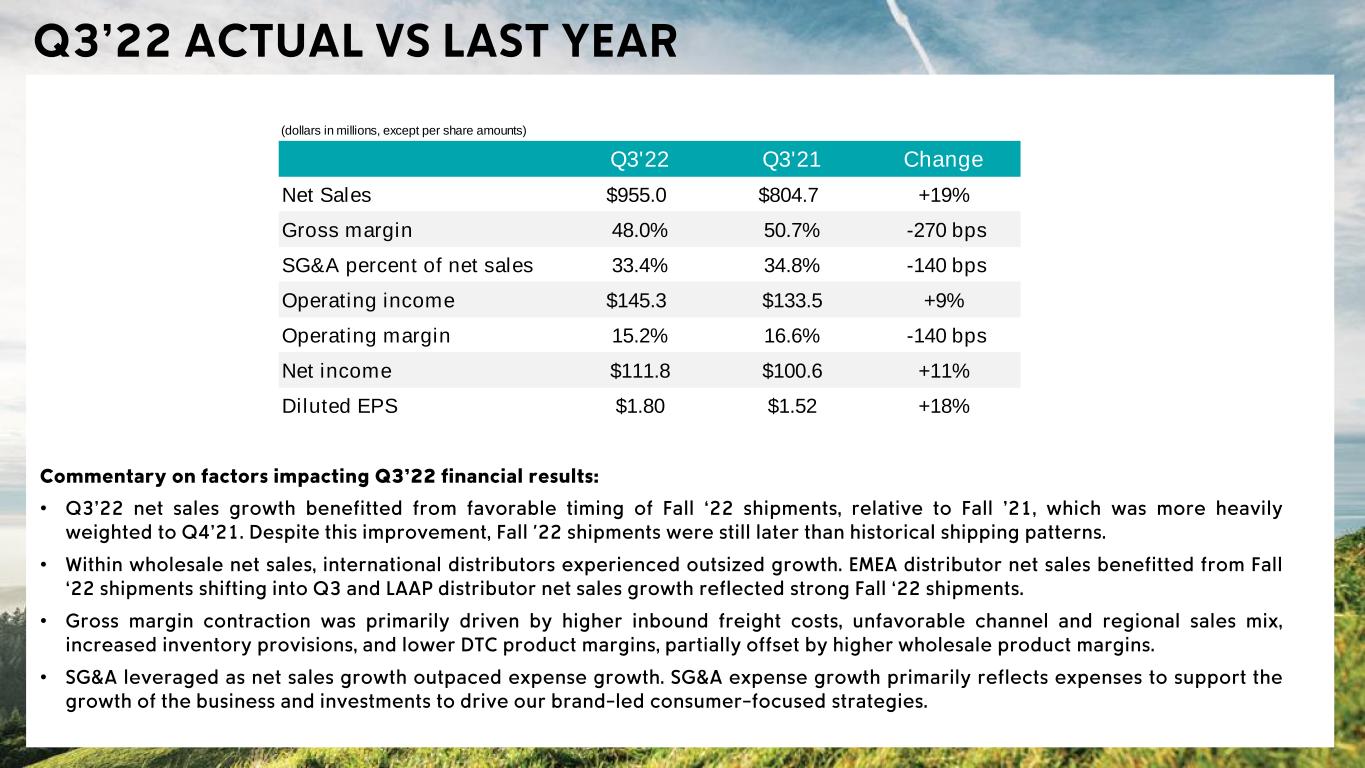

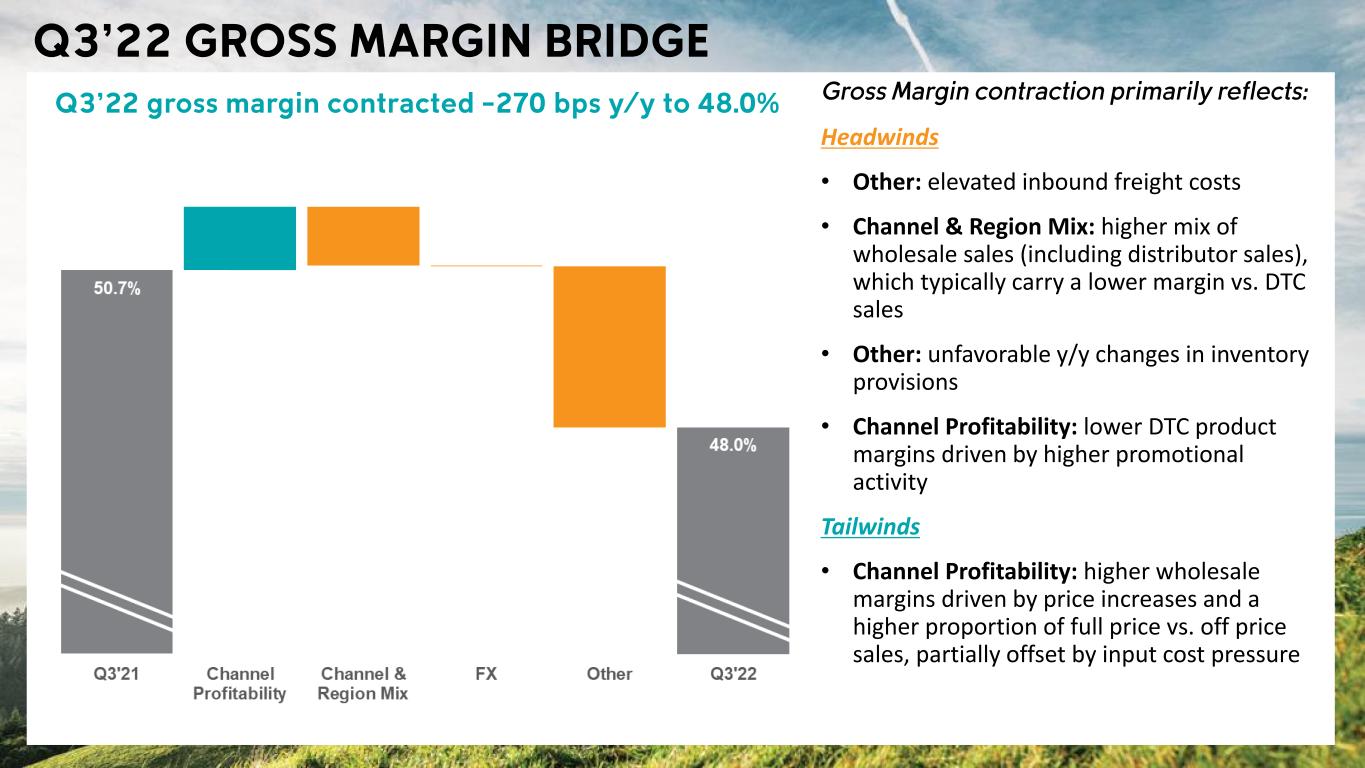

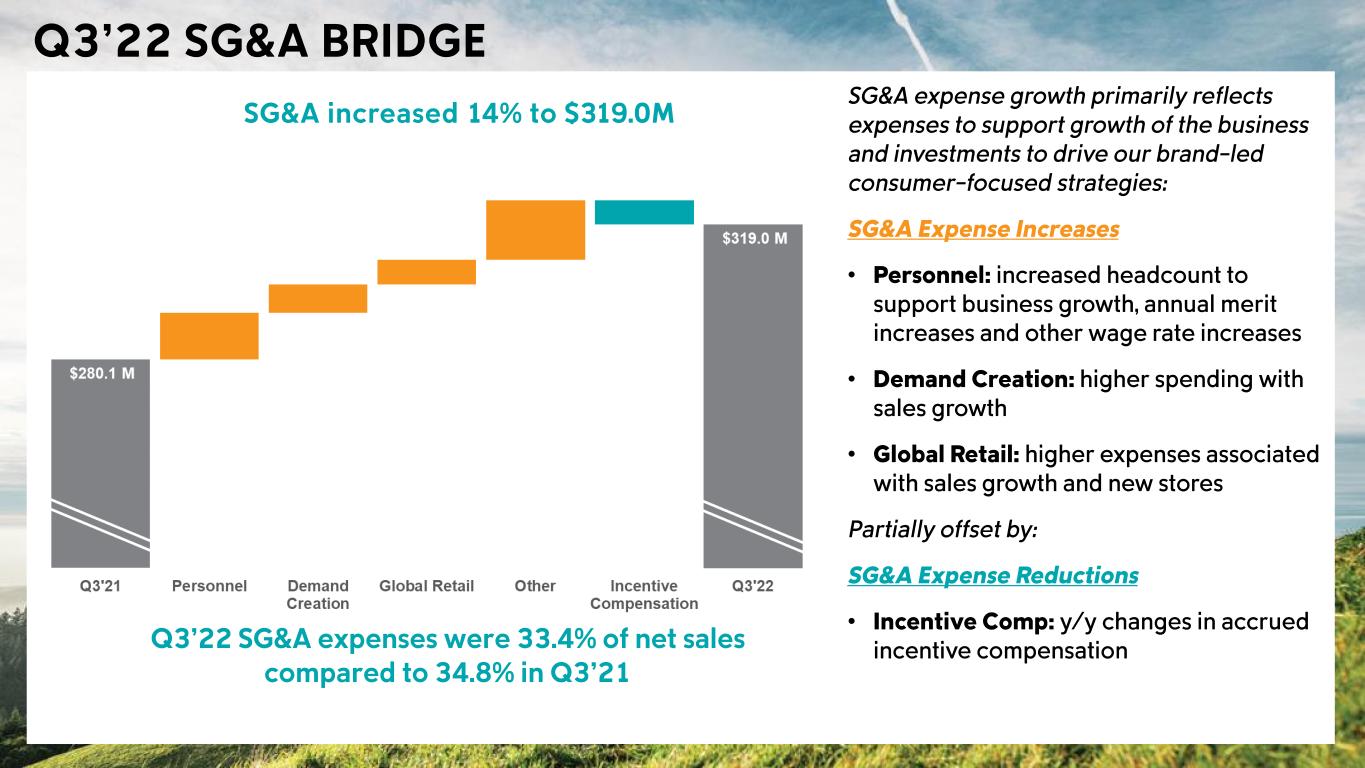

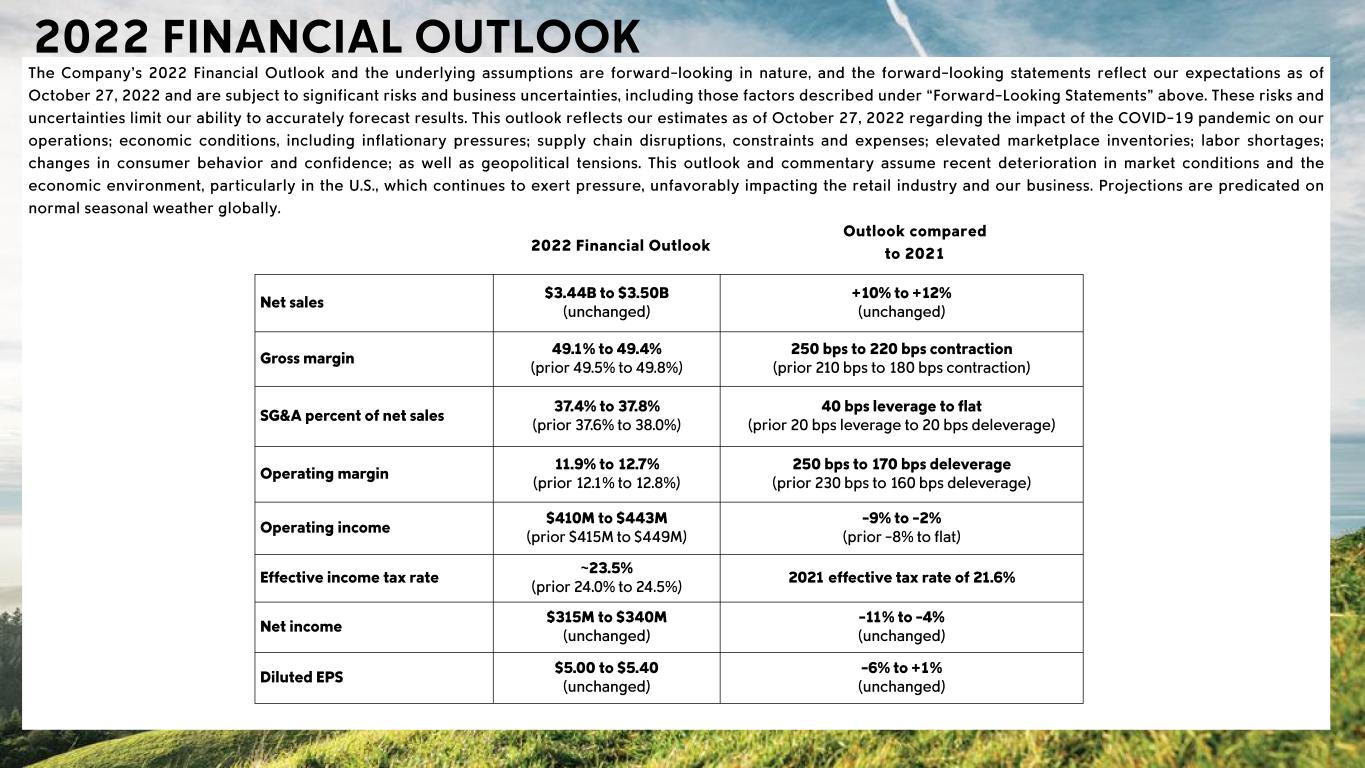

• • • • (dollars in millions, except per share amounts) Q3'22 Q3'21 Change Net Sales $955.0 $804.7 +19% Gross margin 48.0% 50.7% -270 bps SG&A percent of net sales 33.4% 34.8% -140 bps Operating income $145.3 $133.5 +9% Operating margin 15.2% 16.6% -140 bps Net income $111.8 $100.6 +11% Diluted EPS $1.80 $1.52 +18%

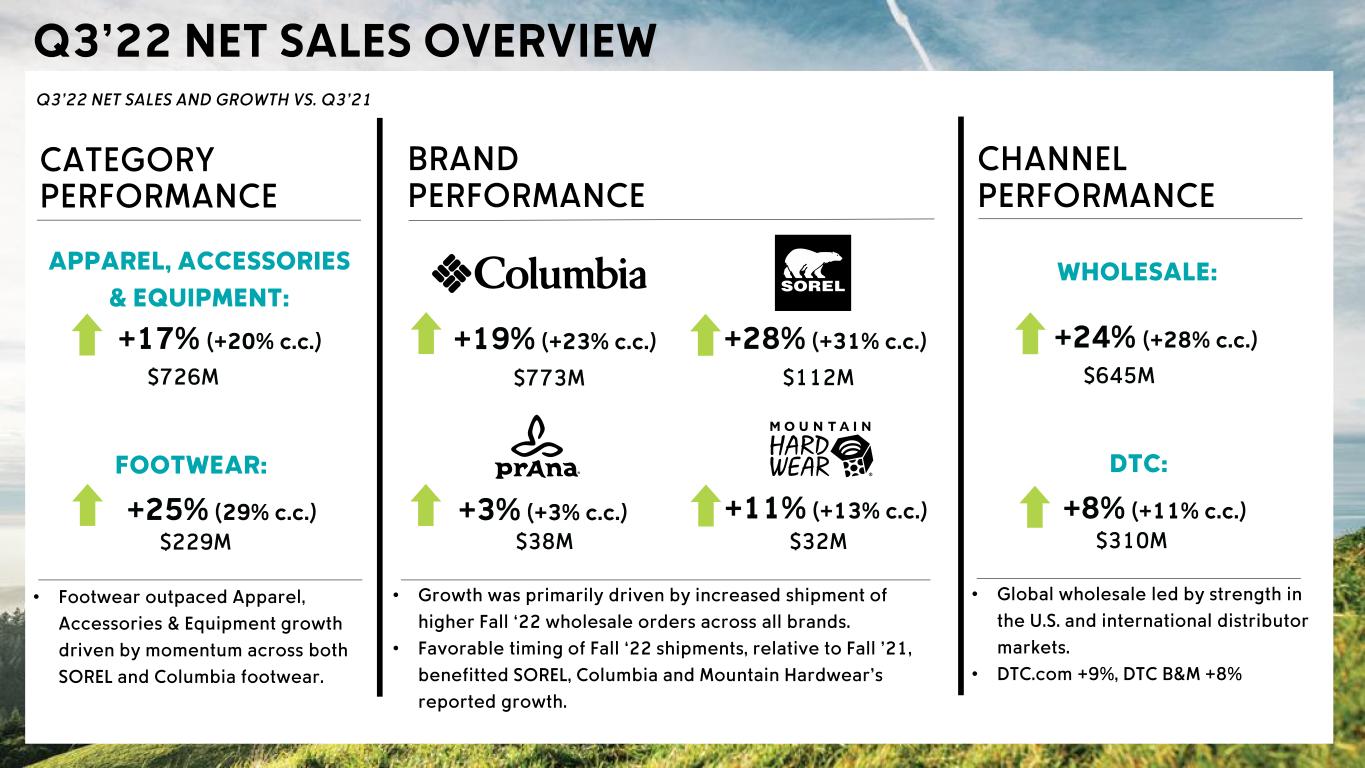

• • • • •

• • • • • • • • • •

Headwinds • Other: elevated inbound freight costs • Channel & Region Mix: higher mix of wholesale sales (including distributor sales), which typically carry a lower margin vs. DTC sales • Other: unfavorable y/y changes in inventory provisions • Channel Profitability: lower DTC product margins driven by higher promotional activity Tailwinds • Channel Profitability: higher wholesale margins driven by price increases and a higher proportion of full price vs. off price sales, partially offset by input cost pressure

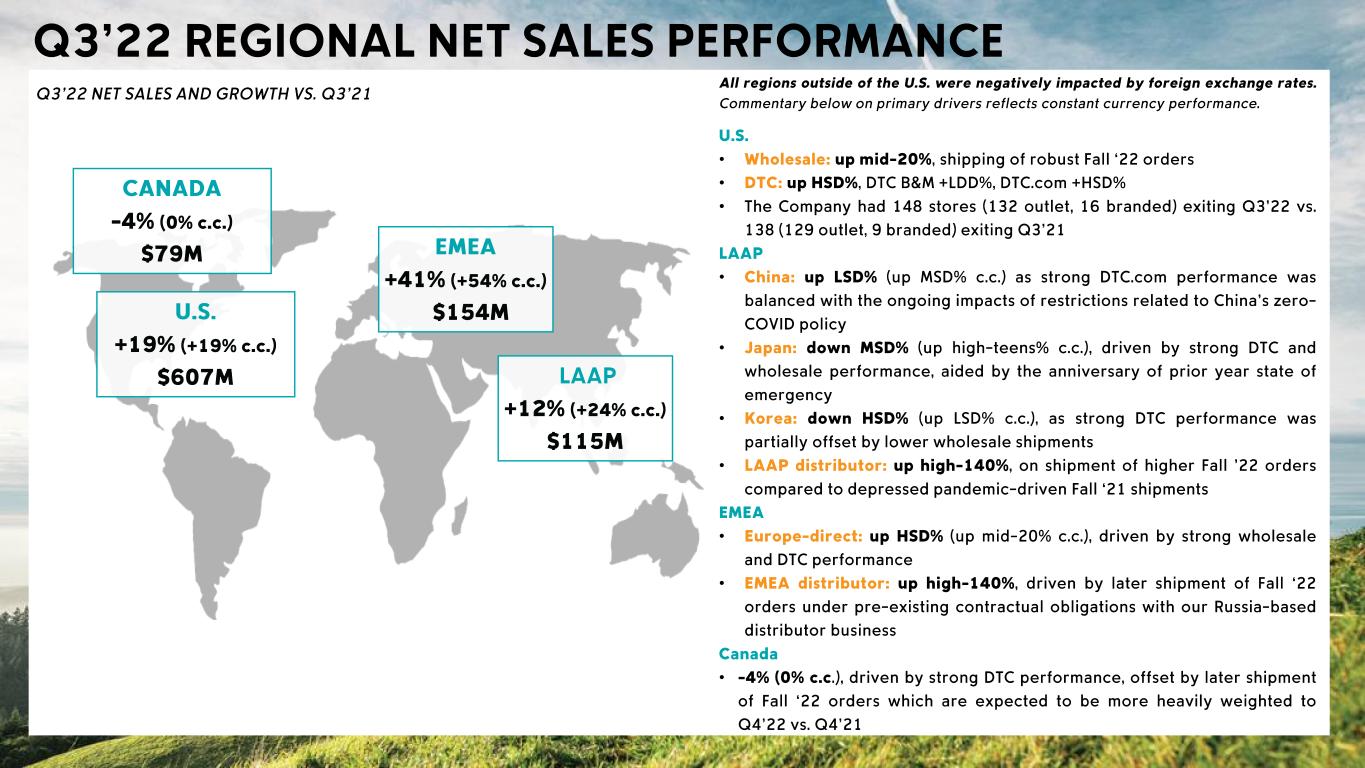

• • • •

• • • • • • • • • • • • • • • • • • • •

• • • • • • • • •

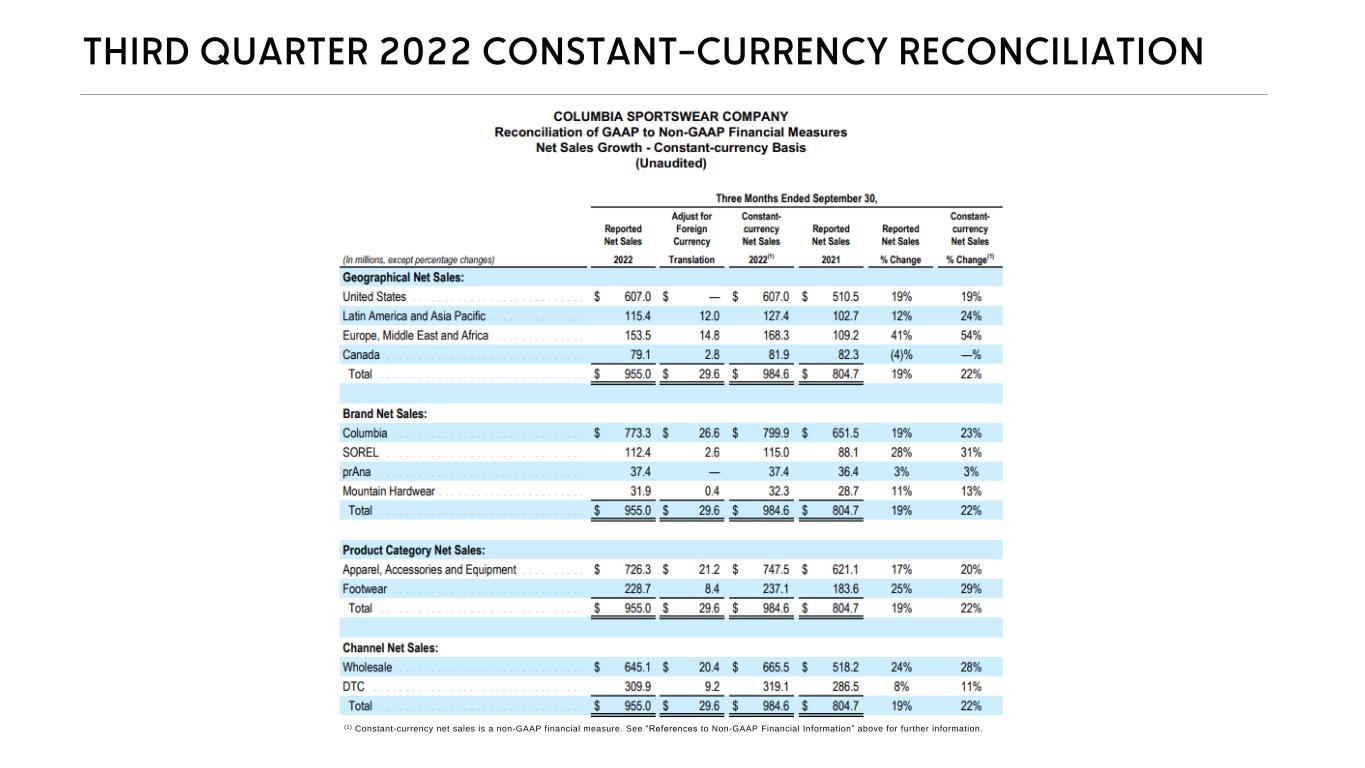

(1) Constant-currency net sales is a non-GAAP financial measure. See “References to Non-GAAP Financial Information” above for further information.