DTC DTC.com DTC B&M y/y U.S. LAAP EMEA SG&A EPS bps direct-to-consumer DTC e-commerce DTC brick & mortar year-over-year United States Latin America and Asia Pacific Europe, Middle East and Africa selling, general & administrative earnings per share basis points “+” or “up” “-” or “down” LSD% MSD% HSD% LDD% low-20% mid-30% high-40% increased decreased low-single-digit percent mid-single-digit percent high-single-digit percent low-double-digit percent low-twenties percent mid-thirties percent high-forties percent “$##M” “$##B” c.c. M&A FX ~ H1 Q1 in millions of U.S. dollars in billions of U.S. dollars constant-currency mergers & acquisitions foreign exchange approximately first half first quarter

W E C O N N E C T A C T I V E P E O P L E W I T H T H E I R P A S S I O N S 4

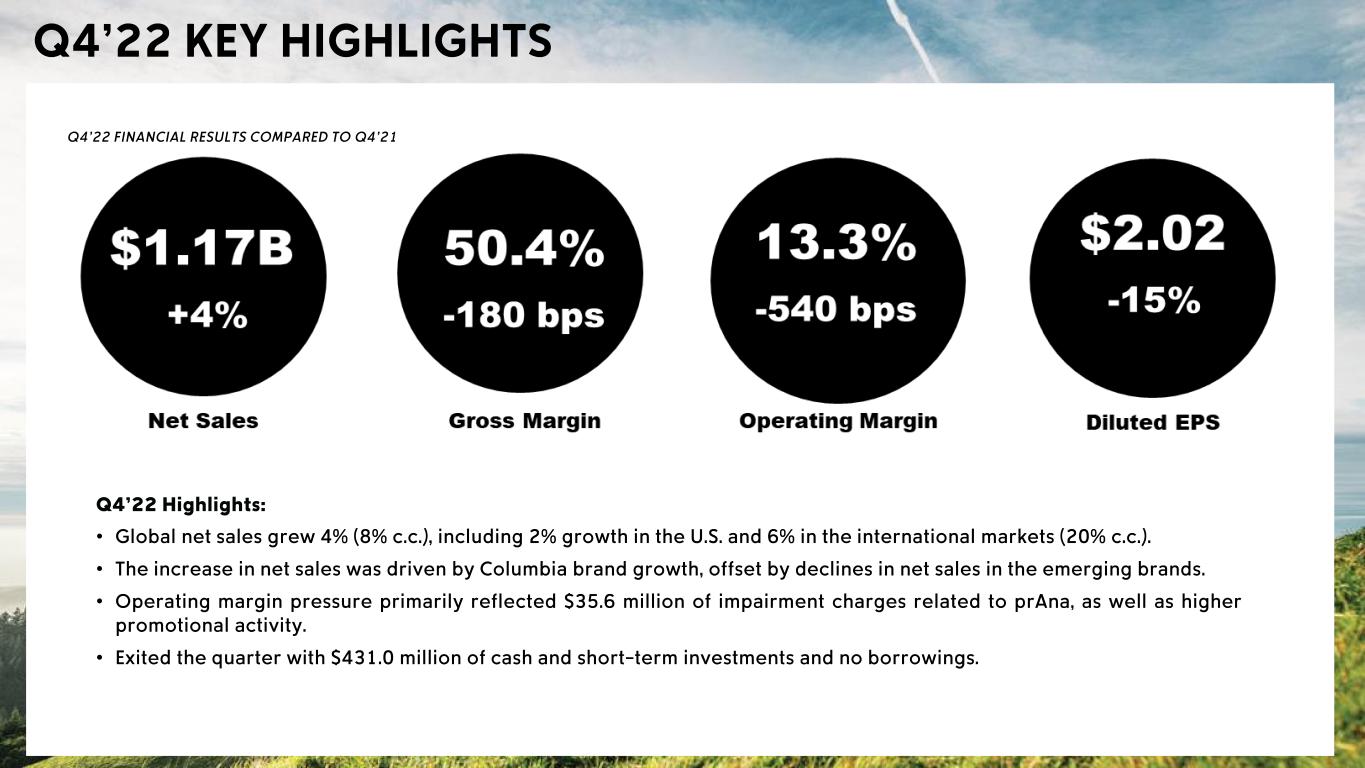

• • • •

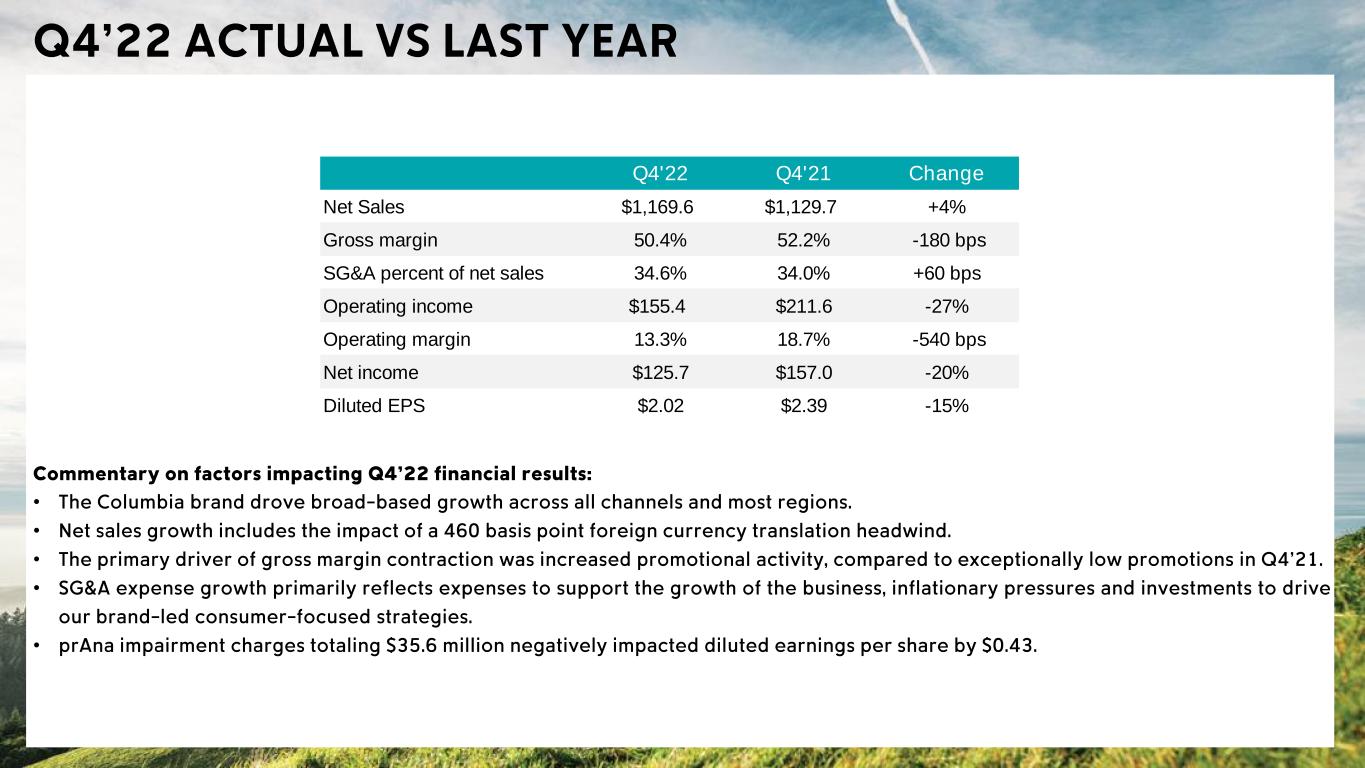

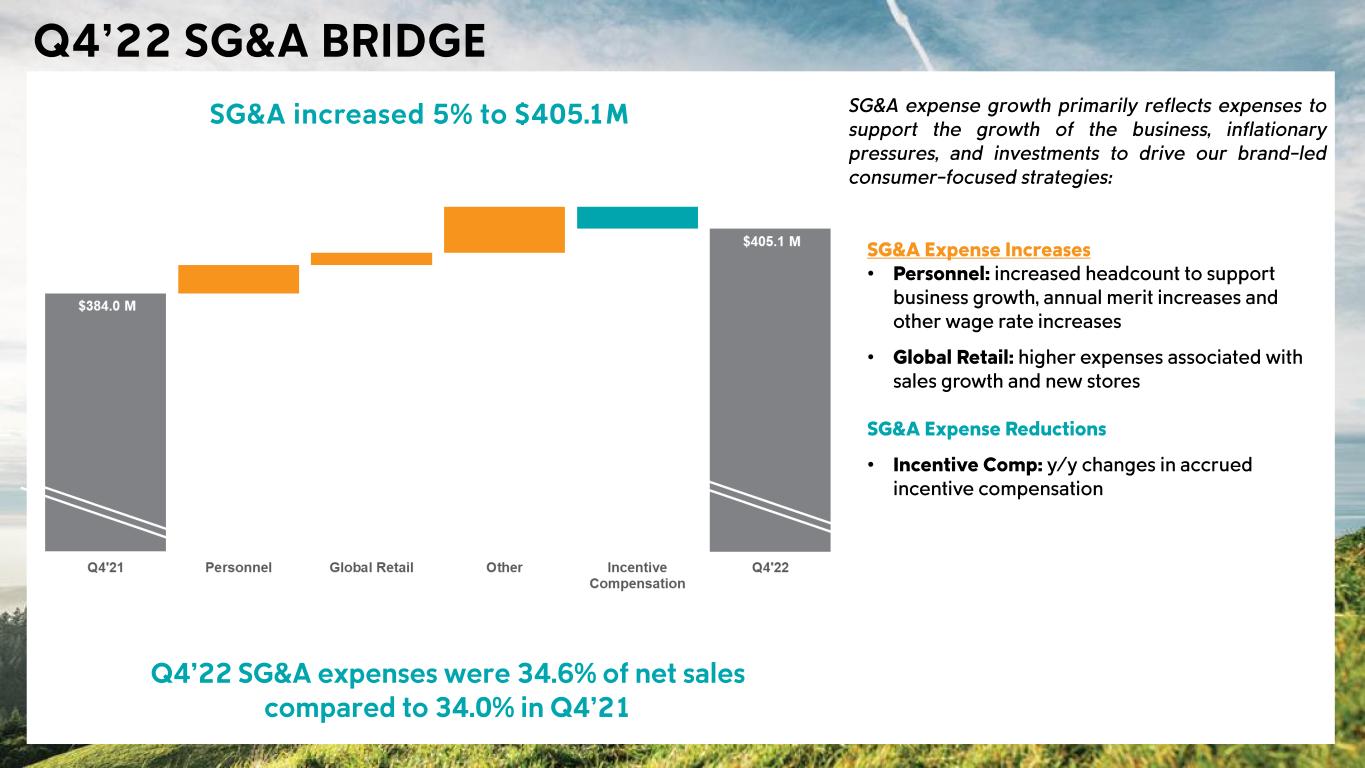

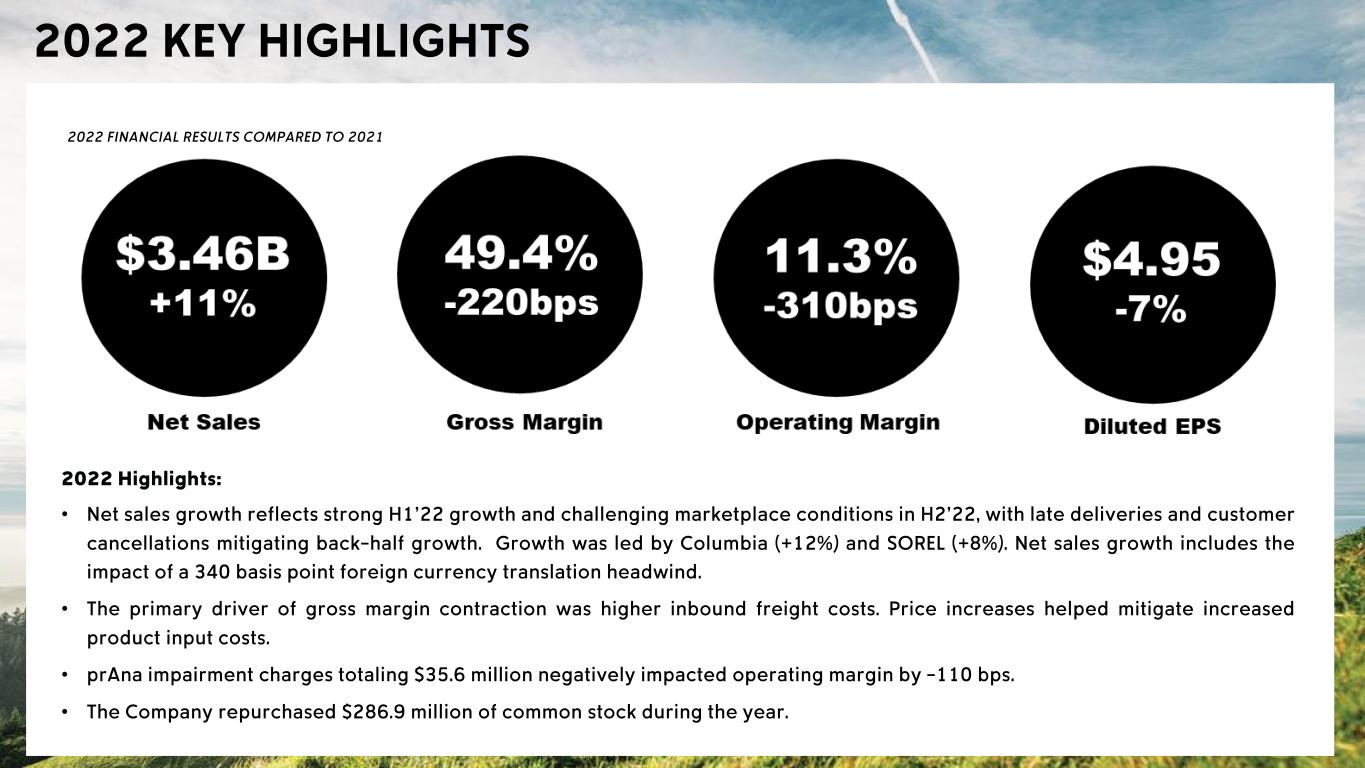

• • • • • Q4'22 Q4'21 Change Net Sales $1,169.6 $1,129.7 +4% Gross margin 50.4% 52.2% -180 bps SG&A percent of net sales 34.6% 34.0% +60 bps Operating income $155.4 $211.6 -27% Operating margin 13.3% 18.7% -540 bps Net income $125.7 $157.0 -20% Diluted EPS $2.02 $2.39 -15%

• • • • •

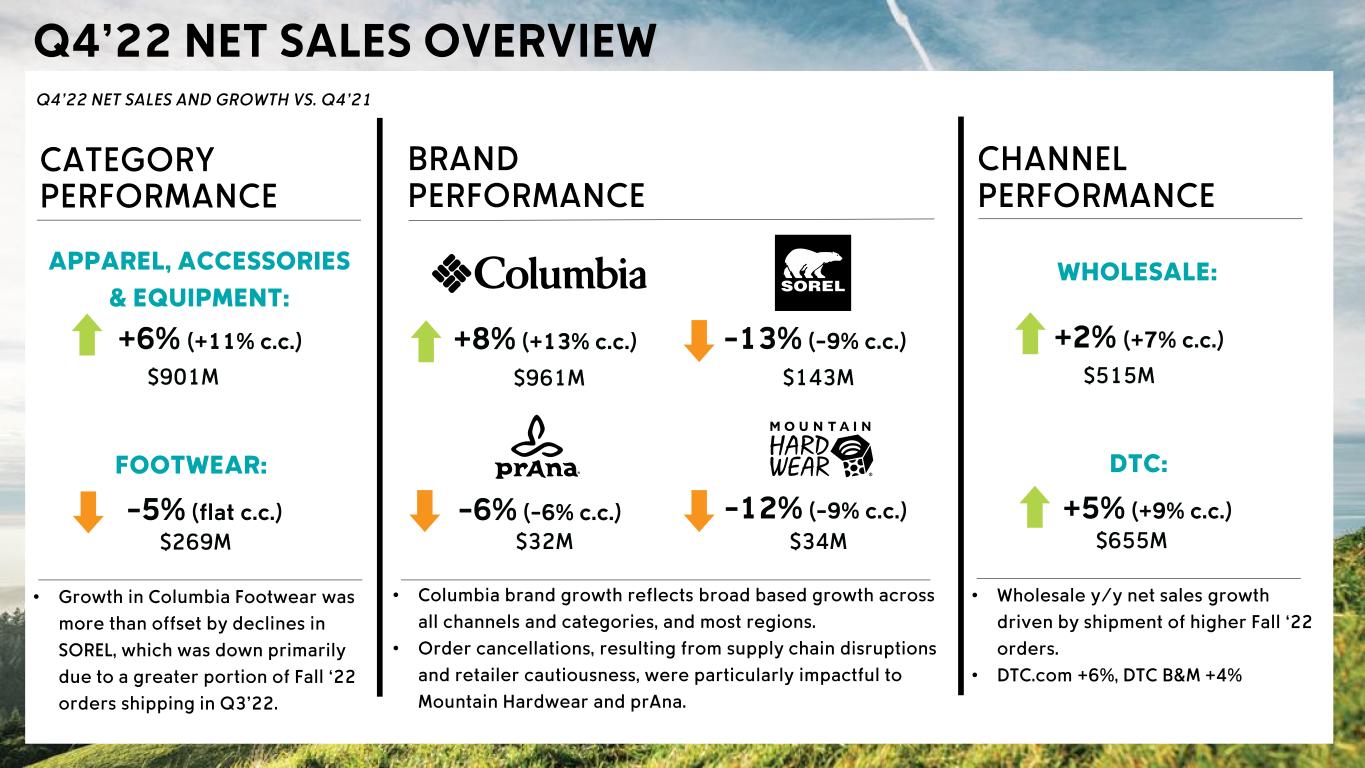

• • • • • • • • • •

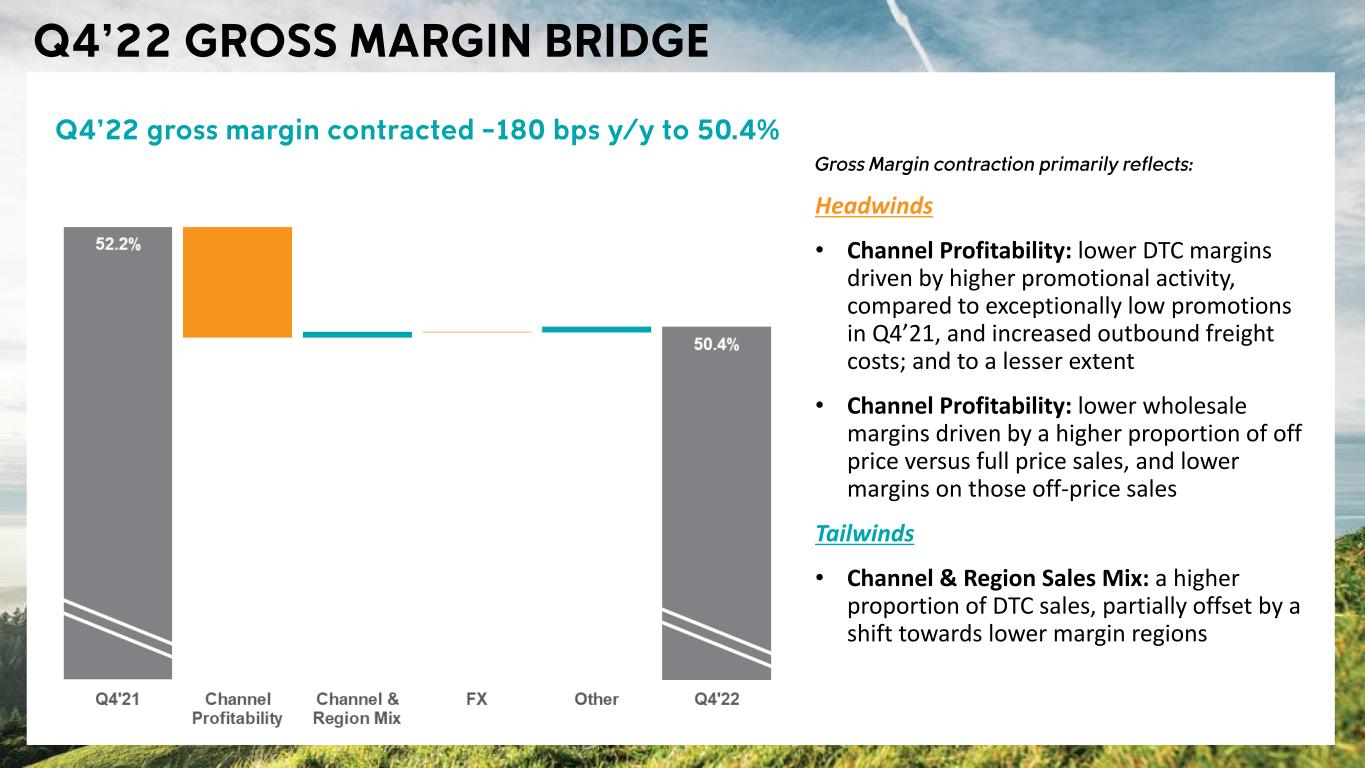

Headwinds • Channel Profitability: lower DTC margins driven by higher promotional activity, compared to exceptionally low promotions in Q4’21, and increased outbound freight costs; and to a lesser extent • Channel Profitability: lower wholesale margins driven by a higher proportion of off price versus full price sales, and lower margins on those off-price sales Tailwinds • Channel & Region Sales Mix: a higher proportion of DTC sales, partially offset by a shift towards lower margin regions

• • •

• • • •

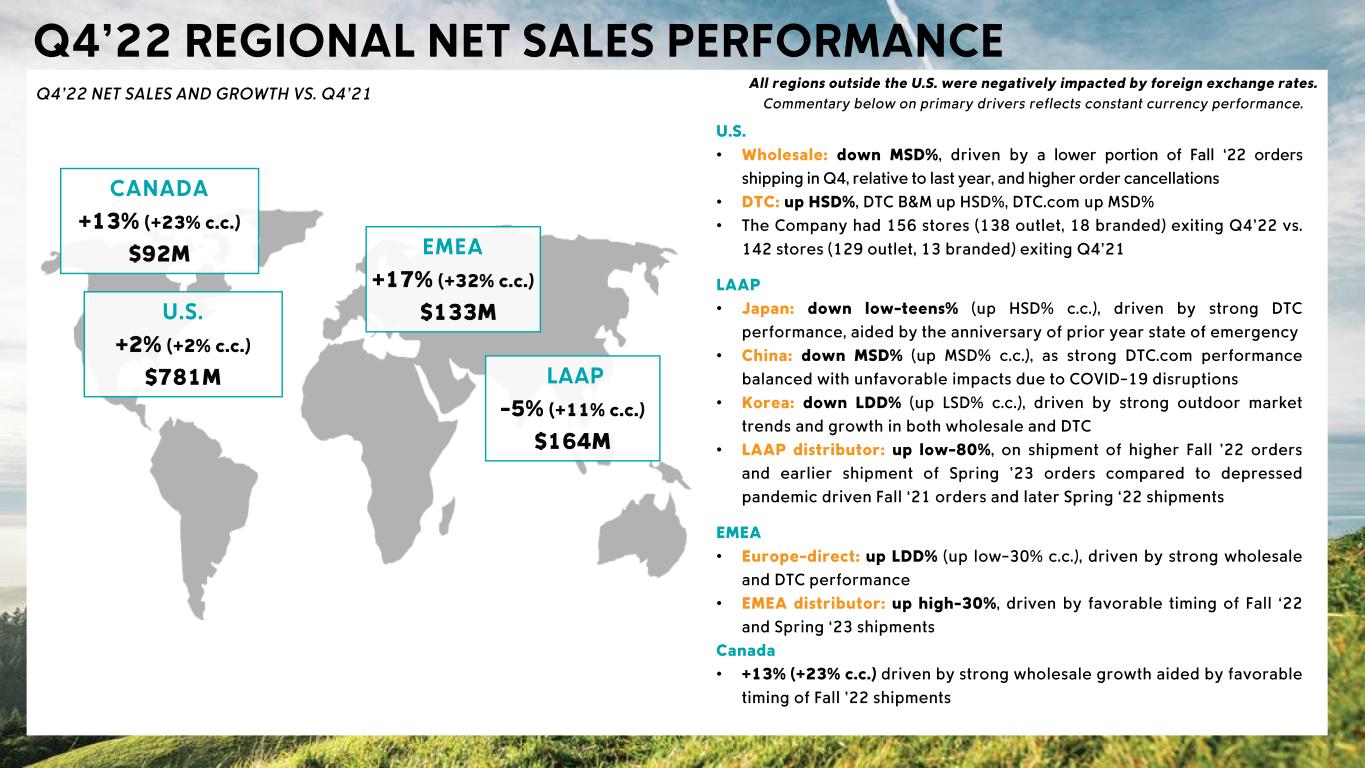

• • • • • • • • • • • •

• • • - - • • • • • •

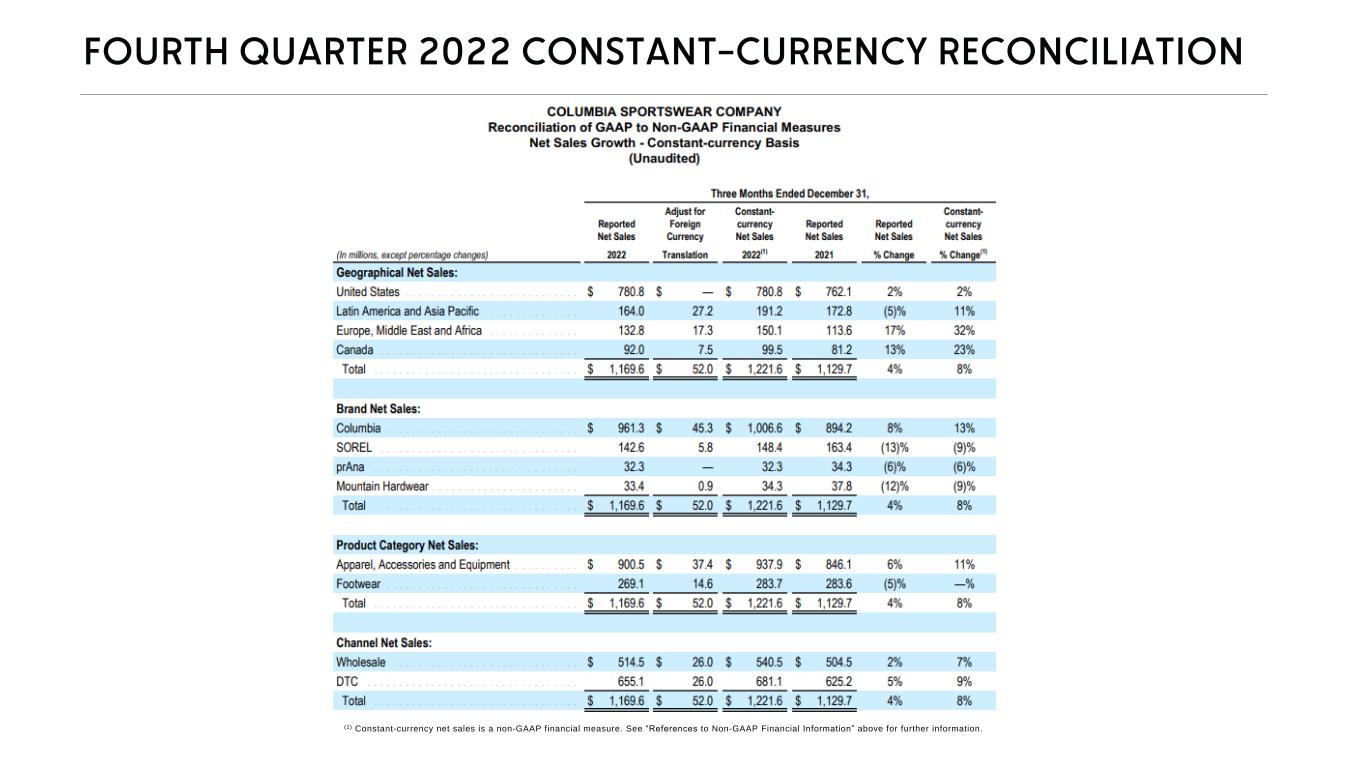

(1) Constant-currency net sales is a non-GAAP financial measure. See “References to Non-GAAP Financial Information” above for further information.