Exhibit 99.2

DTC DTC.com DTC B&M y/y U.S. LAAP EMEA SG&A EPS Bps direct-to-consumer DTC e-commerce DTC brick & mortar year-over-year United States Latin America and Asia Pacific Europe, Middle East and Africa selling, general & administrative earnings per share basis points “+” or “up” “-” or “down” LSD% MSD% HSD% LDD% low-20% mid-30% high-40% increased decreased low-single-digit percent mid-single-digit percent high-single-digit percent low-double-digit percent low-twenties percent mid-thirties percent high-forties percent “$##M” “$##B” c.c. M&A FX ~ H1 Q1 YTD 3PL PFAS in millions of U.S. dollars in billions of U.S. dollars constant-currency mergers & acquisitions foreign exchange approximately first half first quarter Year-to-date Third-party logistics perfluoroalkyl and polyfluoroalkyl substances

W E C O N N E C T A C T I V E P E O P L E W I T H T H E I R P A S S I O N S 4

• • • •

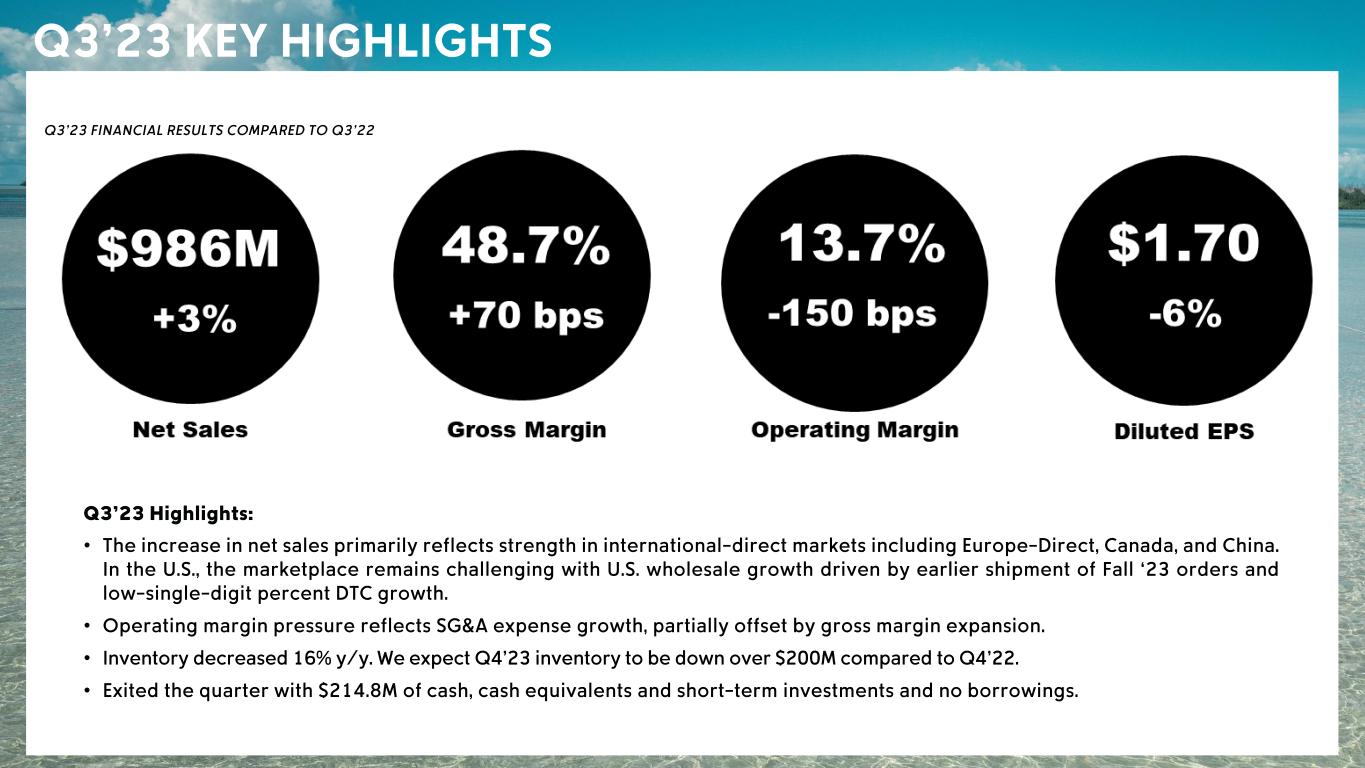

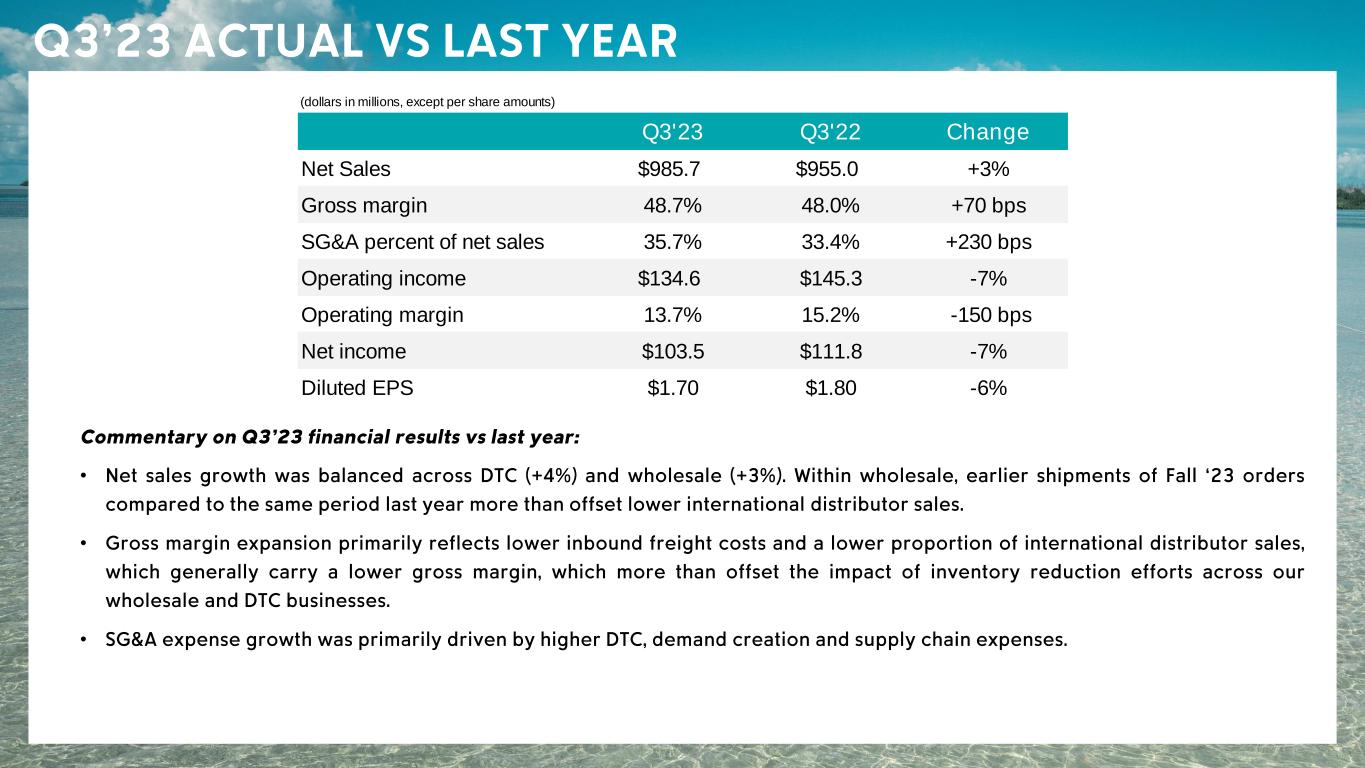

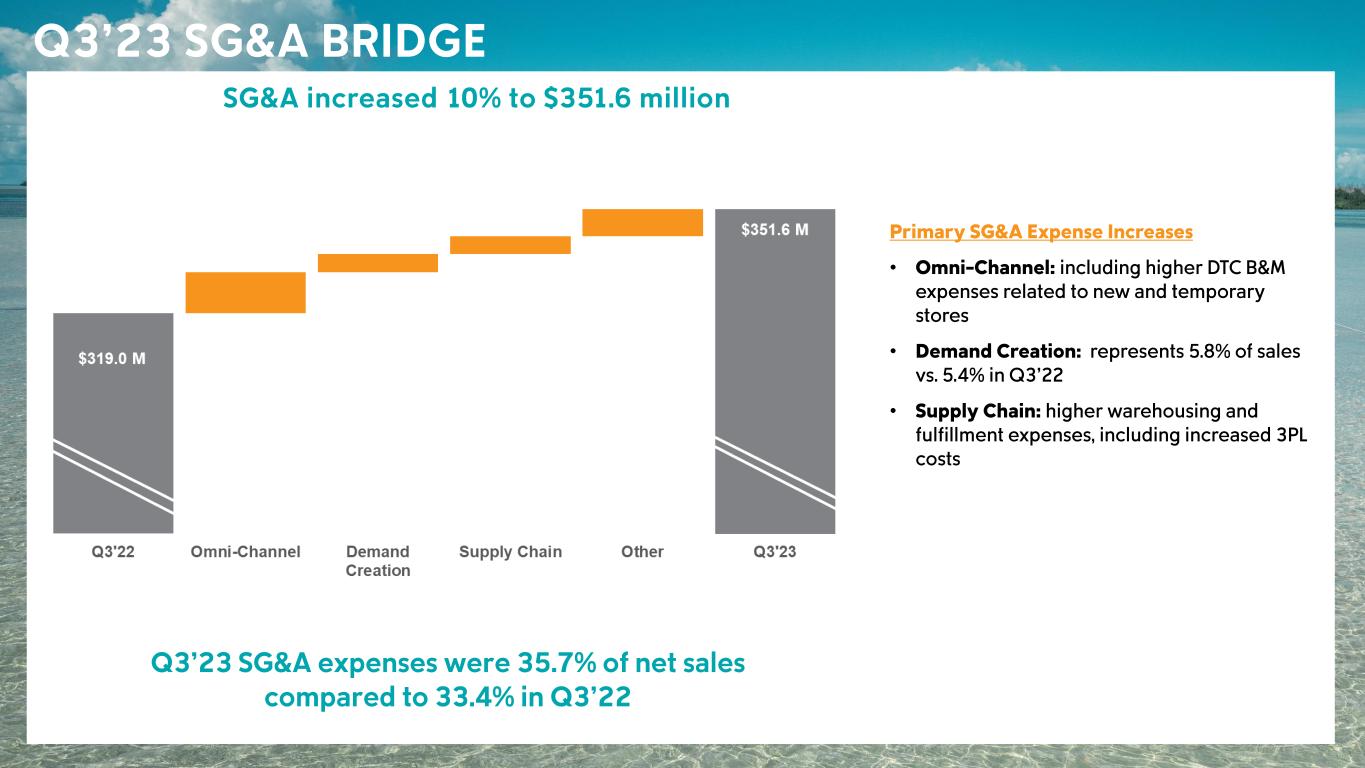

• • • (dollars in millions, except per share amounts) Q3'23 Q3'22 Change Net Sales $985.7 $955.0 +3% Gross margin 48.7% 48.0% +70 bps SG&A percent of net sales 35.7% 33.4% +230 bps Operating income $134.6 $145.3 -7% Operating margin 13.7% 15.2% -150 bps Net income $103.5 $111.8 -7% Diluted EPS $1.70 $1.80 -6%

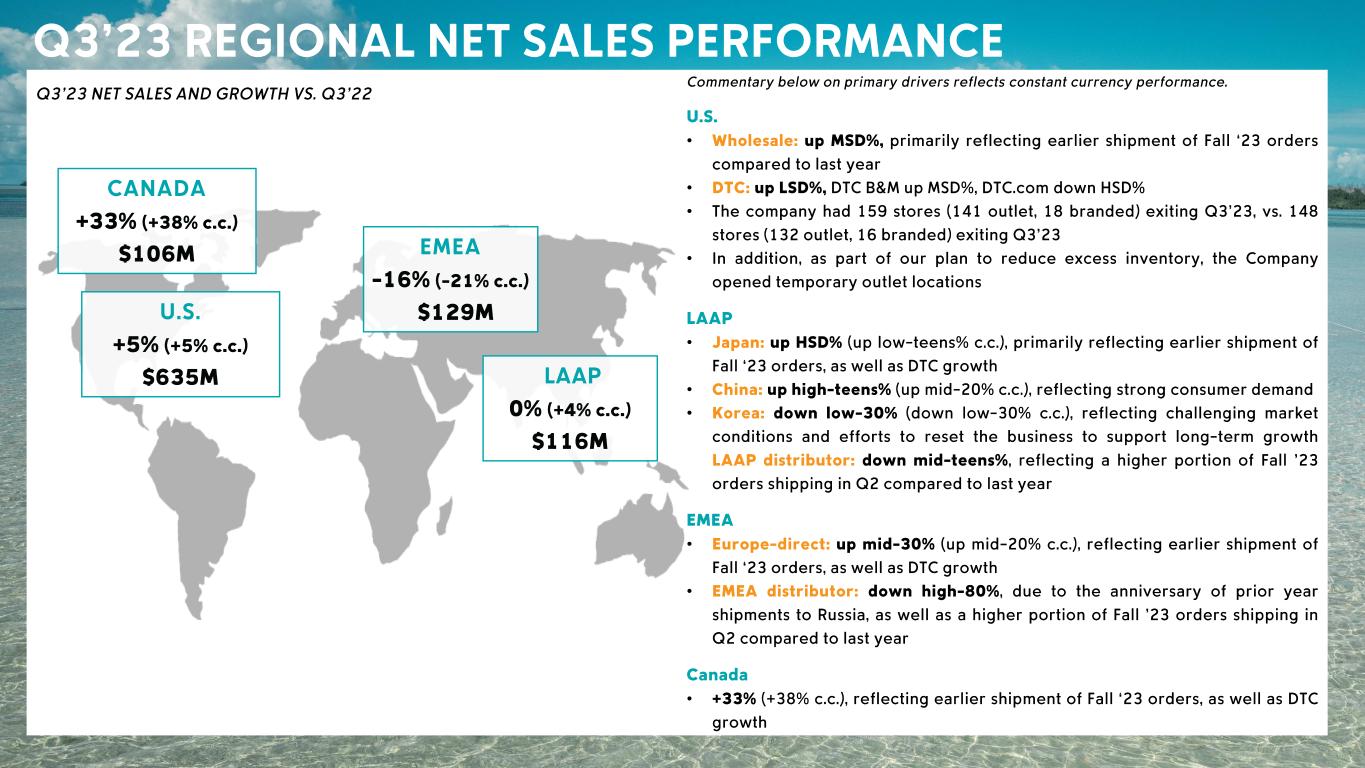

• • • • • • • • • •

• • • • • •

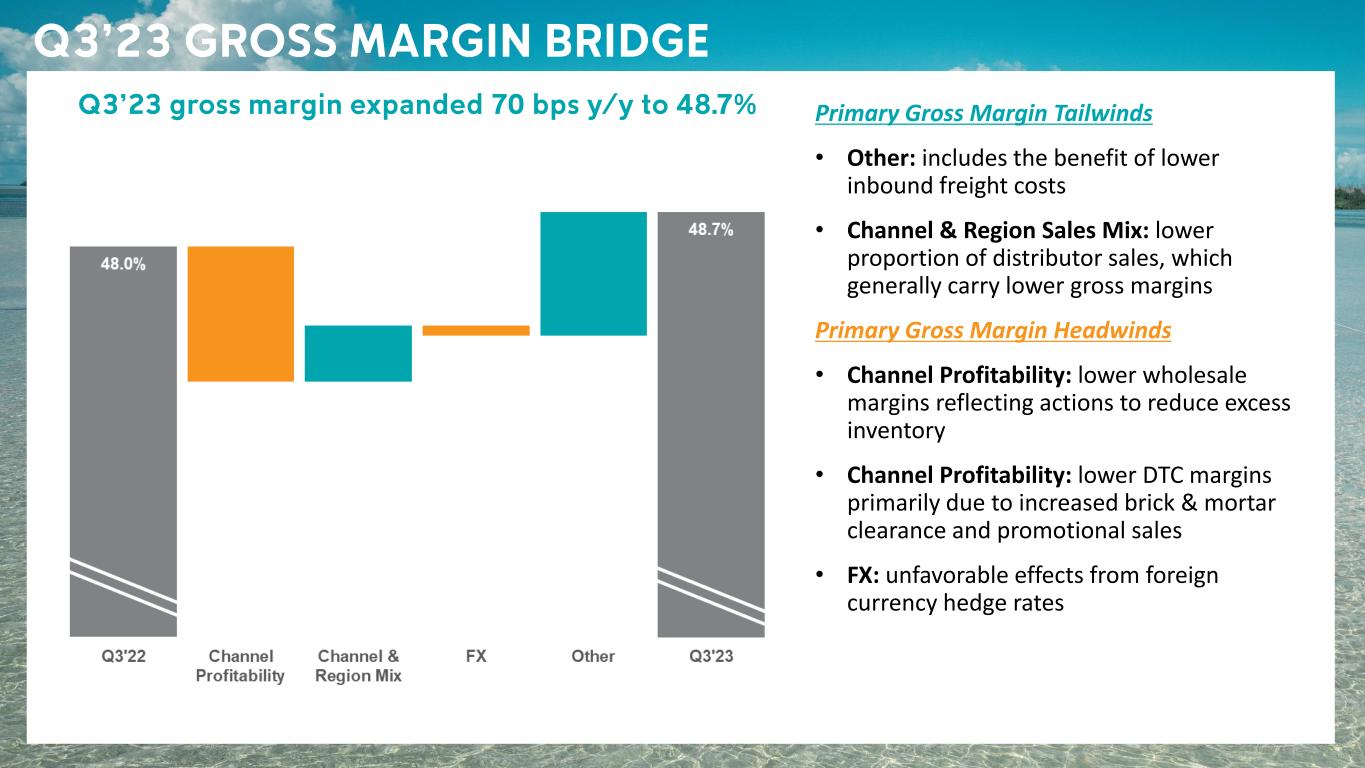

Primary Gross Margin Tailwinds • Other: includes the benefit of lower inbound freight costs • Channel & Region Sales Mix: lower proportion of distributor sales, which generally carry lower gross margins Primary Gross Margin Headwinds • Channel Profitability: lower wholesale margins reflecting actions to reduce excess inventory • Channel Profitability: lower DTC margins primarily due to increased brick & mortar clearance and promotional sales • FX: unfavorable effects from foreign currency hedge rates

• • •

• • • • • • • • • • • • • • • • •

• • • - - • • • • • •

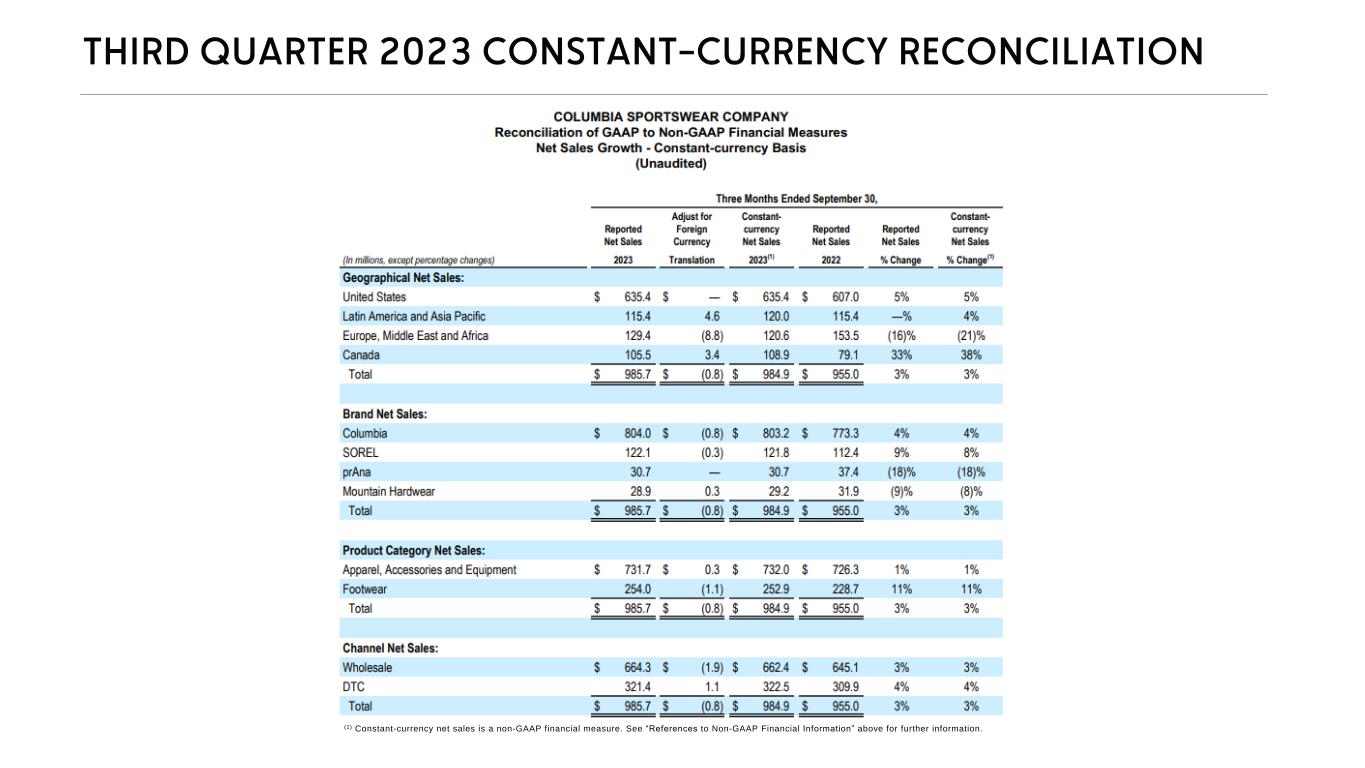

(1) Constant-currency net sales is a non-GAAP financial measure. See “References to Non-GAAP Financial Information” above for further information.