0001050797DEF 14AFALSE00010507972023-01-012023-12-31iso4217:USD00010507972022-01-012022-12-3100010507972021-01-012021-12-3100010507972020-01-012020-12-310001050797ecd:EqtyAwrdsInSummryCompstnTblForAplblYrMemberecd:PeoMember2023-01-012023-12-310001050797ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:PeoMember2023-01-012023-12-310001050797ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:PeoMember2023-01-012023-12-310001050797ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:PeoMember2023-01-012023-12-310001050797colm:AggregateGrantDateFairValueOfStockAwardAmountsReportedInSummaryCompensationTableMemberecd:NonPeoNeoMember2023-01-012023-12-310001050797colm:AggregateGrantDateFairValueOfOptionAwardAmountsReportedInSummaryCompensationTableMemberecd:NonPeoNeoMember2023-01-012023-12-310001050797ecd:YrEndFrValOfEqtyAwrdsGrntdInCvrdYrOutsdngAndUnvstdMemberecd:NonPeoNeoMember2023-01-012023-12-310001050797ecd:NonPeoNeoMemberecd:VstngDtFrValOfEqtyAwrdsGrntdAndVstdInCvrdYrMember2023-01-012023-12-310001050797ecd:ChngInFrValOfOutsdngAndUnvstdEqtyAwrdsGrntdInPrrYrsMemberecd:NonPeoNeoMember2023-01-012023-12-310001050797ecd:ChngInFrValAsOfVstngDtOfPrrYrEqtyAwrdsVstdInCvrdYrMemberecd:NonPeoNeoMember2023-01-012023-12-31000105079742023-01-012023-12-31000105079712023-01-012023-12-31000105079722023-01-012023-12-31000105079732023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

☑ Filed by the Registrant ☐ Filed by a Party other than the Registrant

| | | | | |

| Check the appropriate box: |

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☑ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under § 240.14a-12 |

COLUMBIA SPORTSWEAR COMPANY

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | |

| Payment of Filing Fee (Check all boxes that apply): |

| ☑ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

MESSAGE FROM OUR CHAIRMAN, PRESIDENT AND CEO

DEAR FELLOW SHAREHOLDERS:

I’m proud of what our global workforce was able to achieve in 2023, as we navigated a challenging environment. One of our top priorities throughout the year was executing an inventory management plan. I’m pleased to report that we exited the year with inventories down 27 percent compared to last year.

Overall, 2023 net sales increased 1 percent to $3.5 billion. In this muted growth environment, we experienced selling, general and administrative expense deleverage, and our operating margin performance was well short of my personal goal for the business.

To mitigate further erosion in profitability and to improve the efficiency our operations, we have implemented a multi-year profit improvement program. We are focused on four areas of cost reduction and realignment:

•Operational cost savings, including inventory management

•Organizational cost savings

•Operating model improvements

•Indirect, or non-inventory, spending

Our strong balance sheet enables us to take a thoughtful approach to this work, while still driving meaningful returns to shareholders.

I know we can do better and our short-term performance is not indicative of my long-term beliefs about the Company. Thank you for being with us on this journey.

Sincerely,

| | |

|

|

| Timothy P. Boyle |

| Chairman, President and Chief Executive Officer |

| | |

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS |

Dear Shareholders:

The Board of Directors of Columbia Sportswear Company, an Oregon corporation, cordially invites you to attend our 2024 Annual Meeting of Shareholders (the “Annual Meeting”), which will be held at 3:00 p.m. Pacific Time on Thursday, May 30, 2024. The Annual Meeting will only occur virtually at www.virtualshareholdermeeting.com/COLM2024, as authorized by our Board of Directors. There will be no physical location for shareholders to attend. You may notify the Company of your desire to participate in the meeting by logging into the online site in advance of the meeting. Log-in will begin at 2:45 p.m. Pacific Time. To participate in the Annual Meeting, you will need your unique control number included on your proxy card (printed in the box and marked by the arrow) or on the instructions that accompanied your proxy materials.

The purpose of the meeting is:

1.To elect ten directors;

2.To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2024;

3.To approve, by non-binding vote, executive compensation; and

4.To act upon any other matters that may properly come before the meeting.

Only shareholders of record at the close of business on March 26, 2024 are entitled to vote at the Annual Meeting. A list of shareholders will be available for inspection beginning April 17, 2024 at our corporate headquarters, 14375 NW Science Park Drive, Portland, OR 97229, (503) 985-4000. If you would like to view this shareholder list, please contact us at the address or telephone number provided.

Your vote is very important. Whether or not you attend the virtual Annual Meeting, it is important that your shares are represented and voted at the meeting. Please promptly submit your vote by internet, by telephone, or by signing, dating and returning the enclosed proxy card or voting instruction form in the postage-paid envelope provided so that your shares will be represented and voted at the Annual Meeting.

By Order of the Board of Directors

Christina A. Mecklenborg

Corporate Secretary and Associate General Counsel

Portland, Oregon

April 17, 2024

Important Notice Regarding the Availability of Proxy Materials for the 2024 Annual Meeting of Shareholders

This Notice of Meeting, our Proxy Statement and our 2023 Annual Report to Shareholders are available free of charge at www.proxyvote.com. These materials were first sent or made available to shareholders on April 17, 2024.

| | |

Special Note Regarding Forward Looking Statements |

This document contains forward-looking statements within the meaning of the federal securities laws. Forward-looking statements often use words such as “will,” “anticipate,” “estimate,” “expect,” “should,” “may,” and other words and terms of similar meaning or reference future dates. The Company’s expectations, beliefs and projections are expressed in good faith and are believed to have a reasonable basis; however, each forward-looking statement involves a number of risks and uncertainties, including those set forth in this document, those described in the Company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q under the heading “Risk Factors,” and those that have been or may be described in other reports filed by the Company, including Current Reports on Form 8-K. The Company cautions that forward-looking statements are inherently less reliable than historical information. The Company does not undertake any duty to update any of the forward-looking statements after the date of this document to conform them to actual results or to reflect changes in events, circumstances or its expectations. New factors emerge from time to time and it is not possible for the Company to predict or assess the effects of all such factors or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement.

Throughout this Proxy Statement we may refer to Columbia Sportswear Company as “Columbia,” the “Company,” “we,” “us,” or “our.”

The content on any website referred to in this Proxy Statement is not incorporated by reference in this Proxy Statement unless expressly noted.

COLUMBIA SPORTSWEAR COMPANY | 2024 Annual Proxy Statement | i

This proxy summary highlights information contained elsewhere in this Proxy Statement for Columbia. For more complete information about these topics, please review our 2023 Annual Report to Shareholders and this entire Proxy Statement.

2024 Annual Meeting of Shareholders

| | | | | | | | | | | | | | |

| Date and Time | | Place | | Meeting Agenda |

May 30, 2024 at 3 p.m. PT | | Virtually, through a webcast at www.virtualshareholdermeeting.com/COLM2024 | | The meeting will cover the proposals listed under voting items and Board recommendations below and any other business that may properly come before the meeting |

| | | | |

| Record Date | | Mailing Date | | Voting Eligibility |

March 26, 2024 | | This Proxy Statement was first mailed or made available to shareholders on or about April 17, 2024 | | Owners of our common stock as of the Record Date are entitled to vote on all matters |

Voting Items and Board Recommendations

| | | | | | | | | | | | | | | | | | | | |

| Item | | Proposal | | Board Vote Recommendation | | Further Details |

| 1. | | Elect ten directors | | FOR ALL | | p. 15 |

| 2. | | Ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2024 | | FOR | | p. 19 |

| 3. | | Approve, by non-binding vote, executive compensation | | FOR | | p. 46 |

How to Vote

We strongly encourage you to vote. You may vote via the internet, by telephone, or, if you have received a printed version of these proxy materials, by mail. If you are a beneficial shareholder, your broker will NOT be able to vote your shares with respect to the election of directors and most of the other matters presented during the meeting unless you have given your broker specific instructions to do so. For more information, see “General Information About the Annual Meeting” on page 49 of this Proxy Statement.

2023 Business Highlights

Founded in 1938 in Portland, Oregon, as a small, family-owned, regional hat distributor, Columbia Sportswear Company has grown to become a global leader in designing, developing, marketing, and distributing outdoor, active and lifestyle products, including apparel, footwear, accessories, and equipment. We connect active people with their passions by providing them with the products they need to seek inspiration and adventure. We meet the diverse needs of our customers and consumers through our four well-known brands: Columbia®, SOREL®, Mountain Hard Wear®, and prAna®.

Our products are sold in more than 100 countries through a mix of distribution channels. Our wholesale distribution channel consists of small, independently operated specialty outdoor and sporting goods stores, regional, national and international sporting goods chains, large regional, national and international department store chains, internet retailers, international distributors where we generally do not have our own direct operations, and certain other retailers. Our direct-to-consumer distribution channel consists of our own network of branded and outlet retail stores, brand-specific e-commerce sites, and concession or franchise based arrangements with third parties at branded, outlet and shop-in-shop retail locations in the Latin America and Asia Pacific and Europe, Middle East and Africa regions. In addition, we earn revenue through licensing our trademarks across a range of apparel, accessories, equipment, footwear, and home products.

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 1

Fiscal 2023 Financial Results

| | | | | | | | | | | | | | | | | | | | |

FULL YEAR 2023 |

| GLOBAL RESULTS |

| | | | | | |

TWELVE MONTHS ENDED DEC 31, 2023 |

| | | | | | |

| NET SALES | | GROSS MARGIN | | OPERATING INCOME | | DILUTED EPS |

$3.49 billion | | 49.6% | | $310.3 million | | $4.09 |

+1% | | +20 bps | | –21% | | –17% |

| | | | | | |

Percentage metrics are year-over-year metrics comparing full year 2023 results to full year 2022 results.

2023 was another net sales record year for the Company. Our net sales increased 1% to a record $3,487.2 million, compared to 2022. Our operating income decreased 21% to $310.3 million, or 8.9% of net sales, compared to 2022 operating income of $393.1 million, or 11.3% of net sales. Our diluted earnings per share decreased 17% to $4.09, compared to 2022 diluted earnings per share of $4.95. Management successfully executed its inventory management plan by reducing inventories 27% compared to December 31, 2022.

Strategic Priorities

We are investing in our strategic priorities to:

v accelerate profitable growth;

v create iconic products that are differentiated, functional and innovative;

v drive brand engagement through increased, focused demand creation investments;

v enhance consumer experiences by investing in capabilities to delight and retain consumers;

v amplify marketplace excellence, with digitally-led, omni-channel, global distribution; and

v empower talent that is driven by our core values through a diverse and inclusive workplace.

Continuing Strong Returns for our Shareholders

Our goal is to deliver long-term shareholder value by maintaining a strong balance sheet and a disciplined approach to capital allocation. Dependent upon market conditions and our strategic priorities, our capital allocation approach includes returning cash to shareholders through dividends and share repurchases. In 2023, the Company paid $73 million of dividends and repurchased $184 million of common stock.

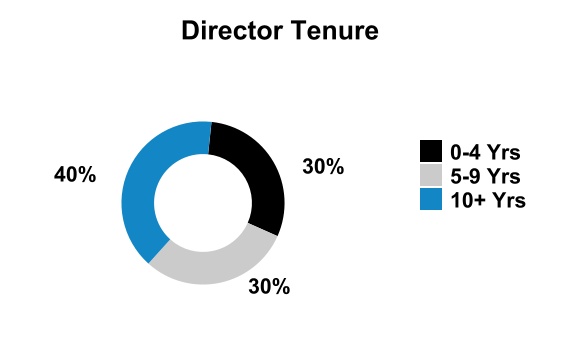

Governance Matters

v Board Refreshment. The Board of Directors (the “Board”) does not believe it should establish a limit on the number of times that a director may stand for election to the Board nor does it believe that there should be an established mandatory retirement age for Board members. However, the Nominating and Corporate Governance Committee considers the tenure of directors when determining whether candidates should stand for re-election and whether new candidates or members should be added. In addition, age is considered in conjunction with other criteria in determining a member's ability to continue to serve effectively. In January 2024, the Board appointed Charles D. Denson to the Board. Since January 2019, four new directors have joined the Board.

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 2

v Highly Qualified Board. Our directors bring a variety of different experiences to help provide effective oversight in the boardroom. In carefully crafting the make-up of our Board, the Nominating and Corporate Governance Committee considers the background and experiences of each candidate, and how the candidate would contribute to the overall experience of the Board. The below outlines some of the key skills of our Board.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Boyle | Babson | Bryant | Culver | Denson | Mansell | Nelson | Shi | Simmons | Wasson |

| Knowledge, Skills and Experience |

| Executive Leadership Experience | l | l | l | l | l | l | l | l | l | l |

Finance / Capital Allocation | l | l | l | l | l | l | l | l | l | l |

| International | l | l | l | l | l | | l | l | l | |

| Supply Chain | l | | | l | l | l | l | l | | |

| E-Commerce / Digital / Technology | l | | l | l | l | l | | l | l | l |

Data Protection / Cyber / IT | l | l | l | l | l | | | | l | l |

Retail / Apparel & Footwear | l | l | | l | l | l | l | l | l | l |

Brand / Marketing | l | | | l | l | l | l | l | | l |

Human Capital Management / Compensation | l | l | l | l | l | l | | l | l | l |

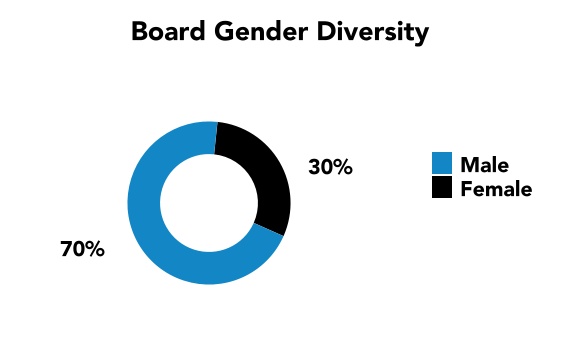

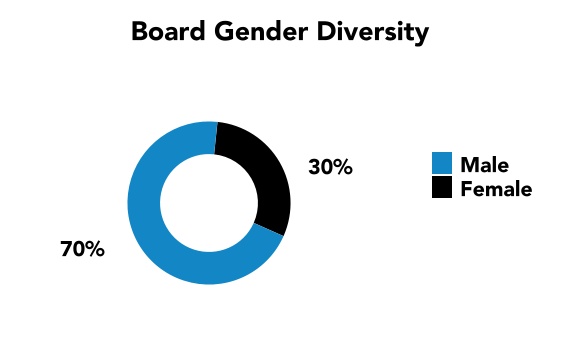

v Board Diversity. Our Board believes that differences in experiences, knowledge, skills, and viewpoints enhance the Board’s overall performance. Although the Board does not maintain a specific policy with respect to Board diversity, the Nominating and Corporate Governance Committee considers a broad range of background and experience in its assessment of the Board’s composition.

v Independent Board Leadership. Timothy P. Boyle, our President and Chief Executive Officer, also serves as Chairman of the Board. Given the combination of the Chairman and Chief Executive Officer roles, the Board also has a Lead Independent Director, Andy D. Bryant. As Lead Independent Director, Mr. Bryant oversees executive sessions of the Board’s independent directors. Nine of the Board’s ten directors are independent. The Board believes the presence of a Lead Independent Director, together with a strong leader in the combined role of Chairman and Chief Executive Officer, serves the best interests of the Company and its shareholders at this time.

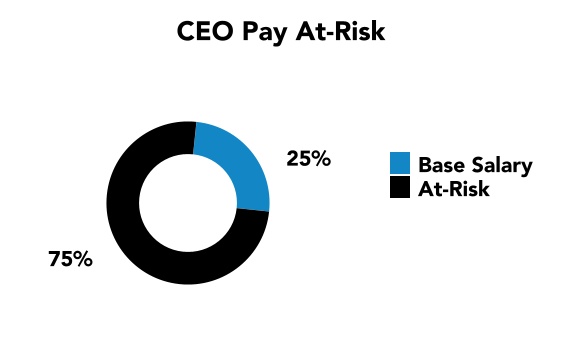

Executive Compensation Highlights

Columbia’s executive compensation program aims to reward performance. Our executive officers typically realize a significant portion of their compensation only when we achieve annual and long-term business goals and when our stock price increases. The following are highlights related to our 2023 compensation program for our named executive officers, Timothy P. Boyle (our “CEO”), Jim A. Swanson, Joseph P. Boyle, Peter J. Bragdon, and Steven M. Potter:

v Majority of Compensation at Risk. For each of our named executive officers, target annual compensation in the form of base salary represented approximately 25% to 38%, and consequently, at-risk compensation represented approximately 62% to 75%, of each such named executive officer’s potential total compensation at target performance levels. “At-risk” compensation includes all short-term and long-term incentive compensation. The percentage of “at-risk” target annual compensation for our CEO is illustrated below.

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 3

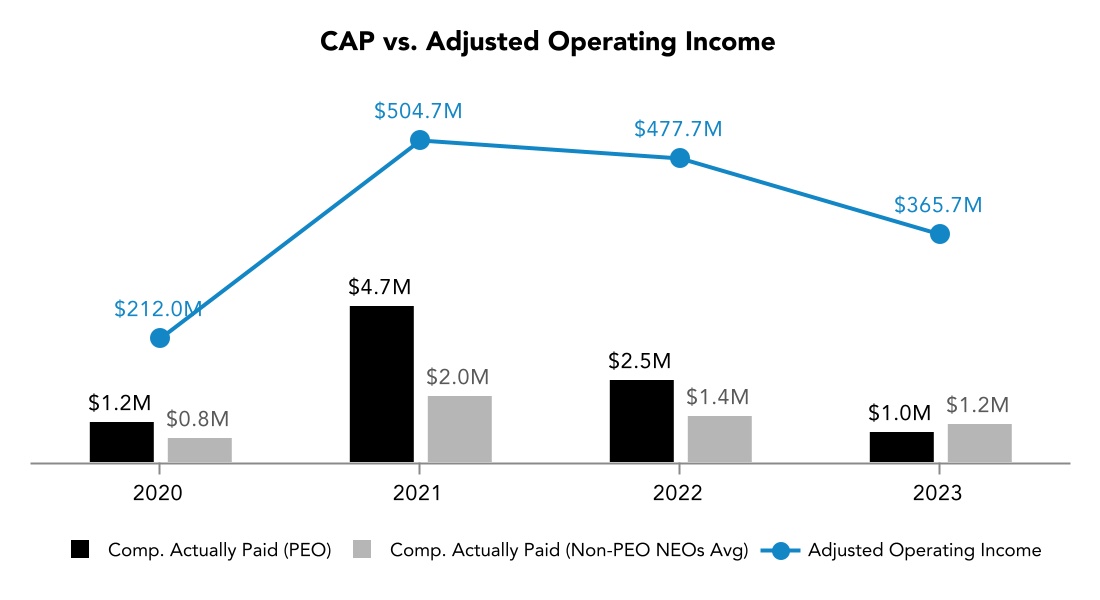

v Annual Incentive Compensation. The Company’s fiscal year 2023 corporate performance target, including minimum threshold and maximum levels, for the Executive Incentive Compensation Plan was set by the Talent and Compensation Committee in early 2023. The corporate performance target was based on adjusted operating income (“AOI”). As a result of the financial achievements of the Company, 73.2% of target was achieved under the Executive Incentive Compensation Plan and certified by the Talent and Compensation Committee in January 2024.

v Long-Term Compensation. In 2023, the Talent and Compensation Committee awarded time-based restricted stock units (“RSUs”) and performance-based restricted stock units (“PRSUs”) to Messrs. Bragdon, Potter and Swanson, and stock options to Messrs. Joseph P. Boyle, Bragdon, Potter, and Swanson, consistent with its historical approach for these executives. Mr. Joseph P. Boyle received 100% stock options due to his level of stock ownership. Because our CEO holds a significant amount of our common stock, he typically does not receive any equity compensation grants (other than an option grant in 2021) and instead continued to receive in 2023 a long-term incentive cash award tied to the same multi-year operating goals to which the vesting of PRSU awards for the other executive officers is subject.

There were no PRSUs or, for our CEO, long-term incentive cash awards, with performance periods ended December 31, 2023 for any of our named executive officers as a result of option grants being made in 2021 instead of PRSU awards or long-term incentive cash awards that year.

v Executive Compensation Best Practices.

| | | | | | | | | | | | | | |

| What We Do | | What We Don’t Do |

| ü | Base a majority of our compensation on performance and retention incentives | | û | Allow hedging and pledging |

| û | Reprice stock options |

| ü | Retain an independent advisor for the Talent and Compensation Committee | | û | Excessive severance payments |

| ü | Cap incentive programs | | û | Single-trigger change-in-control severance |

| ü | Have stock ownership guidelines for our named executive officers | | û | Guaranteed bonus amounts |

| ü | Have a clawback policy for our named executive officers | | û | Excessive perquisites |

| ü | Conduct annual “say-on-pay” advisory votes | | û | Employment contracts |

Sustainability

The Company’s current strategy is to sustain active lifestyles through investing in initiatives that have a positive impact on the people we reach, the places we touch and the products we make through:

•empowering people;

•sustaining places; and

•maintaining responsible practices.

Detailed information regarding our (and our brands’) corporate responsibility priorities and progress can be found in our annual Impact Report (available on our website at www.columbiasportswearcompany.com/corporate-responsibility-group). The content of such report and the website referenced are not incorporated by reference in this Proxy Statement.

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 4

Risk Oversight

Columbia’s management team is responsible for identifying, assessing and managing the material risks facing Columbia, including through an enterprise risk management program. This program includes an annual enterprise risk assessment, during which interviews are conducted with independent directors and members of senior management seeking participants’ judgment and assessment of the material risks facing Columbia. The enterprise risk management program then monitors prioritized risks identified and mitigation efforts underway through meetings with senior management.

The Board generally oversees Columbia’s risk management practices and processes. Annually, the Board reviews the results of the annual enterprise risk assessment and the current status of the enterprise risk management program. The Audit Committee also receives an update on the enterprise risk management program on an annual basis. The Board has delegated primary oversight of the management of (i) financial, accounting and cybersecurity risk to the Audit Committee, (ii) compensation risk to the Talent and Compensation Committee, and (iii) governance risk to the Nominating and Corporate Governance Committee. Oversight of certain aspects of compliance risk is shared by the Audit Committee and the Nominating and Corporate Governance Committee. The Audit Committee annually reviews the strategies, investments and risks related to the Columbia’s information technology systems, including a review of the Company’s cybersecurity programs, and also receives quarterly updates. The Board is informed of cybersecurity events to the extent they may materially impact Columbia or management otherwise believes they need to be escalated.

To permit the Board and its committees to perform their respective risk oversight roles, certain individual members of management who supervise Columbia’s risk management communicate directly to the Board or the relevant committee of the Board responsible for overseeing the management of specific risks, as applicable. For this purpose, management has a high degree of access and communication with independent directors. Because a majority (nine of ten directors) of the Board consists of independent directors, and each committee of the Board consists solely of independent directors, Columbia’s risk oversight structure conforms to the Board’s leadership structure discussed below and demonstrates Columbia’s belief that having a strong, independent group of directors is important for good governance.

Finally, the Board oversees various organizational structures, policies and procedures at Columbia to promote ethical conduct and compliance with laws and regulations. For example, Columbia maintains a Code of Business Conduct and Ethics and has established a confidential compliance line and web-based reporting platform through which employees and other stakeholders can report concerns subject to the Company’s processes for protecting confidentiality. The chair of the Audit Committee receives notifications of all compliance line reports and a summary is shared with the Audit Committee quarterly.

Oversight Documents

Corporate Governance Guidelines. The Board has adopted Corporate Governance Guidelines that address: | | | | | | | | | | | | | | |

| v | Director qualifications | | v | Director compensation |

| v | Director independence | | v | Director orientation and continuing education |

| v | Director responsibilities | | v | CEO evaluation and management succession |

| v | Board committees | | v | Annual board and committee performance evaluations |

| v | Director access to officers, employees and others | | v | Annual review of the Corporate Governance Guidelines |

A copy of our Corporate Governance Guidelines is available on our website at https://investor.columbia.com.

Code of Business Conduct and Ethics. As mentioned above, the Board has adopted a Code of Business Conduct and Ethics that sets out basic principles to guide all of Columbia’s officers, directors and employees worldwide, as well as certain third parties in their dealings with or on behalf of Columbia and our subsidiaries and affiliates. Our Code of Business Conduct and Ethics has been translated into various languages and is available to our employees and also on our website at https://investor.columbia.com. We plan to satisfy the disclosure

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 5

requirement regarding any amendment to, or a waiver of, the Code of Business Conduct and Ethics by posting such information on our website at https://investor.columbia.com.

Board Structure

Meetings. The Board met five times and the independent directors held four executive sessions of the Board in 2023. Each director attended at least 75% of the aggregate of (a) the total number of meetings of the Board held during the period in which the director served, and (b) the total number of meetings held by all committees on which the director served during the service period. While we do not maintain a formal policy regarding director attendance at annual shareholder meetings, four of our directors virtually attended our 2023 annual meeting of shareholders.

Independence. Under our Corporate Governance Guidelines, which adopt the standards for “independence” under applicable Nasdaq listing rules and Securities and Exchange Commission (“SEC”) rules, a majority of the members of our Board of Directors must be independent, as determined by the Board. The Board has determined that Mss. Shi, Simmons and Wasson and Messrs. Babson, Bryant, Culver, Denson, Mansell, and Nelson are independent and, accordingly, a majority of the members of our Board are independent. In addition, the Board has determined that all members of our Audit Committee and Talent and Compensation Committee are independent under the standards for independence applicable to members of each committee. There are no undisclosed material transactions, relationships or arrangements that were considered by the Board in connection with the determination of whether any particular director is independent.

Leadership. Under our Board structure, leadership is provided primarily by our Chairman of the Board, President and CEO and Lead Independent Director.

Timothy P. Boyle is our Chairman of the Board, President and CEO. As President and CEO, Mr. Boyle is primarily responsible for Columbia’s general operations and implementing its business strategy. Mr. Boyle is also Columbia’s largest shareholder. For these reasons, the Board believes that, at this time, Columbia and its shareholders are best served by having the President and CEO also serve as Chairman of the Board.

The Board also believes that having a strong, independent leader is important for good governance. Given the combination of the Chairman and Chief Executive Officer roles, the Board also has a Lead Independent Director, Andy D. Bryant. The Lead Independent Director is elected by a majority of the Board for a renewable term of one year (and until such time as his or her successor is elected) or until such earlier time as he or she ceases to be a director, resigns as Lead Independent Director, is removed or replaced as Lead Independent Director or the roles of Chairman and Chief Executive Officer are no longer combined. The Board adopted a Lead Independent Director Charter outlining the scope of the Lead Independent Director role that is available for review on our website at https://investor.columbia.com. Pursuant to this Charter, the Lead Independent Director has certain powers and responsibilities, including:

| | | | | | | | | | | | | | |

| v | Presiding at all meetings of the Board in the absence of, or upon the request of, the Chairman | | v | Advising on meeting agendas for the Board |

| v | Leading regular executive sessions of the independent directors | | v | Advising on information sent to the Board |

| v | Serving as a liaison and supplemental channel of communication between the Chairman and the independent directors | | v | Being available for consultation and direct communication with shareholders of the Company |

Committees. The Board has designated three standing committees of the Board: the Audit Committee, the Talent and Compensation Committee and the Nominating and Corporate Governance Committee. Each committee operates under a written charter that is available for review on our website at https://investor.columbia.com. The table below provides information regarding the current membership of each standing Board committee and number of meetings held in fiscal 2023.

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 6

| | | | | | | | | | | | | | | | | |

| | | | | |

| Director Name | Audit Committee | | Talent and Compensation Committee | | Nominating and Corporate Governance Committee |

| Timothy P. Boyle | | | | | |

| Stephen E. Babson | | | Chair | | |

| Andy D. Bryant | ü | | | | Co-Chair |

| John W. Culver | | | ü | | |

Charles D. Denson | ü | | | | |

| Kevin Mansell | | | ü | | Co-Chair |

| Ronald E. Nelson | ü | | | | |

| Christiana Smith Shi | ü | | | | |

| Sabrina L. Simmons | | | ü | | ü |

| Malia H. Wasson | Chair | | | | ü |

Meetings in Fiscal 2023 | 6 | | 5 | | 5 |

Audit Committee. The Board has determined that each member of the Audit Committee meets all applicable independence and financial literacy requirements. The Board has also determined that Ms. Wasson is an “audit committee financial expert” as defined in regulations adopted by the SEC. A description of the functions performed by the Audit Committee and Audit Committee activity is set forth in the “Audit Committee Report.”

Talent and Compensation Committee. The Board has determined that each member of the Talent and Compensation Committee meets all applicable independence requirements and is a “non-employee director” within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934. In July 2023, the Compensation Committee elected to change their name to the Talent and Compensation Committee in light of its responsibilities and oversight outside of executive compensation. The Talent and Compensation Committee determines compensation for the Company’s executive officers and administers the Company’s 1997 Stock Incentive Plan and the 2020 Stock Incentive Plan and any executive officer incentive compensation plans, including our Executive Incentive Compensation Plan. The Talent and Compensation Committee’s processes and procedures for determining compensation for the Company’s executive officers and directors are described below in “Compensation Discussion and Analysis” and “Director Compensation,” respectively. The Talent and Compensation Committee also regularly considers human capital initiatives not just for executive officers, but for all employees.

Compensation Consultant. The Talent and Compensation Committee retained Exequity LLP (“Exequity”) as its independent outside compensation consultant from January to July of 2023. During 2023, the Talent and Compensation Committee conducted a request for proposals to evaluate outside compensation consultants as a practice of good governance and periodic review. As a result, in August 2023, the Talent and Compensation Committee retained a new independent outside compensation consultant, Frederic W. Cook & Co., Inc. (“FW Cook”). The Talent and Compensation Committee chose both Exequity and FW Cook primarily because of the competence, knowledge, background, and reputation of the representatives from each who advise the Committee. The compensation consultant reports directly to the Talent and Compensation Committee. Based on direction from the Talent and Compensation Committee, the outside compensation consultant provides the Talent and Compensation Committee with:

•information about market trends in executive officer compensation;

•general information on compensation practices at other companies;

•specific data on the compensation paid to executive officers at peer companies; and

•analyses of performance measures used in incentive programs.

The outside compensation consultant also:

•assists the Talent and Compensation Committee in its evaluation of executive pay, practices and programs; and

•advises the Talent and Compensation Committee on ad hoc issues related to broad-based compensation plans.

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 7

The outside compensation consultant reports on executive officer compensation matters and presents findings directly to the Talent and Compensation Committee, including its recommendations on compensation decisions for executive officers for the Talent and Compensation Committee’s consideration.

Compensation Committee Interlocks and Insider Participation. No member of our Talent and Compensation Committee is a past or present officer or employee of ours or any of our subsidiaries, nor has any member of our Talent and Compensation Committee had any relationship requiring disclosure under Item 404 of Regulation S-K under the Securities Exchange Act of 1934, which requires disclosure of certain relationships and related party transactions. Likewise, none of our executive officers have served on the board of directors or compensation committee (or other committee serving an equivalent function) of any other entity, where one of the other entity’s executive officers served on our Board or Talent and Compensation Committee.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee develops and recommends corporate governance guidelines and standards for business conduct and ethics, identifies individuals qualified to become Board members and makes recommendations regarding nominations for director. The Nominating and Corporate Governance Committee will consider individuals recommended by shareholders for nomination as director in accordance with the procedures described under “Director Nomination Policy” below. The Nominating and Corporate Governance Committee also makes recommendations concerning the size, structure, composition, and membership of the Board and its committees.

Assessments and Evaluations

Board Size. The Board sets the number of directors, which shall be at least three and no more than twelve, from time to time by resolution. The Board has the flexibility to increase or decrease the size of the Board within this range as circumstances warrant. The Board currently consists of ten members. If all of the Board’s nominees are elected, the Board will consist of ten members immediately following the Annual Meeting. If any nominee is unable to serve as a director or if any director leaves the Board between annual meetings, the Board, by resolution, may reduce the number of directors or elect an individual to fill the resulting vacancy.

Annual Evaluations. Our Nominating and Corporate Governance Committee monitors the composition of our Board to ensure it is operating effectively. In order to maintain accountability for the actions of our directors, our Nominating and Corporate Governance Committee also oversees an annual self-evaluation of the Board and its committees.

Diversity. Columbia’s Corporate Governance Guidelines establish that the Nominating and Corporate Governance Committee of the Board is responsible for reviewing annually the desired skills and characteristics of new Board members and the composition of the Board as a whole. In assessing the appropriate composition of the Board, the Committee considers factors set forth in the Corporate Governance Guidelines, including diversity. Although the Board does not maintain a specific policy with respect to Board diversity, the Board believes that the Board should be a diverse body, and the Nominating and Corporate Governance Committee considers a broad range of backgrounds and experiences in its assessment. The Nominating and Corporate Governance Committee considers these and other factors as it oversees the annual Board and committee assessments.

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 8

| | | | | | | | | | | | | | |

Board Diversity Matrix (as of April 17, 2024) |

| Total Number of Directors: | 10 |

| Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity |

| Directors | 3 | 7 | — | — |

| Part II: Demographic Background |

| African American or Black | — | — | — | — |

| Alaskan Native or Native American | — | — | — | — |

| Asian | — | — | — | — |

| Hispanic or Latinx | — | — | — | — |

| Native Hawaiian or Pacific Islander | — | — | — | — |

| White | 2 | 7 | — | — |

| Two or More Races or Ethnicities | 1 | — | — | — |

| LGBTQ+ | — |

| Did Not Disclose Demographic Background | — |

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 9

Director Nominations

Director Nomination Policy. Shareholders may recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board (see “2025 Shareholder Proposals or Nominations” for more information). In addition to shareholder recommendations, the Nominating and Corporate Governance Committee may identify potential director nominees through referrals by directors, officers, employees, and third parties, including search firms, and internal research and recruitment activities.

Director Selection and Qualifications. Following the identification of director candidates, the Nominating and Corporate Governance Committee meets to discuss and consider each candidate’s qualifications and determines by majority vote the candidates who the Nominating and Corporate Governance Committee believes will best serve Columbia, which candidates are then submitted to the Board for approval. In evaluating director candidates, the Nominating and Corporate Governance Committee considers a variety of factors, including the composition of the Board as a whole, the characteristics of each candidate and the performance and continued tenure of incumbent Board members. The Nominating and Corporate Governance Committee considers these factors to evaluate potential candidates regardless of the source of the recommendation. The Nominating and Corporate Governance Committee believes that director candidates should possess high ethical character, business experience with high accomplishment in his or her respective field, the ability to read and understand financial statements, relevant expertise and experience, and the ability to exercise sound business judgment. Candidates must also be over 21 years of age. In addition, the Nominating and Corporate Governance Committee believes at least one member of the Board should meet the criteria for an “audit committee financial expert” as defined by the SEC rules, and that a majority of the members of the Board should meet the definition of “independent director” under the applicable Nasdaq listing requirements.

Our Board believes that maintaining a strong, independent group of directors that comprises a majority of our Board is important for good governance, and nine of our ten directors currently qualify as independent. The Board believes that all of our directors should possess the qualities described in our Corporate Governance Guidelines, including integrity and moral responsibility, the capacity to evaluate strategy and reach sound conclusions and the willingness and ability to devote the time required to fulfill the duties of a director. In addition, the Board places high value on the ability of individual directors to contribute to a constructive Board environment.

The Board believes that our current directors, collectively, provide the diversity of experience and skills necessary for a well-functioning board. All of our directors have substantial senior executive-level business experience. For a more complete description of individual backgrounds, professional experiences, qualifications, and skills, see the director profiles set forth under “Proposal 1: Election of Directors” below.

Certain Relationships and Related Person Transaction

Details. Joseph P. Boyle, son of our CEO, is employed by Columbia as Executive Vice President, Columbia Brand President. In 2023, Joseph P. Boyle received an annualized salary of $605,000 as Executive Vice President, Columbia Brand President and was eligible to receive bonus, equity and employment benefits available to other executive officers. The Nominating and Corporate Governance Committee reviewed and ratified Joseph P. Boyle’s compensation arrangements.

In 2023, Molly E. Boyle, daughter of our CEO and sister of Joseph P. Boyle, was employed by Columbia as Senior Manager - eCommerce Buying for the SOREL brand in North America. In such role, Ms. Boyle received an annualized salary of $157,883 and was eligible to receive bonus, equity and employment benefits available to other employees of similar rank. The Nominating and Corporate Governance Committee reviewed and ratified Ms. Boyle’s compensation arrangements.

In January 2016, Columbia entered into an aircraft arrangement, whereby it subleases an aircraft from Alvador, LLC, a limited liability company wholly owned by our CEO and his wife. Under the terms of the sublease, Columbia pays Alvador, LLC $3,500 per flight hour. Columbia paid Alvador, LLC $94,500 for use of the aircraft in 2023. Under the terms of the arrangement, Columbia has also engaged an entity unaffiliated with our CEO to provide pilot services for operation of the aircraft. Columbia also incurred an aggregate $12,000 in fees for monthly pilot services, which were paid to the unaffiliated entity. The Nominating and Corporate Governance Committee believes that these arrangements are on terms at least as fair to Columbia as those that would have been available in arm’s-length negotiated transactions.

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 10

Approval Process. Our Nominating and Corporate Governance Committee generally approves in advance any transactions with an officer, director, greater-than-5% shareholder, or any immediate family member of an officer, director, or greater-than-5% shareholder (each, a “related person”) pursuant to our written related person transaction approval policy. A “related person transaction” is any actual or proposed transaction or series of transactions, since the beginning of the last fiscal year, amounting to more than $120,000 in which Columbia was or is to be a participant, and in which a related person has or will have a direct or indirect material interest. Our policy requires that the Nominating and Corporate Governance Committee review the material facts of any transaction that could potentially qualify as a “related person transaction” and either approve or disapprove of our entry into the transaction. If advance Nominating and Corporate Governance Committee approval is not feasible, the related person transaction is considered, and if the Committee determines it to be appropriate, ratified at the Committee’s next regularly scheduled meeting. In determining whether to approve or ratify a transaction, the Nominating and Corporate Governance Committee takes into account, among other factors it deems to be appropriate, whether the transaction is on terms no less favorable than terms generally available to an unaffiliated person in the same or similar circumstances and the extent of the related person’s direct or indirect interest in the transaction. If a related person transaction is ongoing, the Nominating and Corporate Governance Committee may establish guidelines for management to follow in its ongoing dealings with the related person. Thereafter, the Nominating and Corporate Governance Committee reviews and assesses ongoing relationships with the related person annually to confirm they are in compliance with the Nominating and Corporate Governance Committee’s guidelines and are appropriate.

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 11

Director Compensation Philosophy

Our director compensation program is intended to enable us to:

v attract and retain qualified non-employee directors by providing compensation that is competitive with other companies; and

v align directors’ interests with shareholders’ interests by including equity as a significant portion of each non-employee director’s compensation package.

In setting director compensation, we consider compensation offered to directors from a peer group, the amount of time that our directors spend providing services to us and the experience, skill and expertise that our directors have. Directors who are employees of Columbia receive no separate compensation for their service as directors.

A peer group was approved by the Talent and Compensation Committee in April 2021 that applied for purposes of setting both executive officer and Board 2023 compensation (the “Executive Compensation Peer Group”). The Executive Compensation Peer Group comprises the apparel, footwear and retail companies set forth in “Compensation Discussion and Analysis—Overview of Executive Compensation Program—Executive Compensation Market Analysis” below.

Non-Employee Director Compensation

Overview of Compensation. In connection with the periodic review of the director compensation program in 2023, the Talent and Compensation Committee recommended, and the Board approved, changes to the director compensation program to (i) increase the annual board service fee from $75,000 to $80,000, (ii) increase the annual chair fee for the Talent and Compensation Committee from $20,000 to $30,000, (iii) increase the annual chair fee for the Audit Committee from $20,000 to $40,000, (iv) increase the lead independent director fee from $25,000 to $50,000 and (v) increase the annual equity award value from $150,000 to $160,000. These changes were effective on June 8, 2023, the date of our 2023 Annual Meeting of Shareholders. The period of time from the annual meeting of shareholders to the next year’s annual meeting of shareholders represents an annual service term.

As a result of the above changes, each director who was not a Columbia employee was eligible to receive the following for service during the 2023-2024 Board term:

v Service Fees

▪an $80,000 annual board service fee

▪a $10,000 annual committee service fee for each committee on which the director serves as a member

▪a $20,000 annual committee chair fee for the Nominating and Corporate Governance Committee on which the director serves as chair

▪a $30,000 annual committee chair fee for the Talent and Compensation Committee on which the director serves as chair

▪a $40,000 annual committee chair fee for the Audit Committee on which the director serves as chair

▪a $50,000 annual lead independent director fee for the director serving in this role

Annual cash fees are paid quarterly following the date the director is appointed to the Board or elected by shareholders at our annual meeting of shareholders.

Prior to each annual service term, directors may elect to receive RSUs in lieu of all or half of the $80,000 annual board service fee that vest in full on May 1 following the date of grant. For the annual 2023-2024 service term, three of our non-employee directors elected to receive RSUs in lieu of half of their $80,000 annual board service fee for the one-year term following our annual meeting, and one of our non-employee directors elected to receive RSUs in lieu of his entire $80,000 annual board service fee for the same period.

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 12

v Merchandise Allowance

▪a $3,500 Company merchandise allowance

v An Annual Equity Award

▪time-based RSUs valued at $160,000 based on the closing market price of our common stock on the date of grant, reduced by the present value of dividends not received during the vesting period

The annual equity award is granted immediately following the election of directors at each annual meeting of shareholders. One hundred percent of the shares of RSUs vest (subject to postponement for weekends and Nasdaq holidays) on May 1 of the year following the year in which the annual equity award was granted.

Reimbursements and Expenses. Non-employee directors are reimbursed for reasonable out-of-pocket expenses (including costs of travel, food and lodging) incurred in attending Board, committee and shareholder meetings. Non-employee directors are also reimbursed for participation in director education programs.

2023 Non-Employee Director Compensation Table. The following table summarizes the compensation paid to each non-employee director in 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | Fees Earned

or Paid in Cash

($) | | Stock Awards(1) ($) | | Option

Awards

($) | | All Other Compensation(2) ($) | | Total

($) |

Stephen E. Babson(3) | 63,750 | | | 200,122 | |

| — | |

| 3,500 | | | 267,372 | |

Andy D. Bryant(3) | 106,250 | | | 200,122 | |

| — | |

| 3,500 | | | 309,872 | |

John W. Culver(3) | 10,000 | | | 240,116 | | | — | | | 3,500 | | | 253,616 | |

| Kevin Mansell | 107,500 | | | 160,052 | | | — | | | 3,500 | | | 271,052 | |

Ronald E. Nelson(3) | 48,750 | | | 200,122 | |

| — | |

| 3,500 | | | 252,372 | |

Christiana Smith Shi | 87,500 | | | 160,052 | | | — | | | 3,500 | | | 251,052 | |

| Sabrina L. Simmons | 97,500 | | | 160,052 | | | — | | | 3,500 | | | 261,052 | |

| Malia H. Wasson | 117,500 | | | 160,052 | | | — | | | 3,500 | | | 281,052 | |

(1)The amounts set forth in the “Stock Awards” column in the table above reflect the aggregate grant date fair value computed in accordance with the Financial Accounting Standards Board Accounting Standards Codification Topic No. 718, Compensation-Stock Compensation (FASB ASC Topic 718), excluding the effect of any estimated forfeiture rate. These amounts may not correspond to the actual value eventually realized by the director, which depends in part on the market value of our common stock in future periods. Assumptions used in the calculation of these amounts are described in the Notes to Consolidated Financial Statements included in Columbia’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC. The following table sets forth the aggregate number of shares subject to unvested stock awards and the aggregate number of shares subject to option awards held as of December 31, 2023 by each of our directors:

| | | | | | | | | | | |

| Name | Stock Awards

Outstanding | | Option Awards

Outstanding |

| Timothy P. Boyle | — | | | 79,284 | |

| Stephen E. Babson | 2,617 | | | 24,239 | |

| Andy D. Bryant | 2,617 | | | 9,337 | |

| John W. Culver | 3,140 | | | 944 | |

| Kevin Mansell | 2,093 | | | 5,595 | |

| Ronald E. Nelson | 2,617 | | | 26,789 | |

| Christiana Smith Shi | 2,093 | | | — | |

| Sabrina L. Simmons | 2,093 | | | 6,852 | |

| Malia H. Wasson | 2,093 | | | 8,709 | |

(2)The amounts set forth in the “All Other Compensation” column consist of the annual merchandise allowance.

(3)Messrs. Babson, Bryant and Nelson elected to receive RSUs in lieu of $40,000 of the annual board service fee due to them for the annual service term beginning June 8, 2023. Mr. Culver elected to receive RSUs in lieu of $80,000 of the annual board service fee due to him for the annual service term beginning June 8, 2023.

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 13

Board Stock Ownership Guidelines. On January 26, 2018, the Board adopted stock ownership guidelines for all non-employee directors. Under the guidelines, non-employee directors are encouraged to hold at a minimum the lesser of Columbia stock valued at five times their annual board service fee, or 5,200 shares. Non-employee directors elected prior to January 26, 2018 were expected to attain these ownership levels by January 26, 2023 and new non-employee directors within five years of their election to the Board. All non-employee directors elected prior to January 26, 2018 have achieved the ownership levels set forth in the guidelines.

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 14

| | |

| PROPOSAL 1: ELECTION OF DIRECTORS |

A Board of ten directors will be elected at the Annual Meeting. The directors are elected at each annual meeting to serve until the next annual meeting or until their successors are elected and qualified. Proxies received from shareholders, unless directed otherwise, will be voted FOR ALL of the following nominees: Mss. Christiana Smith Shi, Sabrina L. Simmons and Malia H. Wasson, and Messrs. Timothy P. Boyle, Stephen E. Babson, Andy D. Bryant, John W. Culver, Charles D. Denson, Kevin Mansell, and Ronald E. Nelson. Each nominee is a current director of Columbia. If any of the nominees for director becomes unavailable for election for any reason, the proxy holders will have discretionary authority to vote pursuant to a proxy for a substitute or substitutes. Set forth below are the name, age and occupation of each of the nominees. Specific skills contributing to the nominee’s overall qualifications as a member of the Board are also highlighted. Proxies may not be voted for a greater number of persons than the number of nominees named below.

| | | | | | | | |

| Name | | Principal Occupation, Other Directorships and Qualification Highlights |

| | | | | | | | |

| Timothy P. Boyle | | Mr. Boyle (age 74) has served on the Board since 1978 and was appointed Chairman of the Board in January 2020. Mr. Boyle joined Columbia in 1971 as General Manager, has served as Chief Executive Officer since 1988, and reassumed the role of President in 2017, which he had previously held from 1988 to 2015. Mr. Boyle is a member of the board of directors of Northwest Natural Holding Company (NYSE: NWN), and its subsidiary, Northwest Natural Gas Company, and formerly served on the board of directors of Craft Brew Alliance, Inc. Mr. Boyle is Joseph P. Boyle’s father. Mr. Boyle has spent his entire business career growing Columbia into a global leader in outdoor, active and everyday lifestyle apparel, footwear, accessories, and equipment products. Mr. Boyle’s customer relationships, market knowledge and breadth of experience performing nearly every function within Columbia has resulted in a deep understanding of the business issues facing Columbia. |

| | | | | | | | |

| Stephen E. Babson | | Mr. Babson (age 73) has served on the Board since 2002. Mr. Babson chairs the Compensation Committee. Mr. Babson is a Managing Director of Endeavour Capital, a Northwest private equity firm, which he joined in 2002. Prior to 2002, Mr. Babson was an attorney at Stoel Rives LLP. Mr. Babson joined Stoel Rives in 1978, was a partner from 1984 to 2002, and served as the firm’s chairman from 1999 to 2002. Mr. Babson serves on a number of boards of privately-held companies, including ATL Technology, LLC, Peninsula Holdings, LLC and ENTEK Technology Holdings LLC. Mr. Babson brings a combination of financial and legal expertise to the Board. His experience in a private equity firm provides Columbia with valuable insights related to capital markets, strategic planning and financial integrity. |

| | | | | | | | |

| Andy D. Bryant | | Mr. Bryant (age 73) has served on the Board since 2005. Mr. Bryant co-chairs the Nominating and Corporate Governance Committee and has served as Lead Independent Director since January 2020. Mr. Bryant served as Chairman of the Board of Intel Corporation from 2012 to 2020. Mr. Bryant joined Intel Corporation in 1981 and held several leadership roles, including Vice Chairman of the Board of Directors from 2011 to 2012 and Executive Vice President and Chief Administrative Officer from 2007 until 2012. Mr. Bryant is a former director of Silver Crest Acquisition Corporation and McKesson Corporation. Mr. Bryant’s years of experience at a large, global public company provide operational, strategic planning and financial expertise to the Board. |

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 15

| | | | | | | | |

| John W. Culver | | Mr. Culver (age 63) has served on the Board since 2021. Mr. Culver served as Group President, North America and Chief Operating Officer of Starbucks Corporation through 2022. Mr. Culver joined Starbucks Corporation in 2002 as Vice President; General Manager, Foodservice and held various positions after, including Group President, International, Channel Development and Global Coffee, Tea & Cocoa from 2018 to 2021. Mr. Culver serves on the board of Kimberly-Clark Corporation (NYSE: KMB). Mr. Culver brings a combination of global public company and operational and strategic planning expertise to the Board. |

| | | | | | | | |

Charles D. Denson | | Mr. Denson (age 67) has served on the Board since January 2024. Mr. Denson is the Chairman of the Board of Directors of Funko, Inc. (Nasdaq: FNKO), where he has served as a director since its formation in 2017, in addition to serving as a director of FAH, LLC since 2016. Mr. Denson has served as the President and Chief Executive Officer of Anini Vista Advisors, an advisory and consulting firm, since 2014. From 1979 to 2014, Mr. Denson held various positions at NIKE, Inc., where he was appointed to several management roles, including President of the NIKE Brand, which he held from 2001 to 2014. Mr. Denson brings robust footwear and apparel market, direct-to-consumer, and wholesale experience to the Board. |

| | | | | | | | |

| Kevin Mansell | | Mr. Mansell (age 71) has served on the Board since 2019. Mr. Mansell co-chairs the Nominating and Corporate Governance Committee. Mr. Mansell spent over 35 years at Kohl’s Corporation, most recently serving as its Chairman, Chief Executive Officer and President prior to retiring in 2018. Mr. Mansell began his retail career in 1975 with the Venture Store Division of May Department Stores, where he held a number of positions in buying and merchandising. He joined Kohl’s Corporation in 1982 and served in several management roles, including President from 1999, Chief Executive Officer from 2008 and Chairman of the Board of Directors from 2009 until his retirement in 2018. Mr. Mansell serves as Chairman of the Board and Chair of the Compensation and Talent Management Committee of Fossil Group, Inc. (Nasdaq: FOSL) and is the former Chair of the Board of Directors of Chicos FAS, Inc. Mr. Mansell brings a combination of retail, public company, strategic and financial expertise to the Board. |

| | | | | | | | |

| Ronald E. Nelson | | Mr. Nelson (age 81) has served on the Board since 2011. He joined NIKE, Inc. in 1976 and went on to serve as Vice President from 1982 to 1997, overseeing a wide variety of operations, including NIKE’s early advertising, promotions and retail operations, global footwear sourcing and financing, and the global apparel division, and he served as President of NIKE’s Japanese subsidiary from 1995 to 1997, retiring from NIKE in 1997. Mr. Nelson served as an advisory board member to Columbia in the 1970s. Mr. Nelson’s broad and deep experience within the apparel and footwear industry provides the Board with insights and guidance regarding our global supply chain, marketing and growth strategies. |

| | | | | | | | |

| Christiana Smith Shi | | Ms. Shi (age 64) has served on the Board since 2022. Ms. Shi is Principal at Lovejoy Advisors, LLC, an advisory services firm focused on digitally transforming consumer and retail businesses, which she founded in 2016. Ms. Shi joined NIKE, Inc. in 2010 and most recently served as President, Direct-to-Consumer from 2013 until her retirement in 2016. Prior to that, Ms. Shi spent 24 years at McKinsey & Company in various roles, including Director and Senior Partner from 2000 to 2010. Ms. Shi began her career at Merrill Lynch & Company in 1981. Ms. Shi currently serves on the Board of Directors of United Parcel Service, Inc. (NYSE: UPS). She served on the Boards of Directors of Williams-Sonoma, Inc. until 2019 and Mondelēz International, Inc. until 2023. Ms. Shi brings robust footwear and apparel industry and direct-to-consumer experience to the Board. |

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 16

| | | | | | | | |

| Sabrina L. Simmons | | Ms. Simmons (age 60) has served on the Board since 2018. She served as Executive Vice President and Chief Financial Officer of Gap, Inc. from 2008 until 2017. Previously, Ms. Simmons also served in the following positions at Gap: Executive Vice President, Corporate Finance from 2007 to 2008, Senior Vice President, Corporate Finance and Treasurer from 2003 to 2007, and Vice President and Treasurer from 2001 to 2003. Prior to that, Ms. Simmons served as Chief Financial Officer and an executive member of the board of directors of Sygen International PLC, and was Assistant Treasurer at Levi Strauss & Co. Ms. Simmons currently serves as a member of the board of directors and chair of the audit committee of each of Coursera, Inc. (NYSE: COUR) and Petco Health and Wellness Company, Inc. (Nasdaq: WOOF). Ms. Simmons formerly served on the board of e.l.f. Beauty, Inc. and Williams-Sonoma, Inc. Ms. Simmons brings a combination of public company, global retail and financial experience to the Board. |

| | | | | | | | |

| Malia H. Wasson | | Ms. Wasson (age 65) has served on the Board since 2015. Ms. Wasson chairs the Audit Committee, and the Board has designated Ms. Wasson as an “audit committee financial expert.” Ms. Wasson worked at U.S. Bank of Oregon for over 25 years, serving as President of U.S. Bank’s Oregon and Southwest Washington operations from 2005 to 2015. In addition to her role as President, she led the Oregon Commercial Banking group for U.S. Bank, which provides a wide variety of financial services to middle market companies. Currently, Ms. Wasson is the Chief Executive Officer of Sand Creek Advisors LLC, which provides business consulting to CEOs of public and private companies. Ms. Wasson serves as Chair of the board of directors and as a member of the governance committee of Northwest Natural Holding Company (NYSE: NWN), as well as Chair of the board of directors of its subsidiary, Northwest Natural Gas Company. Ms. Wasson’s extensive experience in commercial banking, finance and accounting, as well as local and regional leadership, enables her to provide insight and advice to Columbia on strategic matters including mergers and acquisitions, consumer and commercial businesses, regulatory, marketing, public and government policy and relations, media relations, change management and human capital management and diversity. |

| | |

| RECOMMENDATION BY THE BOARD OF DIRECTORS |

The Board recommends that shareholders vote FOR ALL the nominees named in this Proxy Statement.

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 17

Management is responsible for the preparation, presentation and integrity of the Company’s financial statements and for maintaining appropriate financial reporting controls and procedures designed to reasonably ensure such integrity. As described more fully in its charter, the Audit Committee’s role is to assist the Board in its governance, guidance and oversight regarding the financial information provided by the Company to the public or governmental bodies, the Company’s systems of internal controls and the Company’s auditing, accounting and financial reporting processes in general. A copy of the Audit Committee’s charter, which is reviewed and reassessed by the Audit Committee on an annual basis, is available at https://investor.columbia.com.

Deloitte & Touche LLP (“Deloitte”), the Company’s independent registered public accounting firm, is responsible for performing an independent audit of the Company’s consolidated financial statements in accordance with the standards of the Public Company Accounting Oversight Board (“PCAOB”) (United States) and expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. The Audit Committee oversees the relationship between the Company and its independent registered public accounting firm, including appointment of the independent registered public accounting firm, reviewing and pre-approving the scope of services and related fees to be paid to the independent registered public accounting firm and assessing the independent registered public accounting firm’s independence. The Audit Committee regularly meets with management and the Company’s independent registered public accounting firm to discuss, among other things, the preparation of the financial statements, including key accounting and reporting issues.

The Audit Committee has:

•reviewed and discussed with management and Deloitte the audited financial statements and audit of internal control over financial reporting;

•discussed with Deloitte the matters required to be discussed by the applicable requirements of the PCAOB and the SEC;

•received the written disclosures and the letter from Deloitte required by applicable requirements of the PCAOB regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence and discussed with Deloitte the independent registered public accounting firm’s independence from the Company and its management; and

•reviewed and approved the fees paid to Deloitte for audit and non-audit services and discussed whether Deloitte’s provision of non-audit services was compatible with maintaining its independence.

In considering the nature of the non-audit services provided by Deloitte, the Audit Committee determined that these services are compatible with the provision of independent audit services.

Based on the Audit Committee’s review and the meetings, discussions and communications described above, and subject to the limitations of the Audit Committee’s role and responsibilities referred to above and in the Audit Committee charter, the Audit Committee recommended to the Board that the Company’s audited consolidated financial statements for the year ended December 31, 2023 be included in the Company’s Annual Report on Form 10-K.

| | | | | |

| Members of the Audit Committee: |

| Malia H. Wasson—Chairman |

| Andy D. Bryant |

| Charles D. Denson |

| Ronald E. Nelson |

| Christiana Smith Shi |

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 18

| | |

| PROPOSAL 2: RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

The Audit Committee has selected Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the 2024 fiscal year, subject to ratification of the selection by our shareholders at the Annual Meeting.

Principal Accountant Fees and Services

For work performed in regard to fiscal years 2023 and 2022, we incurred the following fees for services provided by Deloitte, as categorized below:

| | | | | | | | | | | |

| 2023 | | 2022 |

Audit Fees(1) | $ | 2,837,148 | | | $ | 2,791,865 | |

Tax Fees(2) | $ | 6,349 | | | $ | 62,130 | |

All Other Fees | $ | — | | | $ | — | |

| Total | $ | 2,843,497 | | | $ | 2,853,995 | |

(1)Fees for audit services billed to Columbia by Deloitte in 2023 and 2022, which consisted of: audit of Columbia’s annual financial statements and internal controls over financial reporting, reviews of Columbia’s quarterly financial statements and statutory audits.

(2)Fees for tax services billed to Columbia by Deloitte in 2023 and 2022, which consisted of: federal tax return compliance assistance and foreign tax compliance, planning and advice.

Representatives of Deloitte are expected to be at the Annual Meeting and will be available to respond to appropriate questions. They do not plan to make a statement but will have an opportunity to make a statement if they wish.

Pre-Approval Policy

All of the services performed by Deloitte in 2023 were pre-approved in accordance with the pre-approval policy and procedures adopted by the Audit Committee. This policy describes the permitted audit, audit-related, tax, and other services (collectively, the “Disclosure Categories”) that the independent auditors may perform. The policy requires the Audit Committee to review at each regularly scheduled Audit Committee meeting (a) a description of the services provided or expected to be provided by the independent registered public accounting firm in each of the Disclosure Categories and the related fees and costs, and (b) a list of newly requested services subject to pre-approval since the last regularly scheduled meeting. Generally, pre-approval is provided at regularly scheduled meetings; however, the authority to pre-approve services between meetings, as necessary, has been delegated to the Chair of the Audit Committee. The Chair provides an update to the Audit Committee at the next regularly scheduled meeting of any services for which she granted specific pre-approval.

| | |

| RECOMMENDATION BY THE BOARD OF DIRECTORS |

The Board recommends that shareholders vote FOR the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2024.

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 19

| | |

| COMPENSATION COMMITTEE REPORT |

The Talent and Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K and, based on its review and the discussions, the Talent and Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and this Proxy Statement.

| | | | | |

| Members of the Talent and Compensation Committee: |

| Stephen E. Babson—Chairman |

| John W. Culver |

| Kevin Mansell |

| Sabrina L. Simmons |

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 20

Compensation Discussion and Analysis

This Compensation Discussion and Analysis, or CD&A, discusses our compensation program for the executives identified as our named executive officers in the 2023 Summary Compensation Table and below.

| | | | | | | | |

2023 NAMED EXECUTIVE OFFICERS |

| Timothy P. Boyle | | Chairman, President and Chief Executive Officer (“CEO”) |

| Jim A. Swanson | | Executive Vice President and Chief Financial Officer (“CFO”) |

| Joseph P. Boyle | | Executive Vice President, Columbia Brand President |

| Peter J. Bragdon | | Executive Vice President, Chief Administrative Officer (“CAO”) and General Counsel |

| Steven M. Potter | | Executive Vice President, Chief Digital Information Officer |

In this CD&A, the terms “we,” “us,” “our,” “Columbia,” and the “Company” refer to Columbia Sportswear Company and not to the Talent and Compensation Committee. The compensation programs for our named executive officers also generally apply to our other senior officers, who are based in the U.S., and references in this CD&A to executive officers generally include the named executive officers and our other senior officers who are based in the U.S.

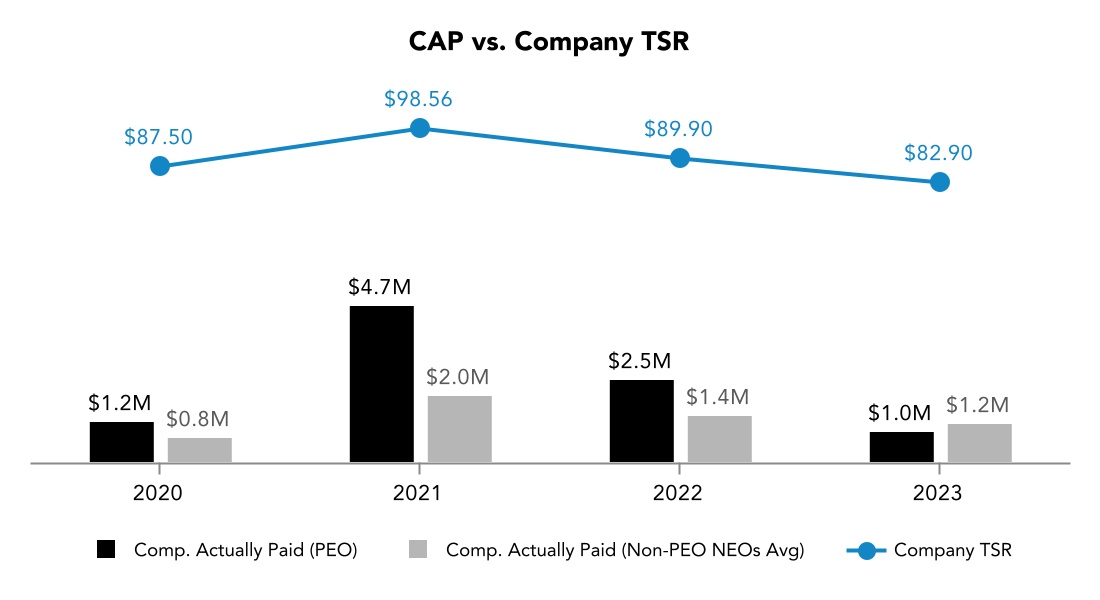

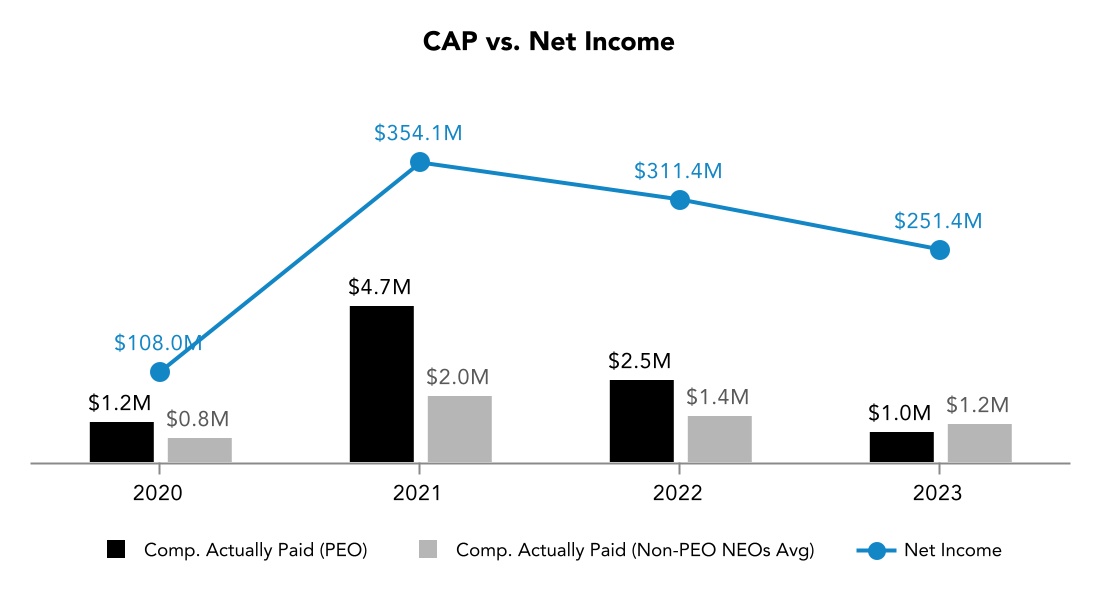

Executive Summary

In 2023, net sales increased 1% to $3,487.2 million from $3,464.2 million in 2022. Operating income decreased 21% to $310.3 million, or 8.9% of net sales, compared to 2022 operating income of $393.1 million, or 11.3% of net sales. Net income decreased 19% to $251.4 million, or $4.09 per diluted share, compared to net income of $311.4 million, or $4.95 per diluted share, in 2022.

Management also successfully executed its inventory management plan in 2023 by reducing inventories 27% compared to December 31, 2022.

Columbia’s executive compensation program aims to reward performance. Our named executive officer compensation in 2023 consisted of (a) base salary, (b) short-term incentive compensation, (c) long-term incentive compensation, and (d) benefits. As a result of the financial performance of the Company in 2023, the Company’s short-term incentive cash plan for executive officers, the Executive Incentive Compensation Plan, paid out to executive officers at 33% of target, with additional amounts payable in connection with individual performance. In 2023, the Talent and Compensation Committee awarded RSUs and PRSUs to Messrs. Bragdon, Potter and Swanson, and stock options to Messrs. Joseph P. Boyle, Bragdon, Potter, and Swanson, consistent with its historical approach for these executives. Mr. Joseph P. Boyle received 100% stock options due to his level of stock ownership. Because our CEO holds a significant amount of our common stock, he typically does not receive equity compensation grants (other than in 2021) and instead continued to receive in 2023 a long-term incentive cash award tied to the same multi-year operating goals to which the vesting of PRSU awards for the other executive officers is subject.

There were no PRSUs or, for our CEO, long-term incentive cash awards, with performance periods ended December 31, 2023 for any of our named executive officers as a result of option grants being awarded instead of PRSU awards or long-term incentive cash awards in 2021.

Overview of Executive Compensation Program

In this CD&A, we describe our overall compensation philosophy, objectives and practices. Our compensation philosophy and objectives generally apply to all of our employees, and most of our key employees are eligible to participate in the three main components of our compensation program: base salary, annual, short-term incentive compensation, and long-term incentive compensation. The relative value of each of these components of our compensation program varies from year to year and for each individual employee, depending on our financial and stock price performance, the employee’s role and responsibilities and competitive market data.

Compensation Objectives. We believe leadership and motivation of our executive officers strengthen our enterprise. We aim to offer a compensation program that motivates our leaders to deliver shareholder value by remaining focused on our strategic priorities as a brand-led, consumer-first organization.

COLUMBIA SPORTSWEAR COMPANY | 2023 Annual Proxy Statement | 21

Compensation Program Design. Our executive compensation program is designed to reward our executive officers competitively when they achieve targeted performance goals, increase shareholder value and maintain long-term careers with us. In our view, a competitive pay package in our industry includes:

| | | | | |

| v | a salary that provides for a minimum level of compensation for an executive officer; |

| v | a meaningful performance-based bonus tied to achievement of corporate and individual objectives; |

| v | long-term incentives that offer significant rewards for achievement of multi-year financial objectives and sustained increases in the market price of our common stock; and |

| v | benefits that aim to be competitive with those that are offered by companies similar to ours. |

The total compensation package for our executive officers is substantially weighted toward incentive compensation tied to corporate and individual performance. Therefore, when targeted performance levels are not achieved or our stock price decreases, executive officer realized compensation may be significantly reduced. When targeted performance levels are exceeded or our stock price increases, executive officer realized compensation may be commensurately increased.

Risk and Compensation. We believe our compensation programs for executive officers are designed to encourage prudent risk-taking to achieve long-term growth in shareholder value. A variety of principles and practices contribute to the alignment of our executive compensation programs with our overall risk profile, including the following:

| | | | | | | | |

| Principle | | Practice |

| Governance | | All Talent and Compensation Committee members are independent, non-employee directors. |

| Program Design | | The Talent and Compensation Committee retains its own independent compensation consultant. |

| Our programs are designed to drive achievement of our strategic objectives, short- and long-term financial performance and growth in shareholder value, while also promoting the attraction and retention of executive talent. |

| Our programs balance strategic, financial and shareholder measures. |

| Our programs balance short- and long-term performance and cash and equity compensation. |

| The vesting periods of long-term incentives provide long-term alignment with shareholders. |

| Maximum amounts payable generally are established under performance-based incentive programs. |

| The presence of compensation risk mitigating policies and practices including a recoupment policies and executive and non-employee director stock ownership guidelines. |

| | |