Sportswear CFO Commentary and Fin anc1a I Review a 2 2 October 30, 2024 Exhibit 99.2

DTC DTC.com DTC B&M y/y U.S. LAAP EMEA SG&A EPS bps direct-to-consumer DTC e-commerce DTC brick & mortar year-over-year United States Latin America and Asia Pacific Europe, Middle East and Africa selling, general & administrative earnings per share basis points “+” or “up” “-” or “down” LSD% MSD% HSD% LDD% low-20% mid-30% high-40% increased decreased low-single-digit percent mid-single-digit percent high-single-digit percent low-double-digit percent low-twenties percent mid-thirties percent high-forties percent “$##M” “$##B” c.c. M&A FX ~ H# Q# YTD PFAS in millions of U.S. dollars in billions of U.S. dollars constant-currency mergers & acquisitions foreign exchange approximately First half, second half Quarter 1, 2, 3, 4 Year-to-date perfluoroalkyl and polyfluoroalkyl substances

W E C O N N E C T A C T I V E P E O P L E W I T H T H E I R P A S S I O N S

• • • • •

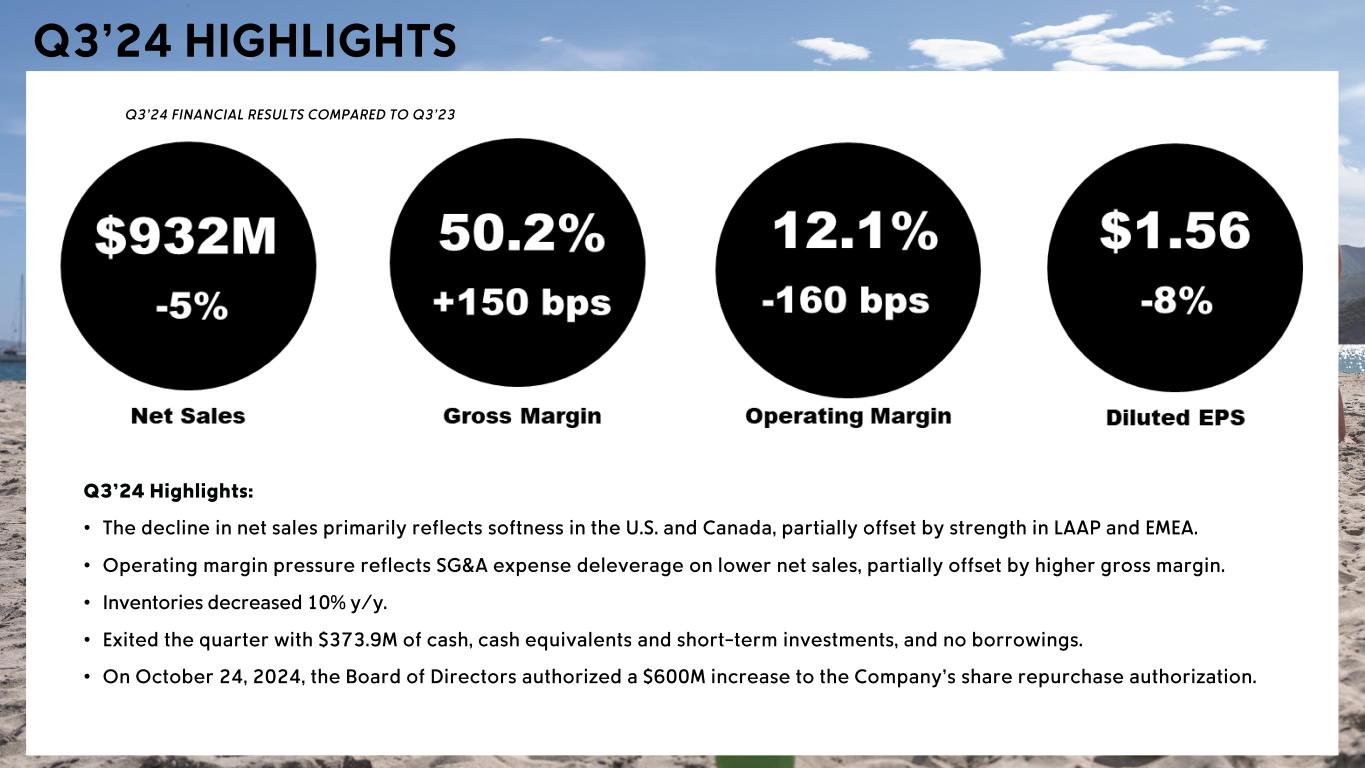

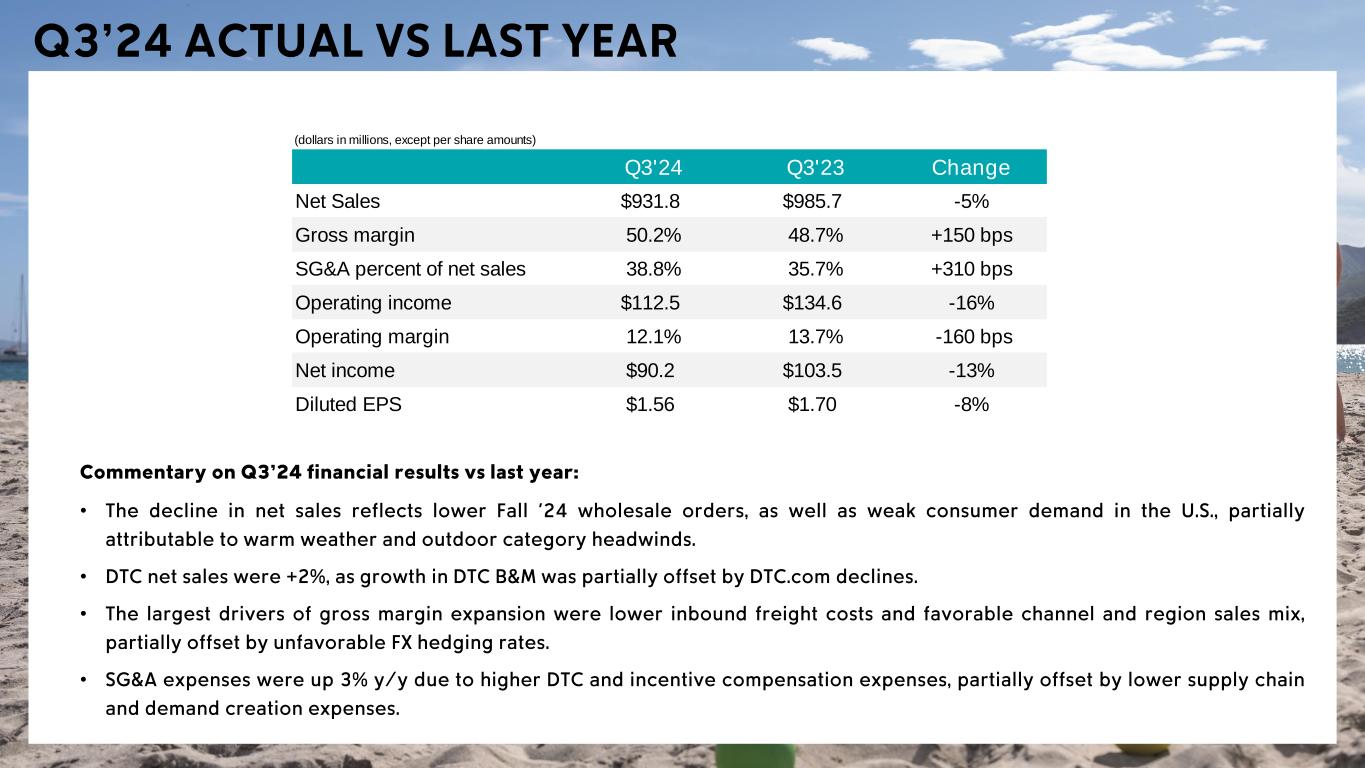

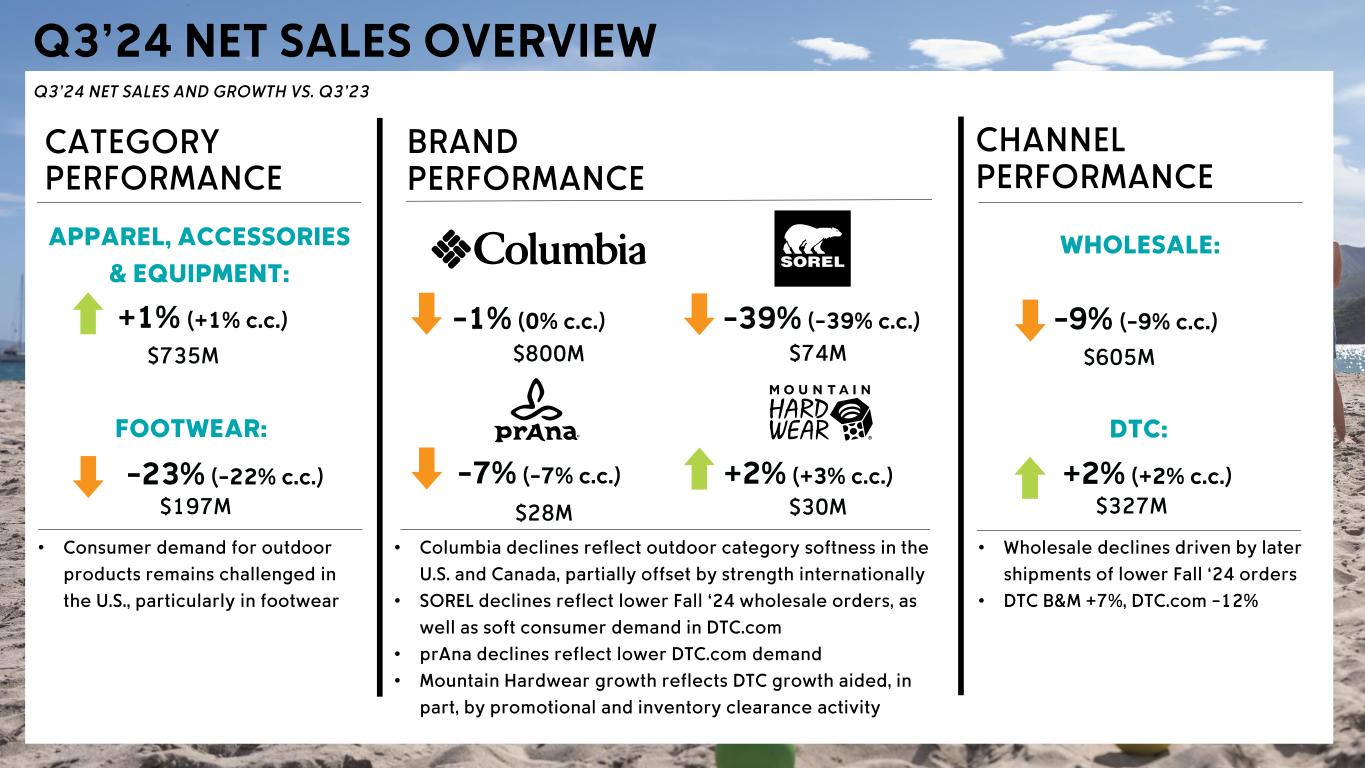

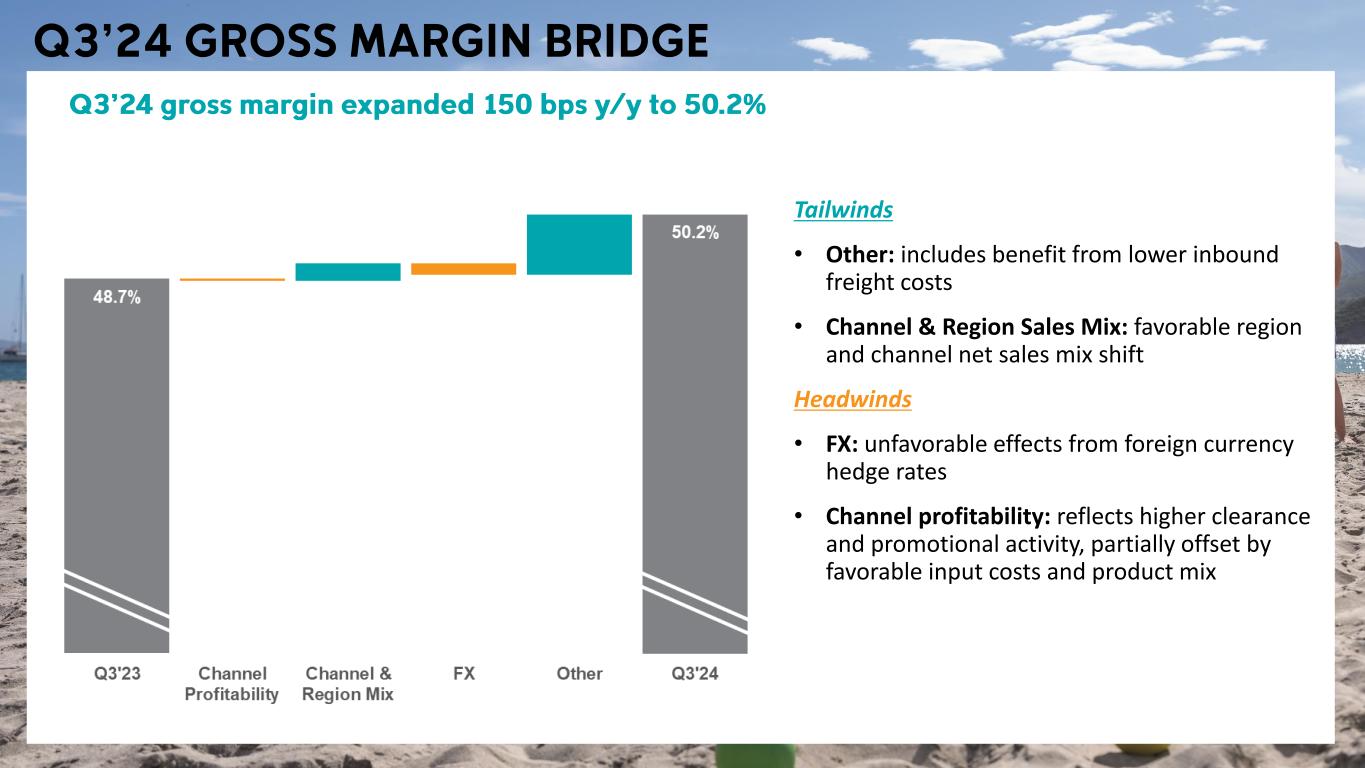

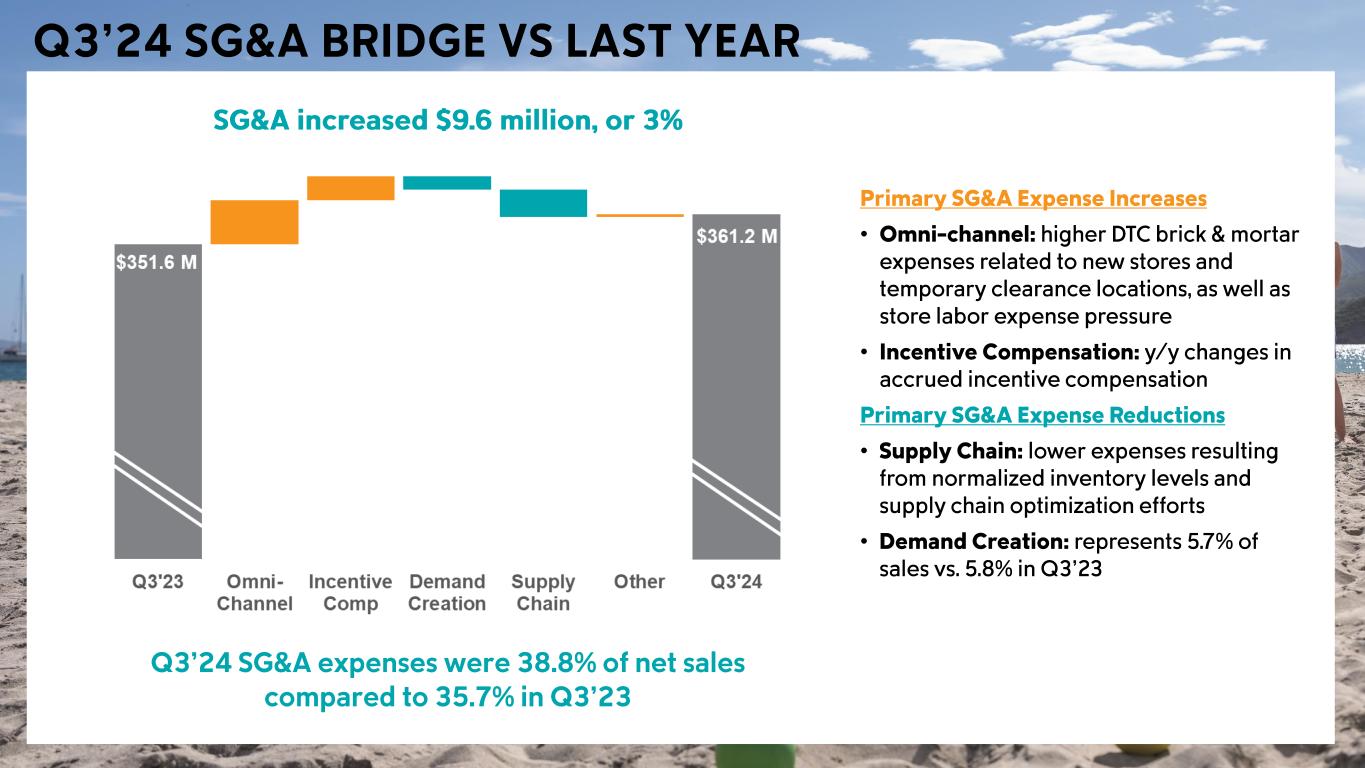

• • • • (dollars in millions, except per share amounts) Q3'24 Q3'23 Change Net Sales $931.8 $985.7 -5% Gross margin 50.2% 48.7% +150 bps SG&A percent of net sales 38.8% 35.7% +310 bps Operating income $112.5 $134.6 -16% Operating margin 12.1% 13.7% -160 bps Net income $90.2 $103.5 -13% Diluted EPS $1.56 $1.70 -8%

• • • • • • • • • •

• • • • • • •

Tailwinds • Other: includes benefit from lower inbound freight costs • Channel & Region Sales Mix: favorable region and channel net sales mix shift Headwinds • FX: unfavorable effects from foreign currency hedge rates • Channel profitability: reflects higher clearance and promotional activity, partially offset by favorable input costs and product mix

• • • •

• • • • • • • • • • • •

• • • • • • • • • • • •

• • • • • •

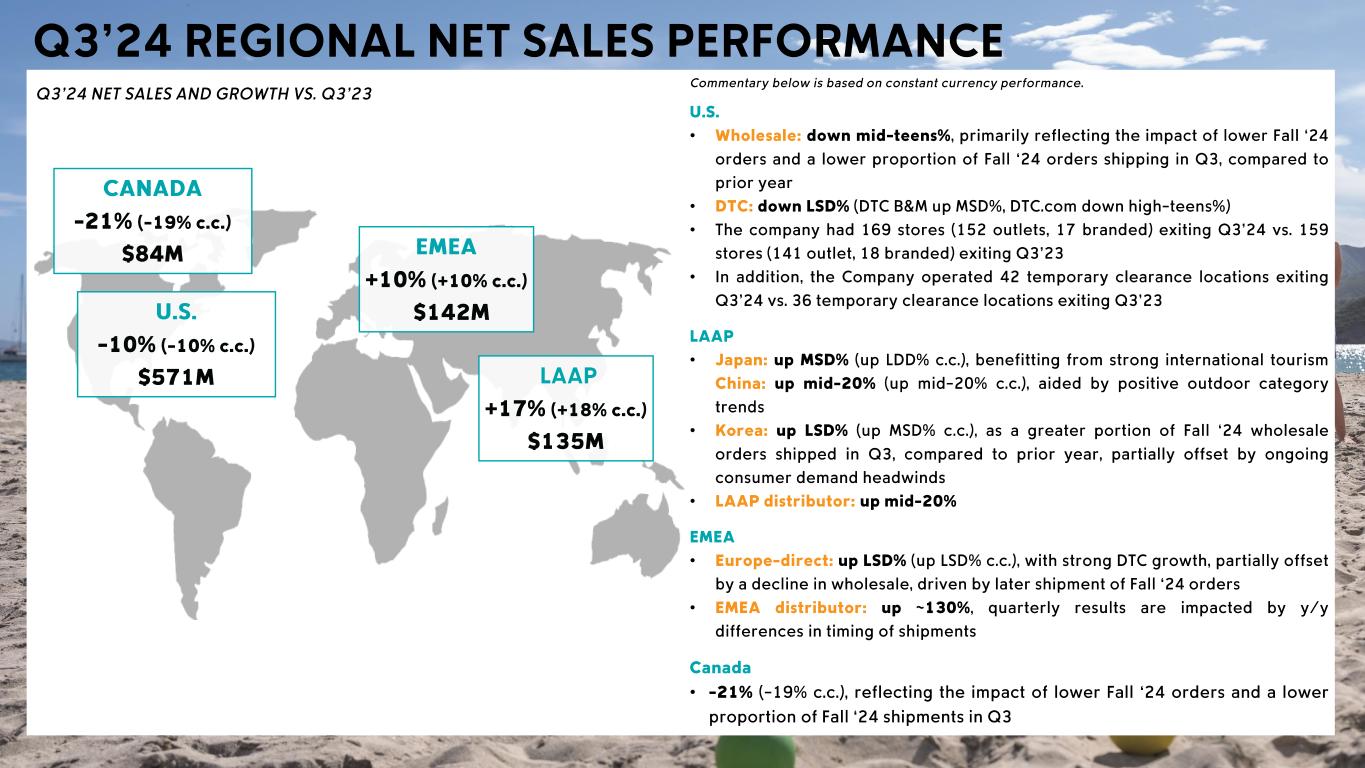

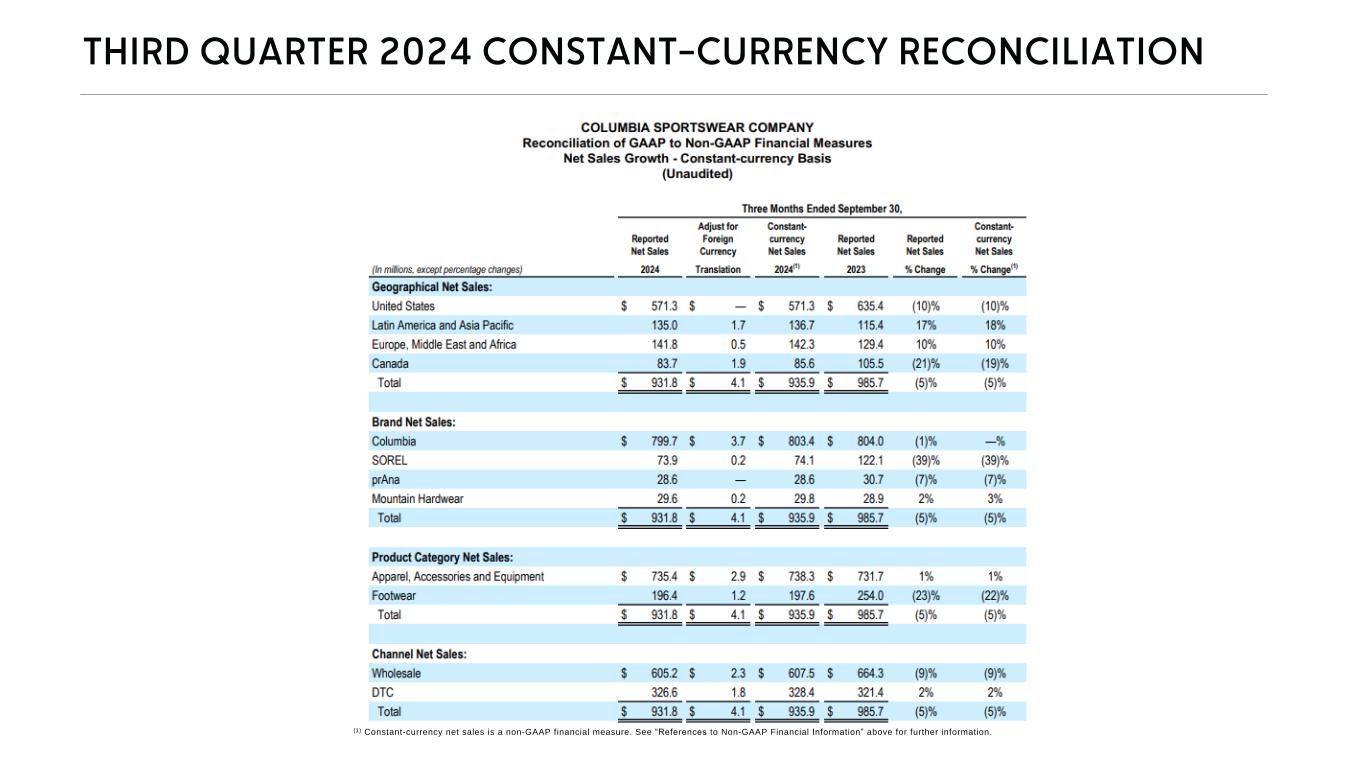

(1) Constant-currency net sales is a non-GAAP financial measure. See “References to Non-GAAP Financial Information” above for further information.