UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ Preliminary Proxy Statement

|

¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||

| x Definitive Proxy Statement |

||||

| ¨ Definitive Additional Materials |

||||

| ¨ Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 |

||||

COLUMBIA SPORTSWEAR COMPANY

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(I)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Portland, Oregon

April 17, 2006

Dear Shareholders:

You are cordially invited to attend our annual meeting of shareholders at 3:00 p.m., Pacific Time, on Thursday, May 18, 2006, at our headquarters at 14375 NW Science Park Drive, Portland, Oregon 97229.

Details of the business to be conducted at the annual meeting are provided in the accompanying Notice of Annual Meeting and Proxy Statement. At the annual meeting, we will also report on the Company’s operations and respond to any questions you may have.

Your vote is very important. Whether or not you attend the annual meeting in person, it is important that your shares are represented and voted at the meeting. Please promptly sign, date, and return the enclosed proxy card in the postage-prepaid envelope. If you attend the meeting, you will have the right to revoke your proxy and vote your shares in person. Retention of the proxy is not necessary for admission to or identification at the meeting.

| Very truly yours, |

| /s/ Timothy P. Boyle |

| Timothy P. Boyle |

| President and Chief Executive Officer |

COLUMBIA SPORTSWEAR COMPANY

14375 NW Science Park Drive

Portland, Oregon 97229

(503) 985-4000

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

May 18, 2006

To the Shareholders of Columbia Sportswear Company:

Our annual meeting will be held at 3:00 p.m., Pacific Time, on Thursday, May 18, 2006, at 14375 NW Science Park Drive, Portland, Oregon 97229. The purpose of the meeting is:

| 1. | To elect directors for the next year; |

| 2. | To ratify the selection of Deloitte & Touche LLP as our independent auditors for 2006; and |

| 3. | To act upon any other matters that may properly come before the meeting. |

Only shareholders of record at the close of business on March 23, 2006, are entitled to vote at the meeting. A list of shareholders will be available for inspection by shareholders beginning April 19, 2006, at our corporate headquarters.

Even if you plan to attend the meeting in person, please sign, date and return the enclosed proxy in the enclosed postage-prepaid envelope. You may attend the meeting in person even if you send in your proxy; retention of the proxy is not necessary for admission to or identification at the meeting.

| By Order of the Board of Directors |

| /s/ Peter J. Bragdon |

| Peter J. Bragdon |

| Vice President, General Counsel and Secretary |

Portland, Oregon

April 17, 2006

PROXY STATEMENT

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| 1 | ||

| Security Ownership of Certain Beneficial Owners and Management |

3 | |

| 5 | ||

| 5 | ||

| 5 | ||

| 5 | ||

| 5 | ||

| 6 | ||

| 6 | ||

| 6 | ||

| 6 | ||

| 6 | ||

| 7 | ||

| 7 | ||

| 8 | ||

| 8 | ||

| 9 | ||

| 10 | ||

| Proposal 2: Ratification of Selection of Independent Auditors |

11 | |

| 12 | ||

| 12 | ||

| 13 | ||

| Aggregated Option Exercises and Fiscal Year-End Option Values |

13 | |

| 14 | ||

| 15 | ||

| 15 | ||

| 15 | ||

| 16 | ||

| 16 | ||

| 17 | ||

| 18 | ||

| 19 | ||

| Shareholder Proposals to be Included in the Company’s Proxy Statement |

19 | |

| 19 | ||

| 19 | ||

COLUMBIA SPORTSWEAR COMPANY

PROXY STATEMENT

Annual Meeting of Shareholders

How Proxies Will Be Solicited. The Board of Directors of Columbia Sportswear Company, an Oregon corporation, is soliciting proxies to be used at the annual meeting of shareholders to be held at 3:00 p.m., Pacific Time, on Thursday, May 18, 2006, at Columbia’s headquarters, located at 14375 NW Science Park Drive, Portland, Oregon 97229 for the purposes set forth in the accompanying Notice of Annual Meeting. This proxy statement, the form of proxy and our 2005 Annual Report will be mailed to shareholders on or about April 17, 2006, at our cost. The proxy statement and Annual Report are also available on our website at www.columbia.com and the website of the Securities and Exchange Commission at www.sec.gov. We will request fiduciaries, custodians, brokerage houses and similar parties to forward copies of proxy materials to beneficial owners of the Company’s stock and we will reimburse these parties for their reasonable and customary charges for distribution expenses. Proxies will be solicited by use of the mail and the Internet, and our directors, officers and employees may also solicit proxies by telephone, fax or personal contact. No additional compensation will be paid for these services. We have retained W.F. Doring & Co. to assist in the solicitation of proxies from nominees and brokers at an estimated fee of $3,500 plus related out-of-pocket expenses.

Householding of Proxy Materials. The Securities and Exchange Commission has adopted rules that permit companies and intermediaries to satisfy the delivery requirements for proxy statements with respect to two or more security holders sharing the same address by delivering a single proxy statement addressed to those security holders. This process, which is commonly referred to as “householding,” may result in more convenience for security holders and cost savings for companies. A number of brokers with accountholders who are Company shareholders will be householding our proxy materials. If you have received notice from your broker that it will be householding communications to your address, householding will continue until you are notified otherwise or until you revoke your consent. If at any time you no longer wish to participate in householding and would prefer to receive a separate proxy statement, please notify your broker or write to us at Columbia Sportswear Company, Attention: Investor Relations, 14375 NW Science Park Drive, Portland, Oregon 97229. If you currently receive multiple copies of the proxy statement and would like to request householding of your communications, please contact your broker.

Who Can Vote. Only shareholders of record at the close of business on March 23, 2006, (the “record date”) are entitled to notice of and to vote at the annual meeting or any adjournments of the annual meeting. At the close of business on March 23, 2006, 36,923,490 shares of the Company’s Common Stock, the only authorized voting security of the Company, were issued and outstanding.

How You Can Vote. Mark your proxy, sign and date it, and return it in the enclosed postage-paid envelope. To ensure your vote is counted, we must receive your proxy before or at the annual meeting. All of your shares that have been properly voted and not revoked will be voted at the annual meeting in accordance with your instructions. If you sign your proxy card but do not give voting instructions, the shares represented by your proxy will be voted as recommended by the Board of Directors.

How You Can Revoke Your Proxy or Change Your Vote. You can revoke your proxy at any time before it is voted at the annual meeting by:

| • | Sending written notice of revocation bearing a later date than the date of the proxy to the Secretary; |

1

| • | Submitting to the Secretary a later-dated proxy relating to the same shares; or |

| • | Attending the annual meeting and voting in person. If your shares are held in the name of a bank, broker or other holder of record, you must obtain a proxy, executed in your favor, from the holder of record to be able to vote at the meeting. |

Any written notice revoking a proxy should be sent to Columbia Sportswear Company, Attention: Peter J. Bragdon, 14375 NW Science Park Drive, Portland, Oregon 97229, or hand-delivered to Mr. Bragdon at or before the vote at the annual meeting.

2

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information as of March 23, 2006, regarding the beneficial ownership of shares of Company Common Stock by (i) each person known by the Company to own beneficially more than 5% of the Common Stock, (ii) each of our directors and director nominees, (iii) each of the executive officers named in the Summary Compensation Table who were serving as executive officers at the end of the last completed fiscal year (“named executive officers”), and (iv) all of our executive officers and directors as a group. The address for each of our executive officers and directors is 14375 NW Science Park Drive, Portland, Oregon 97229. The address for JPMorgan Chase & Co. is 270 Park Avenue, New York, New York 10017. Except as otherwise noted, the persons listed below have sole investment and voting power with respect to the shares owned by them.

| Beneficial Owner |

Shares Beneficially |

Percentage of Shares |

||||

| Gertrude Boyle |

5,362,473 | 14.5 | % | |||

| Timothy P. Boyle |

15,358,816 | (2) | 41.6 | % | ||

| JPMorgan Chase & Co. |

3,388,611 | (3) | 10.5 | % | ||

| Patrick D. Anderson |

106,980 | (4) | * | |||

| Rick D. Carpenter |

5,376 | (5) | * | |||

| Robert G. Masin |

74,567 | (6) | * | |||

| Bryan L. Timm Murrey R. Albers |

64,050 35,733 |

(7) (8) |

* * |

| ||

| Stephen E. Babson |

20,452 | (9) | * | |||

| Sarah A. Bany |

2,270,769 | (10) | 6.1 | % | ||

| Andy D. Bryant |

2,604 | (11) | * | |||

| Edward S. George |

56,615 | (12) | * | |||

| Walter T. Klenz |

30,167 | (13) | * | |||

| John W. Stanton |

313,640 | (14) | * | |||

| All directors and executive officers as a group (15 persons) |

23,791,645 | (15) | 63.6 | % |

| * | Less than 1%. |

| (1) | Shares that the person or group has the right to acquire within 60 days after March 23, 2006 are deemed to be outstanding in calculating the percentage ownership of the person or group but are not deemed to be outstanding as to any other person or group. |

| (2) | Includes (a) 320,814 shares held in trust, for which Mr. Boyle’s wife is trustee, for the benefit of Mr. Boyle’s children, and (b) 417 shares held in trust for Mr. Boyle’s wife, for which she is trustee. Mr. Boyle disclaims beneficial ownership of these shares. Also includes 288,012 shares held in grantor retained annuity trusts for which Mr. Boyle is trustee and income beneficiary. |

| (3) | Based solely upon information reported in a Schedule 13G filed on February 8, 2006, reporting beneficial ownership as of December 31, 2005, JPMorgan Chase & Co. has sole power to vote or to direct the vote for 2,717,045 shares, has shared power to vote or to direct the vote for 583,566 shares, has sole power to dispose or to direct the disposition of 2,804,018 shares, and has shared power to dispose or to direct the disposition of 583,771 shares. JPMorgan Chase & Co. is the beneficial owner of these shares on behalf of other persons known to have one or more of the following: the right to receive dividends for these securities, the power to direct the receipt of dividends from these securities, the right to receive the proceeds from the sale of these securities, and the right to direct the receipt of proceeds from the sale of these securities. None of these persons are known to own more than 5% of the class of these securities. |

| (4) | Includes 98,480 shares subject to options exercisable within 60 days after March 23, 2006. |

| (5) | Based solely upon information reported by Mr. Carpenter upon his resignation in January 2006. |

3

| (6) | Includes 72,640 shares subject to options exercisable within 60 days after March 23, 2006. |

| (7) | Includes 57,707 shares subject to options exercisable within 60 days after March 23, 2006. |

| (8) | Includes 34,233 shares subject to options exercisable within 60 days after March 23, 2006. |

| (9) | Includes (a) 750 shares held by Babson Capital Partners, LP, for which Mr. Babson is general partner, (b) 1,500 shares held by the Jean McCall Babson Trust for which Mr. Babson is trustee and whose beneficiaries include members of Mr. Babson’s family, and (c) 16,702 shares subject to options exercisable within 60 days after March 23, 2006. |

| (10) | Includes (a) 2,225 shares held in trust, for which Ms. Bany’s husband is trustee, for the benefit of Ms. Bany’s children, (b) 1,010,720 shares held in grantor retained annuity trusts for which Ms. Bany is trustee and income beneficiary, and (c) 35,417 shares subject to options exercisable within 60 days after March 23, 2006. Also includes 7,500 shares held by the Marie Lamfrom Charitable Foundation, for which Ms. Bany is a trustee. Ms. Bany disclaims beneficial ownership of these shares. |

| (11) | Includes 1,604 shares subject to options exercisable within 60 days after March 23, 2006. |

| (12) | Includes 7,800 shares held by George Family Investment L.P. and 6,400 shares held by The George Family Trust, for which Mr. George is a trustee. Mr. George disclaims beneficial ownership of these shares. Also includes 41,415 shares subject to options exercisable within 60 days after March 23, 2006. |

| (13) | Consists of 30,167 shares subject to options exercisable within 60 days after March 23, 2006. |

| (14) | Includes 25,000 shares held by the Aven Foundation, for which Mr. Stanton is a trustee. Mr. Stanton disclaims beneficial ownership of these shares. Also includes 10,062 shares subject to options exercisable within 60 days after March 23, 2006. |

| (15) | Includes 492,529 shares subject to options exercisable within 60 days after March 23, 2006, and 5,376 shares owned by Mr. Carpenter upon his employment termination in January 2006. |

4

Corporate Governance Guidelines and Independence. The Company’s Board of Directors has adopted a Nominating and Corporate Governance Committee Charter that is available for review on our website at www.columbia.com. Under the Company’s Nominating and Corporate Governance Committee Charter, which adopts the standards for “independence” under the NASDAQ National Market listing standards and the Securities and Exchange Commission rules, a majority of the members of the Board of Directors must be independent as determined by the Board of Directors. The Board of Directors has determined that Messrs. Albers, Babson, Bryant, George, Klenz and Stanton are independent and, accordingly, a majority of our Board of Directors is independent. In addition, all members of our Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee are independent.

The Company has also adopted a Code of Business Conduct and Ethics that applies to the Company’s Chief Executive Officer, Chief Financial Officer, Controller, and all other Company directors, officers and employees. A copy of our Code of Business Conduct and Ethics is available on our website at www.columbia.com.

Communications with Board. Any shareholder who desires to communicate with the Board of Directors, individually or as a group, may do so by writing to the intended member or members of the Board of Directors, c/o Corporate Secretary, Columbia Sportswear Company, 14375 NW Science Park Drive, Portland, Oregon 97229. Communications should be sent by overnight or certified mail, return receipt requested. All communications will be compiled by the Secretary and submitted to the individual director to whom it is addressed.

Communications with the Board of Directors regarding recommendations of individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board of Directors must be made in accordance with the Director Nomination Policy described below.

Director Compensation. Each director who is not an employee of the Company receives the following compensation for his or her services as director:

| • | annual compensation of $30,000; |

| • | $2,000 per Board meeting attended; |

| • | $1,000 per committee meeting attended as a member; |

| • | $2,000 per Compensation Committee or Nominating and Corporate Governance Committee meeting attended as the chairman; |

| • | $4,000 per Audit Committee meeting attended as the chairman; |

| • | an annual option to acquire 5,250 shares of Common Stock; |

| • | an annual $2,500 Columbia Sportswear merchandise allowance; and |

| • | reasonable out-of-pocket expenses incurred in attending meetings. |

Directors are given the opportunity to receive an option grant in lieu of the annual cash compensation. In 2005, three of the seven non-employee directors elected to receive an option to acquire 1,511 shares of Common Stock in lieu of the annual $30,000 cash compensation. All option grants to directors have an exercise price equal to the fair market value of the Company’s Common Stock at the time of the grant, vest ratably over thirty-six months beginning the first month following the date of grant, and expire ten years from the date the option was granted. Directors who are employees of the Company receive no separate compensation for their service as directors.

Board Meetings. The Board of Directors met seven times in 2005. Five executive sessions of the Board of Directors were held in 2005. Each director attended at least 75 percent of the total number of meetings of the Board of Directors and of any committee on which he or she served in 2005. The Company does not maintain a

5

formal policy regarding director attendance at annual shareholder meetings; however, the Company encourages directors to attend the annual meeting of shareholders. Seven directors attended the Company’s 2005 annual meeting of shareholders.

Board Committees. The Board of Directors has designated three standing committees. The Audit Committee, the Compensation Committee and the Nominating and Corporate Governance Committee each operate under a written charter that is available for review on our website at www.columbia.com. The current membership of each committee and its principal functions, as well as the number of times it met during fiscal year 2005, is described below.

Audit Committee. The Audit Committee is composed of Messrs. George, Bryant, and Stanton. Mr. Klenz was a member of the Audit Committee until May 2005, when Mr. Bryant joined the Audit Committee. The Board of Directors has determined that each member of the Audit Committee meets all applicable independence and financial literacy requirements. The Board has also determined that Mr. George is an “audit committee financial expert” as defined in regulations adopted by the Securities and Exchange Commission. A description of the functions performed by the Audit Committee and Audit Committee activity is set forth below in “Report of the Audit Committee.” The Audit Committee met four times in 2005.

Compensation Committee. The Compensation Committee is composed of Messrs. Albers, Babson and Klenz. The Compensation Committee determines compensation for the Company’s executive officers and administers the Company’s 1997 Stock Incentive Plan, the 1999 Employee Stock Purchase Plan, and the Executive Incentive Compensation Plan. For additional information about the Compensation Committee, see “Compensation Committee Report on Executive Compensation,” set forth below. The Compensation Committee met six times in 2005.

Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee is composed of Messrs. Babson, Albers, Bryant, George, Klenz and Stanton. Messrs. Bryant, Klenz and Stanton joined the Nominating and Corporate Governance Committee in May 2005. The Nominating and Corporate Governance Committee develops and recommends corporate governance guidelines and standards for business conduct and ethics, identifies individuals qualified to become Board members, and makes recommendations regarding nominations for director. The Nominating and Corporate Governance Committee will consider individuals recommended by shareholders for nomination as director in accordance with the procedures described under “Director Nomination Policy” below. The Nominating and Corporate Governance Committee also oversees the annual self-evaluations of the Board and its committees and makes recommendations concerning the size, structure, composition and membership of the Board of Directors and its committees. The Nominating and Corporate Governance Committee met four times in 2005.

Director Nomination Policy. Shareholders may recommend individuals for consideration by the Nominating and Corporate Governance Committee to become nominees for election to the Board of Directors by submitting a written recommendation to the Nominating and Corporate Governance Committee c/o Corporate Secretary, Columbia Sportswear Company, 14375 NW Science Park Drive, Portland, Oregon 97229. Communications should be sent by overnight or certified mail, return receipt requested. Submissions must include sufficient biographical information concerning the recommended individual, including age, five-year employment history with employer names and a description of the employer’s business, whether the individual can read and understand financial statements, and board memberships, if any, for the Nominating and Corporate Governance Committee to consider. The submission must be accompanied by a written consent of the individual to stand for election if nominated by the Board and to serve if elected by the shareholders. Recommendations received by December 31, 2006 will be considered for nomination at the 2007 Annual Meeting of Shareholders. Recommendations received after December 31, 2006 will be considered for nomination at the 2008 Annual Meeting of Shareholders.

Following the identification of the director candidates, the Nominating and Corporate Governance Committee meets to discuss and consider each candidate’s qualifications and determines by majority vote the

6

candidate(s) who the Nominating and Corporate Governance Committee believes would best serve the Company. In evaluating director candidates, the Nominating and Corporate Governance Committee considers a variety of factors, including the composition of the Board as a whole, the characteristics (including independence, diversity, age, skills and experience) of each candidate, and the performance and continued tenure of incumbent Board members. The Committee believes that candidates for director should possess high ethical character, business experience with high accomplishment in his or her respective field, the ability to read and understand financial statements, relevant expertise and experience, and the ability to exercise sound business judgment. They must also be over 21 years of age. In addition, the Committee believes at least one member of the Board should meet the criteria for an “audit committee financial expert” as defined by Securities and Exchange Commission rules, and that a majority of the members of the Board should meet the definition of “independent director” under the NASDAQ National Market listing standards. The Committee also believes key members of the Company’s management should participate as members of the Board.

Certain Relationships and Related Transactions. B2 Flight LLC, a limited liability company wholly owned by Timothy P. Boyle and his wife, leases its Hawker aircraft to the Company for business use at a price comparable to commercial airfare for each business traveler. In addition, the Company contracts with Global Aviation, Inc., an unrelated party, for flight crew services; the fee that the Company pays to Global Aviation, Inc. partially offsets the minimum monthly fee that B2 Flight LLC owes to Global Aviation, Inc. for its own flight crew services. In 2005, the Company paid B2 Flight LLC $110,645 for use of the aircraft, and paid Global Aviation, Inc. $63,868 for flight crew services. The Company believes that these transactions were on terms as fair to the Company as those that would have been available in arm’s-length negotiated transactions.

Section 16(a) Beneficial Ownership Reporting Compliance. Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s executive officers, directors, and persons who own more than 10% of the Common Stock to file reports of ownership and changes in ownership with the Securities and Exchange Commission. Executive officers, directors, and beneficial owners of more than 10% of the Common Stock are required to furnish the Company copies of all section 16(a) reports they file. Based solely on a review of reports received by the Company and on written representations from reporting persons regarding compliance, the Company believes that all section 16(a) transactions were reported on a timely basis, except that one report of a sale of shares was filed late by Ms. Bany.

7

REPORT OF THE AUDIT COMMITTEE1

The Audit Committee’s role is to provide governance, guidance, and oversight regarding financial information provided by the Company to the public or governmental bodies, the Company’s systems of internal controls, and the Company’s auditing, accounting, and financial reporting processes in general. The Audit Committee regularly meets with management and the Company’s independent auditors, Deloitte & Touche LLP, to discuss, among other things, the preparation of financial statements, including key accounting and reporting issues. In accordance with the Audit Committee charter, the Audit Committee also oversees the relationship between the Company and its outside auditors, including recommending their appointment, reviewing the scope and pre-approving their services and related fees, and assessing their independence. A copy of the Audit Committee charter is available for review on our website at www.columbia.com.

The Audit Committee has:

| • | Reviewed and discussed with management and Deloitte & Touche LLP the audited financial statements; |

| • | Discussed with Deloitte & Touche LLP the matters required to be discussed under generally accepted auditing standards and Statement on Auditing Standards No. 61 (Communication with Audit Committees); |

| • | Received the written disclosures and the letter from Deloitte & Touche LLP required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees); |

| • | Reviewed and approved the amount of fees paid to Deloitte & Touche LLP for audit and non-audit services, and discussed whether Deloitte & Touche LLP’s provision of non-audit services was compatible with maintaining its independence; and |

| • | Established policies and procedures under which all audit and non-audit services performed by the Company’s independent auditors must be approved in advance by the Audit Committee. |

Principal Accountant Fees and Services. The following table summarizes the aggregate fees billed to the Company by Deloitte & Touche LLP:

| 2004 |

2005 | |||||

| Audit Fees (a) |

$ | 1,145,719 | $ | 1,163,144 | ||

| Audit-Related Fees (b) |

37,000 | 37,711 | ||||

| Tax Fees (c) |

404,534 | 1,161,891 | ||||

| All Other Fees |

— | — | ||||

| Total |

$ | 1,587,523 | $ | 2,362,746 | ||

| (a) | Fees for audit services billed in 2004 and 2005 consisted of: |

| • | Audit of the Company’s annual financial statements and Sarbanes-Oxley Act, Section 404 related services; |

| • | Reviews of the Company’s quarterly financial statements; and |

| • | Statutory and regulatory audits, consents and other services related to Securities and Exchange Commission matters. |

| 1 | This Report of the Audit Committee, in addition to the section entitled “Compensation Committee Report” and the section entitled “Performance Graph,” are not “soliciting material,” are not deemed “filed” with the Securities and Exchange Commission, and are not to be incorporated by reference in any filing of the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934, regardless of date or any general incorporation language in any filing. |

8

| (b) | Fees for audit-related services billed in 2004 and 2005 consisted of: |

| • | Financial accounting and reporting consultations; |

| • | Employee benefit plan audits; |

| • | Due diligence associated with acquisitions; |

| • | Opening and closing balance sheet audits/reviews of an acquisition; and |

| • | Agreed-upon procedures engagements. |

| (c) | Fees for tax services billed in 2004 and 2005 consisted of: |

| • | Tax compliance and tax planning and advice; |

| • | Federal, state and local income tax return assistance; |

| • | Sales and use, property and other tax return assistance; |

| • | Assistance with tax return filings in various foreign jurisdictions; |

| • | Requests for technical advice from taxing authorities; |

| • | Assistance with tax audits and appeals; and |

| • | Preparation of expatriate tax returns. |

In considering the nature of the services provided by Deloitte & Touche LLP, the Audit Committee determined that these services are compatible with the provision of independent audit services. The Audit Committee discussed these services with Deloitte & Touche LLP and Company management to determine whether or not they are permitted under the rules and regulations concerning auditor independence promulgated by the Securities and Exchange Commission to implement the Sarbanes-Oxley Act of 2002, as well as the American Institute of Certified Public Accountants.

Pre-Approval Policy. All of the services performed by Deloitte & Touche LLP in 2005 were pre-approved in accordance with the pre-approval policy and procedures adopted by the Audit Committee. This policy describes the permitted audit, audit-related, tax, and other services (collectively, the “Disclosure Categories”) that the independent auditors may perform. The policy requires the Audit Committee to periodically review and revise (a) a description of the services provided or expected to be provided by the independent auditors in each of the Disclosure Categories and the related fees and costs, and (b) a list of newly requested services subject to pre-approval since the last regularly scheduled meeting.

Generally, pre-approval is provided at regularly scheduled meetings; however, the authority to pre-approve services between meetings, as necessary, has been delegated to the Chairman of the Audit Committee. The Chairman updates the Audit Committee at the next regularly scheduled meeting of any services for which he granted specific pre-approval.

Based on the Audit Committee’s review and the meetings, discussions and reports described above, and subject to the limitations of the Audit Committee’s role and responsibilities referred to above and in the Audit Committee charter, the Audit Committee recommended to the Board that the Company’s audited consolidated financial statements for the year ended December 31, 2005, be included in the Company’s Annual Report on Form 10-K.

Members of the Audit Committee:

Edward S. George—Chairman

Andy D. Bryant

John W. Stanton

9

PROPOSAL 1: ELECTION OF DIRECTORS

A Board of nine directors will be elected at the Annual Meeting. The directors of the Company are elected at each annual meeting to serve until the next annual meeting or until their successors are elected and qualified. Proxies received from shareholders, unless directed otherwise, will be voted FOR election of the following nominees: Mrs. Gertrude Boyle, Ms. Sarah A. Bany, and Messrs. Timothy P. Boyle, Murrey R. Albers, Stephen E. Babson, Andy D. Bryant, Edward S. George, Walter T. Klenz and John W. Stanton. Each nominee is now a director of the Company. If any of the nominees for director becomes unavailable for election for any reason, the proxy holders will have discretionary authority to vote pursuant to a proxy for a substitute or substitutes. The following table briefly describes the name, age and occupation of each of the nominees.

Name, Principal Occupation, and Other Directorships

Gertrude Boyle (age 82) has served as Chairman of the Board of Directors since 1970. Mrs. Boyle also served as the Company’s President from 1970 to 1988. Mrs. Boyle is Timothy P. Boyle and Sarah A. Bany’s mother.

Timothy P. Boyle (age 56) has served on the Board of Directors since 1978. Mr. Boyle joined the Company in 1971 as General Manager and has served as President and Chief Executive Officer since 1988. Mr. Boyle is also a member of the Board of Directors of Northwest Natural Gas and Widmer Brothers Brewing Company. Mr. Boyle is Gertrude Boyle’s son and Sarah A. Bany’s brother.

Sarah A. Bany (age 47) has served on the Board of Directors since 1988. Ms. Bany is the owner and Executive Vice President of Brand Development of Moonstruck Chocolate Company. From 1979 to August 1998, Ms. Bany held various positions at Columbia Sportswear, most recently as Director of Retail Stores. Ms. Bany is Gertrude Boyle’s daughter and Timothy P. Boyle’s sister.

Murrey R. Albers (age 64) became a director of the Company in July 1993. Mr. Albers is President and Chief Executive Officer of United States Bakery, a bakery with operations in Oregon, Washington, Idaho, Montana and California. Mr. Albers, who has been in his current position since June 1985, joined United States Bakery as general manager of Franz Bakery in 1975. Mr. Albers chairs the Compensation Committee.

Stephen E. Babson (age 55) became a director of the Company in July 2002. Mr. Babson has been a Principal of Endeavour Capital, a Northwest private equity firm, since April 2002. Before that, Mr. Babson was an attorney at Stoel Rives LLP. Mr. Babson joined Stoel Rives in 1978, was a partner from 1984 to February 2002, and served as its chairman from July 1999 to February 2002. Mr. Babson chairs the Nominating and Corporate Governance Committee.

Andy D. Bryant (age 55) became a director of the Company in 2005. Mr. Bryant is Executive Vice President and Chief Financial and Enterprise Services Officer of Intel Corporation. Mr. Bryant joined Intel in 1981 as Controller for the Commercial Memory Systems Operation, became the Chief Financial Officer in February 1994, and was promoted to Senior Vice President in January 1999. Mr. Bryant expanded his role to Chief Financial and Enterprise Services Officer in December 1999. Mr. Bryant is a member of the board of directors of Kryptiq Corporation.

Edward S. George (age 69) became a director of the Company in 1989. For 30 years, until his retirement, Mr. George worked in the banking industry. From 1980 to 1990, he was President and CEO of Torrey Pines Bank and from 1991 to 1998 he served as a financial consultant. Mr. George also served as a director of First National Bank of San Diego until its sale in September 2002. Mr. George chairs the Audit Committee.

Walter T. Klenz (age 60) became a director of the Company in 2000. He served as Managing Director of Beringer Blass Wine Estates from 2001 until his retirement in 2005. Mr. Klenz became President and Chief Executive Officer of Beringer Wine Estates in 1990, and Chairman of its Board of Directors in August 1997, and

10

he served in those positions until the 2000 acquisition of Beringer Wine Estates by Foster’s Brewing Group Limited. Mr. Klenz joined Beringer Wine Estates in 1976 as director of marketing for the Beringer brand. He is a member of the board of directors of Vintage Wine Trust.

John W. Stanton (age 50) became a director of the Company in 1997. Mr. Stanton is currently engaged in private investment activities including Trilogy Partners, and public policy activities. Mr. Stanton served as Chief Executive Officer of Western Wireless Corporation and its predecessor companies from 1992 until shortly after its acquisition by ALLTEL Corporation in 2005. From 1994 to 2002, Mr. Stanton also served as Chief Executive Officer and Chairman of VoiceStream Wireless Corporation. Mr. Stanton serves as a director of Advanced Digital Information Corporation and Hutchison Telecommunications International LTD.

RECOMMENDATION BY THE BOARD OF DIRECTORS

The Board of Directors recommends that shareholders vote FOR election of the nominees named in this proxy statement. If a quorum of shareholders is present at the annual meeting, the nine nominees for election as directors who receive the greatest number of votes cast at the meeting will be elected directors. Abstentions and broker non-votes are counted for purposes of determining whether a quorum exists at the annual meeting, but will have no effect on the results of the vote. If any of the nominees for director at the annual meeting becomes unavailable for election for any reason, the proxy holders will have discretionary authority to vote pursuant to the proxy for a substitute or substitutes.

PROPOSAL 2: RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Board of Directors has selected Deloitte & Touche LLP as the Company’s independent auditors for the 2006 fiscal year, subject to ratification of the selection by the shareholders of the Company at the annual meeting. Representatives of Deloitte & Touche LLP are expected to be present at the annual meeting and will be available to respond to appropriate questions. They do not plan to make any statement but will have the opportunity to make a statement if they wish.

RECOMMENDATION BY THE BOARD OF DIRECTORS

The Board of Directors recommends that shareholders vote FOR ratification of the selection of Deloitte & Touche LLP as the Company’s independent auditors for the 2006 fiscal year. This proposal will be approved if a quorum is present at the meeting and the votes cast in favor of this proposal exceed the votes cast opposing this proposal. Abstentions and broker non-votes are counted for purposes of determining whether a quorum exists at the annual meeting, but will have no effect on the results of the vote. The proxies will be voted for or against this proposal or as an abstention in accordance with the instructions specified on the proxy form. If no instructions are given, proxies will be voted for approval of the adoption of this proposal.

11

The following table sets forth all compensation paid by the Company for each of the last three fiscal years to the Chief Executive Officer and each of the five other most highly compensated executive officers.

| Annual Compensation |

Long-Term Compensation Securities Underlying Options |

All Other Compensation |

||||||||||||

| Name and Principal Position |

Fiscal Year |

Salary(1) |

Bonus |

|||||||||||

| Timothy P. Boyle President, Chief Executive Officer |

2005 2004 2003 |

$ $ $ |

720,000 726,539 690,000 |

$ $ |

— 903,700 970,761 |

— — — |

$ $ $ |

19,824 20,521 19,352 |

(2) (2) (2) | |||||

| Gertrude Boyle Chairman of the Board |

2005 2004 2003 |

$ $ $ |

715,850 720,962 675,000 |

$ $ |

— 326,233 345,330 |

— — — |

$ $ $ |

15,005 15,702 14,363 |

(3) (3) (3) | |||||

| Patrick D. Anderson Vice President and Chief Operating Officer |

2005 2004 2003 |

$ $ $ |

360,500 362,462 324,000 |

$ $ $ |

72,100 164,290 165,758 |

5,000 20,000 30,000 |

$ $ $ |

16,688 16,769 15,930 |

(4) (4) (4) | |||||

| Rick D. Carpenter(5) Vice President of Manufacturing Operations |

2005 2004 2003 |

$ $ $ |

309,000 310,962 284,231 |

$ $ |

— 140,819 145,806 |

5,000 20,000 24,000 |

$ $ $ |

13,005 14,202 13,363 |

(6) (6) (6) | |||||

| Robert G. Masin Senior Vice President of Sales and Merchandising |

2005 2004 2003 |

$ $ $ |

385,980 388,733 363,825 |

$ $ $ |

77,196 149,516 186,133 |

12,750 12,000 15,000 |

$ $ $ |

21,233 22,660 19,861 |

(7) (7) (7) | |||||

| Bryan L. Timm Vice President and Chief Financial Officer, Treasurer |

2005 2004 2003 |

$ $ $ |

275,000 259,231 246,154 |

$ $ $ |

90,917 117,349 122,784 |

15,000 15,000 18,000 |

$ $ $ |

25,745 16,021 24,412 |

(8) (8) (8) | |||||

| (1) | The Company’s practice is to pay salaries biweekly, which usually results in 26 pay periods during each calendar year. Because of the timing of pay periods, however, there may be 25 or 27 pay periods in certain years. As a result, the salary paid to an executive officer during the year (as reported on a cash basis in the table above) may vary from the executive officer’s annualized salary. |

| (2) | Includes (a) profit share contributions under the Company’s 401(k) Profit Sharing Plan of $7,363 for 2003, $7,702 for 2004, and $6,005 for 2005; (b) matching contributions under the Company’s 401(k) Profit Sharing Plan of $7,000 for 2003, $8,000 for 2004, and $9,000 for 2005; and (c) payments of executive officer disability insurance premiums of $4,989 for 2003, $4,819 for 2004, and $4,819 for 2005. |

| (3) | Includes (a) profit share contributions under the Company’s 401(k) Profit Sharing Plan of $7,363 for 2003, $7,702 for 2004, and $6,005 for 2005; and (b) matching contributions under the Company’s 401(k) Profit Sharing Plan of $7,000 for 2003, $8,000 for 2004, and $9,000 for 2005. |

| (4) | Includes (a) profit share contributions under the Company’s 401(k) Profit Sharing Plan of $7,363 for 2003, $7,702 for 2004, and $6,005 for 2005; (b) matching contributions under the Company’s 401(k) Profit Sharing Plan of $6,000 for 2003, $6,500 for 2004, and $7,000 for 2005; and (c) payments of executive officer disability insurance premiums of $2,567 for 2003, $2,567 for 2004, and $3,683 for 2005. |

| (5) | Mr. Carpenter resigned from the Company in January 2006. |

| (6) | Includes (a) profit share contributions under the Company’s 401(k) Profit Sharing Plan of $7,363 for 2003, $7,702 for 2004, and $6,005 for 2005; and (b) matching contributions under the Company’s 401(k) Profit Sharing Plan of $6,000 for 2003, $6,500 for 2004, and $7,000 for 2005. |

12

| (7) | Includes (a) profit share contributions under the Company’s 401(k) Profit Sharing Plan of $7,363 for 2003, $7,702 for 2004, and $6,005 for 2005; (b) matching contributions under the Company’s 401(k) Profit Sharing Plan of $7,000 for 2003, $8,000 for 2004, and $9,000 for 2005; and (c) payments of executive officer disability insurance premiums of $5,498 for 2003, $6,958 for 2004, and $6,228 for 2005. |

| (8) | Includes (a) profit share contributions under the Company’s 401(k) Profit Sharing Plan of $7,363 for 2003, $7,702 for 2004, and $6,005 for 2005; (b) matching contributions under the Company’s 401(k) Profit Sharing Plan of $6,000 for 2003, $6,500 for 2004, and $7,000 for 2005; (c) payments of executive officer disability insurance premiums of $1,819 for 2003, $1,819 for 2004, and $2,163 for 2005; and (d) payment of cash-out of personal time off of $10,577 for 2005. |

Stock Option Grants in Fiscal Year 2005

The following table provides information regarding stock options granted in 2005 to the Company’s executive officers named in the Summary Compensation Table. All option grants were made pursuant to the Company’s 1997 Stock Incentive Plan.

| Name |

Number of Shares Underlying Options Granted(1) |

Percentage of Options Granted to Employees During Fiscal Year |

Exercise Price Per Share |

Expiration Date |

Potential Realizable Value at Assumed Rates of Annual Stock Price Appreciation For Option Term(2) | |||||||||||

| 5% |

10% | |||||||||||||||

| Gertrude Boyle |

— | — | — | — | — | — | ||||||||||

| Timothy P. Boyle |

— | — | — | — | — | — | ||||||||||

| Patrick D. Anderson |

5,000 | 1.11 | % | $ | 45.88 | Sept. 5, 2015 | $ | 144,218 | $ | 365,449 | ||||||

| Rick D. Carpenter |

5,000 | 1.11 | % | $ | 45.88 | Sept. 5, 2015 | $ | 144,218 | $ | 365,449 | ||||||

| Robert G. Masin |

12,750 | 2.84 | % | $ | 45.88 | Sept. 5, 2015 | $ | 367,757 | $ | 931,895 | ||||||

| Bryan L. Timm |

15,000 | 3.34 | % | $ | 45.88 | Sept. 5, 2015 | $ | 432,655 | $ | 1,096,348 | ||||||

| (1) | The options granted to Messrs. Anderson, Carpenter, Masin and Timm become exercisable on the first anniversary of the date of grant. |

| (2) | In accordance with rules of the Securities and Exchange Commission, these amounts are the hypothetical gains or option spreads that would exist for the respective options based on assumed compounded rates of annual stock price appreciation of 5% and 10% from the date the options were granted over the option term. |

Aggregated Option Exercises and Fiscal Year-End Option Values

The following table indicates for all executive officers named in the Summary Compensation Table, on an aggregated basis,

| • | stock options exercised during 2005, including the value realized on the date of exercise; |

| • | the number of shares subject to exercisable and unexercisable stock options as of December 31, 2005; and |

| • | the value of “in-the-money” options. |

| Number of Shares Acquired on Exercise |

Value Realized |

Number of Shares Underlying Unexercised Options At Fiscal Year-End |

Value of Unexercised In-the-Money Options at Fiscal Year-End(1) | ||||||||||||

| Name |

Exercisable |

Unexercisable |

Exercisable |

Unexercisable | |||||||||||

| Gertrude Boyle |

— | — | — | — | — | — | |||||||||

| Timothy P. Boyle |

— | — | — | — | — | — | |||||||||

| Patrick D. Anderson |

2,026 | $ | 86,383 | 90,147 | 30,625 | $ | 1,291,519 | $ | 179,150 | ||||||

| Rick D. Carpenter |

19,034 | $ | 391,377 | 8,542 | 28,208 | $ | 12,136 | $ | 147,133 | ||||||

| Robert G. Masin |

— | — | 67,119 | 27,958 | $ | 891,069 | $ | 119,351 | |||||||

| Bryan L. Timm |

2,655 | $ | 107,267 | 51,145 | 34,749 | $ | 569,288 | $ | 151,312 | ||||||

13

| (1) | Options are “in-the-money” at the fiscal year-end if the fair market value of the underlying securities on that date exceeds the exercise price of the option. The amounts set forth represent the fair market value of the securities underlying the options on December 31, 2005 based on the closing sale price of $47.73 per share of Common Stock on that date (as reported on the NASDAQ National Market) less the per share exercise price of the options, multiplied by the applicable number of shares underlying the options. |

Compensation Committee Interlocks and Insider Participation

The Compensation Committee of the Board of Directors consists of Messrs. Albers, Babson, and Klenz. No Compensation Committee member participates in committee deliberations or recommendations relating to his own compensation. Each of the members of the Compensation Committee is “independent” under NASDAQ National Market listing standards and there are no compensation committee interlocks as described in Securities and Exchange Commission Regulation S-K, Item 402(j).

14

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee makes recommendations to the Board of Directors regarding compensation for the executive officers of the Company, and administers the executive compensation plans, the Company’s Employee Stock Purchase Plan, under which offerings were suspended on July 1, 2005, and the Company’s stock incentive plan, from which stock awards may be granted periodically to executive officers and other employees of the Company.

Compensation Principles and Philosophy. The Compensation Committee believes that leadership and motivation of the Company’s executives are critical to the long-term success of the Company. In support of this philosophy, the Company has adopted an executive compensation policy in which the primary objectives are to provide a total compensation package that:

| • | will allow it to attract and retain key executive officers who are primarily responsible for the long-term success of the Company; |

| • | takes into consideration the compensation practices of comparable companies with whom the Company competes for executive talent; and |

| • | will motivate executives to maximize shareholder returns by achieving both short- and long-term Company goals. |

The Compensation Committee maintains the philosophy that compensation of the Company’s executives should be directly linked to the financial performance of the Company as well as to each executive’s individual contribution. In determining competitive compensation levels, the Compensation Committee has engaged independent compensation consultants to analyze all components of executive compensation, including base salaries, stock options, perquisites, and other personal benefits, for executive officers at comparable companies. In the process of reviewing each component of the total compensation package, separately and in the aggregate, the Compensation Committee considered the relationships between various levels of executive compensation within the Company, including in particular the relative difference between the Chief Executive Officer’s compensation and the compensation of the Company’s other executive officers. The Company’s executive salaries increased an average of 4.5% percent from 2005 to 2006, falling slightly below the 50th percentile of comparable companies.

The Compensation Committee continues to place emphasis on aligning compensation with Company performance by maintaining the proportion of executive pay that is “at risk,” offering increased rewards for strong Company and individual performance and reduced returns if performance expectations are not met.

The total compensation package includes a base salary, bonuses, periodic stock option grants, as well as a 401(k) plan with a Company match, and a Company profit sharing plan.

Compensation Elements. The Company’s executive compensation program consists of several elements, all determined by individual performance and Company profitability, except for stock option grants that are intended to correlate compensation to stock price performance.

Base Salary Compensation. Base salaries for the Chief Executive Officer and other select executive officers have been established by reviewing a number of factors, including responsibilities, experience, demonstrated performance and potential for future contributions. The Compensation Committee also takes into account competitive factors, including the level of salaries associated with similar positions at businesses that compete with the Company.

Annual Incentive Compensation. In 1999, the Board of Directors and shareholders approved the Executive Incentive Compensation Plan. The Executive Incentive Compensation Plan was re-approved by shareholders at the 2004 annual meeting of shareholders. Under the Executive Incentive Compensation Plan, the Compensation

15

Committee establishes Company performance goals, which may include Company revenues or earnings or other Company benchmarks, within 90 days of the beginning of the calendar year. Cash bonuses for eligible executive officers are determined by the extent to which the Company attains the established goals and by an assessment of each executive officer’s performance during the year. In each case, the target bonus will be a percentage of the executive’s base salary. Bonuses may exceed the target by a predetermined amount if Company performance goals are exceeded and if the executive’s performance meets or exceeds the Compensation Committee’s expectations. An executive may also receive no bonus for the year if less than a predetermined percentage of a Company performance goal is met or if the executive’s performance does not meet the Compensation Committee’s expectations. Although the Executive Incentive Compensation Plan requires that Company performance goals and target bonuses be established in the first quarter of the year in order to comply with Section 162(m) of the Internal Revenue Code, the Compensation Committee may exercise discretion by reducing bonuses from a preset amount. For example, if Company performance would result in a maximum bonus, but individual performance does not meet the Compensation Committee’s standards, the Compensation Committee could exercise discretion by reducing the bonus amount. Under the Executive Incentive Compensation Plan, the Compensation Committee established a performance goal for the Company for 2005 based on pre-tax income. The Company did not achieve its performance goals for fiscal 2005.

Bonuses. In consideration of each executive’s individual performance during the year, the Compensation Committee awarded 2005 bonuses to three of the Company’s named executive officers, Patrick Anderson, Robert Masin, and Bryan Timm.

Stock Options. Options provide executives with the opportunity to buy and maintain an equity interest in the Company and to share in the appreciation of the value of the stock. They also provide a long-term incentive for the executive to remain with the Company and promote shareholder returns. The Company has made periodic stock option grants under the 1997 Stock Incentive Plan to most executive officers. The Company to date has not granted stock options to Timothy P. Boyle or Gertrude Boyle, each of whom has a substantial ownership interest in the Company, which provides a long-term performance incentive.

The Compensation Committee grants annual stock option awards to selected executives and other select employees. The number of shares in each award will depend on factors such as the level of base pay and individual performance. Stock options are awarded with an exercise price no less than the fair market value of the Company’s Common Stock at the time of the grant. Options granted in 2005 generally expire ten years after the option was granted and vest over a period of one year. The options only have value to the recipients if the price of the Company’s stock appreciates after the options are granted.

Other Benefits. The Company has a 401(k) profit-sharing plan, which covers substantially all employees in the United States with more than ninety days of service. The Company has historically made discretionary matching and non-matching contributions, with the non-matching contributions made in the form of profit sharing. All contributions to the plan are determined by the Board of Directors.

Other benefits that are offered to key executives are largely those that are offered to the general employee population, with some variation. In general, these variations are designed to provide key executives a safety net of protection against the financial catastrophes that can result from illness or disability.

Chief Executive Officer Compensation. The Compensation Committee determined the compensation for the Chief Executive Officer based on a number of factors. Mr. Boyle’s base salary was determined after a review of his experience, performance and an evaluation of comparable positions at other companies. Under the Executive Incentive Compensation Plan total compensation for Mr. Boyle is tied to the overall financial performance of the Company. For 2005, Mr. Boyle was eligible to receive as a bonus between 30 percent and 220 percent of his base salary, depending on the Company achieving between 85 and 130 percent of predetermined financial goals. Because the Company achieved less than 85 percent of its financial goals, Mr. Boyle did not receive a bonus. Mr. Boyle’s 2006 base salary is $740,000, an increase of $20,000 from 2005,

16

and was established by the Compensation Committee after a review of a commissioned survey of executive salaries across related industries as well as in the same geographic region. In 2006, Mr. Boyle is again eligible for a performance-based bonus of between 22 percent and 220 percent of his base salary, depending on his performance and on the Company achieving between 65 percent and 120 percent of pre-set financial goals. If the Company’s performance is below 65 percent of the financial goals, Mr. Boyle will receive no bonus under the Executive Incentive Compensation Plan. Because of Mr. Boyle’s substantial ownership interest in the Company, the Compensation Committee believes he has an effective long-term incentive tied directly to shareholder return.

Deductibility of Compensation. Section 162(m) of the Internal Revenue Code limits to $1,000,000 per person the amount that the Company can deduct for compensation paid to the Company’s Chief Executive Officer and four highest compensated officers (other than the Chief Executive Officer) in any year. Depending on individual and Company performance, total compensation for some of these executives may be greater than $1,000,000. The limit on deductibility, however, does not apply to performance-based compensation that meets specified requirements. The Company’s current policy is generally to grant stock options that meet those requirements so that option compensation recognized by an optionee will be fully deductible by the Company. Similarly, the Executive Incentive Compensation Plan is intended to provide for fully deductible performance-based compensation.

Members of the Compensation Committee:

Murrey R. Albers—Chairman

Stephen E. Babson

Walter T. Klenz

17

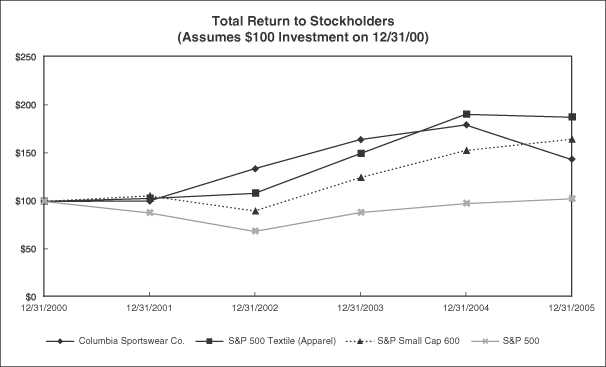

The line graph below compares the cumulative total shareholder return of the Company’s Common Stock with the cumulative total return of the Standard & Poor’s Small Cap 600 Index, the S&P 500 Textile (Apparel) Index and the S&P 500 Index for the period beginning December 31, 2000 and ending December 31, 2005. The graph assumes that $100 was invested on December 31, 2000, and that any dividends were reinvested. Indices for the S&P 500 and S&P 500 Textile (Apparel) are included in order to provide shareholders comparisons with companies outside the small capitalization category.

Historical stock price performance should not be relied on as indicative of future stock price performance.

Columbia Sportswear Company

Stock Price Performance

December 31, 2000 – December 31, 2005

| Total Return Analysis |

12/31/00 |

12/31/01 |

12/31/02 |

12/31/03 |

12/31/04 |

12/31/05 | ||||||||||||

| Columbia Sportswear Co. |

$ | 100.00 | $ | 100.40 | $ | 133.93 | $ | 164.32 | $ | 179.73 | $ | 143.91 | ||||||

| S&P 500 Textile (Apparel) |

$ | 100.00 | $ | 103.05 | $ | 108.52 | $ | 149.80 | $ | 190.72 | $ | 187.89 | ||||||

| S&P Small Cap 600 |

$ | 100.00 | $ | 105.73 | $ | 89.97 | $ | 124.82 | $ | 153.02 | $ | 164.66 | ||||||

| S&P 500 |

$ | 100.00 | $ | 88.17 | $ | 68.71 | $ | 88.35 | $ | 97.91 | $ | 102.65 | ||||||

18

Shareholder Proposals to be Included in the Company’s Proxy Statement. To be considered for inclusion in proxy materials for the Company’s 2007 annual meeting of shareholders, a shareholder proposal must be received by the Company by December 18, 2006.

Shareholder Proposals Not in the Company’s Proxy Statement. Shareholders wishing to present proposals for action at this annual meeting or at another shareholders’ meeting must do so in accordance with the Company’s bylaws, a copy of which is available upon written request to Peter J. Bragdon, Vice President, General Counsel and Secretary. A shareholder must give timely notice of the proposed business to the Secretary. For purposes of the Company’s 2007 annual meeting of shareholders, any notice, to be timely, must be received by the Company by January 17, 2007.

Shareholder Nominations for Director. Shareholders wishing to nominate directly candidates for election to the Board of Directors at an annual meeting must do so in accordance with the Company’s bylaws by giving timely notice in writing to the Secretary as defined above. The notice must set forth (a) the name and address of the shareholder who intends to make the nomination, (b) the name, age, business address and residence address of each nominee, (c) the principal occupation or employment of each nominee, (d) the class and number of shares of the Company that are beneficially owned by each nominee and by the nominating shareholder, (e) any other information concerning the nominee that must be disclosed of nominees in proxy solicitations pursuant to Regulation 14A of the Securities Exchange Act of 1934, and (f) the executed consent of each nominee to serve as a director of the Company if elected.

If the number of directors to be elected is increased and there is no public announcement by the Company naming all nominees or specifying the size of the increased Board of Directors at least 100 days prior to the first anniversary of the preceding year’s annual meeting, a shareholder’s notice shall also be considered timely (but only with respect to nominees for new positions created by any increase) if delivered to the Secretary at the Company’s principal executive offices no later than the close of business on the tenth day following the day on which the public announcement is first made by the Company.

Shareholders wishing to make any director nominations at any special meeting of shareholders held for the purpose of electing directors must do so, in accordance with the bylaws, by delivering timely notice to the Secretary setting forth the information described above for annual meeting nominations. To be timely, the notice must be delivered to the Secretary at the principal executive offices of the Company not earlier than the close of business on the 90th day prior to the special meeting and not later than the close of business on the tenth day following the day on which public announcement is first made of the date of the special meeting and of the nominees proposed by the Board to be elected at the meeting. The officer presiding at the meeting may, if in the officer’s opinion the facts warrant, determine that a nomination was not made in accordance with the procedures prescribed by the bylaws. If the officer does so, the officer shall so declare to the meeting and the defective nomination shall be disregarded.

| By Order of the Board of Directors |

| /s/ Timothy P. Boyle |

| Timothy P. Boyle President and Chief Executive Officer |

Portland, Oregon

April 17, 2006

19

PROXY

COLUMBIA SPORTSWEAR COMPANY

SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

FOR THE ANNUAL MEETING OF SHAREHOLDERS

MAY 18, 2006

The undersigned hereby appoints Gertrude Boyle, Timothy P. Boyle, Patrick D. Anderson and Peter J. Bragdon, and each of them, with power to act without the other and with full power of substitution, as proxies and attorneys-in-fact and hereby authorizes them to represent and vote, as designated on the reverse side, all the shares of Columbia Sportswear Company Common Stock that the signatory on the reverse side is entitled to vote, and, in their discretion, to vote upon any other business that may properly come before the Annual Meeting of Shareholders of Columbia Sportswear Company to be held May 18, 2006, or at any adjournments or postponements of the Annual Meeting, with all powers which the signatory on the reverse side would possess if personally present.

The shares represented by this proxy will be voted in accordance with instructions, if given. If no instructions are given, this proxy will be voted FOR the election of the nominees for director and FOR proposal 2. The proxies may vote in their discretion as to other matters that may come before the meeting.

(Continued and to be marked, dated and signed, on the other side)

Address Change/Comments (Mark the corresponding box on the reverse side)

FOLD AND DETACH HERE

You can now access your Columbia Sportswear Company account online.

Access your Columbia Sportswear Company shareholder/stockholder account online via Investor ServiceDirect® (ISD).

Mellon Investor Services LLC, Transfer Agent for Columbia Sportswear Company, now makes it easy and convenient to get current information on your shareholder account.

View account status View payment history for dividends

View certificate history Make address changes

View book-entry information Obtain a duplicate 1099 tax form

Establish/change your PIN

Visit us on the web at http://www.melloninvestor.com

Call 1-877-978-7778 between 9am-7pm Monday-Friday Eastern Time

Please Mark Here for Address Change or Comments

SEE REVERSE SIDE

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION OF THE NOMINEES FOR DIRECTOR AND FOR PROPOSAL 2.

1. Election of Directors:

2. Proposal to ratify the selection of Deloitte & Touche LLP as the Company’s independent auditors for 2006.

FOR

AGAINST

ABSTAIN

Nominees:

01 Gertrude Boyle

02 Timothy P. Boyle

03 Sarah A. Bany

04 Murrey R. Albers

05 Stephen E. Babson

06 Andy D. Bryant

07 Edward S. George

08 Walter T. Klenz

09 John W. Stanton

For All Withhold All For All Except

To withhold authority to vote for any nominee(s), mark “For All Except” and write the nominee’s name(s) or number(s) on the line below.

The shares represented by this proxy willl be voted in accordance with instructions, if given. If no instructions are given, this proxy will be voted FOR the election of the nominees for director and FOR proposal 2. The proxies may vote in their discretion as to other matters that may come before the meeting.

SIGNATURE(S) Date: ,2006

NOTE: Please sign as name or names appears hereon. Joint owners should each sign. Corporation proxies should be signed in full corporate name by an authorized officer and attested. When signed as attorney, executor, administrator, trustee or guardian, please give full title as such.

FOLD AND DETACH HERE